Company X is a private limited company that owns a lot of assets. It owns plantations, factories, shop houses and various businesses. Its net book value is very high. If it can sell off everything at the fair market price, it should be worth a lot of money.

It has many shareholders. Many are from the same related brothers and sisters. There are also many outsiders who own shares in the company.

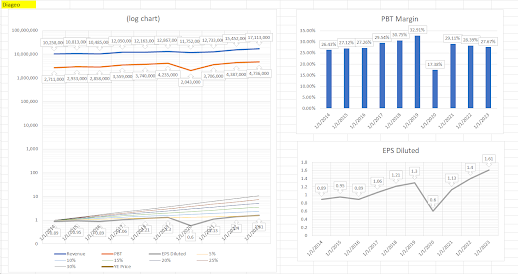

The company makes good profit every year and is cash rich. It is well managed. It chooses to distribute a small portion of the yearly profits as dividends and retains the major portion as cash which is kept in the bank. Every year its net book value increases due to its retained earnings. The shareholders get their dividends without fail, though these have not increased through the years, despite the company earnings having improved over the period.

The management remains sound and those in control of the management and the directors enjoy their fees for their services, which are fair and reasonable.

The company continues to grow its assets and earnings over the years. Its assets, which are land, properties and businesses have appreciated a lot over the very many years.

Alas, some shareholders wish to cash out. Who are the buyers? Yes, some of the shareholders are still accumulating the shares in the company regularly. There are also many who also are not willing to buy, not because the company is not good and also not because it is overvalued. They do not wish to tie their money up in the company as they cannot see how they will be rewarded in the coming years. Except for the dividends received yearly, which weren't much when you compared with the yields from the risk free fixed deposit rates, they just cannot see how they can cash out of this company at a fair price. The buyers have indicated that they are always available for those who wish to cash out, but the price offered is about half that of the net book value. This state of affair existed for many years and continues till today.

Are there similarities we can observe in some of the listed companies who are deemed value traps too?