Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Thursday, 14 January 2010

Investsmart blogsite is still a good useful resource for serious investors

http://investssmart.blogspot.com/

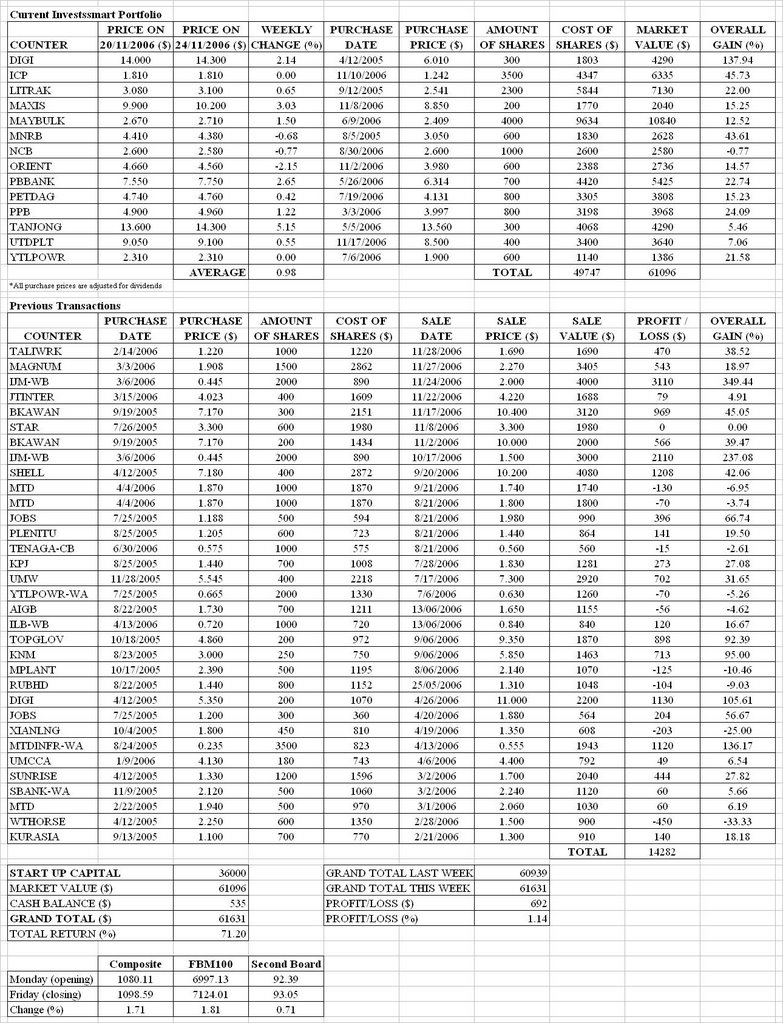

Investsmart blogged on his investing in the KLSE for a short while. He had an impressive record. He started blogging at the time when the market was low and was just on the way up. His reasoning and analysis were very educational and sound. His blog remains a good site to visit to learn of the way he picked and analysed the stocks he invested in.

A Better Way to Calculate Earnings Yield

Value Stock Investing - A Better Way to Calculate Earnings Yield

By Lee Franzen Lee Franzen

Value stock investing is a favorite method used by many long term investors to generate profits that regularly beat the stock markets annual returns. Value investors generally look for stocks that are currently out of favor with Wall Street, but also have an underlying value that should make them worth more in the future. Put another way, value stocks are currently relatively cheap - you may even want to call them temporarily on sale.

One of the primary screens that can be used in value stock investing to find candidates to buy is earnings yield (EY). This screen is available on some of the free money research sites. On the surface, EY is a simple concept - take a company's net earnings per share (EPS), divide that EPS by the price per share, multiply by 100%, and you have a percentage that equates to what the stock would yield if it distributed all of it's earnings. If you cannot find this indicator on your favorite stock screening web site, just take the P/E ratio (which is contained on nearly all of those screening web sites), and invert it - or multiply it by 1/x. Obviously, the higher the number, the cheaper the stock is relative to it's earnings.

Another way that you should consider calculating earnings yield is more complicated, but will give you a much better view of the way a company is valued relative to it's earnings. This alternate form of the EY calculation was discussed by Joel Greenblatt in his book, "The Little Book That Beats the Market". The alternative EY that he wrote about is useful in comparing stocks that have different tax rates and different levels of debt. Greenblatt's alternative formula is:

EY = pre-tax operating profit (EBIT) / Enterprise Value

First, the numerator in this value stock investing equation (EBIT) is derived from the company's income statement, and the equations denominator (Enterprise Value) is determined by adding the value of all common and preferred equity (number of shares outstanding multiplied by price per share) to the value of all interest bearing debt that the company owes. Interest bearing debt is located on the company's balance sheet.

This alternative way of calculating earnings yield is better than the much more popular E/P method highlighted at the beginning of this article, since it gives a more accurate view of what is happening with cash flows inside of a company, and also gives a more balanced view when comparing multiple companies to each other. Think about it - if a company is using debt to finance it's growth, and you are comparing it to a company with little or no debt, this method of calculating earnings yield clarifies which company is yielding better earnings relative to it's overall financial structure, and is clearly superior for value stock investing.

http://ezinearticles.com/?Value-Stock-Investing---A-Better-Way-to-Calculate-Earnings-Yield&id=3528291

By Lee Franzen Lee Franzen

Value stock investing is a favorite method used by many long term investors to generate profits that regularly beat the stock markets annual returns. Value investors generally look for stocks that are currently out of favor with Wall Street, but also have an underlying value that should make them worth more in the future. Put another way, value stocks are currently relatively cheap - you may even want to call them temporarily on sale.

One of the primary screens that can be used in value stock investing to find candidates to buy is earnings yield (EY). This screen is available on some of the free money research sites. On the surface, EY is a simple concept - take a company's net earnings per share (EPS), divide that EPS by the price per share, multiply by 100%, and you have a percentage that equates to what the stock would yield if it distributed all of it's earnings. If you cannot find this indicator on your favorite stock screening web site, just take the P/E ratio (which is contained on nearly all of those screening web sites), and invert it - or multiply it by 1/x. Obviously, the higher the number, the cheaper the stock is relative to it's earnings.

Another way that you should consider calculating earnings yield is more complicated, but will give you a much better view of the way a company is valued relative to it's earnings. This alternate form of the EY calculation was discussed by Joel Greenblatt in his book, "The Little Book That Beats the Market". The alternative EY that he wrote about is useful in comparing stocks that have different tax rates and different levels of debt. Greenblatt's alternative formula is:

EY = pre-tax operating profit (EBIT) / Enterprise Value

First, the numerator in this value stock investing equation (EBIT) is derived from the company's income statement, and the equations denominator (Enterprise Value) is determined by adding the value of all common and preferred equity (number of shares outstanding multiplied by price per share) to the value of all interest bearing debt that the company owes. Interest bearing debt is located on the company's balance sheet.

This alternative way of calculating earnings yield is better than the much more popular E/P method highlighted at the beginning of this article, since it gives a more accurate view of what is happening with cash flows inside of a company, and also gives a more balanced view when comparing multiple companies to each other. Think about it - if a company is using debt to finance it's growth, and you are comparing it to a company with little or no debt, this method of calculating earnings yield clarifies which company is yielding better earnings relative to it's overall financial structure, and is clearly superior for value stock investing.

http://ezinearticles.com/?Value-Stock-Investing---A-Better-Way-to-Calculate-Earnings-Yield&id=3528291

Shariah-compliant companies

Shariah-compliant companies can’t run casinos or sell tobacco, alcohol, pork, or pornography. Also, debt can’t exceed 30 percent of equity.

http://www.businessweek.com/news/2010-01-13/mobius-says-templeton-may-set-up-shariah-compliant-equity-fund.html

http://www.businessweek.com/news/2010-01-13/mobius-says-templeton-may-set-up-shariah-compliant-equity-fund.html

Wednesday, 13 January 2010

Winners Keep on Winning

Winners Keep on Winning

By Rick Aristotle Munarriz

January 12, 2010

Some of last year's biggest winners aren't showing any signs of slowing down in 2010.

From resurgent automaker Ford (NYSE: F) to comeback kid Sirius XM Radio (Nasdaq: SIRI), many of the stocks that thrilled investors by doubling, tripling, or taking even bigger steps through 2009 are off to races again this year.

Take Dollar Thrifty Automotive Group (NYSE: DTG), for starters. Auto rental agencies were scorchers last year after being left for dead in 2008. Dollar Thrifty and Avis Budget (NYSE: CAR) appreciated several times over after bottoming out early last year. In Dollar Thrifty's case, the stock that began 2009 priced at a mere $1.09 closed out the year revving up to $25.61.

Dollar Thrifty now finds itself fetching $27.58. A nearly 8% gain may not seem all that scintillating, but keep in mind that we're just six trading days into the new year. Whole Foods Market (Nasdaq: WFMI), Ford, and Sirius are off to even better starts in 2010.

Company

2009

2010

Ford

337%

21%

Sirius XM Radio

400%

15%

Dollar Thrifty

2,250%

8%

Whole Foods

191%

8%

Source: Yahoo! Finance.

The momentum is impressive, since this could have been a logical time for many giddy investors to cash out. Instead of a hefty capital gains hit in 2009, many could have punched out at the start of 2010.

Why are they still hanging on? Well, the prospects are a whole lot brighter for these four companies now than they were a year ago.

Ford hit a new 52-week high yesterday. Technically speaking, it's closer to a 250-week high, since Ford hasn't traded this high since March of 2005. It's hard to bet against the automaker, especially after its head-turning 33% surge in December sales.

Sirius XM Radio had a prosperous 2009, particularly in the latter half of the year, when subscriber growth resumed and cash flow growth accelerated. Like many of last year's winners, Sirius XM had the luxury of an easy starting line -- its stock began the year at a just $0.12 a share -- but its surprising breakeven third-quarter results and renewed optimism for auto sales, where most of its new subscribers are coming from these days, find the satellite-radio monopoly sitting pretty.

Analysts see Dollar Thrifty earning $1.52 a share this year. Yes, it's expected to earn more than its entire market cap at the start of 2009. An economic recovery has lifted hopes for upticks in corporate and leisure travel, and Dollar Thirfty is a clear beneficiary.

Whole Foods is another company positioned for a big bounce if the economy continues to improve. Shoppers cut back on expensive organic groceries during the recession, but they should storm back soon.

So why are 2009's winners among the stocks with the healthiest starts in 2010? That's easy. They're earning it.

http://www.fool.com/investing/general/2010/01/12/winners-keep-on-winning.aspx

By Rick Aristotle Munarriz

January 12, 2010

Some of last year's biggest winners aren't showing any signs of slowing down in 2010.

From resurgent automaker Ford (NYSE: F) to comeback kid Sirius XM Radio (Nasdaq: SIRI), many of the stocks that thrilled investors by doubling, tripling, or taking even bigger steps through 2009 are off to races again this year.

Take Dollar Thrifty Automotive Group (NYSE: DTG), for starters. Auto rental agencies were scorchers last year after being left for dead in 2008. Dollar Thrifty and Avis Budget (NYSE: CAR) appreciated several times over after bottoming out early last year. In Dollar Thrifty's case, the stock that began 2009 priced at a mere $1.09 closed out the year revving up to $25.61.

Dollar Thrifty now finds itself fetching $27.58. A nearly 8% gain may not seem all that scintillating, but keep in mind that we're just six trading days into the new year. Whole Foods Market (Nasdaq: WFMI), Ford, and Sirius are off to even better starts in 2010.

Company

2009

2010

Ford

337%

21%

Sirius XM Radio

400%

15%

Dollar Thrifty

2,250%

8%

Whole Foods

191%

8%

Source: Yahoo! Finance.

The momentum is impressive, since this could have been a logical time for many giddy investors to cash out. Instead of a hefty capital gains hit in 2009, many could have punched out at the start of 2010.

Why are they still hanging on? Well, the prospects are a whole lot brighter for these four companies now than they were a year ago.

Ford hit a new 52-week high yesterday. Technically speaking, it's closer to a 250-week high, since Ford hasn't traded this high since March of 2005. It's hard to bet against the automaker, especially after its head-turning 33% surge in December sales.

Sirius XM Radio had a prosperous 2009, particularly in the latter half of the year, when subscriber growth resumed and cash flow growth accelerated. Like many of last year's winners, Sirius XM had the luxury of an easy starting line -- its stock began the year at a just $0.12 a share -- but its surprising breakeven third-quarter results and renewed optimism for auto sales, where most of its new subscribers are coming from these days, find the satellite-radio monopoly sitting pretty.

Analysts see Dollar Thrifty earning $1.52 a share this year. Yes, it's expected to earn more than its entire market cap at the start of 2009. An economic recovery has lifted hopes for upticks in corporate and leisure travel, and Dollar Thirfty is a clear beneficiary.

Whole Foods is another company positioned for a big bounce if the economy continues to improve. Shoppers cut back on expensive organic groceries during the recession, but they should storm back soon.

So why are 2009's winners among the stocks with the healthiest starts in 2010? That's easy. They're earning it.

http://www.fool.com/investing/general/2010/01/12/winners-keep-on-winning.aspx

Profit whether up or down

Bull or Bear, Profit Anyway

By Jeff Fischer

January 12, 2010 |

Following last year's record rebound, and awaiting economic data along with January and February earnings reports, everyone is on pins and needles waiting to see if stocks can continue their enthusiastic climb.

Will there be a recovery in the United States? Or will we just muddle along? We'd all like to see a recovery, but that's far from assured. And even if we enjoy a broad economic recovery, it may not lead to more stock gains in the near term, because the market has already soared in anticipation of a stronger economy.

The market is usually a few steps ahead like that, which makes predicting it nearly impossible. Thankfully, we don't need to know what it will do next. We have strategies that can profit whichever way stocks turn.

Profit whether up or down

Most of us have favorite stocks that we've been comfortable with for a long time, stocks we don't expect to soar anytime soon, but which we wish to own regardless. Maybe you'd like to buy more, too, if the price declined.

But it all depends on the market, right? If it goes down, you'll buy. If it goes up, you'll sit on what you have or sell at a higher price.

What you may not know is that those stocks could be generating profit for you even if the price they're selling for barely changes. In fact, this unclear market situation may be perfect for setting up income-generating option strategies called ... drumroll, please ... strangles and straddles.

Strangle profits from the market

Let's assume you own at least 100 shares of networking giant Cisco Systems (Nasdaq: CSCO), recently $24.30 per share. If the shares declined, you would be happy to add another 100 shares to your position. (All options contracts work in 100-share lots.) If the price appreciates, you'd be willing to sell your existing stock. This situation is ideal for writing (or selling) a strangle option strategy.

Writing a strangle, you sell put options on a stock at a strike price below the current share price, and sell covered call options on your shares, too, at a higher strike price -- selling the same number of contracts of each.

The puts obligate you to buy more shares if the stock falls by expiration, and the calls obligate you to sell your existing shares at a higher price if the stock appreciates by expiration.

You're paid for selling both options, putting significant income in your pocket:

Selling Puts

Cisco Systems

Selling Calls

Combined Options

July $23 strike pays you $1.18

$24.66

July $26 strike pays you $1.15

$2.33 payment to you, or 9% of the share price

Source: TD AMERITRADE quotes, Jan. 11.

This strangle trade pays $2.33 per share today, or $233 for every $2,466 in stock that you own. This 9% income is yours to keep.

Your obligations? If Cisco shares are below $23 by the July expiration date, your puts obligate you to buy more shares. Since you keep the $2.33 you were paid, your effective net buy price is $20.67 -- far below today's price. On the flipside, if Cisco is above $26 by expiration, you're obligated to sell your existing shares. Your net sell price equates to $28.33 -- a good sell price.

If Cisco is anywhere between $24 and $26 at expiration, both options you wrote expire, you keep the full payment, and you have no further obligations -- you just made great income even while the stock was flat. In fact, if Cisco is anywhere above $20.67 and below $28.33 by expiration, you can close your option trades for a partial profit and still not have any other obligations. That's a wide profit range.

Straddle your way to profits

Another way to squeeze profits from a stock is to write a straddle. The concept is the same as the strangle that we just explained, but here you use the same strike price on your calls and puts.

You generally use this strategy if you believe a stock is going to be less volatile over time, staying in a tight price range.

For example, Netflix (Nasdaq: NFLX) was up more than 80% last year. If you believe the stock is due to settle down, but you'd be happy to buy more shares cheaper or sell your shares higher, you could straddle the $53.30 shares with options today (this trade is ideal when the stock is right near an option's strike price, but here it's just $0.80 higher). Take a gander:

Selling Puts

Netflix

Selling Calls

Combined Options

March $52.50 puts pay you $3.60

$53.30

March $52.50 calls pay you $4.60.

$8.20 payment to you, or 15% of the stock price

Compared to a strangle, the straddle has much higher odds of resulting in a stock transaction, since you're using strike prices that nearly equal the current share price. If Netflix is below $52.50 by March expiration, you get to add to your position. Your effective net buy price would be $44.30. If Netflix is above $52.50, your existing shares would be sold, resulting in a net $60.70 sell price including everything the options paid you.

However, if Netflix is anywhere above $44.30 and below $60.70 by expiration, you can close your options for a partial profit, and keep your shares with no other obligations. That's another wide range for profits. Finally, if Netflix ends the expiration near $52.50, you'd make most of the $8.20 closing your options early.

Or, if you owned a position in Buffalo Wild Wings (Nasdaq: BWLD), the $40 stock offers a June $40 straddle that pays $8.80 right now. Would you be happy to buy more shares at a net $31.20 or sell your existing shares at $48.80? Or just make option profits as long as the stock is within this range? Bull or bear, it gives you plenty of room to earn option income. Other stocks with options that pay well include GlaxoSmithKline (NYSE: GSK), Hasbro (NYSE: HAS), Under Armour (NYSE: UA), and Apple (Nasdaq: AAPL).

Strangles and straddles summed up

To use a strangle or straddle strategy, you have to own at least 100 shares of a stock, you have to be willing to buy at least 100 shares more, and you have to be ready to sell your existing shares.

So, while the media and most investors obsess over the market's next move, you can set up strategies that will profit whether it's up or down. And if stocks stay in a range, as they eventually will following this record ascent, you'll be ready to keep right on profiting anyway.

http://www.fool.com/investing/general/2010/01/12/bull-or-bear-profit-anyway.aspx

By Jeff Fischer

January 12, 2010 |

Following last year's record rebound, and awaiting economic data along with January and February earnings reports, everyone is on pins and needles waiting to see if stocks can continue their enthusiastic climb.

Will there be a recovery in the United States? Or will we just muddle along? We'd all like to see a recovery, but that's far from assured. And even if we enjoy a broad economic recovery, it may not lead to more stock gains in the near term, because the market has already soared in anticipation of a stronger economy.

The market is usually a few steps ahead like that, which makes predicting it nearly impossible. Thankfully, we don't need to know what it will do next. We have strategies that can profit whichever way stocks turn.

Profit whether up or down

Most of us have favorite stocks that we've been comfortable with for a long time, stocks we don't expect to soar anytime soon, but which we wish to own regardless. Maybe you'd like to buy more, too, if the price declined.

But it all depends on the market, right? If it goes down, you'll buy. If it goes up, you'll sit on what you have or sell at a higher price.

What you may not know is that those stocks could be generating profit for you even if the price they're selling for barely changes. In fact, this unclear market situation may be perfect for setting up income-generating option strategies called ... drumroll, please ... strangles and straddles.

Strangle profits from the market

Let's assume you own at least 100 shares of networking giant Cisco Systems (Nasdaq: CSCO), recently $24.30 per share. If the shares declined, you would be happy to add another 100 shares to your position. (All options contracts work in 100-share lots.) If the price appreciates, you'd be willing to sell your existing stock. This situation is ideal for writing (or selling) a strangle option strategy.

Writing a strangle, you sell put options on a stock at a strike price below the current share price, and sell covered call options on your shares, too, at a higher strike price -- selling the same number of contracts of each.

The puts obligate you to buy more shares if the stock falls by expiration, and the calls obligate you to sell your existing shares at a higher price if the stock appreciates by expiration.

You're paid for selling both options, putting significant income in your pocket:

Selling Puts

Cisco Systems

Selling Calls

Combined Options

July $23 strike pays you $1.18

$24.66

July $26 strike pays you $1.15

$2.33 payment to you, or 9% of the share price

Source: TD AMERITRADE quotes, Jan. 11.

This strangle trade pays $2.33 per share today, or $233 for every $2,466 in stock that you own. This 9% income is yours to keep.

Your obligations? If Cisco shares are below $23 by the July expiration date, your puts obligate you to buy more shares. Since you keep the $2.33 you were paid, your effective net buy price is $20.67 -- far below today's price. On the flipside, if Cisco is above $26 by expiration, you're obligated to sell your existing shares. Your net sell price equates to $28.33 -- a good sell price.

If Cisco is anywhere between $24 and $26 at expiration, both options you wrote expire, you keep the full payment, and you have no further obligations -- you just made great income even while the stock was flat. In fact, if Cisco is anywhere above $20.67 and below $28.33 by expiration, you can close your option trades for a partial profit and still not have any other obligations. That's a wide profit range.

Straddle your way to profits

Another way to squeeze profits from a stock is to write a straddle. The concept is the same as the strangle that we just explained, but here you use the same strike price on your calls and puts.

You generally use this strategy if you believe a stock is going to be less volatile over time, staying in a tight price range.

For example, Netflix (Nasdaq: NFLX) was up more than 80% last year. If you believe the stock is due to settle down, but you'd be happy to buy more shares cheaper or sell your shares higher, you could straddle the $53.30 shares with options today (this trade is ideal when the stock is right near an option's strike price, but here it's just $0.80 higher). Take a gander:

Selling Puts

Netflix

Selling Calls

Combined Options

March $52.50 puts pay you $3.60

$53.30

March $52.50 calls pay you $4.60.

$8.20 payment to you, or 15% of the stock price

Compared to a strangle, the straddle has much higher odds of resulting in a stock transaction, since you're using strike prices that nearly equal the current share price. If Netflix is below $52.50 by March expiration, you get to add to your position. Your effective net buy price would be $44.30. If Netflix is above $52.50, your existing shares would be sold, resulting in a net $60.70 sell price including everything the options paid you.

However, if Netflix is anywhere above $44.30 and below $60.70 by expiration, you can close your options for a partial profit, and keep your shares with no other obligations. That's another wide range for profits. Finally, if Netflix ends the expiration near $52.50, you'd make most of the $8.20 closing your options early.

Or, if you owned a position in Buffalo Wild Wings (Nasdaq: BWLD), the $40 stock offers a June $40 straddle that pays $8.80 right now. Would you be happy to buy more shares at a net $31.20 or sell your existing shares at $48.80? Or just make option profits as long as the stock is within this range? Bull or bear, it gives you plenty of room to earn option income. Other stocks with options that pay well include GlaxoSmithKline (NYSE: GSK), Hasbro (NYSE: HAS), Under Armour (NYSE: UA), and Apple (Nasdaq: AAPL).

Strangles and straddles summed up

To use a strangle or straddle strategy, you have to own at least 100 shares of a stock, you have to be willing to buy at least 100 shares more, and you have to be ready to sell your existing shares.

So, while the media and most investors obsess over the market's next move, you can set up strategies that will profit whether it's up or down. And if stocks stay in a range, as they eventually will following this record ascent, you'll be ready to keep right on profiting anyway.

http://www.fool.com/investing/general/2010/01/12/bull-or-bear-profit-anyway.aspx

Volatility is not risk. Avoid investment advice based on volatility.

Redefining Risk

Risk was the chance that you might not meet your long-term investment goals. And the greatest enemy of reaching those goals: inflation. Nothing is safe from inflation. It's major victims are savings accounts, T-bills, bonds, and other types of fixed-income investments.

Investors usually use Treasury bills as their benchmark for risk. These are considered risk-free because their nominal value can't go down. However, T-bills and bonds are in fact highly risky because of their susceptibility to inflation.

Realistic definition of Risk

A realistic definition of risk recognizes the potential loss of capital through inflation and taxes, and includes:

1. The probability your investment will preserve your capital over your investment time horizon.

2. The probability your investments will outperform alternative investments during the period.

Why Volatility is not Risk?

Traditionally, investors view "risk" as being synonymous with "volatility." They believe that to get higher returns, they must be willing to stomach bigger short-term swings in a stock's price.

There is no correlation between this volatility-related-risk and return.

Higher volatility does not give better results, nor lower volatility worse.

Studies have shown that there is not necessarily any stable long-term relationship between volatility-related-risk and return, and often there is no relationship between the return achieved and the volatility-related-risk taken.

Volatility is not risk. Avoid investment advice based on volatility.

So if volatility is not risk, what is?

The major risk is not the short-term stock price volatility that many thousands of academic articles have been written about. Rather it is the possibility of not reaching your long-term investment goal through the growth of your funds in real terms. To measure monthly or quarterly volatility and call it risk - for investors who have time horizons 5, 10, 15 or even 30 years away - is a completely inappropriate definition. (David Dreman)

Take Home Lesson

Using Dreman's definition of risk, stocks are actually the safest investment out there over the long term.

Investors who put some or most of their money into bonds and other investments on the assumption they are lowering their risk are, in fact, deluding themselves.

"Indeed, it goes against the principle we were taught from childhood - that the safest way to save was putting our money in the bank."

http://myinvestingnotes.blogspot.com/2009/05/redefining-risk.html

Risk was the chance that you might not meet your long-term investment goals. And the greatest enemy of reaching those goals: inflation. Nothing is safe from inflation. It's major victims are savings accounts, T-bills, bonds, and other types of fixed-income investments.

Investors usually use Treasury bills as their benchmark for risk. These are considered risk-free because their nominal value can't go down. However, T-bills and bonds are in fact highly risky because of their susceptibility to inflation.

Realistic definition of Risk

A realistic definition of risk recognizes the potential loss of capital through inflation and taxes, and includes:

1. The probability your investment will preserve your capital over your investment time horizon.

2. The probability your investments will outperform alternative investments during the period.

Why Volatility is not Risk?

Traditionally, investors view "risk" as being synonymous with "volatility." They believe that to get higher returns, they must be willing to stomach bigger short-term swings in a stock's price.

There is no correlation between this volatility-related-risk and return.

Higher volatility does not give better results, nor lower volatility worse.

Studies have shown that there is not necessarily any stable long-term relationship between volatility-related-risk and return, and often there is no relationship between the return achieved and the volatility-related-risk taken.

Volatility is not risk. Avoid investment advice based on volatility.

So if volatility is not risk, what is?

The major risk is not the short-term stock price volatility that many thousands of academic articles have been written about. Rather it is the possibility of not reaching your long-term investment goal through the growth of your funds in real terms. To measure monthly or quarterly volatility and call it risk - for investors who have time horizons 5, 10, 15 or even 30 years away - is a completely inappropriate definition. (David Dreman)

Take Home Lesson

Using Dreman's definition of risk, stocks are actually the safest investment out there over the long term.

Investors who put some or most of their money into bonds and other investments on the assumption they are lowering their risk are, in fact, deluding themselves.

"Indeed, it goes against the principle we were taught from childhood - that the safest way to save was putting our money in the bank."

http://myinvestingnotes.blogspot.com/2009/05/redefining-risk.html

What's in store for investors next?

If we should have learned anything from the past 10 years, it is that valuation matters.

In a dynamic world, a static portfolio is by definition a fatally flawed strategy.

The price of investment success is constant vigilance.

The advice to buy and hold long term begs a critical question: buy and hold what?

In a dynamic world, a static portfolio is by definition a fatally flawed strategy.

The price of investment success is constant vigilance.

The advice to buy and hold long term begs a critical question: buy and hold what?

Younger generation of M'sians not active in stock market. Why?

Wednesday January 13, 2010

Younger generation of M'sians not active in stock market. Why?

By TEE LIN SAY

KUALA LUMPUR: Bursa Malaysia needs to address the low retail participation among the younger generation in the stock market or risk losing out on a huge investor base, said CEO Datuk Yusli Mohamed Yusoff.

There is data to prove it. Based on a survey spearheaded by Bursa and conducted by Synovate Malaysia to understand the investing attitudes and perceptions of Malaysians, it was revealed to StarBiz that only 12% of investors represent the 20-29 age group, while 59% involve those 40 years and above.

In addition, those in the younger and older age groups make up merely 4% and a staggering 61% respectively of the total number of dealers in the market.

“We need to enhance our current business model. The younger generation will not wait for us. If we don’t capture them, they will invest in other products and other markets in the future,” said Yusli at Bursa’s industry leadership forum entitled Rethink Retail yesterday. With 67% of the Malaysian population aged below 25, Yusli said there was tremendous potential in attracting the younger segment.

“We at Bursa are out of touch. If we don’t tap the right age group, we will be in trouble,” said chief operating officer Omar Merican. He highlighted that there was a generation gap between young potential investors and ageing investors and dealers and that half the population used the Internet to monitor share prices.

Yusli also said that one of Bursa’s main tasks in attracting investors was to convince them that it had good products to offer. “There are good companies listed on Bursa ... the only problem is convincing people on that,” he told StarBiz.

The survey also revealed that of an addressable market of 1.2 million, almost 50% of potential investors reject shares while 26% sit on the fence when it comes to shares.

“People are spending on property, cars and going for movies. We want to take some of that spend to the stock market,” said Yusli.

AirAsia X CEO Azran Osman Rani, who participated in the forum, said that wooing greater retail participation had less to do with infrastructure and more to do with content.

“You need to get people excited. If you get people excited, they will walk through cut glass to obtain it. In AirAsia X, we create the demand. Because of our cheap prices, customers fly to locations they had not initally planned on going.”

Synovate Malaysia research director Ben Llewellyn said many viewed investing in shares as requiring very high capital over a short investing period and also having a higher risk premium.

“People shy away from investing because they feel there is a high risk attached and they do not have enough money and don’t know how to invest. Clearly these reasons show a lack of knowledge and can be addressed by education,” he said.

http://biz.thestar.com.my/news/story.asp?file=/2010/1/13/business/5458288&sec=business

Younger generation of M'sians not active in stock market. Why?

By TEE LIN SAY

KUALA LUMPUR: Bursa Malaysia needs to address the low retail participation among the younger generation in the stock market or risk losing out on a huge investor base, said CEO Datuk Yusli Mohamed Yusoff.

There is data to prove it. Based on a survey spearheaded by Bursa and conducted by Synovate Malaysia to understand the investing attitudes and perceptions of Malaysians, it was revealed to StarBiz that only 12% of investors represent the 20-29 age group, while 59% involve those 40 years and above.

In addition, those in the younger and older age groups make up merely 4% and a staggering 61% respectively of the total number of dealers in the market.

“We need to enhance our current business model. The younger generation will not wait for us. If we don’t capture them, they will invest in other products and other markets in the future,” said Yusli at Bursa’s industry leadership forum entitled Rethink Retail yesterday. With 67% of the Malaysian population aged below 25, Yusli said there was tremendous potential in attracting the younger segment.

“We at Bursa are out of touch. If we don’t tap the right age group, we will be in trouble,” said chief operating officer Omar Merican. He highlighted that there was a generation gap between young potential investors and ageing investors and dealers and that half the population used the Internet to monitor share prices.

Yusli also said that one of Bursa’s main tasks in attracting investors was to convince them that it had good products to offer. “There are good companies listed on Bursa ... the only problem is convincing people on that,” he told StarBiz.

The survey also revealed that of an addressable market of 1.2 million, almost 50% of potential investors reject shares while 26% sit on the fence when it comes to shares.

“People are spending on property, cars and going for movies. We want to take some of that spend to the stock market,” said Yusli.

AirAsia X CEO Azran Osman Rani, who participated in the forum, said that wooing greater retail participation had less to do with infrastructure and more to do with content.

“You need to get people excited. If you get people excited, they will walk through cut glass to obtain it. In AirAsia X, we create the demand. Because of our cheap prices, customers fly to locations they had not initally planned on going.”

Synovate Malaysia research director Ben Llewellyn said many viewed investing in shares as requiring very high capital over a short investing period and also having a higher risk premium.

“People shy away from investing because they feel there is a high risk attached and they do not have enough money and don’t know how to invest. Clearly these reasons show a lack of knowledge and can be addressed by education,” he said.

http://biz.thestar.com.my/news/story.asp?file=/2010/1/13/business/5458288&sec=business

Losses are painful. Understand them.

http://myinvestingnotes.blogspot.com/2009/11/when-should-stock-be-sold.html

In a portfolio of good quality stocks bought at fair or bargain price, there are usually few reasons for selling. However, the businesses of these companies need to be tracked regularly and their quarterly results announcements followed.

In a portfolio of good quality stocks bought at fair or bargain price, there are usually few reasons for selling. However, the businesses of these companies need to be tracked regularly and their quarterly results announcements followed.

When should a stock be sold?

Reappraise the fundamentals and valuations of this stock, in particular, its future earnings growth potential.

It maybe timely to cash out on a portion or all of a stock if

-----

http://myinvestingnotes.blogspot.com/2009/11/types-of-stock-market-losses.html

Types of Stock Market Losses

There is no person who likes losing money. However, you should accept the idea of losing some money from time to time. Additionally, whenever you notice that your stocks are losing their positions and their long-term prospects are not good, it may be better to sell them and move on to a better deal.

Types of losses

Capital loss

One of the simplest forms of losing in the stocks market is by selecting and purchasing a stock whose price starts to gradually fall. At a certain point you decide that you have seen enough. You sell the stock and live with the realised losses. This loss is commonly referred to as capital loss. It involves loss of actual dollar amount. Aside from offsetting huge profits for tax purposes, capital losses may be used as a lesson to avoid committing the same mistakes in the future.

Lost opportunity

Another type of loss is the so called lost opportunity. It is less painful than the capital loss, but still has its implications and negative effects. The lost opportunity loss represents the investment you could have made with the money you have locked in a stock that haven't brought you any profits. Even though you haven't lost any dollars from the stock that you have purchased and remained at the same price levels, you could have used the same money for other investment purposes, which could have brought you profits. Even a savings account in a bank would have returned you some money. The lack of movement on the part of the stock means that you are losing money. Even if the stock's price doesn't drop you are sustaining opportunity loss.

Missed profit loss

Missed profit loss results when the investor watches the rising of the price of a stock. When it reaches its top the price starts to fall. The investor has missed the top point at which s/he could have made a profit. Instead, s/he hopes that the stock will resume its high levels. However, this rarely happens and even if it happens it will doubtfully be the same level as the one reached at first.

-----

All the above losses are painful experiences. Investors, being human, avoid pain and may not be rationale in dealing with losses. For example, investors may sit on paper losses when in fact it will be better for them to take the loss and move on.

The rapid rise in the stock market since March 09 too has caused pain to a particular group of investors. They are those who are not in the market before the rise or those who sold their stocks too early only to see them rising up and up later in the recent bull run. For some, this lost opportunity, akin to investing in a "stock named cash" which did not rise in price relative to another stock, can be painful too. Due to the large increase in stock prices the last few months, some investors opined that this large lost opportunity, though usually less painful, can be very intense. How can these investors avoid such 'lost opportunity' pain?

He can reason that it is better to be safe giving a miss to some good investments rather than be sorry ploughing into a stock and realising a loss. He can also rationalise that realising his profits pocketing the cash make him more comfortable and pleasure than risking a missed profit loss or actual capital loss sometime in the future.

A strategy used by some investors is to sell partially, rather than totally when the stock price has risen substantially. How does this benefit them? You need not sell stock just because its price has fallen or risen. It is probably their hedge to minimise the pain that can arise from missed profit loss or "lost opportunity" loss. Should the price of the stock rises, he still has some stocks riding the upside, thereby reducing "lost opportunity" pain. On the other hand, when the price of the stock falls, he has already cashed out some profits, thereby reducing missed profit loss. He can even picked up the same stocks cheaper with his cash.

Understanding losses and your emotional responses to these are important. You need to understand these to make good decisions and to avoid making bad decisions in your investments in the face of uncertainties.

- Firstly, if the fundamentals of the stock are deteriorating, the stock should be sold urgently.

- Another good reason would be when the stock is overpriced.

Reappraise the fundamentals and valuations of this stock, in particular, its future earnings growth potential.

It maybe timely to cash out on a portion or all of a stock if

- the present high PE cannot be justified or

- if the present high PE has run ahead of the fundamentals of the stock.

-----

http://myinvestingnotes.blogspot.com/2009/11/types-of-stock-market-losses.html

Types of Stock Market Losses

There is no person who likes losing money. However, you should accept the idea of losing some money from time to time. Additionally, whenever you notice that your stocks are losing their positions and their long-term prospects are not good, it may be better to sell them and move on to a better deal.

Types of losses

- Capital loss

- Lost opportunity

- Missed profit loss

Capital loss

One of the simplest forms of losing in the stocks market is by selecting and purchasing a stock whose price starts to gradually fall. At a certain point you decide that you have seen enough. You sell the stock and live with the realised losses. This loss is commonly referred to as capital loss. It involves loss of actual dollar amount. Aside from offsetting huge profits for tax purposes, capital losses may be used as a lesson to avoid committing the same mistakes in the future.

Lost opportunity

Another type of loss is the so called lost opportunity. It is less painful than the capital loss, but still has its implications and negative effects. The lost opportunity loss represents the investment you could have made with the money you have locked in a stock that haven't brought you any profits. Even though you haven't lost any dollars from the stock that you have purchased and remained at the same price levels, you could have used the same money for other investment purposes, which could have brought you profits. Even a savings account in a bank would have returned you some money. The lack of movement on the part of the stock means that you are losing money. Even if the stock's price doesn't drop you are sustaining opportunity loss.

Missed profit loss

Missed profit loss results when the investor watches the rising of the price of a stock. When it reaches its top the price starts to fall. The investor has missed the top point at which s/he could have made a profit. Instead, s/he hopes that the stock will resume its high levels. However, this rarely happens and even if it happens it will doubtfully be the same level as the one reached at first.

-----

All the above losses are painful experiences. Investors, being human, avoid pain and may not be rationale in dealing with losses. For example, investors may sit on paper losses when in fact it will be better for them to take the loss and move on.

The rapid rise in the stock market since March 09 too has caused pain to a particular group of investors. They are those who are not in the market before the rise or those who sold their stocks too early only to see them rising up and up later in the recent bull run. For some, this lost opportunity, akin to investing in a "stock named cash" which did not rise in price relative to another stock, can be painful too. Due to the large increase in stock prices the last few months, some investors opined that this large lost opportunity, though usually less painful, can be very intense. How can these investors avoid such 'lost opportunity' pain?

He can reason that it is better to be safe giving a miss to some good investments rather than be sorry ploughing into a stock and realising a loss. He can also rationalise that realising his profits pocketing the cash make him more comfortable and pleasure than risking a missed profit loss or actual capital loss sometime in the future.

A strategy used by some investors is to sell partially, rather than totally when the stock price has risen substantially. How does this benefit them? You need not sell stock just because its price has fallen or risen. It is probably their hedge to minimise the pain that can arise from missed profit loss or "lost opportunity" loss. Should the price of the stock rises, he still has some stocks riding the upside, thereby reducing "lost opportunity" pain. On the other hand, when the price of the stock falls, he has already cashed out some profits, thereby reducing missed profit loss. He can even picked up the same stocks cheaper with his cash.

Understanding losses and your emotional responses to these are important. You need to understand these to make good decisions and to avoid making bad decisions in your investments in the face of uncertainties.

Tuesday, 12 January 2010

Reviewing the rise in KLCI from March 09 to now

The market turned in March 09. Those who continued to hold their stocks during the downturn would have seen substantial rebound in the prices of their stocks. Remarkably many good stocks have risen above their previous highs.

The initial rise in the prices of these stocks was due to the steep bargain offered by the knocked-down prices created during the severe downturn. Soon this steep bargain was eroded and most of the stocks were trading close to their fair price. The market has the tendency to over-react on the downside and the upside. As was mentioned before, this has something to do with the inexact science of finding the intrinsic value of a particular stock. Moreover, there are many participants in the market who felt this is not important, driven mainly in their "trade" or "investing" by studying the sentiment driving the buying and selling of a particular stock.

What can we recollect from March 09 to now in KLSE? The initial price rise from March 09 was broad base. Almost all counters went up. Few were laggards. Soon the initial rise flattened. The blue chips however continued to performed well. The index linked counters continued their steady rise over the last few months, probably supported by huge institutional investors initially. The financial counters moved steadily and swiftly, followed by others blue chips and KLCI component stocks. The other stocks did not move much, though there were much excitement in some individual stocks like Mamee, Daibochi, HaiO and others.

As usual, the retail investors were slow to enter the market missing the steepest part of the market rise. It should be of interest to know the percentage of previous retail investors who are now permanently out of the stock market following the calamity in the market in 2008. But the market is always a huge magnet. When the market rises, new players (and also suckers) are attracted in. The market has paused on a few occasions over the last 9 months. The correction was not painful, the worst was a 6 percentage dip in the index over a brief period so far.

As to whether the market price presently reflects the fundamentals, there are as many who argue either ways. Is the market undervalued at present price? Is the market overvalued at present price levels? Is the market reflecting the fundamentals of the economy? Is the market price ahead of the economy, not supported by the underlying fundamentals? One way to get out of this confusion is to realise that in investing, you are investing into stocks and not into the market. Therefore, for those stock pickers, the importance is in understanding the business of the company, the quality of its management and being able to place a value on the price of the business of this company.

Since the start of market trading this new year, the market has risen upwards extremely fast indeed. Many would have seen significant gains in their portfolio. Many stocks have reached their 52 weeks high and there are also many that reach their all time high prices. The prices of various stocks climbed not by mini-steps but by giant steps. Interestingly, a piece of good news can push up a stock price by a large amount. The present play is in the glove counters. This sector has proven to be resilient and growing. Can one truly believe that the business fundamentals of a stock has increased 2 or 3 folds over this short period as would have to be accounted for by such rising prices in the stock? As with all things too good to be true, be prepared now for when the music stops. This is particularly most relevant for those who are late or recent comers to this wonderful bull party in the stock market.

Among my favourite stock picking matrix: Search for those companies with 5 or 10 years consistent records of :

This matrix has turned up many big winners with long sustainable economic moats for long term investing consistently. Keep track of these companies and buy them when they are offered at fair or bargain prices.

At bargain prices,

[where,

FCF = Free Cash Flow = Cash Flow from Operation - Cash Flow from Investing = (CFO - CFI)

TOCE = Total Capital Employed = (Equity + LT Debt)

EV = Enterprise Value = (Market Cap + ST Debt + LTL Debt - Cash)]

http://www.investopedia.com/articles/stocks/05/cashcow.asp

The initial rise in the prices of these stocks was due to the steep bargain offered by the knocked-down prices created during the severe downturn. Soon this steep bargain was eroded and most of the stocks were trading close to their fair price. The market has the tendency to over-react on the downside and the upside. As was mentioned before, this has something to do with the inexact science of finding the intrinsic value of a particular stock. Moreover, there are many participants in the market who felt this is not important, driven mainly in their "trade" or "investing" by studying the sentiment driving the buying and selling of a particular stock.

What can we recollect from March 09 to now in KLSE? The initial price rise from March 09 was broad base. Almost all counters went up. Few were laggards. Soon the initial rise flattened. The blue chips however continued to performed well. The index linked counters continued their steady rise over the last few months, probably supported by huge institutional investors initially. The financial counters moved steadily and swiftly, followed by others blue chips and KLCI component stocks. The other stocks did not move much, though there were much excitement in some individual stocks like Mamee, Daibochi, HaiO and others.

As usual, the retail investors were slow to enter the market missing the steepest part of the market rise. It should be of interest to know the percentage of previous retail investors who are now permanently out of the stock market following the calamity in the market in 2008. But the market is always a huge magnet. When the market rises, new players (and also suckers) are attracted in. The market has paused on a few occasions over the last 9 months. The correction was not painful, the worst was a 6 percentage dip in the index over a brief period so far.

As to whether the market price presently reflects the fundamentals, there are as many who argue either ways. Is the market undervalued at present price? Is the market overvalued at present price levels? Is the market reflecting the fundamentals of the economy? Is the market price ahead of the economy, not supported by the underlying fundamentals? One way to get out of this confusion is to realise that in investing, you are investing into stocks and not into the market. Therefore, for those stock pickers, the importance is in understanding the business of the company, the quality of its management and being able to place a value on the price of the business of this company.

Since the start of market trading this new year, the market has risen upwards extremely fast indeed. Many would have seen significant gains in their portfolio. Many stocks have reached their 52 weeks high and there are also many that reach their all time high prices. The prices of various stocks climbed not by mini-steps but by giant steps. Interestingly, a piece of good news can push up a stock price by a large amount. The present play is in the glove counters. This sector has proven to be resilient and growing. Can one truly believe that the business fundamentals of a stock has increased 2 or 3 folds over this short period as would have to be accounted for by such rising prices in the stock? As with all things too good to be true, be prepared now for when the music stops. This is particularly most relevant for those who are late or recent comers to this wonderful bull party in the stock market.

Among my favourite stock picking matrix: Search for those companies with 5 or 10 years consistent records of :

This matrix has turned up many big winners with long sustainable economic moats for long term investing consistently. Keep track of these companies and buy them when they are offered at fair or bargain prices.

At bargain prices,

- the EYs (EPS/Price) and DYs are at the higher of their usual historical ranges,.and

- the FCF/EV yields are attractive multiples of the risk free interest rates offered by fixed deposits.

[where,

FCF = Free Cash Flow = Cash Flow from Operation - Cash Flow from Investing = (CFO - CFI)

TOCE = Total Capital Employed = (Equity + LT Debt)

EV = Enterprise Value = (Market Cap + ST Debt + LTL Debt - Cash)]

http://www.investopedia.com/articles/stocks/05/cashcow.asp

=====

Click here for further discussion on this article:

My occasional rumination

One of the most fascinating figure in investing is the wide range of intrinsic value one can obtain from various types of valuations and by various analysts.

It is this inability to determine the intrinsic value or the lack of consensus of what constitutes the right intrinsic value that allows the price of the market to zig-zag but always tracking the intrinsic value. Over the short term, the price may be up or down by a wide margin. However, over the long term, it always reflect the fundamental value of the business.

Are you a bargain hunter? Are you a trend follower? There are more than one way to make a profit from the stock market. There are also more than one way to make a loss from the stock market. The rules are generally fair, though one need to watch out for manipulations in certain price movements of certain stocks.

There are those who discard the fundamentals and only study and follow the sentiment driving the supply and demand of the stock. Buy low and sell high. Buy high and sell higher. It sounds so easy for an "expert" to pronounce that those who did not do this on the first trading day of this month by following the chart would have been stupid or foolish, given the chart patterns. To these believers, fundamentals do not matter in their trades.

On the other hand, there are those who discard the charts. They painstakingly study the fundamentals. They patiently analyse their thinking and behaviour guiding their investing. They are generally followers of value investing as practised by Benjamin Graham and his students. They track a few high quality stocks and bargain hunt when the price is right. They have strict rules too guiding their selling. Their achievements are not measured by the days, weeks or months, but over a long period of years. After an initial period of investing, their returns are often positive by a huge percentage over their initial cost. Short term fluctuating prices in the stocks of their portfolio rarely cause a capital loss in their portfolio value. The low markets significantly reduced the compound annual growth rate returns for the whole investment when these were measured at those times. On the other hand, the compound annual growth rate rebounded when the returns were calculated at the time when the market shot up to stratosphere.

Those who trade protects their downside with stop loss strategy. They often take profit when a certain percentage gain is achieved. They may also allow the winners to climb higher at the same time moving their stop loss value higher.

Those who employ value investing, protect the downside through buying with a margin of safety and careful stock picking. They often allow these stocks to eventually reflect the fundamental intrinsic value. Often the carefully chosen stock can be held for long term, without the necessity to take short term profit. Compounding over years provide the substantial returns. The reinvested dividend returns contitute a substantial part of the return too, this return is not enjoyed by the chartists whose investing period are often short term..

While the traders may plough in a certain amount onto a certain stock, to make big gains over a short trading period, this amount has to be meaningful and substantial. Short term volatilities are unpredicatable and this constitutes the main risk in trading.

On the other hand, those who value invest can usually afford to keep a large amount in their portfolio permanently. This is safe except druing those times when the market is truly bubbly. The volatilities in the market over the short term do not affect their investment behaviour which is strategized for the long term. The short term volatility is often treated as a "friend" when the price can be taken advantaged of. Over the long term, these short term volatilities - often a tinyl blip on the long term price chart - is in fact very small for carefully chosen good quality stocks.

It is this inability to determine the intrinsic value or the lack of consensus of what constitutes the right intrinsic value that allows the price of the market to zig-zag but always tracking the intrinsic value. Over the short term, the price may be up or down by a wide margin. However, over the long term, it always reflect the fundamental value of the business.

Are you a bargain hunter? Are you a trend follower? There are more than one way to make a profit from the stock market. There are also more than one way to make a loss from the stock market. The rules are generally fair, though one need to watch out for manipulations in certain price movements of certain stocks.

There are those who discard the fundamentals and only study and follow the sentiment driving the supply and demand of the stock. Buy low and sell high. Buy high and sell higher. It sounds so easy for an "expert" to pronounce that those who did not do this on the first trading day of this month by following the chart would have been stupid or foolish, given the chart patterns. To these believers, fundamentals do not matter in their trades.

On the other hand, there are those who discard the charts. They painstakingly study the fundamentals. They patiently analyse their thinking and behaviour guiding their investing. They are generally followers of value investing as practised by Benjamin Graham and his students. They track a few high quality stocks and bargain hunt when the price is right. They have strict rules too guiding their selling. Their achievements are not measured by the days, weeks or months, but over a long period of years. After an initial period of investing, their returns are often positive by a huge percentage over their initial cost. Short term fluctuating prices in the stocks of their portfolio rarely cause a capital loss in their portfolio value. The low markets significantly reduced the compound annual growth rate returns for the whole investment when these were measured at those times. On the other hand, the compound annual growth rate rebounded when the returns were calculated at the time when the market shot up to stratosphere.

Those who trade protects their downside with stop loss strategy. They often take profit when a certain percentage gain is achieved. They may also allow the winners to climb higher at the same time moving their stop loss value higher.

Those who employ value investing, protect the downside through buying with a margin of safety and careful stock picking. They often allow these stocks to eventually reflect the fundamental intrinsic value. Often the carefully chosen stock can be held for long term, without the necessity to take short term profit. Compounding over years provide the substantial returns. The reinvested dividend returns contitute a substantial part of the return too, this return is not enjoyed by the chartists whose investing period are often short term..

While the traders may plough in a certain amount onto a certain stock, to make big gains over a short trading period, this amount has to be meaningful and substantial. Short term volatilities are unpredicatable and this constitutes the main risk in trading.

On the other hand, those who value invest can usually afford to keep a large amount in their portfolio permanently. This is safe except druing those times when the market is truly bubbly. The volatilities in the market over the short term do not affect their investment behaviour which is strategized for the long term. The short term volatility is often treated as a "friend" when the price can be taken advantaged of. Over the long term, these short term volatilities - often a tinyl blip on the long term price chart - is in fact very small for carefully chosen good quality stocks.

Cheap Is No Longer Good Enough, Company must be Excellent too.

Cheap Is No Longer Good Enough

By Toby Shute

January 11, 2010 |

After a recent college reunion/homecoming, I had a chance to connect with fund manager Harry Long, the managing partner of Contrarian Industries. Long's company specializes in alternative asset management, algorithmic system research and development, and strategic consulting. Harry and I had a wide-ranging conversation about fundamental and systematic approaches to investing. Here's an edited portion of our exchange.

Toby Shute: You've described your investing approach as an attempt to marry the qualitative with the systematic. This reminds me of Warren Buffett's description of his investment strategy as 85% Benjamin Graham and 15% Philip Fisher. Let's start with Graham. What was his most important contribution to the investment field?

Harry Long: Graham's most important contribution to investing was the brilliant way he went about systematizing it. He gave very clear, mechanical rules, which outperform most discretionary human investors, even today.

If you look at services like Validea.com, the American Institute for Individual Investors, and countless other services, they have taken his dictates from The Intelligent Investor and put them into a screen, which beats the pants off just about everything else developed since.

I think Joel Greenblatt is trying to follow in that tradition. We'll see how he stacks up to Graham. It's a noble pursuit.

Shute: Phil Fisher is known for focusing on the characteristics of a great growth franchise, some of which are impossible to quantify. Importantly, though, he weeded out potential investments using a 15-point checklist that he applied pretty strictly. Are checklists an effective way of systematizing a qualitatively oriented investment process?

Long: When it comes to checklists, I've seen many, but very few good ones. It's really multiple simple rules, when applied in combination, that get you performance. For instance, if investors automatically sold, or had a rule against investing in, any company with earnings decreases of greater than 14% in any quarter, they should have sold almost all bank stocks in 2008.

In practice, you'll find that a well-designed system, using objective data, will often key in on companies that Fisher would have appreciated qualitatively. You have to do both, but I would encourage your readers to find businesses with great metrics and then ask "why?" rather than trying to find great stories which may or may not be executing.

Shute: What else can investors learn from Phil Fisher?

Long: Most investors would do best to stick to Fisher's basic tenet -- buy businesses with strong competitive positions. As Fisher pointed out, if you avoid companies with unhealthy profit margins, you save yourself a lot of money, sleep, and heartache. On the other hand, there are occasionally companies such as Wal-Mart (NYSE: WMT) that have low margins on purpose.

As for his focus on R&D, it's pretty hit-or-miss. Apple (Nasdaq: AAPL) and Google (Nasdaq: GOOG) would be examples of great success stories. However, while the Intels (Nasdaq: INTC) of the world had great runs, they are still plowing billions into R&D and hitting a growth wall.

Investors should have a diversified portfolio of quality. Cheap is no longer good enough -- investors need to search for cheap and excellent. Competition is simply too brutal, unless you are in a position to take control of ailing firms.

Shute: Can you apply this advice to a particular sector?

Long: In the financial sector, rather than owning banks, which risk capital through lending and have infinite competition, [investors] could own something like MSCI, which gets fee income from its MSCI indices. It doesn't risk capital. Simple business -- you hand me money, I hand you information -- and it has very little strong competition in the index business. MasterCard (NYSE: MA) and Visa (NYSE: V) also don't have the same balance-sheet risk as an issuer like American Express.

I could go on and on. Just because you're investing in the financial sector, you don't have to be conventional.

[Michael] Bloomberg understood that the way to be successful is to sell the miners their picks and shovels. Why does everyone spend time studying banks, rather than his example? Why aren't people obsessed with studying FactSet Research Systems (NYSE: FDS)? Maybe it's a tabloid phenomenon where success is simply too boring.

Stay tuned as Toby's conversation with Harry Long continues tomorrow. Harry Long's comments are purely his personal opinions and should not be construed as financial or investment advice.

So, Fool, how do you weigh the quantitative and qualitative aspects of a business in your own investing decisions? Share your philosophy in the comments section below.

http://www.fool.com/investing/value/2010/01/11/cheap-is-no-longer-good-enough.aspx

By Toby Shute

January 11, 2010 |

After a recent college reunion/homecoming, I had a chance to connect with fund manager Harry Long, the managing partner of Contrarian Industries. Long's company specializes in alternative asset management, algorithmic system research and development, and strategic consulting. Harry and I had a wide-ranging conversation about fundamental and systematic approaches to investing. Here's an edited portion of our exchange.

Toby Shute: You've described your investing approach as an attempt to marry the qualitative with the systematic. This reminds me of Warren Buffett's description of his investment strategy as 85% Benjamin Graham and 15% Philip Fisher. Let's start with Graham. What was his most important contribution to the investment field?

Harry Long: Graham's most important contribution to investing was the brilliant way he went about systematizing it. He gave very clear, mechanical rules, which outperform most discretionary human investors, even today.

If you look at services like Validea.com, the American Institute for Individual Investors, and countless other services, they have taken his dictates from The Intelligent Investor and put them into a screen, which beats the pants off just about everything else developed since.

I think Joel Greenblatt is trying to follow in that tradition. We'll see how he stacks up to Graham. It's a noble pursuit.

Shute: Phil Fisher is known for focusing on the characteristics of a great growth franchise, some of which are impossible to quantify. Importantly, though, he weeded out potential investments using a 15-point checklist that he applied pretty strictly. Are checklists an effective way of systematizing a qualitatively oriented investment process?

Long: When it comes to checklists, I've seen many, but very few good ones. It's really multiple simple rules, when applied in combination, that get you performance. For instance, if investors automatically sold, or had a rule against investing in, any company with earnings decreases of greater than 14% in any quarter, they should have sold almost all bank stocks in 2008.

In practice, you'll find that a well-designed system, using objective data, will often key in on companies that Fisher would have appreciated qualitatively. You have to do both, but I would encourage your readers to find businesses with great metrics and then ask "why?" rather than trying to find great stories which may or may not be executing.

Shute: What else can investors learn from Phil Fisher?

Long: Most investors would do best to stick to Fisher's basic tenet -- buy businesses with strong competitive positions. As Fisher pointed out, if you avoid companies with unhealthy profit margins, you save yourself a lot of money, sleep, and heartache. On the other hand, there are occasionally companies such as Wal-Mart (NYSE: WMT) that have low margins on purpose.

As for his focus on R&D, it's pretty hit-or-miss. Apple (Nasdaq: AAPL) and Google (Nasdaq: GOOG) would be examples of great success stories. However, while the Intels (Nasdaq: INTC) of the world had great runs, they are still plowing billions into R&D and hitting a growth wall.

Investors should have a diversified portfolio of quality. Cheap is no longer good enough -- investors need to search for cheap and excellent. Competition is simply too brutal, unless you are in a position to take control of ailing firms.

Shute: Can you apply this advice to a particular sector?

Long: In the financial sector, rather than owning banks, which risk capital through lending and have infinite competition, [investors] could own something like MSCI, which gets fee income from its MSCI indices. It doesn't risk capital. Simple business -- you hand me money, I hand you information -- and it has very little strong competition in the index business. MasterCard (NYSE: MA) and Visa (NYSE: V) also don't have the same balance-sheet risk as an issuer like American Express.

I could go on and on. Just because you're investing in the financial sector, you don't have to be conventional.

[Michael] Bloomberg understood that the way to be successful is to sell the miners their picks and shovels. Why does everyone spend time studying banks, rather than his example? Why aren't people obsessed with studying FactSet Research Systems (NYSE: FDS)? Maybe it's a tabloid phenomenon where success is simply too boring.

Stay tuned as Toby's conversation with Harry Long continues tomorrow. Harry Long's comments are purely his personal opinions and should not be construed as financial or investment advice.

So, Fool, how do you weigh the quantitative and qualitative aspects of a business in your own investing decisions? Share your philosophy in the comments section below.

http://www.fool.com/investing/value/2010/01/11/cheap-is-no-longer-good-enough.aspx

Focus on future growth of the company

When we are looking at stock prices, we are not focussing on this quarter's earnings but on the company's future growth.

Watch for Events Suggesting It Is Time for Selling

Watch for Events Suggesting It Is Time for Selling

Many events can have a negative effect on the value of your winning stock. Thus, you should carefully consider them and whenever they occur you should embark on selling. Such events may include:

◦Too much attention from the media

Too much attention on the part of the media may lead to artificially inflated prices of the stock since many investors show interest. After the hype passes the price may start to fall and result in the loss of profits.

◦Slowed growth of the stock.

If you possess a growth stock, it is good to consider its selling after it has reached the point at which its growth speed has started to decrease. This is required because the market shows negative attitude toward growth stocks that are unable to sustain their growth.

◦Better investment opportunities

It may turn out that there are other stocks that provide better returns. The latter may present a lower level of risk as well. Thus, it is recommended that you consider the selling of your stock and purchasing one of these.

◦Decreased or Eliminated Dividends

At one point or another, the company issuing the stock may start to decrease the dividends it pays to shareholders. If they are also completely eliminated, then this may indicate that the company is undergoing some change or problem. This represents a good reason for selling the stock and avoiding losing your profits.

Many financial experts advise the selling of part of the stock. The rest is left to grow further. In this way you get part of your profits and let the rest generate further returns.

Many events can have a negative effect on the value of your winning stock. Thus, you should carefully consider them and whenever they occur you should embark on selling. Such events may include:

◦Too much attention from the media

Too much attention on the part of the media may lead to artificially inflated prices of the stock since many investors show interest. After the hype passes the price may start to fall and result in the loss of profits.

◦Slowed growth of the stock.

If you possess a growth stock, it is good to consider its selling after it has reached the point at which its growth speed has started to decrease. This is required because the market shows negative attitude toward growth stocks that are unable to sustain their growth.

◦Better investment opportunities

It may turn out that there are other stocks that provide better returns. The latter may present a lower level of risk as well. Thus, it is recommended that you consider the selling of your stock and purchasing one of these.

◦Decreased or Eliminated Dividends

At one point or another, the company issuing the stock may start to decrease the dividends it pays to shareholders. If they are also completely eliminated, then this may indicate that the company is undergoing some change or problem. This represents a good reason for selling the stock and avoiding losing your profits.

Many financial experts advise the selling of part of the stock. The rest is left to grow further. In this way you get part of your profits and let the rest generate further returns.

Know When to Sell

Don't sell just because the price has gone up or down, but give it some serious thought if one of the following things has happened.

- Did you make a mistake buying it in the first place?

- Have the fundamentals deteriorated?

- Has the stock risen too far above its intrinsic value?

- Is there something better you can do with the money, that is, you can find better opportunities?

- Do you have too much money in one stock, taking up too much space in your portfolio?

Monday, 11 January 2010

Stock market: is it time to take profits?

Stock market: is it time to take profits?

The FTSE100 is at a 16-month high leaving many people wondering whether they should take some profits and redirect their money elsewhere.

Published: 10:13PM GMT 10 Jan 2010

Stock markets across the globe have carried on where they left off in 2009 and continue to climb. The FTSE 100 index, for instance, reached a 16‑month high on Tuesday when it broke through the 5,500 level.

Since Britain's blue-chip index fell to a low of 3,512 in March last year, investors have seen a 60pc return on many of their investments. In some cases they will have seen even greater gains if they had invested in overseas funds.