Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Thursday, 22 February 2024

Wednesday, 21 February 2024

Fraser & Neave at a glance

Market Capital (RM)

10.710b

Number of Share

366.78m

Revenue (TTM)

5.116B

Net Profit (TTM)

508.84M

Net Margin (TTM)

9.9%

EPS (TTM)

138.73

P/E Ratio

21.05

ROE

14.29%

P/B Ratio

3.01

NTA

9.710

5y CAGR - Revenue

4.0%

5y CAGR - Profit

6.9%

Dividend (cent)

77.000 ^

Dividend Yield

2.64%

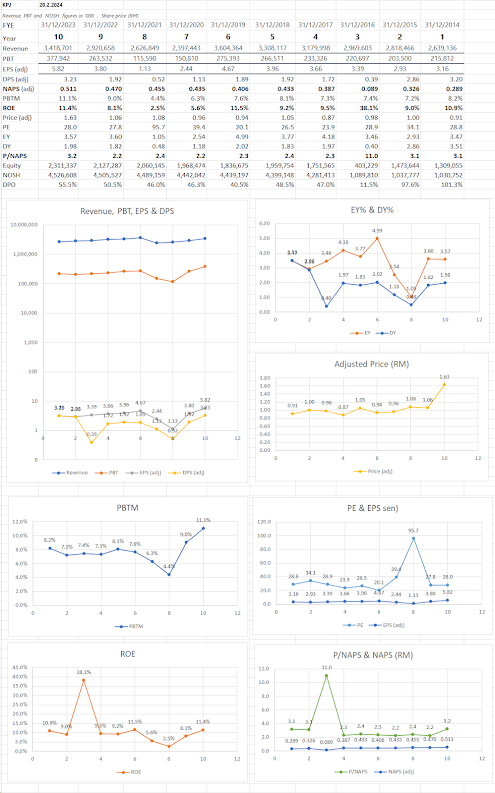

Over the last 10 years, the revenues grew about 4% yearly and the PBT grew at a slightly faster rate of about 6.9%. This indicated its profit margins had improved. Over the 10 years above, its PBT Margin increased steadily from 8.3% to 12.5%.

Its NAPS (Net Asset Price per Share) grew from RM 4.603 per share to RM 9.112 per share. F&N is a great company, with high ROE in the mid teens. Its ROE for the above 10 years period ranged from low of 12.9% to a high of 19.4%; averaging 15% to 16%.

Given the risk free interest rate of 5% or so, its present price of RM 29.2 per shar means it is trading at a P/NAPS of 3.01 x. This valuation means it is trading at a fair price today.

F&N has distributed dividends yearly. Its DPO was around 52% to 56%. Its latest DY is 2.68%.

In summary, F&N is a great company, growing at a slow rate of 5% to 7% yearly. It retained about 50% of its earnings for future growth and with its ROE at around 15% or so, and many new projects for future growth, this stock in my portfolio remains for the long term.

Tuesday, 20 February 2024

Subscribe to:

Comments (Atom)