Its market price is RM 2.24 on 17.9.2015, giving a CAGR of 8.4% over the last 10 years.

Who are the winners?

1. Those who have been holding the funds since inception. They are the winners.

2. Those who bought in 2008 and 2009, they are winners. They would have bought icap close end fund at a low price.

3. Yes, the fund manager has been a big winner in this fund. This is to be expected as managing fund is a highly lucrative business indeed.

Who are the losers?

1. Those who bought into icap at the time of over-enthusiasm, when icap was trading at a huge premium. Those who bought into icap in 2007 and who did not hold the stocks till today were more likely to be losers.

2. Those who bought the stock in the last 3 years. They would have lost due to non-performance or poor performance of the fund over this period. They would have enjoyed a better return from investing into their risk free FDs.

.

As for foreign investors who bought into the fund over the last few years, are they winners or losers?

Taking into consideration, the loss of value of the ringgit in relation to the US and the UK currency, they may not be winners either.

Probably more shareholders burnt than benefited.

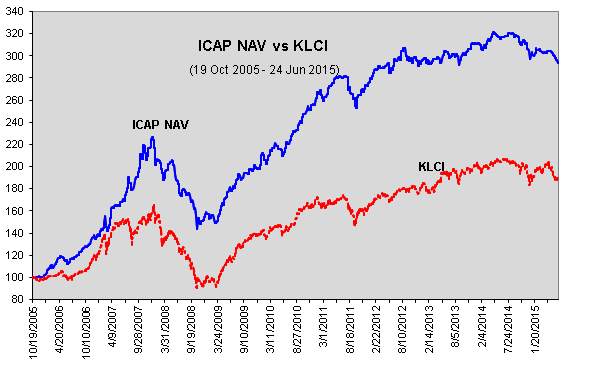

Peter Lynch delivered great returns while managing the Magellan fund for 13 years. Yet, when he analysed the returns to the shareholders, the majority lost money! Similarly, I am of the opinion, even today, the majority of shareholders who had bought and sold icapital close end fund were losers. The winners are probably a minority who bought in the early years especially the initial investors into the fund at the time of launch, and who have hold onto the stocks till today.

The Fund Manager should stay focus.

Over the recent years, the fund manager of icap close end fund has been extensively involved in expansion into new funds and new geographical territory. His activities appear to target growing his assets under management by his company. His involvement in Investors Days, though commendable, is of doubtful benefit to the core shareholders of icap closed end fund.

As for hard core shareholders of icap closed end fund, their single focus is on the performance of the fund. In particular, can the fund deliver >15% compound annual return over the long term. Hopefully, by the year 2020, the year of reckoning, when the fund would have existed for a long period of 15 years and have been through a few up and down cycles, we can make a more objective assessment of the ability of the fund manager.

It is expected that most funds would just perform about the market return or slightly lower than the market return. Will icap close end fund be able to deliver returns much higher than this? Will icap close end fund be able to beat the returns of Buffett's during his earlier years of his involvement in stocks?

*Special Dividend of 9.5 sen per share less Income Tax of 25% for the financial year ended 31 May 2013 is deducted from NAV.

No comments:

Post a Comment