Understanding the time value of money

February 28, 2018, Wednesday AKPK

Imagine that you are offered a sum of money and asked to choose whether you want the money now or one year later. It is good to think what RM1 could buy back in 1990, what it could buy today and what would it be able to buy in the future?

Instinctively, you would know that money you have now – at the present time – is worth more than the same amount in the future. This is a key principle of economics that states as long as money can earn interest, any amount of money is worth more the sooner it is received. This concept illustrates the time value of money, also known as ‘present discounted value’.

Let us understand this idea. Say you deposit money into an interest bearing savings account at a five per cent interest rate, RM1,000 saved today will be worth RM1,050 in one year. Here multiplication is used when the ringgit amount is deposited in an interest bearing account. This is because from now to a given time in future it would continually yield interest.

On the other hand, RM1,000 received one year from now is only worth RM952.38 today. Division is used to represent the losses that arise during the period that a ringgit amount is not in an interest bearing account. It is that simple!

From this illustration you can observe that money has a time value. All things being equal, the present value of money is greater than the value of the same amount of money at any given time in the future.

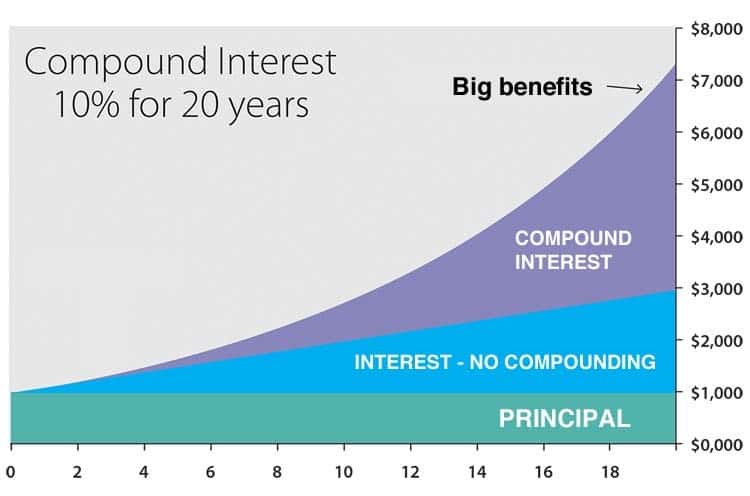

The power of compound interest

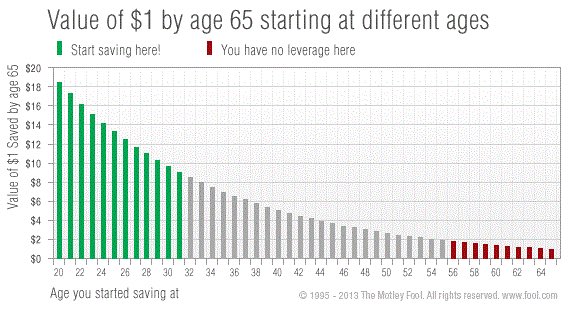

How important is it to begin putting aside money for savings right now, instead of sometime later?

For example: Ahmad, Siti and Zainal consistently invest the same amount of money, i.e. RM3,000 per year for 10 years, which earn the same interest return of five per cent per annum. But they start investing at different ages – Ahmad at 18, Siti at 28 and Zainal at 38.

When all three retire at 60, Ahmad has more money than Siti and Zainal. He has RM198,228.14, whereas Siti has RM121,694.88 and Zainal has RM74,710.

Ahmad has more money at age 60 compared to Siti and Zainal although each of them invested RM30,000.

Important notes

Investment return will fluctuate over the years due to economic and stock market conditions. Some years may be lower than five per cent per year and some years may be higher than five per cent per year. Therefore, the total investment value may be more or less than the original investment amount.

The total investment that Ahmad, Siti and Zainal will get at the age of 60 will be as stated above only if the annual investment return is consistently at five per cent per year.

The outcome in the example above is due to the effect of compound interest. It is the additional interest earned on top of the original savings amount plus the interest received.

The power of compound interest is that, the earlier you start saving, the greater the interest accumulated on your original investment.

This simply means the more money you keep aside now, the faster you can fulfil your dreams. will you get interest on the original investment, you also receive interest on the interest you earned the prior year. This is called compounded interest, which is basically interest applied to interest.

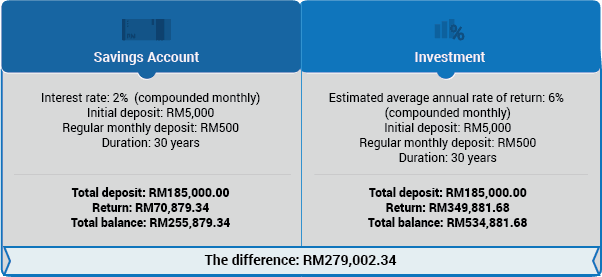

Compound interest is important to investors who are able to leave their investments to grow over long periods. The RM10,000 investment mentioned above, when invested for 10 years at five per cent per annum, will be worth RM16,289.

If the interest rate of five per cent is compounded on a monthly basis, the monthly interest rate is 0.42 per cent, which is five per cent divided by 12 months.

If the same amount of RM10,000 is invested based on 0.42 per cent per month and invested for 10 years, it will be worth RM16,401, which is RM112 more than if invested at a yearly rate of five per cent. Therefore, you will gain more if you invest in an investment that pays interest on a monthly instead of yearly compounded basis.

Compound interest can be what we call a double-edged sword. It can work both to your advantage and disadvantage.

It can help give you more return on your investment as the benefit of compounding interest means you will earn more interest income the longer you keep your money invested.

In contrast, if you have a loan or credit card debt, you can end up paying more interest if these debts are calculated on a compounded interest rate.

This is because if you delay your loan or credit card repayment for a longer time, you will be charged more interest, eventually making it increasingly difficult for you to settle your loan or credit card debt.

Next week, AKPK will focus on the importance of setting your financial goals for a better future.

The Credit Counselling and Debt Management Agency (AKPK) is an agency under Bank Negara Malaysia tasked to help individuals take control of their financial situation. For assistance, please contact AKPK’s Power Infoline at 03-26167766 or visit www.akpk.org.my.

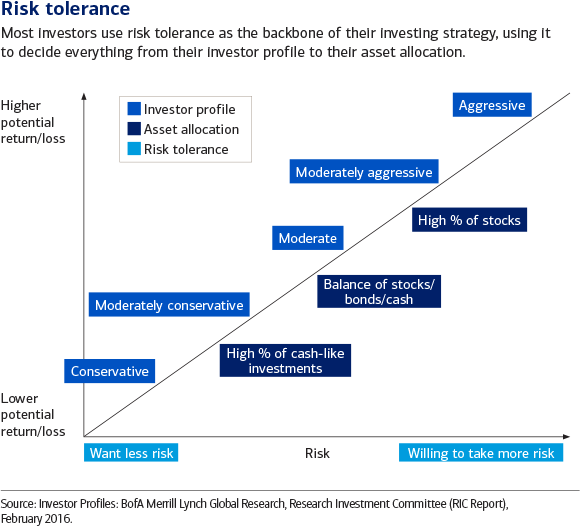

/Investmentrisk1-4-56a635313df78cf7728bd723.gif)