The Subtle Power of Rate of Return Earned on Reinvested Capital

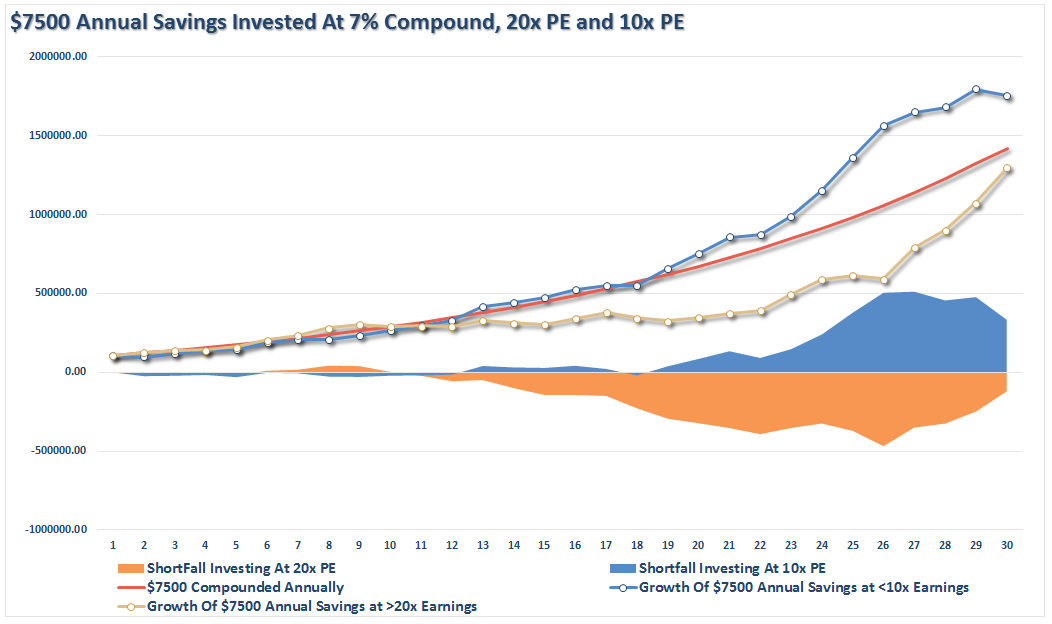

In this table, we compare a bond paying 6.5% interest with the stocks of two companies paying dividends of 1.5% while reinvesting a like amount in growing the business. One company earns 20% on the capital it reinvests in the business and the other earns 10%. Reinvestment of earnings gives a business the capital to grow by funding initiatives such as developing new products, building a new plant, and expanding the sales force. A return earned on this investment should lead to an increase in earnings, dividends and eventually stock price. For purposes of the illustration below, we assume that the stock price increases in line with earnings growth and dividends are invested in a money market fund that pays 4%.

Clearly, earning a high rate of return on reinvested capital is the key to long-term compounded growth

No comments:

Post a Comment