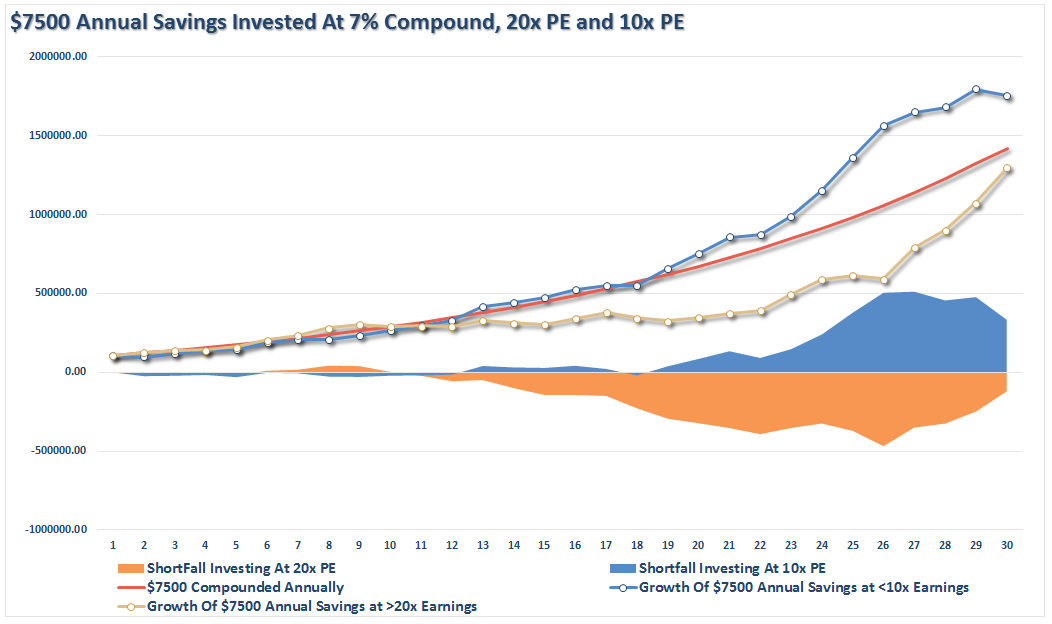

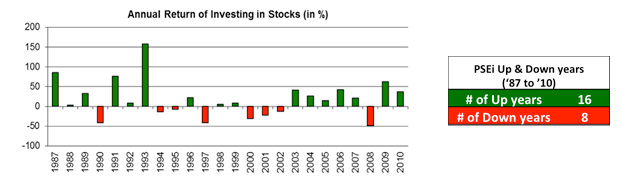

Four hypothetical investors each invested $10,000 in the market from January 1, 1972, to December 31, 2013, but all four investors acted differently during the 1973 to 1974 bear market.

The Nervous Investor sold out and went to cash. The Market Timer sold out but moved back into stocks on January 1, 1983, at the beginning of a historic bull market. The Buy and Hold Investor held steady throughout the period. And lastly, the Opportunistic Investor realized that the bear market had created opportunities and contributed an additional $10,000 to his original investment on January 1, 1975.

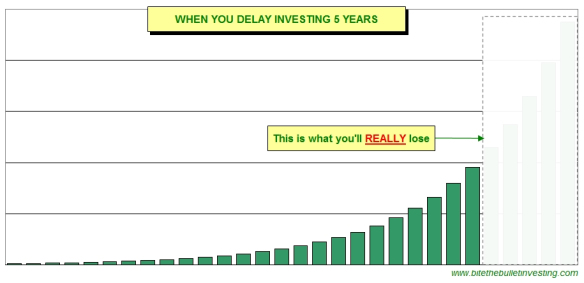

This chart shows more than just the benefits of compounding. It also highlights the stupidity of market timing. The chart clearly shows that trying to time the market will severely impact your long-term returns -- there is plenty of other research on the topic of market timing out there that reaches the same conclusion.

It would help explain the wild divergence between total US wealth and the regular incomes of people, now followed by a financial and economic collapse that shows much of that exuberant growth was actually some kind of betting that created only illusory wealth.