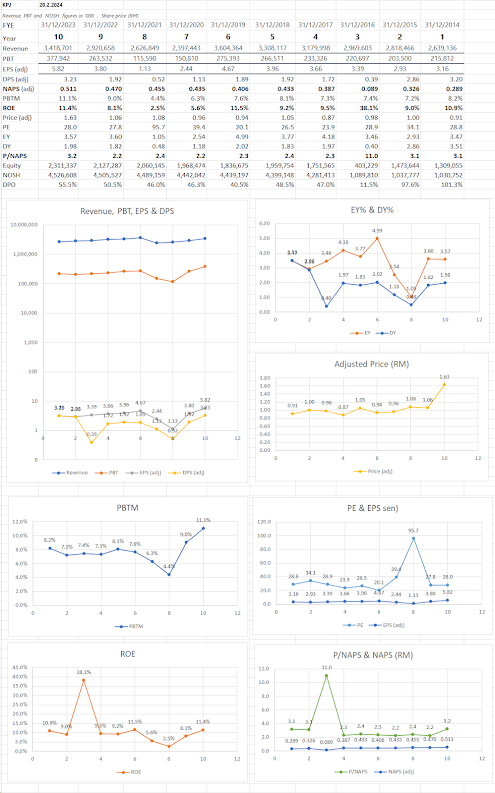

Summary: Surge in the P/E and P/B multiples (2023-2024) coincides

with KPJ achieving its highest ever PBT Margins and ROE.

KPJ Healthcare: 10-Year Financial Summary (Adjusted for Latest Capital Structure)

All monetary values in RM '000, except per-share data.

Per-share data is adjusted for NOSH of 4,363,857.

This adjusted dataset allows for a proper analysis of KPJ's valuation

metrics (like P/E and P/B ratios) over the entire 10-year period, as

if the company's current share capital had always been in place.