Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Thursday, 19 December 2024

MYEG

Wednesday, 18 December 2024

Creating new S-curves - developing new engines of growth - ideally before the current cycle of growth reaches maturity.

Every business goes through the S-curve cycle of growth:

- infancy (low growth),

- expansion (rapid growth) and

- maturity (slow growth).

No matter how successful the product is, growth must slow at some point (maturity phase), due to a number of reasons:

- increased competition,

- market saturation,

- technology disruption,

- regulatory changes and

- changing consumer preferences.

Ultimately, whether a company remains VALUE CREATIVE OR DESTRUSTIVE, depends on how well management understand this inevitability, its mindset and how successful it is in creating new S-curves - developing new engines of growth - ideally before the current cycle of growth reaches maturity.

New S-curves could include

- tapping into new selling channels and geographies for the existing products, or

- it could be expansion into a related business - for instance, starting a new product line and going upstream or downstream, or

- diversification into something entirely different and unrelated.

In short, the S-curve is dynamic over the company's life, that is, the company should continuously reinvent, reinvest and create new S-curves to start new growth cycles.

We see real-life examples of how this is done every day.

Companies starting new S-curves to start new growth cycles:

QL started Family Mart

YTL Power entered a new S-curve selling power to Singapore and enters the AI related sector.

Padini started Brands' Outlets.

Scientex growing its manufacturing business organically and through acquisitions and entering the property development sector business successfully.

KGB supplying its products to many industries and to many countries.

Facebook promoting Metaverse (but unsuccessfully).

Microsoft branching into cloud computing and AI.

Amazon continues to reinvent itself, selling books initially, and now selling almost everything. (Many new S-curves)

Of course, growth comes with a price too.

Some growths can be good and some can be very bad for the companies.

Shareholder wealth in a company is destroyed with failure to find new S-curve.

With no growth or business in decline, value of company shrinks (contracting PE x lower EPS); value is destroyed.

There are many companies in Bursa Malaysia in this category.

Companies that have STEEPER S-curve cycle of growth with LONGEVITY will also trade at .HIGHER valuations

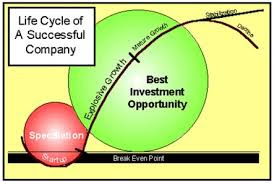

Savvy investors know about the corporate life cycle:

- start-up,

- rapid growth phase,

- mature growth phase,

- stagnation or outright decline.

Companies in their startup phase lose money.

If they're successful, though, they enter a rapid growth period, where sales - and eventually profits - shoot upward.

Then, alas, comes the point when the company has exhausted all of the easy growth opportunities. The low-hanging fruit has been picked. The company enters a mature phase in which sales maybe growing, but at a much slower rate than before.

Finally, in a company's dotage, it's all management can do to grow the company at all. The company's either in stagnation or outright decline.

Best time to invest is during its explosive growth phase or the mature slower growth phase of a successful company. Emphasis: growth phase.

S-curve cycle of growth

Every business goes through the S-curve cycle of growth:

- infancy (low growth),

- expansion (rapid growth) and

- maturity (slow growth).

Different businesses have a different S-curve shape and longevity.

Some S-curves will be steeper (stronger rates of growth) than others due to major innovation (e.g. Nvidia) that drives rapid adoption and demand across multiple market segments (market size).

Some S-curves will have greater longevity, that is, sustained high growth (expansion phase) for a longer period of time (e.g Amazon, Apple, Facebook) for a longer period of time because of, intellectual property protection or strong network effects. These have enduring competitive advantage.

Companies that have steeper S-curve with longevity will also trade at higher valuations.

Personal finance. Know your enemy - Mr. Inflation. Know your friend - Mr. Compounding

You have to invest. Inflation is the enemy of your cash. Compounding is the friend of your cash. You do not have a choice but to invest for the long term. The purchasing power of your cash continues to be eroded by inflation.

You have no choice but to be educated on investing. Either you invest on your own or you invest through a fund, you will still require an education on investing, to be able to do so intelligently on your own or even to know how to use or work with your fund managers.

The earlier you obtain this education, the better.

Sadly, the schools during my time, and perhaps even now, do not teach financial and investing knowledge. Personal finance is a subject that one should quickly learn from others or on your own. There are simple books to get started on this subject, easily available in the book shops. The introduction books on this subject for the first year university students are worth looking at.

Only one definition for valuation: the discounted cash flow

- Price/Earnings,

- Price/Ebidta,

- Price/Sales,

- Price/Book value and

- EV/Ebitda. (EV or Enterprise Value = Market cap + Debt).

Tuesday, 17 December 2024

Companies trading at below net cash. Opportunity or value trap?

Companies that are trading at negative enterprise value (EV)

EV = market value of common stock + market value of preferred equity + market value of debt + minority interest - cash and investments.

Why is the market having a very negative perception of the company's future prospects (rightly or wrongly), governance and/or believe the cash is not real?

Some of these companies are simply too small, and not tradeable.

Some are shell companies waiting for a corporate exercise.

There are many reasons:

Fake bank statements

It is very hard to fake bank statements and accordingly, net cash on the balance sheet. But if the monies are located offshore, this might not be the case.

Recall, several China based companies, such as China Stationery and Xingquan International Sports Holdings previously listed on Bursa. Investors were badly burnt, following revelations of massive accounting irregularities - including the reported cash going missing and discovery of previously unknown (un-authorised) loans. When something appears too good to be true, it often is.

Poor corporate governance

The integrity of management and controlling shareholders is a key factor for investors when valuing stocks and this is reflected in the stock price.

Investors lack of confidence maybe when investors expect that the cash - even though real - could be used in a way that is not in the interests of minority shareholders. It has happened time and time again.

Contingent liabilities

Existing cash on the balance sheet could be whittled away by contingent liabilities, when the market anticipates imminent payments for retrenchment exercises, lawsuits and so on.

Persistent loss-making and negative cash flows from operations

When a company is persistently loss-making and importantly, suffers negative cash flows from operations - whether due to idiosyncratic issues and/or broader economic downturn - that too will eat into its cash hoard. If the market has a downbeat outlook for the company's prospects, it will place a big discount on the stock.

Time to monetisation factor

Oftentimes, companies trade at discounts to their net cash and more broadly, the value of their underlying assets, because of the "time to monetisation" factor. It takes many years to translate an asset into earnings, cash flows and returns to shareholders.

Absence of powerful activist shareholders

There was no EV company among components of the S&P's 500 index and only a handful of very small companies in the Russell 3000 Index. This could be attributed to the presence of powerful activist shareholders in a mature market. The absence of activist investors may well be the problem for Bursa.

Time to Monetisation

Often, companies trade at discounts to their net cash and more broadly, the value of their underlying assets, because of the "time to monetisation" factor.

Investors are generally not patient enough to wait for asset value to crystallise.

An example:

Many property companies are currently trading below their book values, not for any of the ominous reasons, but simply because they are land-banking. The land is valuable but it takes many years to be developed and translated into earnings, cash flows and returns to shareholders.

In these cases, opportunity arises when the company unlocks the value of its assets,

- usually coinciding with the emergence of new substantial shareholders or activist investors, or

- when the company undertakes a major strategic change and restructuring or

- the privatisation of a listed entity.

Summary

One of the biggest risks for buying stocks priced far below their net asset values is time to monetisation.

But they could be deep-value stocks, trading at less than net cash in hand and likely to have limited downside risks. Patient investors may well be handsomely rewarded, over time.

Monday, 16 December 2024

Hidden debts. How to analyse companies with hidden debts.

If you are thinking of investing in the shares of airline, rail or retail companies, and many others, you need to understand of the biggest risks that you will face as a shareholder - hidden debts.

By understanding what hidden debts are and how to analyse companies that have them, you will make better investment decisions and take on less risk.

Retail company with big future rent commitments

Where a company has big future rent commitments, there are 2 useful things you can do:

1. Calculate a company's fixed charge cover.

2. Calculate the capitalised value of operating leases.

1. Fixed charge cover

Fixed charge cover = (EBIT + operating lease expense) / (net interest + operating lease)

A result within the range of 1.5 to 2 is not unusual.

Fixed charge cover of 1.3 times is the lowest level investors should tolerate, as the risk of financial distress becomes significant below that level.

Fixed charge cover has been a great way to spot retailers in trouble in the past, such as HMV, Game Group and Woolworth. These companies did not have huge amounts of debt on their balance sheets, but the rental commitments crippled them when profits start falling.

In 2005, Woolworth's fixed charge cover was only 1.3 times which was right at the limit of what is normally comfortable. Once profits started to fall in the following year, the company was in the danger zone. By 2007, the company's finances were close to breaking point. It filed for bankruptchy in January 2009. Prudent investors would not have invested even in 2005.

For the year to December 2015, Domino's had normalised EBIT of Sterling 73.6m, rental expenses of Sterling 21.3m and normalised net interest expenses of Sterling 0.02m. Its fixed charge cover was therefore:

(73.6 + 21.3) / (0.02 + 21.3) = 4.5 times

This is a healthy figure.

Domino's fixed charge cover has been consistently healthy despite the rapid growth in new stores. As the profitability of new stores increases, the fixed charge cover should improve.

Domino is a franchising business. It sublets the building it is renting out to its franchisees: the franchisee commits to pay the rent. This gives it an extra level of protection and explains why its fixed charge cover is not a matter for concern.

2. Capitalising the value of operating leases

There are two ways to estimate the value of hidden debt by taking an approach that is referred to as capitalising operating leases. In other words, you are working out what the total amount of the future liability might be in today's money.

a) The first way is to discount the future lease commitments to their present value using an interest rate similar to the interest rate paid on existing borrowings.

b) A quicker way, used by the credit rating agencies. Multiply the current annual rental expenses by a multiple between 6 and 8. (Use this which is simpler and much more straightforward).

Using the simpler method of multiplying by a number between 6 and 8 with the company's annual rental expense. Look for this in the annual accounts labelled "operating lease payments" or something similar.

For example, for 2015, the lease or rent expenses for Domino's was Sterling 21,313m.

Sterling m 2015 2014

Rent expense 21,313 20,874

Capitalised at 8x 170.5 167.0

Capitalised at 7x 149;2 146.1

Capitalised at 6x 127.9 125.2

Domino's hidden debts has evolved over the years. They have been growing as the company has opened more Pizza shops.

How are these calculations useful to an investor?

The impact on ROCE

Many retailers rent rather than own their high street stores, which means they have a lot of hidden debts.

Without taking these debts into account these companies can look like very good businesses with very high ROCEs. Once the debts are factored in, this changes.

There is nothing wrong with investing in companies with hidden debts, but it makes sense to ensure that they pass the tests of quality and safety, meaning:

- a minimum adjusted ROCE of 15%.

- a minimum fixed charge cover of at least 2.

Example

All in Sterling

Company Next WH Smith

Capital employed 1501.9 188.0

Lease adjusted Capital employed 3004.1 1987.0

Estimated hidden debt 1502.2 1799.0

ROCE (%) 60.2% 33.2%

Lease adjusted ROCE 33.2% 12.9%

Using Lease adjusted ROCE gives you a truer picture of a company's financial performance. In most cases, ROCE will decline when hidden debts are included.

Once the hidden debts are factored in, ROCE changes. In the above example, Netx still looks good, but WH Smith sees a big fall in ROCE.

Be wary of sale and leasebacks

In recent times, one of the easiest ways for companies to raise cash has been to sell some of their properties to property companies or investment funds and then rent them back. This is known as a sale and leaseback transactions.

For supermarket companies, such as Tesco, this was a big warning sign that all was not well.

Without the cash proceeds from selling supermarket stores to property companies, Tesco would have been struggling to find the free cash flow to pay dividends or invest in its business. The cash inflow from property sales made it look as if Tesco's debt was nothing to worry about, but the off-balance sheet debt ((Tesco's future rent obligations) increased at a rapid rate from 2005 to 2013.

After selling a number of its stores, Tesco tied itself into long-term rent agreements for stores that aren't as profitable as they used to be. This was one of the main reasons why Tesco had to stop paying a dividend in 2015. Trying to get out of these rented stores could prove to be very expensive for Tesco in the future. This is a good example of why investors ignore hidden debt at their peril.

Saturday, 14 December 2024

DEBTS are often neglected in company analysis and valuations. Red flags.

Look out for companies that report consistent profits but also a substantial rise in gearing, which would indicate negative FCF.

Receivables and/or inventories rise even faster than increasing sales

This is usually the case when companies report increasing sales but where receivables and/or inventories rise even faster.

If a company's receivables grow at a much faster rate than revenue, it will suffer net cash outflows, which have to be funded with increasing debt (or cash calls). It can continue to report steady profits for many years - even as the company is being crushed by mounting debt and interest expenses. Investors who are fixated on earnings would not realise the looming issue until it is too late.

Paying dividends in excess of cash flow from operations

Companies that pay dividends in excess of cash flow from operations may also warrant a red flag.

This is the danger when management's interest are not always aligned with that of shareholders. The fact is that management remuneration/incentives are usually based on profitability and share price gains, which encourages short-termism and risk-taking, including using leverage to boost earnings. Anecdotal evidence shows that high dividends/share buybacks tend to lead to higher share prices.

Indeed, sometimes not all shareholder's interests align either. Some are short term, preferring dividends/share buybacks while longer-term-minded investors would prefer companies to conserve cash for future opportunities and/or pay down their debts.

Borrowing to invest in productive assets

Companies necessarily reinvest for the future, funded with internally generated funds and/or borrowings and equity cash calls. Borrowing to invest in productive assets that will generate future cash flows is perfectly fine - as long as the increased risks that come with it are understood and properly taken into consideration.

Company with less debts is less risky and better positioned

Company that pay off its debts would be better positioned to withstand any unexpected economic and financial shocks - thereby making it the safer investment. It would be better able to capitalise on future opportunities - for example, mergers and acquisitions, relative to its competitors which large debts, thanks to its stronger balance sheet.

Conclusions

There will always exist a trade-off between risks and rewards. It is important to analyse both aspects in tandem.

There is nothing wrong if you choose to go for the higher returns, provided you also understand the risks and can stomach the potential losses.

Some investors are risk takers, others are more risk-averse, but the smartest investors make informed decisions.

Earnings are not equivalent to cash flows

These metrics rely on reported profits or earnings rather than cash flows:

P/E

P/EBITDA

P/S

P/BV

EV/EBITDA

Profits may not reflect the actual underlying cash flows.

Some examples:

1. Interest paid on perpetual securities (perps)

- These are not considered interest expense, thereby inflating profits.

- At the same time, accounting for perps as equity also understates the company's actual gearing.

2. Companies can capitalise interest expense as assets in certain circumstances

- Interests during construction of assets or when property developers borrow to purchase land for future development.

- This would understate expenses and inflate profits and book value.

- A company is allowed to recognise construction revenue from in-house concessionaires based on estimated fair values of future income streams under the long-term agreements. This revenue is recorded as financial receivables/intangible assets on the balance sheet.

- When the concession asset commences operation, cash flows generated from the asset are recognised as sales, while the operating costs include amortisation of the financial receivables/intangible assets.

- Basically, companies report earnings even when there is no cash flow during the construction period, and then actual cash flows are higher than reported earnings when the asset is in operation.

- In short, reported earnings have little relationship to the actual cash flows.

- This is to inflate sales, Ebitda, profits and book values - to give the impression that the company was worth more than it really was.

- As such, scrutinising the Cash Flow Statement - which shows the sources and applications of cash, tying the cash balance at the start and end of the financial period - can be more informative than the popular Profit and Loss Statement.

- For instance, the P/E ratio attributes value to the earnings - but ignores the risks of debt used to generate those earnings.

- This omission can have serious consequences for investors.

- A company with debts may appear to have more attractive valuations but this come with higher risks, which are not immediately evident and therefore, not properly accounted for, simply by looking at the Profit & Loss statement.

- When companies have to borrow to service debts, the situation will, often spiral rapidly out of control.

Ref: Tong's Portfolio 2 It's all a matter of trust

Tuesday, 10 December 2024

The last Malaysian property boom in 2012 - 2015.

During this period, a friend of mine worked half the time and the other half, he was busy speculating and flipping properties. He declared he made more in "flipping" properties than his income from actual professional work during that period.

DIBS induced property boom in the early 2010s

This was driven by massive speculative activities on the back of the Developer Interest Bearing Scheme (DIBS) that was introduced in 2009.

The scheme allowed developers to absorb all the interest costs on mortgages during the construction period. This significantly reduced the cost for house buyers during construction, thereby boosting demand.

Also, developers imputed the additional financing costs into their selling prices, thereby artificially inflating property prices.

The artificially inflated property prices and reduced upfront costs gave buyers (speculators) further leverage and bigger profits on a quick flip of the property upon completion.

Housing quicly became unaffordable

It soon became clear that the steep increase in property prices was a growing problem - housing quickly became unaffordable.

The DIBS scheme was abolished in Budget 2014.

Demand promptly collapsed.

The steep price increases between 2012 and 2015 were in effect pulled forward gains, resulting in stagnant house prices in subsequent years.

It took the property market years to recover from the DIBS bubble burst.

The demand-supply dynamics are finally improving.

Housing (Un)affordability in Malaysia

Housing (Un)affordability

Based on the Medium Multiple approach, as recommended by the World Bank as well as the United Nations.

House price-to-income ratio

Severely unaffordable 5.1 & above

Seriously unaffordable 4.1 - 5.0

Moderately unaffordable 3.1 - 4.0

Affordable 3.0 & below

House prices in Malaysia are seriously unaffordable across most states

a. Median house price (2020) RM 295,000

b. Annual median income (2020) RM 62,508

Malaysia's house price-to-income ratio = a / b = 4.7 (In 2019: 4.1)

Reasons for housing unaffordability

Housing is unaffordable because many do not earn enough and are already highly indebted.

House prices (+4.1%) grew faster than income (+2.1%).

Households have low savings buffer: 76% (3/4) of households have savings that can only cover less than 3 months living expenses.

Prospective borrowers are already highly indebted: 65% (2/3) of borrowers already have either car or personal loans, which may constrain their capacity to take on a housing loan.

There are also not enough affordable homes

1 in 3 newly launched are priced < RM 300,000

3 in 4 households earn < RM 100,000/year

- To afford a house priced up to RM 300,000*, a household needs to earn RM 100,000/year# or RM 8,333/month.

- 76% (or 3/4) of households in Malaysian earn < or = RM 8,333, but only 36% (or 1/3) of newly-launched units are priced < or = RM 300,000.

Reference:

*Based on the National Affordable Housing Policy 2019, the maximum price of affordable housing in Malaysia is RM 300,000.

#Estimated using Median Multiple approach, in which a house is deemed affordable if the house price is not more than 3 times the annual income.

Source: Bank Negara Malaysia. Household income estimates and incidence of poverty report (2020)by the Department of Statistics, Malaysia (DOSM).

Buying a house to stay in is better than renting one, no question.

The math remains strongly in favour of home ownership versus renting.

In the long run, the comparative value of owning a home far exceeds that of renting.

This is the case even when the rental yield (rental as a percentage of house value) is lower than the mortgage rate, primarily because both the rental and house prices will rise in tandem with inflation, at least.

This means that the cost of renting (an expense) will keep rising while home ownership is an asset whose value will appreciate with time.

Monday, 9 December 2024

US dollar hegemony

As World War II was coming to an end, 44 Allied nations met in July 1944 in New Hampshire, the US, to design a new set of rules that would govern the post-war international monetary order.

1994: Bretton Woods Conference

In 1944, the US dollar officially became the world's reserve currency. The Bretton Woods Conference pegged all other currencies against the US dollar. To ensure confidence in the system, the US dollar itself was convertible to gold at a fixed rate of US$35 an ounce. The US at that time, held some three-quarters of the world's official gold reserves.

The system worked well enough in the initial years, on the back of robust demand for US goods and services from Europe and Japan for their post-war rebuilding efforts.

1960s: Balance of payments crisis emerged

It started to fray going into the 1960s, when European and Japanese exports became more competitive and the US share of world output declined. Huge military spending during the Vietnam War further pushed the US into persistent deficits. Demands for the US to balance its budget were ignored.

A balance of payments crisis emerged. Official US dollar liabilities held overseas mounted, exceeding its gold stock multifold - the US dollar was overvalued. By the second half of the 1960s, European nations demanded gold for their US dollar holdings, creating a run on US gold reserves.

1971: End of Bretton Woods and end of gold convertibility

With rising inflation, unemployment, a weakening US dollar and the risk of running down all of its gold reserves, President Richard Nixon ended gold convertibility on Aug 15, 1971. This also, effectively ended the Bretton Woods system. He imposed a wage and price freeze to control inflation and levied import tariffs to boost US production and jobs. The US dollar crashed and the world "stagflation" was coined.

The international monetary system transitioned from a gold standard to one based on pure fiat money, backed not by any underlying assets with intrinsic value but by faith in the US government. It was due in no small part, to the rise of "petrodollar" in the 1970s.

1974: Rise of Petrodollar - "oil for dollars"

In 1974, Saudi Arabia made a deal with the Nixon administration that includes the condition that all its oil exports would be traded exclusively in US dollars. This "oil for dollars" was later embraced by other by other members of the OPEC. Given oil's critical importance in every economy, this all but cemented the US dollar's position as the pre-eminent medium of exchange as well as store of value. The recycling of petrodollars into US dollar-denominated assets, including Treasury bonds, further anchored its reserve currency status.

Over time, US dollar dominance extended to the entire commodities complex and the rest of the world. Today, central banks typically hold about two-thirds of their foreign reserves in US dollar assets.

US enjoys an "exorbitant privilege".

US dollar as a world reserve currency allows US to enjoy an "exorbitant privilege".

The insatiable demand for US dollar allowed the US to sustain the world's largest current account deficit, with no negative consequences. The US is able to finance ever-growing fiscal spending with cheap borrowings - to keep building on its military superpower status, fortify its unparalleled influence in economics, finance and technology, pursue expansive social programs, support American consumerism and elevate living standards for its population, all the time compounding the positive feedback loop.

Many believe that the US dollar hegemony has driven American foreign policy over the years. This US exceptionalism was paid for largely by the rest of the world. Its dominance is a legacy of the Bretton Woods system, which it created nearly eight decades ago. Will this remain the case 20 years from now?

Reference: Tong's Portfolio 2 Its all a matter of trust

Friday, 6 December 2024

Relative and Absolute Price Earnings Ratio

Relative PE ratio

Relative PE ratio moves up because people expect either the industry or the company's prospects to be better relative to other securities than they have been than their preceding view and that can turn out to be justified or otherwise.

Absolute PE ratio

Absolute PE ratio moves up in respect to the earning power or the perspective earning power of that is viewed by the investing public of the future returns on equity and also in response to changes in interest rates.

Warren Buffett

Thursday, 5 December 2024

Bacteria and Bricklayers

Bacteria and Bricklayers

Bacteria

In bacteria populations, growth is fixed. Subject to the resource constraints of the environment they inhabit, bacteria grow at a constant rate indefinitely.

A simple example to illustrate the point:

Let's say we have some bacteria that reproduce on a fixed time schedule, one doubling per minute to keep the numbers simple.

We start with a single bacteria cell. After one minute, we'll have two bacteria. With time, the population grows as such:

- 1

- 2

- 4

- 8

- 16

- ...

Now we ask the question, how fast does our bacteria population grow (in percentage terms)?

The minute-over-minute growth rate is: 1 or 100%.

This is an example of perfectly compounding growth, also referred to as exponential or geometric growth.

Put simply, how fast the bacteria grow is entirely independent of population size. In other words, growth and scale are perfectly uncorrelated.

Importantly, most things do not work this way.

Layering on

Let's look at another example - constructing a brick wall.

Assume a bricklayer can lay 10 bricks per hour. The brick count will proceed as follows

- 0

- 10

- 20

- 30

- 40

- ...

The brick count grows by 10 bricks per hour.

Going through the same growth rate calculations from above: initially we are growing the brick count quite fast - 100% in fact. But by the time we reach 30 bricks, our forward-looking growth rate has fallen to 33%. At 100 bricks, we'll only be growing 10%.

Notice that the growth rate depends on how many bricks we've already laid. This is linear or arithmetic growth. Because the number of bricks laid each hour is static through time, growth (in percentage terms) necessarily slows down. Scale is in the denominator. Therefore, growth and scale are negatively correlated: more scale -> less growth.

Wednesday, 4 December 2024

Trade tariffs

Lessons from the past

In 1930, the USA enacted the Smoot-Hawley tariff, which raised tariffs on imported goods to record levels. These tariffs reduced demand for foreign goods. Foreign countries retaliated by imposing their own tariffs. The result was a collapse in world trade that worsened the effects of the Depression. It took decades to rebuild the world economy.

The costs of tariffs

Why politicians continue to impose policies that are likely to damage the overall economy, even though the costs are widely known?

A small number of large domestic producers and their workers - suffer a visible impact from cheap imports. They are 'protected and saved'.

However, the potentially larger number of consumers who have to pay higher prices because of tariffs, and those workers in affiliated industries who might lose their jobs through knock-on impacts, are dispersed around the economy.

Examples of effects of tariffs:

- US tariffs on Chinese car tyres in 2009

In 2009, China accused the USA of "rampant protectionism", for imposing heavy tariffs (taxes) on imported Chinese car tyres. The decision to increase tariffs came after pressure from US workers who had seen tyre imports grow from 14 to 46 million from 2004 - 08, reducing US tyre output, causing factory closure and creating unemployment.

However, the USA had previously accused China of unfairly subsidising its own tyre industry, so tensions mounted. China's response was to threaten retaliatory increases in import taxes on US cars and poultry.

Tariffs produce effects that ripple through economies. Any protection gained for US tyre producers from the tariffs on tyres, for example was counteracted by other negative impacts. Higher tyre prices increased the costs of US cars, making them less competitive and reducing the numbers bought by US consumers. The retaliation by China also damaged US export industries. The jobs of some US tyre workers may have been saved, but in the wider economy, many more jobs were lost.

- India removed tariffs on cheap Indonesian palm oil imports

When the government of India removed tariffs on imports of cheap palm oil from Indonesia, it had the positive effect of raising the living standards of hundreds of millions of Indians, but it destroyed the livelihoods of 1,000,000 farmers who grew peanuts for oil, which was now passed over for palm oil. The peanut farmers cannot simply transfer into the production of other goods, because their investment in capital is immobile - a machine that processes peanuts has no other use.

The future of globalization

Today, markets are more integrated than ever as transport costs have continued to fall and most tariffs have been scrapped altogether.

One vision of the future of globalization involves the elimination of other kind of barriers to trade caused by institutional differences between countries. Markets are embedded in institutions - in property rights, legal systems and regulatory regimes. Differences in institutions between countries create trading costs in the same way that tariffs or distance do.

Despite the removal of tariffs the world is far from being a single market. Borders still matter because of these kinds of institutional incompatibilities. Complete integration requires the ironing out of legal and regulatory differences to create a single institutional space.

Sunday, 24 November 2024

Risk and Ruin

Risk and Ruin

You can be risk loving and yet completely averse to ruin. And indeed, you should.

The idea is that you have to take risk to get ahead, but no risk that can wipe you out is ever worth taking.

Russian roulette

The odds are in your favour when playing Russian roulette. But the downside is not worth the potential upside. There is no margin of safety that can compensate for the risk.

Playing Russian roulette with your own money

Same with money. The odds of many lucrative things are in your favour. But if something has 95% odds of being right, the 5% odds of being wrong means you will almost certainly experience the downside at some point in your life. And if the cost of the downside is ruin, the upside the other 95% of the time likely isn't worth the risk, no matter how appealing it looks.

Leverage is capable of producing ruin

Leverage is the devil here. Leverage - taking on debt to make your money go further - pushes routine risks into something capable of producing ruin. The danger is that rational optimism most of the time masks the odds of ruin some of the time. The result is we systematically underestimate risk.

Housing prices fell 30% last decade. A few companies defaulted on their debt. That is capitalism. It happens. But those with high leverage has a double wipeout: Not only were they left broke, but being wiped out erased every opportunity to get back in the game at the very moment opportunity was ripe. A home owner wiped out in 2009 had no chance of taking advantage of cheap mortgage rates in 2010. Lehman Brothers had no chance of investing in cheap debt in 2009. They were done.

Survive to succeed

I take risk with one portion of my own money and am terrified with the other. This is not inconsistent, but the psychology of money would lead you to believe that it is. I just want to ensure I can remain standing long enough for my risks to pay off. You have to survive to succeed. The ability to do what you want, when you want, for as long as you want, has an infinite ROI.

You have to give yourself room for error. You have to plan on your plan not going according to plan.

The best way to achieve felicity is to aim low. (Charlie Munger)

Things changed. Is detailed analysis of individual stocks necessary?

Just before he died, Graham was asked whether detailed analysis of individual stocks - a tactic he became famous for - remained a strategy he favoured. He answered:

"In general, no. I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook was first published. But the situation has changed a great deal since then."

What changed was: Competition grew as opportunities became well known; technology made information more accessible; and industries changed as the economy shifted from industrial to technology sectors, which have different business cycles and capital uses.

Things changed.

Thursday, 14 November 2024

Monday, 4 November 2024

Have an obsession for cash flow conversion. What is the free cash flow of the company?

Charlie Munger: If you take a business that is a GOOD business but not a fabulous (GREAT) business, they tend to fall into TWO categories:

One is the business where the whole reported profit just sits there in surplus cash at the end of the year and you can take it out of the business and the business will do just as well without it, as it would if it stayed in the business

The second business is one that reports the 12% (return) on capital but there's never any cash. (This) reminds me of the used construction equipment business of my old friend John Anderson and he used to say in my business every year you make a profit and there it is, sitting in the yard. There are awful of businesses like that where just to keep going (and) to stay in place, there is never any cash. Now that business doesn't enable headquarters to drag out a lot of cash and invest it elsewhere. We hate that kind of a business. Don't you think that is a fair statement?

Warren Buffett: Yeah, that is a fair statement.

https://www.facebook.com/reel/507646045755285

Summary:

2 types of Good Businesses:

One that generates a lot of free cash flows; you can take this cash out of the business and the business will just do as well without it.

One that generates little or no free cash flows, as it requires a lot of working capital or capex to maintain and sustain its business.

Monday, 28 October 2024

Valuation cheat sheet. What are some of your favourite metrics?

Tuesday, 22 October 2024

Markets are Competitive

Passive Management

Holding a highly diversified portfolio

No attempt to find undervalued securities

No attempt to time the market.

Active Management

Finding mispriced securities

Timing the market

The biggest mistake that investors make

The biggest mistake that investors make is not sticking with the plan when the market goes down.

What you do when the market goes down is more important than what you do as it is rising. WHY?

Because the worse days are followed by the best days.

Manage your emotions

When it is our own money, we think it is math, but it is actually not. Just because we learn about money in math class doesn't mean it is math to us. It is actually very EMOTIONAL.

One of the things that we need to do is manage the emotion, because we do feel the pain of a loss more than the euphoria of a gain.

Manage the emotion and just keep plodding along, paddling along in the markets for a long time.

Catherine Keating

Global Head of BNY Wealth

Bloomberg Interview

Thursday, 17 October 2024

Emotional Intelligence

Conflict between our thinking and our feelings makes things complicated.

Instincts, feelings and personal values take over and become a major part of our actions and behaviour.

Gut instincts or intuition rely a great deal on emotion and feelings.

Both feelings and instincts are major influences on our behaviour in the real world.

How can you benefit from improving your emotional intelligence?

Doing so, will also make life easier for those who have to interact with you.

Emotional intelligence is a valuable set of ideas you can use everyday and everywhere: in the workplace and in the home; as a parent, teacher or manager.

It is about being aware of feelings in yourself and in others, understanding them and managing their impact.

It is about being in control, interpreting body language, coping with negativity, working with others and building psychological well-being.

Emotional Intelligence

Emotional Intelligence is an assortment of mental abilities and skills that can help you to successfully manage both yourself and the demands of working with others.

Developing your own emotional intelligence enables you to:

- Know yourself reasonably well

- Control your own emotions

- Show empathy with the feelings of others

- Use social skills in an effective as well as simply pleasant way.

- Mindfulness: being aware - understanding yourself and others

- Being in control of your own thoughts, emotions and needs

- Being positive and self motivated particularly in the face of setbacks

- Using empathy: being able to put yourself in others' shoes

- Communicating effectively to build productive and positive relationships

- Using emotional reasoning: being able to use emotions to enhance rather than restrict your thinking.

- It is estimated that 15% of people will have a bout of severe depression at some point in their lives.

- 2% of teenagers are diagnosed with emotional disorders before the age of 18.

- Emotional disorders in old age is also a major and increasing problem.