Traits

• Sales and profits rise and fall in regular, if

not completely regular fashion, as business

expands and contracts.

• Timing is everything. Coming out of a

recession into a vigorous economy, they

flourish more than Stalwarts. In the opposite

direction, they can lose >50% very quickly

and may take years before another upswing.

• Most misunderstood type, and investors can

lose money in stocks considered safe. Large

Cyclicals are falsely classified as Stalwarts.

• If a defensive Stalwart loses 50% in a slump,

then Cyclicals may lose 80%.

• It’s much easier to predict upswing, vs, a

downturn, so one has to detect early signs of

business changes. You get a working edge if

you’re in the same industry – to be used to

your advantage. Most important in Cyclicals.

• Unreliable dividend payers. If they’ve

financial problems, then they become

potential Turnaround candidates.

• Inventory build-up = bad sign. Inventory

growth > Sales growth = red flag. Inventory

build-up with companies having fluctuating

end product pricing causes larger problems.

• Monitor inventory to figure out business

direction. If inventory is depleting in a

depressed company, it’s the first evidence of

a possible business turnaround.

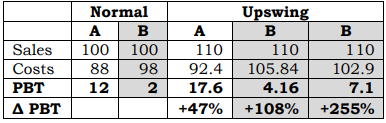

• High Operating Profit Margin (OPM) = Lowest

Cost producer, who’s got a better chance of

survival if business conditions deteriorate.

• Upswing favours companies with Low

OPM’s. Therefore, what you want to do is to

Hold relatively High OPM companies for long

term and play relatively Low OPM companies

for successful Turnarounds / cycle turns.

• The best time to get involved with Cyclicals

is when the economy is at its weakest,

earnings are at their lowest, and public

sentiment is at its bleakest. Even though

Cyclicals have rebounded in the same way 8

times since WWII, buying them in the early

stages of an economic recovery is never easy.

• Every recession brings out sceptics who

doubt that we will ever come out of it, who

predict a depression and the country going

bankrupt. If there’s any time not to own

Cyclicals, it’s in a depression. “This one is

different,” is the doomsayer’s litany, and, in

fact, every recession is different, but that

doesn’t mean it’s going to ruin us.

• Whenever there was a recession, Lynch paid

attention to them. Since he always thought

positively and assumed that the economy

will improve, he was willing to invest in

Cyclicals at their nadir. Just when it seems

it can’t get any worse, things begin to get

better. A comeback of depressed Cyclicals

with strong balance sheets is inevitable.

• Cyclicals lead the market higher at the end

of a recession – how frequently today’s

mountains turn into tomorrow’s molehills,

and, vice versa.

• Cyclicals are like blackjack: stay in the game

too long and it’s bound to take back all your

profits. Things can go from good to worse

very quickly and it’s important to get out at

the right time.

• As business goes from lousy to mediocre,

investors in Cyclicals can make money; as it

goes from mediocre to good, they can make

money; from good to excellent, they may

make a little more money, though not as

much as before. It’s when business goes

from excellent back to good that investors

begin to lose; from good to mediocre, they

lose more; and from mediocre to lousy,

they’re back where they started.

• So, you have to know where we are in the

cycle. But it’s not quite as simple as it

sounds. Investing in Cyclicals has become a

game of anticipation, making it doubly hard

to make money. Large institutions try to get

a jump on competitors by buying Cyclicals

before they’ve shown any signs of recovery.

This can lead to false starts, when stock

prices run up and then fall back with each

contradictory statistic (we’re recovering,

we’re not recovering) that is released.

• The principal danger is that you buy too

early, then get discouraged, and, sell. To

succeed, you’ve to have some way of

tracking the fundamentals of the industry

and the company. It’s perilous to invest

without the working knowledge of the

industry and its rhythms.

• Timing the cycle is only half the battle.

Other half is picking companies that will

gain Most from an upturn. If Industry pick =

Right, but Company pick = Wrong, then you

can lose money just as easily as if you were

wrong about the industry.

• If investing in a troubled industry, buy

companies with staying power. Also, wait for

signs of revival. Some troubled industries

never came back.

• If you sell at 2x, you won’t get 10x. If the

original story is intact or improving, stick

around to see what happens and you’ll be

amazed at the results.

Examples

• Auto, airlines, steel, tyres, chemicals,

aerospace & defence, non-ferrous metals,

nursing, lodging, oil & gas

• Autos: 3-4 up years, after 3-4 down years.

Worse Slump = Better Recovery. An extra

bad year brings longer and more sustainable

upside. People will eventually replace their

cars, even if put off for 1-2 years.

o Units of pent up demand – compare

Actual Sales vs Trend, ie, estimate of

how many units should’ve been sold

based on demographics, previous year

sales, age of cars on road etc.

o 1980-83 = sluggish economy + people

saving up, therefore pent up demand =

7mm. 1984-89 boom, sales exceeded

trendline by 7.8mm.

o After 4-5 years below trend, it takes

another 4-5 years above trend, before

the car market can catch upto itself. If

you didn’t know this, you might sell your

auto stocks too soon. After 1983, sales

increased from 5mm to 12.3mm and you

might sell fearing the boom was over.

But if you follow the trend, you’d know

the pent up demand was 7mm, which

wasn’t exhausted until 1988, which was

the year to sell your auto stocks, since

pent up demand from early 80’s got used

up. Even though 1989 was a good year,

units sold fell by 1mm.

o If industry had 5 good years, it means

it’s somewhere in the middle of the cycle.

Can predict upturn, not downturn.

o Chrysler EPS for 1988, ’89, ’90 & ’91

was $4.7, $11.0, $0.3 & Loss,

respectively. When your best case is

worse than everyone’s worst case, worry

that the stock is floating on fantasy.

• At one point, high yield Utilities were 10% of

Magellan’s AUM. This usually happened

when interest rates were declining and the

economy was in a splutter. Therefore, treat

Utilities as interest rate Cyclicals and time

entry and exit accordingly. Can also treat

Fannie / NBFC’s as interest rate Cyclicals

benefitting from rate cuts.

• In the Gold Rush, people selling picks and

shovels did better than the miners. During

periods when mutual funds are popular,

investing in the fund companies is more

rewarding than putting money into their

funds. When interest rates are falling, bond

& equity funds attract most cash. Money

market funds prosper when rates rise.

• In US /Europe insurance companies, the

rates go up months before earnings show

any improvement. If you buy when the rates

first begin to rise, you can make a lot of

money. It’s not uncommon for a stock to

become 2x after a rate increase and another

2x on the higher earnings that result from a

rate increase.

People Examples

• Make all their money in short bursts, then

try to budget it through long, unprofitable

stretches. Farmers, resort employees, camp

operators, writers, actors. Some may also

become Fast Growers.

PE Ratio

• Slow Growers (7-9x) < Cyclicals (7-20x) <

Fast Growers (14-20x)

• Assigning PE’s: Peak EPS (3-4x) < Decent

EPS (5-8x) < Average EPS (8-10x)

• Stock Pattern: 1990 EPS = $6.5, Price Range

= $23 - $36, PE Range = 3.6-5.5x. 1991 EPS

= $3.9, Price drops to $26. PE = 6.7x, higher

than previous year PE, that had higher EPS.

• With most stocks, a Low PE is regarded as a

good thing, but not with Cyclicals. When

Low, it’s usually a sign that they are at the

end of a prosperous interlude.

• Unwary investors hold onto their shares

since business is still good & the company

continues to show higher earnings, but this

will change soon. Smart investors sell their

shares early to avoid the rush.

• When a large crowd begins to sell, the Price

and PE drops, making a Cyclical more

attractive to the uninitiated. This can be an

expensive misconception. Soon, the economy

will falter and earnings will decline at a

breathtaking speed. As more investors head

for the exit, price will plummet. Buying

Cyclicals after years of record earnings and

when PE has hit a low point is a proven

method to lose ~50% in a short time.

• Conversely, a High PE may be good news for

a Cyclical. Often, it means that a company is

passing through the worst of the doldrums

and soon its business will improve, earnings

will exceed expectations, and investors will

start buying the stock.

2 Minute Drill

• Script revolves around business conditions,

inventories and prices.

• There’s been a 3 year slump in autos but

this year things have turned around. I know

that because car sales are up across the

board for the first time in recent memory.

GM’s new models are selling well and in the

last 18 months GM closed down 5 inefficient

plants, cut 20% labour and earnings are

about to turn higher.

Checklist

• Inventories: keep a close eye on inventory

levels, changes, and, the supply & demand

relationship.

• Competition: new entrants / added supply =

dangerous development, because they may

cut prices to capture market share.

• Know your Cyclical: if you do, then you have

an advantage in figuring things out and

timing the cycles.

• Balance Sheet: strong enough to survive the

next downturn? Can it outlast competitors?

Is capex on upgradation / expansion a cause

for concern? How much of a drag is it on

FCF? Is CF > Capex, even in bad years? Are

plant & machinery in good shape?

Portfolio Allocation %

• 10-20% Allocation

Risk/Reward

• Low Risk – High Gain; or

High Risk – Low Gain, depending on

investor adeptness at anticipating cycles.

• +10x / (80-90% loss)

• Get out of situations where Price overtakes

Fundamentals and rotate into Fundamentals

> Price

Sell When

• Understand strange rules to play game

successfully, because Cyclicals are tricky.

Sell towards the end of the cycle, but who

knows when that is? Who even knows what

cycles they’re talking about? Sometimes, the

knowledgeable vanguard sells 1 year before

any signs of decline, so price falls for no

apparent reason.

• Whatever inspired you to buy after the last

bust, will help clue you in that the latest

boom is over. If you’d enough of an edge to

buy in the first place, then you’ll notice

changes in business and price.

• Company spends on new technological

expansion, instead of cheaper expenditures

on modernizing old plants.

• Sell when something has actually gone

wrong. Rising costs, 100% utilization but

spending on capacity expansion, labour asks

for increased wages, which were cut in the

previous bust etc.

• Final product demand slows down.

Inventory builds up and the company can’t

get rid of it. If storage is full of finished

goods, you may already be late in selling.

• Falling commodity prices, Futures < Spot

Price. Oil, steel prices turn lower much

earlier than EPS impact.

• Strong competition for market share leads to

price cuts. Company tries cost cuts but can’t

compete against cheap imports.

The Peter Lynch Playbook

Twitter@mjbaldbard 7 mayur.jain1@gmail.com