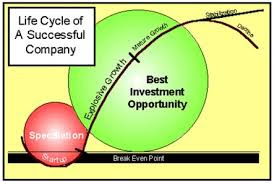

Every business goes through the S-curve cycle of growth:

- infancy (low growth),

- expansion (rapid growth) and

- maturity (slow growth).

No matter how successful the product is, growth must slow at some point (maturity phase), due to a number of reasons:

- increased competition,

- market saturation,

- technology disruption,

- regulatory changes and

- changing consumer preferences.

Ultimately, whether a company remains VALUE CREATIVE OR DESTRUSTIVE, depends on how well management understand this inevitability, its mindset and how successful it is in creating new S-curves - developing new engines of growth - ideally before the current cycle of growth reaches maturity.

New S-curves could include

- tapping into new selling channels and geographies for the existing products, or

- it could be expansion into a related business - for instance, starting a new product line and going upstream or downstream, or

- diversification into something entirely different and unrelated.

In short, the S-curve is dynamic over the company's life, that is, the company should continuously reinvent, reinvest and create new S-curves to start new growth cycles.

We see real-life examples of how this is done every day.

Companies starting new S-curves to start new growth cycles:

QL started Family Mart

YTL Power entered a new S-curve selling power to Singapore and enters the AI related sector.

Padini started Brands' Outlets.

Scientex growing its manufacturing business organically and through acquisitions and entering the property development sector business successfully.

KGB supplying its products to many industries and to many countries.

Facebook promoting Metaverse (but unsuccessfully).

Microsoft branching into cloud computing and AI.

Amazon continues to reinvent itself, selling books initially, and now selling almost everything. (Many new S-curves)

Of course, growth comes with a price too.

Some growths can be good and some can be very bad for the companies.

Shareholder wealth in a company is destroyed with failure to find new S-curve.

With no growth or business in decline, value of company shrinks (contracting PE x lower EPS); value is destroyed.

There are many companies in Bursa Malaysia in this category.