Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Saturday, 9 March 2024

Tuesday, 5 March 2024

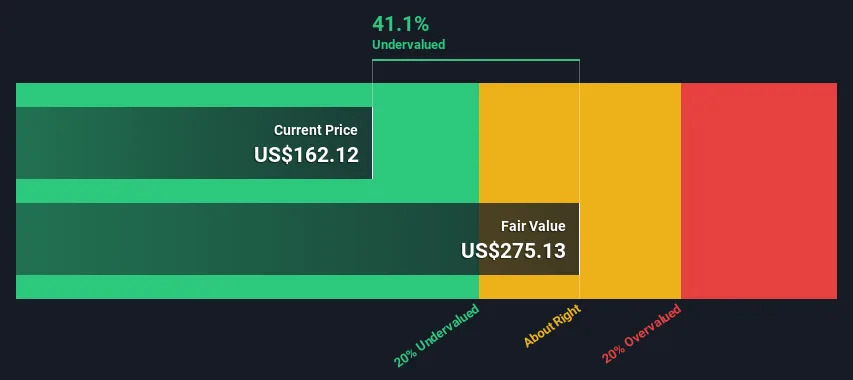

Is There An Opportunity With Johnson & Johnson's (NYSE:JNJ) 41% Undervaluation?

Comment:

An example of using 2 stage growth model and discount cash flow method in valuing a company.

The discount cash flow method is based on 2 assumptions: future cash flows and the applied discount rate.

It is not an exact science. One should you conservative assumptions in your valuation.

Charlie Munger mentioned that he had never seen Warren Buffett using the DCF method in his valuation. There are better and easier ways to value a company. Often you will know if a company is cheap or very expensive, even without having to do elaborate studies. (An analogy is you do not need to know the weight to know that this person is overweight or obese or underweight.)

Keep your valuation simple. It is better to be approximately right than to be exactly wrong.

The article below shares how to do valuation in detail.

Happy investing.

Key Insights

Using the 2 Stage Free Cash Flow to Equity, Johnson & Johnson fair value estimate is US$275

Johnson & Johnson is estimated to be 41% undervalued based on current share price of US$162

Analyst price target for JNJ is US$174 which is 37% below our fair value estimate

Does the March share price for Johnson & Johnson (NYSE:JNJ) reflect what it's really worth? Today, we will estimate the stock's intrinsic value by taking the forecast future cash flows of the company and discounting them back to today's value. We will use the Discounted Cash Flow (DCF) model on this occasion. There's really not all that much to it, even though it might appear quite complex.

We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model.

Check out our latest analysis for Johnson & Johnson

What's The Estimated Valuation?

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars:

10-year free cash flow (FCF) estimate

2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

Levered FCF ($, Millions) | US$22.8b | US$23.9b | US$24.5b | US$25.0b | US$26.4b | US$27.2b | US$28.0b | US$28.7b | US$29.4b | US$30.2b |

Growth Rate Estimate Source | Analyst x5 | Analyst x6 | Analyst x5 | Analyst x3 | Analyst x3 | Est @ 2.99% | Est @ 2.78% | Est @ 2.63% | Est @ 2.53% | Est @ 2.46% |

Present Value ($, Millions) Discounted @ 6.0% | US$21.5k | US$21.3k | US$20.6k | US$19.9k | US$19.8k | US$19.2k | US$18.6k | US$18.1k | US$17.5k | US$16.9k |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$193b

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.3%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 6.0%.

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = US$30b× (1 + 2.3%) ÷ (6.0%– 2.3%) = US$838b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$838b÷ ( 1 + 6.0%)10= US$469b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$663b. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Relative to the current share price of US$162, the company appears quite good value at a 41% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

The Assumptions

The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. If you don't agree with these result, have a go at the calculation yourself and play with the assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Johnson & Johnson as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 6.0%, which is based on a levered beta of 0.800. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

SWOT Analysis for Johnson & Johnson

Strength

Debt is not viewed as a risk.

Dividends are covered by earnings and cash flows.

Weakness

Earnings declined over the past year.

Dividend is low compared to the top 25% of dividend payers in the Pharmaceuticals market.

Opportunity

Annual earnings are forecast to grow for the next 3 years.

Good value based on P/E ratio and estimated fair value.

Threat

Annual earnings are forecast to grow slower than the American market.

Next Steps:

Valuation is only one side of the coin in terms of building your investment thesis, and it shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. What is the reason for the share price sitting below the intrinsic value? For Johnson & Johnson, there are three pertinent aspects you should consider:

Risks: Every company has them, and we've spotted 1 warning sign for Johnson & Johnson you should know about.

Future Earnings: How does JNJ's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NYSE every day. If you want to find the calculation for other stocks just search here.

editorial-team@simplywallst.com (Simply Wall St)

https://uk.finance.yahoo.com/news/opportunity-johnson-johnsons-nyse-jnj-110049724.html

Saturday, 2 March 2024

Selling is often a harder decision than buying

Selling is often a harder decision than buying

Investing is fun. For every rule, there is always an exception.

- who made a substantial commitment in theearly years of a company in whose future they had great confidence and

- who held their original shares unwaveringly while they increased 10-fold or 100-fold or more in value?

The answer is "Yes."

- To raise cash to reinvest into another asset with better return.

- A certain stock (or property sector) may be over-represented in your portfolio due to recent rapid price rises and you need to reduce its weightage to reduce your risk of over-exposure in this single stock (or property sector).

Friday, 1 March 2024

How to invest in the stock market?

Traditionally, stocks have provided high returns and have been a mainstay of most investors’ portfolios. Since a share of stock merely represents an ownership interest in an actual business, owning a portfolio of stocks just means we’re entitled to a share in the future income of all those businesses. If we can buy good businesses that grow over time and we can buy them at bargain prices, this should continue to be a good way to invest a portion of our savings over the long term.

Following a similar strategy with international stocks (companies based outside of the country e.g, United States and others) for some of our savings would also seem to make sense (in this way, we could own businesses whose profits might not be as dependent on our local economy or our local currency)

Thursday, 29 February 2024

Wednesday, 28 February 2024

Berkshire Hathaway Inc. 2023 Shareholder Letter

Operating Results, Fact and Fiction

Let's begin

with the numbers. The official annual

report begins on K-1 and extends for 124 pages. It is filled with a vast amount

of information - some important, some trivial.

Among its

disclosures many owners, along with financial reporters, will focus on page

K-72. There, they will find the proverbial "bottom line" labeled

"Net earnings (loss)." The numbers read $90 billion for 2021, ($23

billion) for 2022 and $96 billion for 2023.

What in the

world is going on?

You seek

guidance and are told that the procedures for calculating these

"earnings" are promulgated by a sober and credentialed Financial

Accounting Standards Board ("FASB"), mandated by a dedicated and

hard-working Securities and Exchange Commission ("SEC") and audited

by the world-class professionals at Deloitte & Touche

("D&T"). On page K-67, D&T pulls no punches: "In our

opinion, the financial statementspresent fairly, in all material respects (italics mine), the

financial position of the Company . . . . . and the results of its operations .

. . . . for each of the three years in the period ended December 31, 2023"

So

sanctified, this worse-than-useless "net income" figure quickly gets

transmitted throughout the world via the internet and media. All parties

believe they have done their job - and, legally, they have.

We,

however, are left uncomfortable. At Berkshire, our view

is that "earnings" should be a sensible concept that Bertie will find

somewhat useful - but only as a starting point-

in evaluating a business. Accordingly, Berkshire also reports to Bertie and you what we call

"operating earnings." Here is the story they tell: $27.6 billion for 2021; $30.9 billion

for 2022 and $37.4 billion for 2023.

The primary difference between the mandated figures

and the ones Berkshire prefers is that we exclude unrealized capital gains or

losses that at times can exceed $5 billion a day.

Ironically, our preference was pretty much the rule until 2018, when the

"improvement" was mandated. Galileo's experience, several centuries

ago, should have taught us not to mess with mandates from on high. But, at

Berkshire, we can be stubborn.

Make no

mistake about the significance of capital gains: I expect them to be a very important component of Berkshire's value

accretion during the decades ahead. Why else would we commit huge dollar

amounts of your money (and Bertie's) to marketable equities just as I have been

doing with my own funds throughout my investing lifetime?

I can't

remember a period since March 11, 1942 - the date of my first stock purchase -

that I have not had a majority of my

net worth in equities, U.S.-based equities.

And so far, so good. The Dow Jones Industrial Average fell below 100 on that

fateful day in 1942 when I "pulled the trigger." I was down about $5

by the time school was out. Soon, things turned around and now that index

hovers around 38,000. America has been a terrific country for investors. All

they have needed to do is sit quietly, listening to no one.

It is more

than silly, however, to make judgments about Berkshire's investment value based

on "earnings" that incorporate the capricious day-by-day and, yes, even year-by-year movements

of the stock market. As Ben Graham taught me, "In the short run the market

acts as a voting machine; in the long run it becomes a weighing machine."