BIGGEST RISK: PAYING TOO MUCH

The biggest risk you face to be a successful investor in shares is paying too much.

It is important to remember that no matter how good a company is, its shares are not a buy at any price.

Paying the right price is just as important as finding a high-quality and safe company.

Overpaying for a share makes your investment less safe and exposes you to the risk of losing money.

USUALLY HAVE TO PAY UP FOR QUALITY

Be careful not to be too mean with the price you are prepared to pay for a share.

Obviously, you want to buy a share as cheaply as possible, but bear in mind that you usually have to pay up for quality.

Waiting to buy quality shares for very cheap prices may mean that you end up missing out on some very good investments.

Some shares can take years to become cheap and many never do.

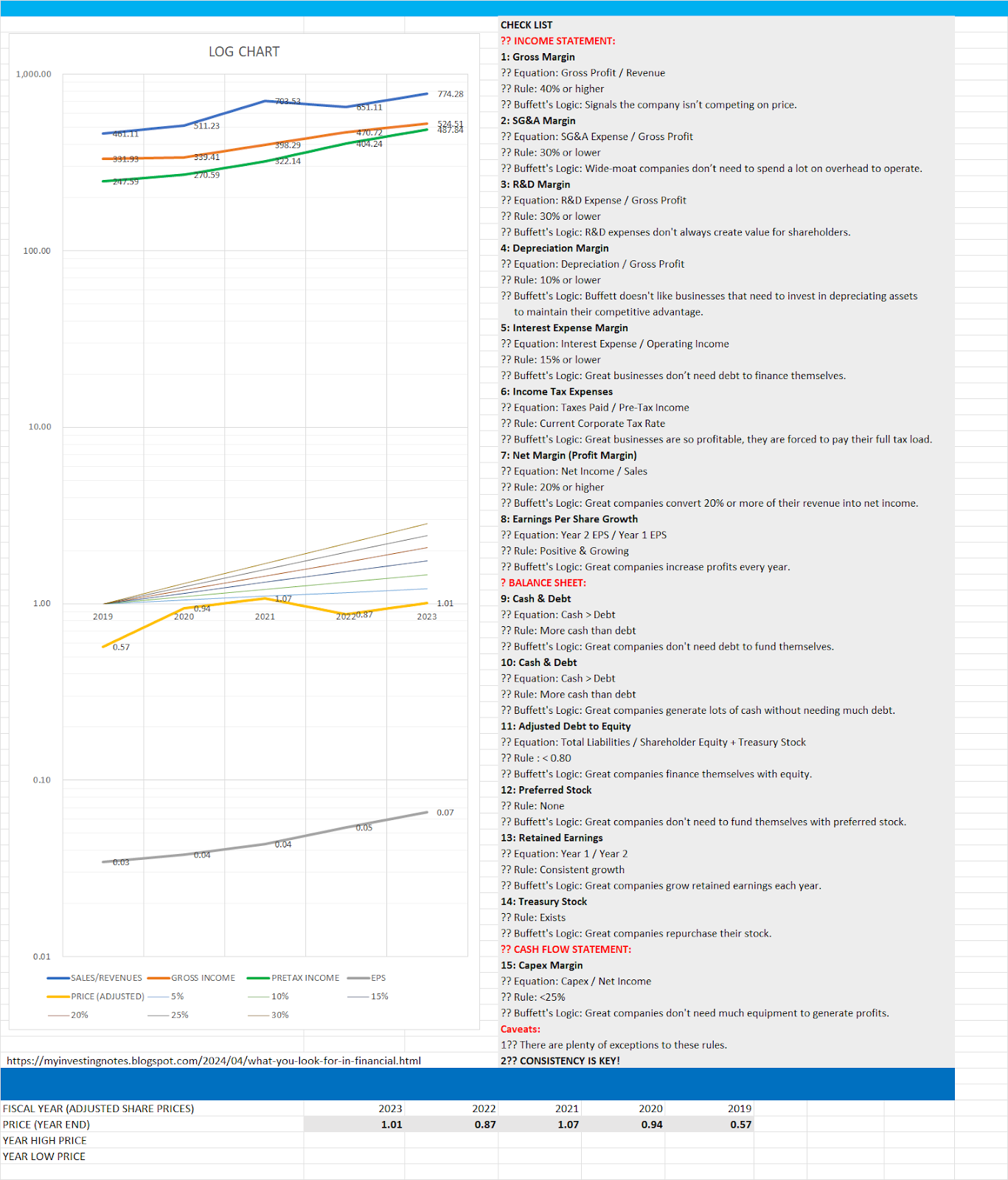

CHECKLIST ON HOW TO VALUE SHARES

When valuing shares, you can use the following checklist to remind of the process to follow:

1. Value companies using an estimate of their cash profits.

2. Work out the cash yield a company is offering at the current share price. Is it high enough?

3. Calculate a company's earnings power value (EPV) to work out how much of a company's share price is explained by its current profits and how much is dependent on future profits growth. Do not buy shares where more than half the current share price is dependent on future profits growth.

4. Work out the maximum price you will pay for a share. Try and buy shares for less than this value. At least a discount of 15% or more.

5. The interest rate use to calculate the maximum price should be at least 3% more than the rate of inflation.

6. You must be very confident in continued future profits growth to pay a price at or beyond the valuations estimated here.

7. The higher the price you pay for profits/turnover/ growth, the more risk you are taking with your investment. If profits stop growing, then paying an expensive price for a share can lead to substantial losses.