Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Tuesday, 26 September 2023

INSAS

This company retained most of its earnings. It started distributing some dividends in recent years. Despite retaining most of its earnings, its profits remained unimpressive, showing no long term consistent growth.

LII HEN

IFCA-MSC

Revenues, profits before tax and adj EPSs declined over the years. In 2022, the company reported a loss.

Quality: -

Management: -

Valuation: -

Hartalega

Petronas Dagangan

The fast growths in the 80s and 90s have petered out. It is now a big company with steady revenues and earnings, throwing up a lot of free cash flows. It distributes most of its earnings as dividends. Those in this stock are mainly enjoying its steady dividends.

PARKSON

Parkson showed losses for many years since 2016. The recent quarters showed small profits.

Will Parkson turnaround? Turnarounds can be very slow. In fact, many turnarounds never turned to the better.

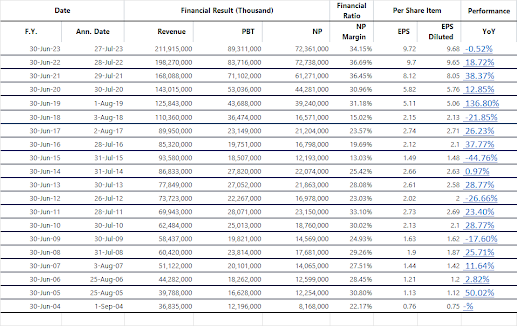

PUBLIC BANK BERHAD

PBB is a stalwart in Peter Lynch's 6 groups of businesses.

You are owning a stock that is growing at a reasonable rate.

Own this when its price is fair or reasonable.

This is an example of owning a GARP company (Growth at Reasonable Price).