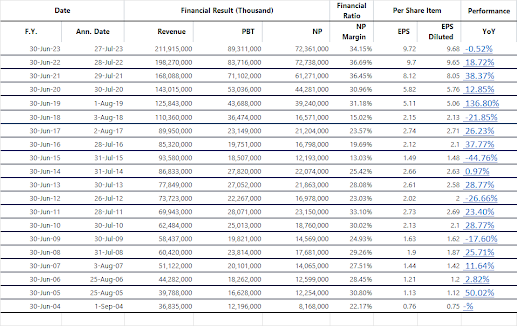

Here is a detailed breakdown of Microsoft's revenues and net earnings for the fiscal years 2015 to 2025, followed by a summary of the Compound Annual Growth Rate (CAGR).

**Important Note on Fiscal Years:** Microsoft's fiscal year (FY) ends on June 30. For example, **Fiscal Year 2025** will end on June 30, 2025. The data for 2015-2024 is actual, while 2025 is based on analyst consensus estimates.

---

### **Microsoft's Revenue and Net Earnings (FY2015 - FY2025E)**

All figures are in USD millions. Data for FY2015-FY2024 is sourced from Microsoft's official annual reports (10-K filings). **Data for FY2025 is based on the current consensus analyst estimates** as the fiscal year is not yet complete.

| Fiscal Year | Revenue ($ millions) | Net Earnings ($ millions) |

| :---------- | :------------------- | :------------------------- |

| **FY2015** | $93,580 | $12,193 |

| **FY2016** | $85,320 | $16,798 |

| **FY2017** | $89,950 | $21,204 |

| **FY2018** | $110,360 | $16,571 |

| **FY2019** | $125,843 | $39,240 |

| **FY2020** | $143,015 | $44,281 |

| **FY2021** | $168,088 | $61,271 |

| **FY2022** | $198,270 | $72,738 |

| **FY2023** | $211,915 | $72,361 |

| **FY2024** | $245,088 | $87,388 |

| **FY2025 (Est.)**| ~$273,500 | ~$101,500 |

**Key Context for the Data:**

* **FY2015-FY2017: The Nadella Transition.** Satya Nadella became CEO in 2014. This period shows the strategic shift away from one-time license sales (like Windows) toward cloud and subscription services (Azure, Office 365), which initially impacted revenue but soon began driving significant profit growth.

* **FY2018: One-Time Tax Charge.** The dip in net income was primarily due to a $13.7 billion one-time net charge related to the TCJA (Tax Cuts and Jobs Act).

* **FY2019-FY2022: The Cloud Hyper-Growth Era.** Revenue and earnings saw tremendous growth, fueled by the massive expansion of the Azure cloud platform, the dominance of Office 365, and the growth of LinkedIn and Dynamics.

* **FY2023: A Period of Consolidation.** Growth moderated due to macroeconomic headwinds that impacted cloud and enterprise spending. Net income was slightly down as the company continued heavy investment in AI.

* **FY2024: The AI Acceleration.** Revenue growth re-accelerated significantly, driven by the integration of AI capabilities across the entire tech stack (Copilot, Azure AI services). Profit margins expanded.

* **FY2025 (Est.): Sustained AI-Driven Growth.** Analysts project continued strong growth as Microsoft's early lead in generative AI, through its partnership with OpenAI and its own services, translates into broader market adoption and monetization.

---

### **Summary of CAGR (2015 to 2025E)**

The Compound Annual Growth Rate (CAGR) provides a smoothed annual growth rate over the specified period.

**Period:** From the end of **Fiscal Year 2015** to the end of **estimated Fiscal Year 2025** (a 10-year period).

* **Revenue CAGR (FY2015 to FY2025E):**

* Starting Value (FY2015): $93,580 million

* Ending Value (FY2025E): ~$273,500 million

* Number of Years: 10

* **CAGR = ~11.3%**

* **Net Earnings CAGR (FY2015 to FY2025E):**

* Starting Value (FY2015): $12,193 million

* Ending Value (FY2025E): ~$101,500 million

* Number of Years: 10

* **CAGR = ~23.6%**

### **Conclusion**

Over the ten-year period from FY2015 to the projected FY2025, Microsoft has executed one of the most successful corporate transformations and financial performances in history.

* The **Revenue CAGR of approximately 11.3%** is highly impressive for a company of Microsoft's immense scale, demonstrating its ability to consistently find new growth vectors and expand its total addressable market.

* The even more remarkable **Net Earnings CAGR of ~23.6%** highlights the powerful financial model of its strategic shift. The transition to high-margin, recurring revenue streams (cloud subscriptions, Azure) has driven profitability to grow at more than twice the rate of revenue. This signifies tremendous operating leverage and a strategic mastery of the cloud and AI eras.

This decade under Satya Nadella's leadership has seen Microsoft evolve from a legacy software giant into a cloud-first, AI-first behemoth, with financial metrics that reflect its dominant and highly profitable market position.

***Disclaimer:*** *This information is for illustrative purposes only. Data for FY2015-FY2024 is historical. Data for FY2025 are analyst estimates and are not guaranteed. This is not financial advice. Investing in the stock market involves risk, including the possible loss of principal.*