IDEASROOM

What type of business will survive Covid-19?

The University of Auckland's Mike Lee analyses the impact of Covid-19 on different types of business, and how they will fare in future pandemic-related crises

A global economic recession is now inevitable.

Yet, as demonstrated in the past, not all businesses are impacted in the same way by the same recession. For instance, the luxury brand market recovered more quickly than mass appeal brands following the Global Financial Crisis and has sustained constant growth since 2010.

While fundamentally different, Covid-19 is still no exception. Many of us have already experienced, first-hand, the increase in demand for hand sanitisers, fever medication, face masks and, in some countries, toilet paper. Logically, the former three industries should do well in a recession brought about by Covid-19, or any other future pandemic. Other sectors such as tourism, hospitality, and mass gatherings are more likely to suffer. Unfortunately, some companies will become bankrupt owing to a downturn in demand, combined with government protocols (rightly) prioritising health before wealth.

In this article, I will analyse the similarities and differences of businesses that will dive, survive or thrive during the Covid-19 pandemic, as well as future pandemic-related crises.

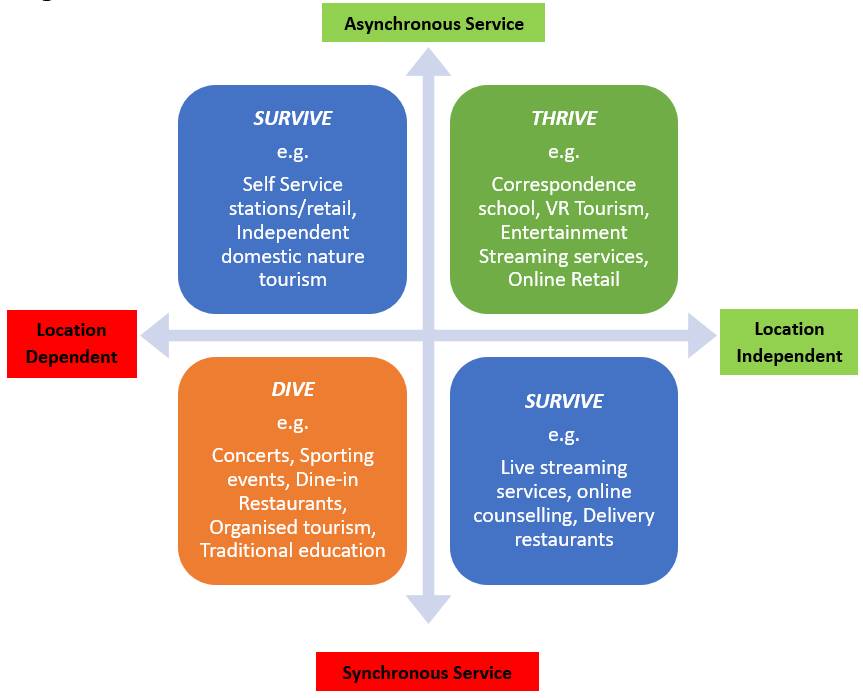

The two key factors I have used to categorise businesses into three Covid-19 outcomes (Dive, Survive, Thrive) are:

1) Synchronicity and 2) Location dependence.

1) Synchronicity and 2) Location dependence.

Figure 1 (below) illustrates how most businesses may be mapped out on these two criteria, and how that might be detrimental or beneficial for any given business during this, and future crises brought about by human to human contagion.

Notably, businesses hardest hit by Covid-19 are those in the bottom left quadrant. These businesses are location dependent and rely on synchronous timing between customer and provider. For example, traditional tour operators, cruise ships, dine-in restaurants, concerts and sporting events. In all these cases, customers and providers need to be in the same place (location dependent) at the same time (synchronous service). In the climate of Covid-19, or any other future pandemic, such business models will always suffer.

Paradoxically, such synchronous location dependent businesses require the most complex levels of coordination and scheduling, which means they are also highly inconvenient, in that all stakeholders need to be at the same place at the same time. It wasn’t that long ago that TV broadcasting was a location dependent synchronous activity. People had to be home by their TV set and wait for the news or favourite TV show to be broadcasted at a specific time. Note how (even without a global pandemic) this model was quickly displaced by asynchronous (on-demand) location independent (mobile, laptops, etc.) businesses such as Netflix.

Figure 1:

Certainly the regular work week, Monday to Friday, 9am-5pm (and the consequent traffic jams many of us endure twice a day), was implemented to ensure most workers could be at the same place at the same time to accomplish joint projects, and also to ensure customers that they could reach our businesses at an assured time and place.

This time and place was then elongated and expanded to make business interactions more accessible (24/7, in every corner of the globe) mainly for the convenience of the customer, but more recently for the convenience of Covid-19. Thus, it should come as no surprise businesses that rely the most on physical and temporal availability are those hardest hit by a virus that also relies on physical and temporal proximity. Covid-19 has essentially built its success on the success of our globalised economy.

Ironically, while the virus has evolved very well to adapt to our system of international trade and commercial capitalism, many synchronous location dependent business models have not evolved much in the last 200 years, since the industrial revolution. Perhaps one silver lining in the corona cloud is that all modern businesses will be forced to question their practices in terms of synchronicity and location dependence. What is the real role of time and place for our business?

Indeed, the next class of businesses that should be able to survive Covid-19 are those that are location-based, but able to operate asynchronously (such as self-service stations, or independent domestic nature tourism); or businesses that may rely on synchronous service but independent of location (for example, online counselling and restaurants built around delivery).

For the former (asynchronous location-dependent businesses), the place of business (the where) is important but the when is flexible, thus enabling a spreading out of physical proximity. For the latter (synchronous location independent businesses) shared timing, or the when, is critical but the location (the where) is flexible, once again, enabling a spreading out of physical proximity.

From a commercial point of view, these businesses would be more desirable, with or without a pandemic, since both offer convenience and flexibility in either timing or location. Later, I will discuss strategies to help businesses evolve from synchronous location dependence to a slightly more flexible position, and then eventually evolve into the most flexible business model: asynchronous location independence.

These businesses, the final class and set to thrive during Covid-19, have already mastered the art of allowing the customer when and where to do business. Netflix, Amazon, Uber Eats, Fortnite, are all examples of businesses thriving before Covid-19; and now may be on track to do even better as governments, health authorities, and employers call for social distancing and self-isolation.

Case example: Tertiary education

As a marketing professor I have noticed, over the past two decades, universities coming to terms with an audience increasingly comfortable with, nay, expectant of, asynchronous location independent service and product offerings. Even before Covid-19, our main stakeholders (students) have come to expect online lecture recordings. These are part of several changes helping universities evolve from heavily synchronous location dependent institutions to more flexible and inclusive asynchronous location independent businesses.

Undoubtedly, during the adoption of such technological changes, many faculty staff would have complained about the watering down of the tertiary educational experience and lamented about the emerging class of graduates who can no longer be bothered ‘turning up’. Yet, if anything, Covid-19 is forcing us to confront the importance of ‘turning up’. If our off-campus students are now expected to achieve similar results via asynchronous location-independent models of pedagogy, surely many ‘real-world’ businesses should also be able to thrive, or at the very least survive, the next 18 months, and beyond?

Questions to shift your business from Dive to Survive to Thrive:

1. Critically analyse the when and where of your business operations.

a) How important is synchronicity or temporal proximity to your business? Really?

b) How important is physical proximity? Do you really need to be in the same place as your key stakeholders to deliver the same outcomes?

2. Can you achieve the same outcome if time and place were not considered a fixed entity?

3. What aspects of your operations could evolve to become less reliant on temporal proximity?

4. What aspects of your operations could evolve to be less reliant on physical proximity?

5. Pick the path of least resistance to become more asynchronous or less location dependent, if achieving both is too challenging.

The luxury brand market recovered more quickly than mass appeal brands following the Global Financial Crisis. Photo: Lynn Grieveson