Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Friday, 22 September 2023

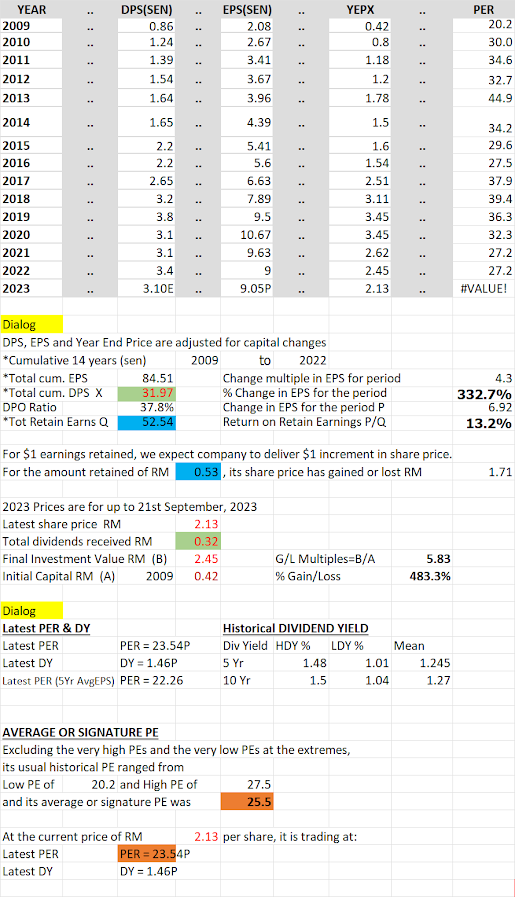

POH HUAT RESOURCES HOLDINGS BHD

SARAWAK CONSOLIDATED INDUSTRIES BHD

Quality: Gruesome. Making losses every year

Management: -

Valuation: -

Investing can be very simple. When the company does not satisfy your quality criteria for a great company, just move on. Do not proceed to deeper study of this company. Use your precious time for more productive work.

MALAYSIA BUILDING SOCIETY BHD

Its earnings had been volatile: not the consistent and growing EPSs that I like.

Those owning this stock would have had a roller coaster ride. Only certain way to profit from this "investment" is to have bought at the time when its price was obviously low. (Of course, this statement applies to all your stock purchases too, but it is particularly important in stocks with cyclical and volatile earnings and prices.)

SERBA DINAMIK HOLDINGS BHD