Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Thursday, 9 May 2024

Wednesday, 8 May 2024

KLCI MARKET PE (2008 TO 2024)

The total market cap of the whole Bursa is approaching RM 2 Trillion today.

The top 30 counters in Bursa account for >50% of the total market cap of Bursa.

KLCI historical chart

Friday, 3 May 2024

How to perform CPR

How to perform CPR

Check the scene for safety and put on personal protective equipment

If the person seems unresponsive, check for life-threatening conditions, using shout-tap-shout

If the person still isn't breathing, call 9-1-1

Kneel down and place the person on their back, on a firm, flat distance

Give 30 chest compressions

Give two breaths

Continue giving sets of 30 chest compressions and two breaths, and use a AED [defibrillator], as soon as one is available

'If the person does not respond, and is not breathing, or only gasping, CALL 9-1-1 and get equipment, or tell someone to do so.

'Kneel beside the person. Place the person on their back on a firm, flat surface.

'Give 30 chest compressions. Hand position: Two hands centered on the chest. Body position: Shoulders directly over hands [and keep] elbows locked. Depth: At least two inches.'

The instructions continued, 'Rate: 100 to 120 per minute. Allow chest to return to normal position after each compression. Give two breaths.

'Open the airway to a past-neutral position using the head-tilt/chin-lift technique.

'Pinch the nose shut, take a normal breath, and make complete seal over the person's mouth with your mouth.

'Ensure each breath lasts about one second and makes the chest rise. Allow air to exit before giving the next breath.'

The next steps include: 'If the first breath does not cause the chest to rise, re-tilt the head, and ensure a proper seal before giving the second breath.

'If the second breath does not make the chest rise, an object may be blocking the airway.

'Continue giving sets of 30 chest compressions and two breaths. Use an AED [defibrillator] as soon as one is available!

'Minimize interruptions to chest compressions to less than 10 seconds.'

© Provided by Daily Mail

Thursday, 2 May 2024

REDTONE at a glance

Company Profile

Sector: TELECOMMUNICATIONS & MEDIA

Subsector: TELECOMMUNICATIONS SERVICE PROVIDERS

Description:

REDtone International Bhd is a digital infrastructure and services provider that offers services under three categories that are Telecommunications Services which offers data and voice services to government, enterprises, and small and medium enterprises (SMEs), Managed Telecommunications Network Services (MTNS) which includes building, maintaining and operating large scale WiFi hotspots, radio access network (RAN) infrastructure and fibre optic infrastructure, and Industry Digital Services (IDS) which includes data centre services, internet of things (IoT) services, cloud services and applications, and healthcare solutions to enterprises, government and the healthcare industry. The company's Telecom services generate maximum revenue for the company.

OCK at a glance

Company Profile

Sector: TELECOMMUNICATIONS & MEDIA

Subsector: TELECOMMUNICATIONS SERVICE PROVIDERS

Description:

OCK Group Bhd provides telecommunications network services. The company is engaged in the provision of telecommunication services equipped with the ability to provide full turnkey services. It provides comprehensive services to all six segments of the telecommunication network services market: network planning, design and optimization, network deployment, network operations and maintenance, energy management, infrastructure management, and other professional services. The company also trades in telecommunication hardware and installation of materials such as antennas, feeder cables, and connectors.

Cocoa plunged by the most ever, slumping as much as 27% in just two days

https://theedgemalaysia.com/node/709963

Cocoa plunges most ever with trader exodus sparking huge moves

By Mumbi Gitau / Bloomberg

30 Apr 2024

Despite the recent pullback, the price of cocoa has roughly doubled since the start of the year.

(April 30): Cocoa plunged by the most ever, slumping as much as 27% in just two days, with price swings becoming more extreme as fewer investors and companies can afford to maintain trading positions.

Futures slid as much as 13% in New York on Tuesday (April 30) before paring some of the loss after tumbling the previous day by the most in data going back to 1960. The retreat marks a stark turnaround from earlier this month, when prices soared to a record above US$11,000 (RM52,497.09) a tonne due to a historic supply crunch, raising the cost of making chocolate.

Even with the recent pullback to the lowest in a month, cocoa has still roughly doubled since the start of the year. The rally made it more expensive to keep positions and prompted investors to close out trades, which has drained liquidity and made the market more vulnerable to large price swings.

Cocoa’s rally had made it more expensive than copper, and the big question was how far prices could reach. Pierre Andurand, a hedge-fund manager best known for his oil wagers, bet on higher cocoa prices ahead of the massive recent surge. He forecast futures to break US$20,000 this year.

The magnitude of the recent drop was a surprise, though the declines could prove brief because the fundamental picture hasn’t changed, said Fuad Mohammed Abubakar, head of Ghana Cocoa Marketing Company UK Ltd, a subsidiary of the country’s regulator.

“The market action in the last three days goes to show the fall is always easier and faster than the climb,” he said.

Harvests in West Africa have been battered by crop disease and poor weather this season, putting the world on track for a third straight supply deficit and forcing both Ivory Coast and Ghana to roll forward supply contracts. The amount paid to farmers there is also well below the global market prices, making growers less able to invest in plantations and boost production.

Lower prices would offer some relief to chocolate makers, who have seen costs soar and have been scouring the world for cocoa beans. Shares of Barry Callebaut AG, which supplies some of the biggest consumer chocolate brands, climbed as much as 6.6% on Tuesday.

Maintaining Positions

Cocoa’s advance this year has meant traders — including those who’ve hedged against physical holdings — have had to come up with more money to pay margin calls, which work as an insurance policy to cover potential losses. When they can’t do that, they’re forced to close out positions. That has helped push down open interest, or the number of outstanding contracts, curbing liquidity.

Looking forward, the end of the El Nino weather phenomenon could help harvests recover next year, Marijn Moesbergen, sourcing lead at Cargill Inc, said at the recent World Cocoa Conference in Brussels. Prices may have overshot and the market needs to find a new equilibrium between supply and demand, he said.

Prices:

- The most-active cocoa contract was last down 5.9% at $8,405 in New York. London cocoa futures slid 8.4%.

- In other soft commodities, arabica coffee declined 1.5% and raw sugar fell 0.9%.

LPI Capital’s 1Q net profit surges 37%

LPI Capital’s 1Q net profit surges 37%, shares snap losing streak after results

By Hee En Qi / theedgemalaysia.com

29 Apr 2024, 01:34 pm

KUALA LUMPUR (April 29): Shares in LPI Capital Bhd snapped a three-day losing streak on Monday, after the general insurer reported a 37% net profit surge in the first quarter, thanks largely to sharply lower net expenses from reinsurance contracts held and higher investment income.

LPI had turned positive following the results announcement, and rose nearly 3% to as high as RM12.12. The stock closed at RM11.92 at 5pm, valuing the company founded by the late Tan Sri Dr Teh Hong Piow of Public Bank Bhd at RM4.75 billion. Trading volume stood at 251,900 shares at the closing bell.

Net profit for the three months ended March 31, 2024 (1QFY2024) was RM101.29 million compared to RM73.83 million over the same period last year, LPI said in an exchange filing. Revenue for the quarter edged up 1.4% year-on-year to RM469.8 million from RM463.3 million as gross written premiums rose.

“The Malaysian insurance industry will continue to face greater competition and underwriting margins compression owing to the phased liberalisation process,” LPI said. The company said it will focus on “strategic sectors that can provide steady and sustainable profits”.

For 1QFY2024, the company’s general insurance segment — which mainly provides motor and fire insurance — reported a 30% year-on-year increase in its profit before tax to RM107.45 million from RM82.4 million, on a lower net claims incurred ratio of 40.1% in 1QFY2024, from 51.8% a year earlier.

Meanwhile, the pre-tax profit of the investment holding segment more than doubled to RM19.9 million from RM9 million, contributed by higher tax-exempt dividend income received from its equity investment.

The company “will continue to strengthen its distribution channels by forming partnerships and enhancing its collaboration with agents and bancassurance partners, to grow the desired portfolios”, LPI added.

Shares of LPI closed at RM11.92 on Monday, up 12 sen from last Friday’s close. The stock have dipped two sen or 0.17% this year, amid caution among analysts.

There are three “hold” calls out of five research houses covering the stock and two “buy” ratings. The consensus 12-month target price is RM13.13.

https://theedgemalaysia.com/node/709704

Wednesday, 1 May 2024

KOSSAN at a glance

Positive outlook for Kossan on strong greenback

Tuesday, 30 April 2024

Monday, 29 April 2024

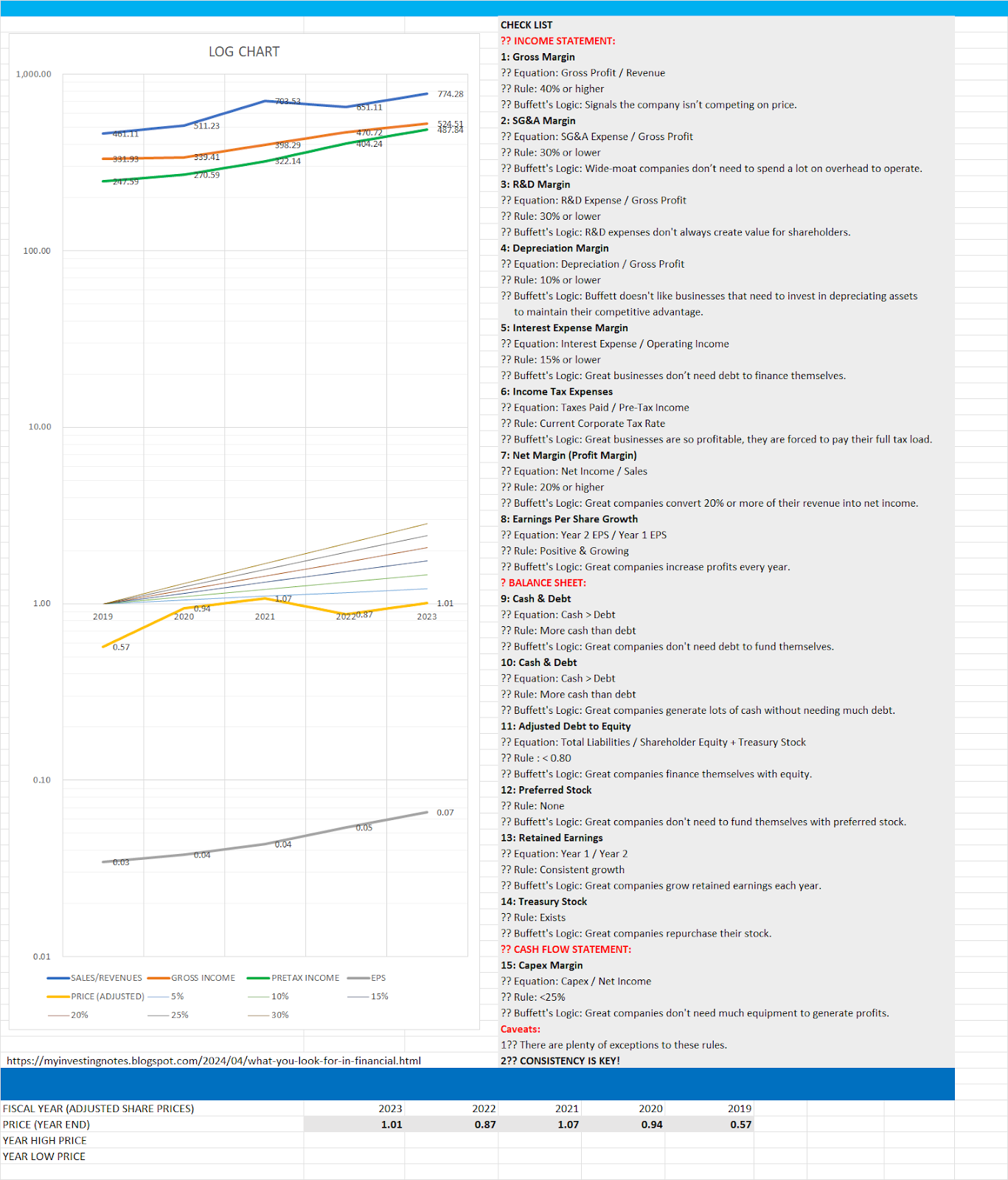

Great, Good and Gruesome Companies. Studying their financial statements.

?? INCOME STATEMENT:

1: Gross Margin

?? Equation: Gross Profit / Revenue

?? Rule: 40% or higher

?? Buffett's Logic: Signals the company isn’t competing on price.

2: SG&A Margin

?? Equation: SG&A Expense / Gross Profit

?? Rule: 30% or lower

?? Buffett's Logic: Wide-moat companies don’t need to spend a lot on overhead to operate.

3: R&D Margin

?? Equation: R&D Expense / Gross Profit

?? Rule: 30% or lower

?? Buffett's Logic: R&D expenses don't always create value for shareholders.

4: Depreciation Margin

?? Equation: Depreciation / Gross Profit

?? Rule: 10% or lower

?? Buffett's Logic: Buffett doesn't like businesses that need to invest in depreciating

asset to maintain their competitive advantage.

5: Interest Expense Margin

?? Equation: Interest Expense / Operating Income

?? Rule: 15% or lower

?? Buffett's Logic: Great businesses don’t need debt to finance themselves.

6: Income Tax Expenses

?? Equation: Taxes Paid / Pre-Tax Income

?? Rule: Current Corporate Tax Rate

?? Buffett's Logic: Great businesses are so profitable that they are forced to pay

their full tax load.

7: Net Margin (Profit Margin)

?? Equation: Net Income / Sales

?? Rule: 20% or higher

?? Buffett's Logic: Great companies convert 20% or more of their revenue into net income.

8: Earnings Per Share Growth

?? Equation: Year 2 EPS / Year 1 EPS

?? Rule: Positive & Growing

?? Buffett's Logic: Great companies increase profits every year.

? BALANCE SHEET:

9: Cash & Debt

?? Equation: Cash > Debt

?? Rule: More cash than debt

?? Buffett's Logic: Great companies don't need debt to fund themselves.

10: Cash & Debt

?? Equation: Cash > Debt

?? Rule: More cash than debt

?? Buffett's Logic: Great companies generate lots of cash without needing much debt.

11: Adjusted Debt to Equity

?? Equation: Total Liabilities / Shareholder Equity + Treasury Stock

?? Rule : < 0.80

?? Buffett's Logic: Great companies finance themselves with equity.

12: Preferred Stock

?? Rule: None

?? Buffett's Logic: Great companies don't need to fund themselves with preferred stock.

13: Retained Earnings

?? Equation: Year 1 / Year 2

?? Rule: Consistent growth

?? Buffett's Logic: Great companies grow retained earnings each year.

14: Treasury Stock

?? Rule: Exists

?? Buffett's Logic: Great companies repurchase their stock.

?? CASH FLOW STATEMENT:

15: Capex Margin

?? Equation: Capex / Net Income

?? Rule: <25%

?? Buffett's Logic: Great companies don't need much equipment to generate profits.

Caveats:

1?? There are plenty of exceptions to these rules.

2?? CONSISTENCY IS KEY!

Sunday, 28 April 2024

Multi-bagger or Falling knife.

"The best thing that happens to us is when a great company gets into temporary trouble .... We want to buy them when they are on the operating table."

Warren Buffett

(e.g. American Express)

"A stock that has fallen 90% is a stock that fell 80% first and then halved."

(e.g. Valiant bought and sold by Bill Ackman)

Reasons for steep falls

- Leveraged financials and loan/other losses.

- Food and other consumer products - safety, ingredients, etc.

- Victim of fraud

- Perpetrator of a fraud

- Unethical / Illegal behaviour

- Loss of key customer / product segment/ market

- Regulatory issues