Edge Weekly

Analysing Hengyuan’s discount to Petron

http://www.theedgemarkets.com/article/analysing-hengyuans-discount-petron

Good article on Hengyuan in the Edge.

Well written and very balanced views.

Good luck in your investing.

Highlighting some of the points in the above article.

----

1. A key driver of the refiners’ earnings has been better margins arising from improved spreads between crude oil prices and their refined finished products, primarily RON92 and RON95 gasoline or motor gasoline (mogas).

Based on forward indices, however, the spreads are expected to peak in the fourth quarter. The 2Q2018 forwards show spreads easing 11.6% to US$8.9 per barrel.

Comments: "The 2Q2018 forwards show spreads easing 11.6% to US$8.9 per barrel."

----

2. ... investors have to rely strictly on Hengyuan’s quarterly financial reports to evaluate its prospects. This can be tricky. Some details, for example, the cause of the RM76 million swing, were not explained in the 2Q2017 report.

Comments: The author wished for more details in the account to understand Hengyuan's business more thoroughly.

----

3. Furthermore, it would be difficult to anticipate the company’s capital expenditure plans.

.

.

.

What is not clear, however, is the timeline for the capital expenditure.

Comments: Upgrading is already facing a delay.

4. The good news is that Hengyuan has lots of cash — RM897.77 million as at Sept 30, which was more than double its cash holding a year ago. However, the group also carries a lot of debt — RM1.31 billion in total.

While net gearing has improved to a healthy 9.87% from 34.47% last year, aggressive capital expenditure could put pressure on the group’s balance sheet.

Comments: Lots of cash, also lots of debt. Heavy capex.

----

5. Nevertheless, the company has not been paying dividends, which gives its capex plans more leverage and reduces the need for a cash call.

Comments: With its present balance sheet and huge capital expenditure for next year, this is not unexpected. Not paying dividend is not a big deal.

----

6. ... the bulk of Hengyuan’s debt is denominated in US dollars — two separate term loans of US$350 million, some US$200 million of which has to be repaid (or refinanced) by 2022 while the balance will be run until 2024.

Comments: Short term debt repayment will put pressure on its cash flow

----

Comments: The high margins enjoyed this year is unlikely to be sustained next year. Margin is expected to normalise next year. The good results this year may just be a short term temporary one.

----

8. .... without further elaboration from management, it is difficult to ascertain why Hengyuan has been able to enjoy such good margins compared with Petron.

....... The group notes that revenue was further boosted by a 600,000 barrel increase in sales (from the previous year) during the quarter. Unlike Petron, however, Hengyuan does not disclose exact sales volume each quarter.

....Coupled with big fluctuations in the US dollar and ringgit exchange rate and the steady uptick in crude oil prices this year, it is difficult to ascertain what is driving Hengyuan’s margins.

Comments: The author repeatedly highlighted (in 3 places in the same article) the difficulty establishing what is driving Hengyuan's margins. The management seems not forthcoming it would seem from the author's writing.

----

9. That said, the outlook for both companies, PetronM and Hengyuan, is not without risk, given the difficulty in anticipating what crude oil price volatility will do to spreads going forward.

....... The group notes that revenue was further boosted by a 600,000 barrel increase in sales (from the previous year) during the quarter. Unlike Petron, however, Hengyuan does not disclose exact sales volume each quarter.

....Coupled with big fluctuations in the US dollar and ringgit exchange rate and the steady uptick in crude oil prices this year, it is difficult to ascertain what is driving Hengyuan’s margins.

Comments: The author repeatedly highlighted (in 3 places in the same article) the difficulty establishing what is driving Hengyuan's margins. The management seems not forthcoming it would seem from the author's writing.

----

9. That said, the outlook for both companies, PetronM and Hengyuan, is not without risk, given the difficulty in anticipating what crude oil price volatility will do to spreads going forward.

Comments: The author rightly and honestly drew this conclusion:

----

Conclusion:

The author of this article shares some insights into Hengyuan's risks.

Well written indeed.

Reference:

Edge Weekly

Analysing Hengyuan’s discount to Petron

http://www.theedgemarkets.com/article/analysing-hengyuans-discount-petron

Ben Shane Lim

The Edge Malaysia December 19, 2017

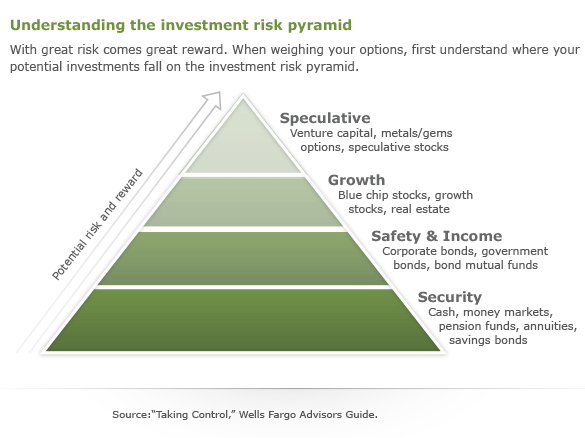

/Investmentrisk1-4-56a635313df78cf7728bd723.gif)