Risk aversion- Various Definitions

Description: In economics and finance, risk aversion is the behavior of humans, who, when exposed to uncertainty, attempt to lower that uncertainty. It is the hesitation of a person to agree to a situation with an unknown payoff rather than another situation with a more predictable payoff but possibly lower expected payoff.

Definition: A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. In other words, among various investments giving the same return with different level of risks, this investor always prefers the alternative with least interest.

What is Risk Averse: Risk averse is the description of an investor who, when faced with two investments with a similar expected return, prefers the one with the lower risk.

Risk Averse: A risk-averse investor dislikes risk and, therefore, stays away from high-risk stocks or investments and is prepared to forego higher rates of return. Investors who are looking for "safer" investments typically invest in savings accounts, bonds, dividend growth stocks and certificates of deposit (CDs).

Description: A risk averse investor avoids risks. S/he stays away from high-risk investments and prefers investments which provide a sure shot return. Such investors like to invest in government bonds, debentures and index funds.

What is Risk Averse?

Someone who is risk averse has the characteristic or trait of preferring to avoiding loss over making a gain. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk. A common concept tied to risk, one which compares thee risk level of an individual investment or portfolio to the overall risk level in the stock market, is the concept of beta.

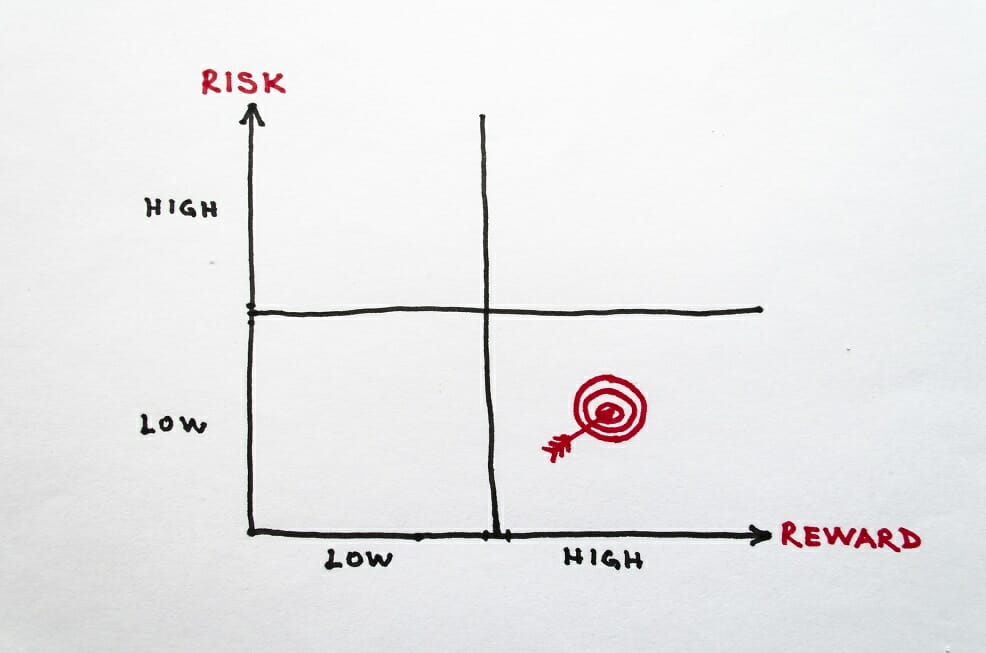

Risk Averse definition and chart

Types of Investments Risk Averse Investors Choose

A risk averse investor tends to avoid relatively higher risk investments such as stocks, options, and futures. They prefer to stick with investments with guaranteed returns and lower-to-no risk. These investments include, for example, government bonds and Treasury bills. Below are two lists that classify lower and higher risk investments. Keep in mind that while the relative risk levels of various types of investments generally remain constant, there can be situations where a usually low-risk investment has a higher risk, or vice versa.

Safer, low-risk investments

Bonds

Certificates of Deposit

Treasury securities

Life Insurance

Investment Grade Corporate Bonds

Bullet Loans

ETFs*

In addition to these specific investments, any type of debt instrument issued by a company will generally be considered a safe, low-risk investment. These debt instruments are typically well-suited for a risk averse investing strategy.

These instruments are lower risk at least partly due to their characteristic of absolute priority. In the event of dissolution or bankruptcy of a company, there is a definite order of payback to the company’s creditors and investors. Legally, the company must first pay of debtors before paying off preferred shareholders and common shareholders (equity investors).

Higher risk investments

Stocks

Penny Stocks

Mutual Funds

Financial Derivatives (Options, warrant, futures)

Commodities

ETFs*

*Some ETFs are higher risk, but most ETFs, especially those invested in market indexes, are considered quite safe, especially when compared to investments in individual stocks. This is because they typically experience relatively lower volatility, due to their diversified nature. Keep in mind, however, that some ETFs are invested in significantly higher risk securities. Hence, the inclusion of ETFs in both the low and high risk categories.

Description: In economics and finance, risk aversion is the behavior of humans, who, when exposed to uncertainty, attempt to lower that uncertainty. It is the hesitation of a person to agree to a situation with an unknown payoff rather than another situation with a more predictable payoff but possibly lower expected payoff.

Definition: A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. In other words, among various investments giving the same return with different level of risks, this investor always prefers the alternative with least interest.

What is Risk Averse: Risk averse is the description of an investor who, when faced with two investments with a similar expected return, prefers the one with the lower risk.

Risk Averse: A risk-averse investor dislikes risk and, therefore, stays away from high-risk stocks or investments and is prepared to forego higher rates of return. Investors who are looking for "safer" investments typically invest in savings accounts, bonds, dividend growth stocks and certificates of deposit (CDs).

Description: A risk averse investor avoids risks. S/he stays away from high-risk investments and prefers investments which provide a sure shot return. Such investors like to invest in government bonds, debentures and index funds.

What is Risk Averse?

Someone who is risk averse has the characteristic or trait of preferring to avoiding loss over making a gain. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk. A common concept tied to risk, one which compares thee risk level of an individual investment or portfolio to the overall risk level in the stock market, is the concept of beta.

Risk Averse definition and chart

Types of Investments Risk Averse Investors Choose

A risk averse investor tends to avoid relatively higher risk investments such as stocks, options, and futures. They prefer to stick with investments with guaranteed returns and lower-to-no risk. These investments include, for example, government bonds and Treasury bills. Below are two lists that classify lower and higher risk investments. Keep in mind that while the relative risk levels of various types of investments generally remain constant, there can be situations where a usually low-risk investment has a higher risk, or vice versa.

Safer, low-risk investments

Bonds

Certificates of Deposit

Treasury securities

Life Insurance

Investment Grade Corporate Bonds

Bullet Loans

ETFs*

In addition to these specific investments, any type of debt instrument issued by a company will generally be considered a safe, low-risk investment. These debt instruments are typically well-suited for a risk averse investing strategy.

These instruments are lower risk at least partly due to their characteristic of absolute priority. In the event of dissolution or bankruptcy of a company, there is a definite order of payback to the company’s creditors and investors. Legally, the company must first pay of debtors before paying off preferred shareholders and common shareholders (equity investors).

Higher risk investments

Stocks

Penny Stocks

Mutual Funds

Financial Derivatives (Options, warrant, futures)

Commodities

ETFs*

*Some ETFs are higher risk, but most ETFs, especially those invested in market indexes, are considered quite safe, especially when compared to investments in individual stocks. This is because they typically experience relatively lower volatility, due to their diversified nature. Keep in mind, however, that some ETFs are invested in significantly higher risk securities. Hence, the inclusion of ETFs in both the low and high risk categories.