Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Monday, 8 April 2024

Wednesday, 3 April 2024

Friday, 15 March 2024

Thursday, 14 March 2024

Fast Growers

Traits

• Small, aggressive new companies. Growing

at 20-25%.

• Land of the 10-40x, even 200x. 1-2 such

companies can make a career.

• Lousy Industry

o May not belong to fast growing industry.

Can expand in the room in a slow growth

industry by taking market share.

o Depressed industries are likely places to

find potential bargains. If business

improves from lousy to mediocre, you are

rewarded, rewarded again when mediocre

turns to good, and good to excellent.

o Moderately fast growers (20-25%) in slow

growth industries are ideal investments.

Look for companies with niches that can

capture market share without price

competition. In business, competition is

never as healthy as total domination.

o Growth ≠ Expansion, leading people to

overlook great companies like Phillip

Morris. Industry wide cigarette

consumption may decline, but company

can increase earnings by cost cuts and

price increases. Earnings growth is the

only growth that really counts. If costs

rise 4%, but prices rise 6%, and profit

margin is 10%, then extra 2% price rise

= 20% increase in earnings.

o Greatest companies in lousy industries

share certain characteristics:

i) low cost operators / penny pinchers

in the executive suite

ii) avoid leverage

iii) reject corporate hierarchies

iv) workers are well paid and have a

stake in the company’s future

v) they find niches, parts of the market

that bigger companies overlook. Zero

Growth Industry = Zero Competition.

• Hot Industry

o Hot Stocks + Hot Industry = Greater

Competition. Companies can thrive only

due to niche/moat/patents etc.

o Growth ≠ Expansion. In low growth

industries, companies expand by

capturing market share, cutting costs

and raising prices. When an industry

gets too popular, nobody makes money

there anymore.

• Life Phases of a Fast Grower: each may last

several years. Keep checking earnings,

growth, stores to check aura of prosperity.

Ask, what will keep earnings going?

i) Startup phase: companies work out

kinks in the basic business. Riskiest

phase for the investor because success is

not yet established.

ii) Rapid Expansion: company enters new

markets. Safest phase for investor where

most amount of money is made, because

growth is merely an act of duplication

across markets. Company reinvests all

FCF into expansion. No dividends help

faster expansion. IPO helps in expanding

without bank debt / leverage.

iii) Maturity / Saturation: company faces the

fact that there’s no easy way to continue

expansion. Most problematic phase

because company runs into its own

limitations. Other ways must be found to

increase earnings, possibly only, via

luring customers away from competitors.

If M&A / diworseification follows, then

you know management is confused.

• Find out growth plans and check if plan is

working?

i) Cost cuts – the proof is in decrease of

selling and administrative costs.

ii) Raise prices

iii) Entry into new markets

iv) Sell more volume in existing markets

v) Exit loss making operations

• What continues to triumph, vs, flop, is:

i) Capable management

ii) Adequate financing

iii) Methodical approach to expansion – slow

but steady wins this kind of race.

o When a company tries to open >100

stores/year, it’s likely to run into

problems. In its rush to glory, it can

pick the wrong sites or managers, pay

too much for real estate, and, fail to

properly train employees. It is easier

to add 35-40 stores / year.

• Re-classification away from Fast Grower

o A large fast growth company faces

devaluation risk, since growth may slow

down as it runs out of space for further

expansion.

o Inability to maintain double digit growth

may see a re-classification into a Slow

Grower, Cyclical or Stalwart. High fliers

of one decade are groundhogs of the next.

o Fast Growers like hotels/retail having

prime real estate turn into Asset Plays.

o There’s high risk, especially in younger

companies that are overzealous and

underfunded. The headache of

underfinancing may lead to bankruptcy.

o Fast Grower’s that can’t stand prosperity,

diworseify, fall out of favour, and, turn

into Turnaround candidates.

o Every Fast Grower turns into a Slow

Grower, fooling many people. People have

a tendency to think that things won’t

change, but eventually they do,

o Very few companies switch from being a

Slow Grower to a Fast Grower.

o Companies may fall into 2 categories at

the same time, or, pass through all

categories over time (Disney).

• During 1949-1995, an investment in the 50

growth stocks on Safian’s Growth Index

returned 230x, while the Safian Cyclical

Index only returned 19x.

• Growth companies were the star performers

during and after 2 corrections (1981-82 and

1987), and they held their own in the 1990

Saddam selloff. The only time you wished

you didn’t own them was 197374, when

growth stocks were grossly overpriced.

Buying and Holding Tips

• Fast Grower => 2x GNP growth rate.

Sustaining 30% growth rate is very difficult,

even for 3 years. 20-25% growth rate is more

sustainable (investing sweet spot).

• Best place to find a 10x stock is close to

home – if not the backyard, then in the

kitchen, mall, workplace etc. You’ll find a

likely prospect ~2/3 times a year. The

person with the edge is always in a position

to outguess the person without an edge.

• Long shots almost never pay off. Better to

miss the 1st stock move (during phase I), or

even the late stage of phase I, when the

company’s only reached 5-10% of market

saturation, and wait to see if it’s plans are

working. If you wait, you may never need to

buy, since failure would’ve become visible.

• Does the idea work elsewhere? Must prove

that cloning works in other markets, and

show its ability to survive early mistakes,

limited capital, find required skilled labour.

• The most fascinating part of long term, Fast

Growers is how much time you have to catch

them. Even a decade later and with stock

already up 20x, it’s not too late to capitalize

on an idea that has still not run its course.

• Emerging growth stocks are much more

volatile than larger companies, dropping and

soaring like sparrow hawks around the

stable flight of buzzards. After small caps

have taken one of these extended dives, they

eventually catch upto the buzzards.

• Small Company Index PE / S&P 500 PE:

Since small companies are expected to grow

faster than larger ones, they’re expected to

sell at higher PE’s, theoretically. In practice,

this isn’t always the case. During periods

when Emerging Growth is unpopular with

investors, these small caps get so cheap that

their PE = S&P 500 PE. When wildly popular

and bid up to unreasonably high levels, it is

= 2x S&P 500 PE.

• In such cases, small caps may get clobbered

for several years afterward. Best time to buy

is when Small PE / Large PE < 1.2x. To reap

the reward from this strategy, you’ve to be

patient. The rallies in small cap stocks can

take a couple of years to gather storm and

then several more years to develop.

• A similar pattern applies to the Growth vs

Value pots. Be patient. Watched stock never

boils. When in doubt, tune in later.

• Look for a good balance sheet and large

profits. Trick is in figuring out when the

growth stops and how much to pay for it?

• Recent price run-ups shouldn’t matter, so

long as PEG still makes it attractive.

• If PEG =1x, then 20% growth @ 20x PE is >

10% growth @ 10x PE. Higher compounded

earnings will compensate even for PE

multiple shrinkage.

• High PE leaves little room for error. Best way

to handle a situation where you love the

company but not the price (great company,

high growth, but high PE), is to make a

small commitment and then increase it in

the next selloff. One can never predict how

far the price may fall. Even if you buy after a

setback, be prepared for further declines

when you might consider buying even more

shares. If the story is still good, after review,

then you’re happy that the price fell.

• So, the important issue is why has the stock

fallen so much? If the long term story is still

intact and the growth will continue for a

long time, then buy more. If you can place

the company in its attractive, mid-life phase,

ex. 2nd decade of 30 years of growth, then

you shouldn’t mind paying 20x PE for a 20-

25% growth rate, especially if market PE =

18-20x with an 8-10% growth rate.

• If you sell at 2x, you won’t get 10x. As long

as same store sales are rising, company isn’t

crippled with excess debt, and is following

its stated expansion plans, stick around. If

the original story stays intact, you’ll be

amazed at the results in several years.

• Trick is to not lose a potential 10x, but know

that, if earnings shrink, then so will the PE

that’s been bid up high – double whammy.

• It’s harder to stick with a winning stock after

price increases, vs, continuing to believe in a

company after price falls. If you’re in danger

of being faked out into selling, revisit the

reasons / story, as to why you bought it in

the first place. There are 2 ways investors

can fake themselves out of the big returns

that come from great growth companies.

i) Waiting to buy the stock when it looks

cheap: Throughout its 27-year rise from

a split-adjusted 1.6 cents to $23, WalMart

the market. Its PE rarely dropped <20x,

but earnings were growing at 25-30%

Any business that keeps up a 20-25%

growth rate for 20 years rewards its

owners with a massive return even if the

overall market is lower after 20 years.

ii) Underestimating how long a great

growth company can keep up the pace.

These "nowhere to grow" theories come

up often & should be viewed sceptically.

o Don't believe them until you check

for yourself. Look carefully at where

the company does business and at

how much growing room is left.

Whether or not it has growing room

may have nothing to do with its age.

o Wal-Mart IPO’d in 1970. By 1980 =

stock 20x, with 7x number of stores.

Was it time to sell, not be greedy, &

put money elsewhere? Stocks don’t

care who owns it and questions of

greed are best resolved in church,

not in brokerage accounts.

o The important issue to analyze was

not whether the Wal-Mart stock

would punish its holders, but

whether the company had saturated

the market. The answer was No.

Wal-Mart’s reach was only 15% of

USA. Over the next 11 years, the

stock went up another 50x.

Sell When

• Hold as long as earnings are growing,

expansion continues and no impediments

arise. Check the story every few months as if

you’re hearing it for the very first time.

• If a Fast Grower rises 50% and the story

starts sounding dubious, sell and rotate into

another, where the current price is <= your

purchase price, but the story sounds better.

• Main thing to watch is the end of phase II of

rapid expansion. Company has no new

stores, old stores are shabby, and the stock

is out of fashion.

• Wall Street covers the stock widely,

institutions hold 60%, and 3 national

magazines fawn over the CEO.

• Large companies with 50x PE!? Even at 40x,

and with wide, saturated presence, where

will the large company grow?

• Last quarter same-store sales are down 3%,

new store sales are disappointing, and the

company is telling positive stories, vs,

showing positive results.

• Top executives / employees leave to join a

rival.

• PE = 30x, but next 2 years’ growth rate =

15%. Therefore, PEG = 2x (very negative)

Examples

• Annheuser Busch, Marriott, Taco Bell,

Walmart, Gap, AMD, Texas Instruments,

Holiday Inn, carpets, plastics, retail,

calculators, disk drives, health maintenance,

computers, restaurants

• While it’s possible to make 2-5x in Cyclicals

and Undervalued situations (if all goes well),

payoffs in Fast Growers like restaurants and

retailers are bigger. Restaurants/retailers

can expand across the country and keep up

the growth rate at 20% for 10-15 years.

• Not only do they grow as fast as high tech

companies, but unlike an electronics or shoe

company, restaurants are protected from

competition. Competition is slower to arrive

and you can see it coming. A restaurant

chain takes a long time to work its way

across the country and no foreign company

can service local customers.

• Taste homogeneity helps scale in food,

drinks, entertainment, makeup, fashion etc.

Popularity in 1 mall = popularity in another.

Certain brands prosper at else’s expense.

• Ways to increase earnings (restaurants):

i) Add more locations

ii) Improve existing operations

iii) High turnover with low priced meals

iv) High priced meals with lower turnover

v) High OPM because of food made with

cheaper ingredients, or, due to low

operating costs

• To break even, a restaurants’ sales must =

Capital Employed. Restaurant group as a

whole may only grow slowly at 4%, but as

long as Americans eat >50% of their meals

out of home, there’ll be new 20x stocks.

People Examples

• Higher failure rate than Stalwarts, but if and

when one succeeds, it may boost income 10-

20-100x.

• Actors, real estate developers, musicians,

small businessmen, athletes, criminals

PE Ratio

• Highest for Fast Growers at 14-20x.

Company with a High PE must have

incredible growth (for next 2 years) to justify

its price. It’s a miracle for even a small

company to justify a 50x PE, as may so

happen during a bull market.

• 1 year forward PE of 40x = dangerously high

and in most cases extravagant. Even fastest

growing companies can rarely achieve 25%

growth, and 40% is a rarity. Such frenetic

growth isn’t sustainable for long & growing

too fast tends to lead to self destruction.

• 40x PE @ 30% growth isn’t attractive, but

not bad if S&P 500 = 23x PE & Coke PEG =

2x (PE = 30x @ 15% growth).

• Unlike Cyclical where the PE contracts near

the end of the cycle, Fast grower’s PE gets

bigger and may reach absurd, illogical levels.

• Earnings are not constant and PE of 40x vs

3x shows investor willingness to gamble on

higher earnings, vs, scepticism about the

cheaply priced company’s future.

PEG

• Where and how can the company continue

to grow fast?

• La Quinta Motels started in Texas. Company

successfully duplicated its formula in

Arkansas & Louisiana. Last year it added

28% more units. Earnings have increased

every quarter. Plans rapid future expansion

& debt isn’t excessive. Motels are low growth

industry and very competitive but La Quinta

has found something of a niche. Long way to

go before it saturates the market.

Checklist

• Percentage of sales – is a new fast growing

product a large % of sales?

• Recent growth rate – favour 20-25% growth

rates. Be wary if growth is > 25%. Hot

industries show growth >50%.

• Proof – has company duplicated its success

in >1 city, for planned expansion to work?

• Runway – does it still have room to grow?

• PE – is it high or low, vs, growth rate?

• Δ Growth rate – is expansion speeding up or

slowing down? For companies doing sales

via large, single deals, vs, selling high

volume & low ticket items, growth slowdown

can be devastating because doing more

volume at bigger ticket sizes is difficult.

When growth slows, stock drops

dramatically.

• Institutional ownership / Analyst coverage –

no presence is a positive, as growth

expectations are still not captured in the

Price or PE.

Portfolio Allocation %

• 30-40% Allocation in Magellan. Magellan’s

allocation to Fast Growers was never >50%.

• 40% in Personal investor’s 10 stock portfolio

• If looking for 10x stocks, likelihood increases

as you hold more stocks. Among several, the

one that actually goes the farthest maybe a

surprise. The story may start at a certain

point, with specific expectations, and get

progressively better. There’s no way to

anticipate pleasant surprises.

• More stocks provide greater flexibility for

fund rotation. If something happens to a

secondary company, it may get promoted to

being a primary selection.

Risk/Reward

• High Risk – High Gain. Higher potential

upside = Greater potential downside.

• +10x / (-100%)

• Major bankruptcy risk for small fast grower’s

via underfinanced, overzealous expansion

• Major rapid devaluation risk for large fast

growers once growth falters, because there’s

no room left for future expansion

Twitter@mjbaldbard 10 mayur.jain1@gmail.com

Stalwarts

Traits

• Growth rate = 2x GNP growth rate

• Growth Rates: Slow Growers (1x GNP) <

Stalwarts (2x GNP) < Fast Growers (20-25%)

• Fairly large sized companies

• You can profit, based on time and price of

purchase. Long term return will be = bonds

• Good performers, but not stars – 50% return

in 2 years is a delightful result. Sell more

readily than Fast Growers.

• Good performers in good markets. Take 30-

50% returns, and then rotate money into

another Stalwart.

• Operating performance of such defensives

helps them survive recessions. No down

quarter for 20-30 years.

• Offer good protection in hard times. Won’t go

bankrupt, soon enough they’ll be

reassessed, and their value will be restored.

• Don’t hold after 2x, hoping for 10x. Can hold

for 20 years only if you bought a “Great”

company at a “Good” price.

• Can hardly go wrong by making a full

portfolio of companies that have raised

dividends for 10-20 years in a row.

• Hidden assets like brands & patents grow

larger, while the company punishes P&L

EPS via amortization, R&D, branding etc.

EPS will jump when these expenses stop, or,

the new product hits the market.

o Due to these hidden assets and low

maintenance capex, FCF > EPS.

o Possible to cut costs, raise prices and

also capture market share in slow growth

markets.

o If you can find a company that can raise

prices without losing customers, you’ve

found a terrific investment.

Examples

• Pharma, Tobacco, FMCG, Alcohol

People Examples

• Command good salaries and get predictable

raises – mid level employees

PE Ratio

• Average = 10-14x.

• PEG <0.5-1x is fine, but 2x is expensive.

2 Minute Drill

• Key issues are PE, recent price run-ups, and

what, if anything is happening to accentuate

growth rate?

• Coke is selling at the low end of its PE range.

Stock hasn’t gone anywhere for 2 years, even

though the company has improved in many

ways. Sold 50% of Columbia Pictures. Diet

drinks have dramatically sped up growth

rate. Foreign sales are excellent. Has better

control over sales & distribution after buying

out many independent, regional distributors.

Thus, it may do better than people think.

Checklist

• Price = key issue, since these are big

companies that aren’t likely to go out of

business

• Diworseification – capital misallocation may

reduce future earnings. Board of Directors’

is better off returning cash to shareholders.

• Long Term Growth Rate – has company kept

up with growth rate momentum in recent

years? Is it slowing/speeding?

• Long Term Holding – how did it fare during

previous recessions / market correction?

Portfolio Allocation %

• 10-20% Allocation, in order to moderate

risks in portfolio full of Fast Growers and

Turnarounds.

• Average 20% Allocation in a personal

investor’s 10 stock portfolio.

Risk/Reward

• Low Risk – Moderate Gain.

• 2 year hold may give 50% upside vs 20%

downside.

• 6 rotations of 25-30% CAGR Stalwarts = 4-

5x, or 1 big winner.

Sell When

• Stalwarts with heavy institutional ownership

and lots of Wall Street coverage, that have

outperformed the market and are overpriced,

are due for a rest or decline.

• 10x not possible. If P>E, or, PE>Normal, sell

and rotate. If Price gets ahead, but the story

is still the same, sell and rotate.

• New products of last 2 years have mixed

results & new testing products are >1 year

from market launch

• PE = 15x, vs similar quality company from

same industry at 11-12x PE

• No Executive/CXO/Director has bought

shares in last 1 year

• Large division (>25% of sales) is vulnerable

to an ongoing economic slump (housing, oil)

• Growth rate is slowing down and though

earnings have been maintained via cost

cuts, there’s no further room left.

Slow Growers

Traits

• Usually large and aging companies, whose

Growth rate = GNP Growth rate

• When industries slow down, most companies

lose momentum as well

• Easy to spot using stock charts

• Pay large and regular dividends

• Bladder theory of corporate finance: the

more cash that builds up in the treasury,

the greater the pressure to piss it away.

Companies that don’t pay dividends, have a

history of diworseification.

• Stocks that pay dividends are favoured vs

stocks that don’t. Presence of dividend

creates a floor price, keeping a stock from

falling away during market crashes. If

investors are certain that the high dividend

yield will hold up, then they’ll buy for the

dividend. This is one reason to buy Slow

Growers and Stalwarts, since people flock to

blue chips during panic.

• If a Slow Grower stops dividend, you’re

stuck with a sluggish company with little

going for it.

Examples

• GE, Alcoa, Utilities, Dow Chemical

People Examples

• Secure jobs + Low salary + Modest raises =

Librarians, Teachers, Policemen

PE Ratio

• Lowest levels, per PEG. Utilities = 7-9x

• Bargain hunting doesn’t make sense without

growth or other catalyst

• During bull market optimism, PE may

expand to Fast Growers’ PE of 14-20x

• Therefore, the only meaningful source of

return = PE re-rating

2 Minute Drill

• Reasons for interest?

• What must happen for the company to

succeed?

• Pitfalls that stand in the path?

• Dividend Play = “For the past 10 years the

company has increased earnings, offers an

attractive dividend yield, it’s never reduced/

suspended dividend, & has in fact raised it

during good and bad times, including the

last 3 recessions. As a phone utility, new

cellular division may aid growth.”

Checklist

• Dividends: Check if always paid and raised.

• Low dividend payout ratio creates cushion,

higher % is riskier.

Portfolio Allocation %

• 0% - NO Allocation, because without growth,

the earnings & price aren’t going to move.

Risk/Reward

• Low risk-Low gain, because Slow Growers

aren’t expected to do much and are priced

accordingly.

Sell When

• After 30-50% rise

• When fundamentals deteriorate, even if price

has fallen:

o Lost market share for 2 Quarters and

hires new advertising agency

o No new products/R&D, indicating that

the company is resting on its laurels

o Diworseification (>2 recent unrelated

M&A’s), excess leverage leaves no room

for buybacks/dividend increase

o Dividend yield isn’t high enough, even at

a lower price.

The Peter Lynch Playbook

Twitter@mjbaldbard 2 mayur.jain1@gmail.com

Turnarounds

Traits

• No growth, potential fatalities – a poorly

managed company is a candidate for trouble

• Make up lost ground very quickly and

performance isn’t related to market moves

• Can’t compile a list of failed Turnarounds,

since their records get deleted after collapse

• Turnaround types:

i) Bail Us Out Or Else: whole deal depends

on a government bailout.

ii) Who Would’ve Thought: can lose money

in utilities?

iii) Unanticipated Problem: minor tragedy

perceived to be worse, leading to major

opportunity. Be patient. Keep up with

news. Read it with dispassion. Stay away

from tragedies where the outcome is

immeasurable.

iv) Good Company Inside a Bad one:

possible bankruptcy spinoff. Look for

institutional selling and insider buying.

Did the parent strengthen the company’s

balance sheet pre-spinoff?

v) Restructuring: company diworseified

earlier, now the loss making business is

being sold off, costs cut etc.

• How will earnings change?

i) Lower costs

ii) Higher prices

iii) Expansion into new markets

iv) Higher volume sold in old markets

v) Changes in loss making operations

• Buy companies with superior financial

condition. Young company + Heavy Debt =

Higher Risk. Determine extent of leverage

and what kind is it? Long term funded debt

is preferable to Short/Medium term callable

bank debt, which may trigger bankruptcy.

• Inventory growth > Sales growth = Red flag,

& inventory growth is a bad sign. Depleting

inventory means things maybe turning

positive. High inventory build up overstates

earnings - may mean that management is

deferring losses by not marking down the

unsold items & getting rid of them quickly.

• Asset/inventory values maybe inflated. Raw

materials are liquidated better than finished

goods. Check for pension liabilities and

capitalized interest expense in asset values.

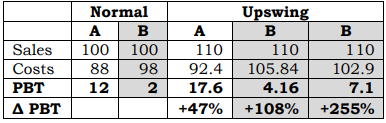

• Upswing favours Turnarounds > Normal

companies. So look for low margin

companies to succeed via operating leverage

/ high cost of production.

• If the industry is robust in general and the

company’s business doesn’t do well, then

one maybe pessimistic about its future.

• If the entire industry is in a slump & due for

a rebound, & the company has strengthened

its balance sheet and is close to the breakeven

point, then it has the potential to do

jumbo sales when the industry picks up.

• Name changes may happen due to M&A or

some fiasco that they hope will be forgotten.

• Are Turnarounds obvious winners? In

hindsight, yes, but a company doesn’t tell

you to buy it. There’s always something to

worry about. There are always respected

investors who say that you’re wrong. You’ve

to know the story better than they do and

have faith in what you know.

• For a stock to do better than expected, it has

to be widely underestimated. Otherwise, it’d

sell for a higher price to begin with. When

the prevailing opinion is more negative than

yours, you’ve to constantly check & re-check

the facts, to assure yourself that you’re not

being foolishly optimistic. The story keeps

changing for better or worse, and you’ve to

follow these changes and act accordingly.

• With Turnarounds, Wall Street will ignore

changes. The Old company had made such a

powerful impression that people can’t see

the New one. Even if you don’t see it right

away, you can still profit more than enough.

• Cyclicals with serious financial problems

collapse into Turnarounds. Also, fast

growers that diworseify & fall out of favour.

• If Slow Grower = Turnaround, then it’s

performance maybe > Stalwart/Fast Grower

• Remind yourself of the Even Bigger Picture –

that stocks in good companies are worth

owning. What’s the worst that can happen?

Recession turns into depression? Then

interest rates will fall, competitors will falter

etc. if things go right, how much can I earn?

What’s the reward side of the equation? Take

the industry which is surrounded by the

most doom and gloom. If the fundamentals

are positive, you’ll find some big winners.

Examples

• Auto (Ford Chrysler), paper, airlines

(Lockheed), steel, electronics, non-ferrous

metals, real estate, oil & gas, retail, Penn

Central, General Utilities, Con Edison, Toys

R Us spinoff, Union Carbide, Goodyear.

• Record with troubled utilities is better than

troubled companies in general, because of

regulations. A utility may cancel dividends /

declare bankruptcy, but if people depend on

it, a way must be found to let it continue

functioning. Regulation determines prices,

profits, passing on costs to customers. Since

the government has a vested interest in its

survival, the odds are overwhelming that it

will be allowed to overcome its problems.

• Troubled Utility Cycle:

i) Disaster Strikes: some huge cost (fuel)

can’t be passed along, or, because a huge

asset is mothballed & removed from the

base rate. Stock drops 40-80% in 1-2

years, horrifying people who view utilities

as safe & stable investments. Soon, it

starts trading at 20-30% P/B. Wall Street

is worried about fatal damage – how long

it takes to reverse this impression varies.

30% P/B implies bankruptcy, emergence

from which may take upto 4 years.

ii) Crisis Management: utility attempts to

respond by cutting costs and capex.

Dividend maybe decreased / eliminated.

Begins to look as if the company will

survive, but price doesn’t reflect the

improved prospects.

iii) Financial Stabilization: cost cuts have

succeeded, allowing it to operate on

current revenues. Capital markets maybe

unwilling to lend money for new projects

& it’s still not earning money for owners,

but survival isn’t in doubt. Prices recover

to 60-70% P/B, 2x from stage (i), (ii)

iv) Recovery At Last: once again capable of

earning and Wall Street has reason to

expect improved earnings and the

reinstatement of dividends. P/B = 1x.

How things progress from here depends

on, (a) reception from capital markets,

because without capital, a utility cannot

increase its base rates, and, (b) support

from regulators’, ie, how many costs are

allowed to be passed on?

• One person’s distress is another man’s

opportunity. You don’t need to rush into

troubled utilities to make large profits. Can

wait until the crisis has abated, doomsayers

are proven wrong, and, still make 2-4x in

short term. Buy on the omission of dividend

& wait for the good news. Or buy when the

first good news has arrived in stage (ii).

• The problem that some people have is they

think they’ve missed it if the stock falls to

$4, then rebounds to $8. A troubled

company has a long way to go and you’ve to

forget that you’ve missed the bottom.

People Examples

• Guttersnipes, drifters, down and outers,

bankrupts, unemployed – if there’s energy

and enterprise left.

2 Minute Drill

• Has the company gone about improving its

fortunes and is the plan working?

• General Mills has made great progress on

diworseification. Cut down from 11 to 2

businesses that are key and the company

does best. Others were sold at good price

and the cash was used for buybacks. 1 key

business’ market share has improved from 7

to 25% and is coming up with new products.

Earnings are up sharply.

Checklist

• Plan – how will it turnaround? Sell loss

making subsidiaries? Cut costs? What’s the

impact of these actions? Is business coming

back? New products?

• Survival – can it survive a raid by short term

creditors? Check cash/debt position, capital

structure, can it sustain more losses?

• Bottom Fishing – if it’s bankrupt already,

then what’s left for owners?

• 20-50% Allocation, based on where greater

value exists - Turnarounds or Fast Growers

Risk/Reward

• High Risk – High Gain.

• Higher potential upside (10x) vs higher

potential downside (100% loss).

Sell When

• After Turnaround is complete, trouble is

over, everyone is aware of changed situation,

& the company is re-classified as a Cyclical/

Fast/Slow Grower etc. Stockholders aren’t

embarrassed to own the shares anymore.

• Stock is judged to be a 2x, but not 5-10x

• PE is inflated vs Earnings prospects, sell and

rotate into juicier Turnaround opportunities,

where Fundamentals are better than Price.

• Debt, which has declined for 5 consecutive

quarters, rises again. Indicates increased

chances of relapse.

• Inventory rise > 2x Sales increase.

• >50% sales of the company’s strongest

division’ come from some customer whose

sales are slowing down.

The Peter Lynch Playbook

Twitter@mjbaldbard 5 mayur.jain1@gmail.com

Cyclicals

Traits

• Sales and profits rise and fall in regular, if

not completely regular fashion, as business

expands and contracts.

• Timing is everything. Coming out of a

recession into a vigorous economy, they

flourish more than Stalwarts. In the opposite

direction, they can lose >50% very quickly

and may take years before another upswing.

• Most misunderstood type, and investors can

lose money in stocks considered safe. Large

Cyclicals are falsely classified as Stalwarts.

• If a defensive Stalwart loses 50% in a slump,

then Cyclicals may lose 80%.

• It’s much easier to predict upswing, vs, a

downturn, so one has to detect early signs of

business changes. You get a working edge if

you’re in the same industry – to be used to

your advantage. Most important in Cyclicals.

• Unreliable dividend payers. If they’ve

financial problems, then they become

potential Turnaround candidates.

• Inventory build-up = bad sign. Inventory

growth > Sales growth = red flag. Inventory

build-up with companies having fluctuating

end product pricing causes larger problems.

• Monitor inventory to figure out business

direction. If inventory is depleting in a

depressed company, it’s the first evidence of

a possible business turnaround.

• High Operating Profit Margin (OPM) = Lowest

Cost producer, who’s got a better chance of

survival if business conditions deteriorate.

• Upswing favours companies with Low

OPM’s. Therefore, what you want to do is to

Hold relatively High OPM companies for long

term and play relatively Low OPM companies

for successful Turnarounds / cycle turns.

• The best time to get involved with Cyclicals

is when the economy is at its weakest,

earnings are at their lowest, and public

sentiment is at its bleakest. Even though

Cyclicals have rebounded in the same way 8

times since WWII, buying them in the early

stages of an economic recovery is never easy.

• Every recession brings out sceptics who

doubt that we will ever come out of it, who

predict a depression and the country going

bankrupt. If there’s any time not to own

Cyclicals, it’s in a depression. “This one is

different,” is the doomsayer’s litany, and, in

fact, every recession is different, but that

doesn’t mean it’s going to ruin us.

• Whenever there was a recession, Lynch paid

attention to them. Since he always thought

positively and assumed that the economy

will improve, he was willing to invest in

Cyclicals at their nadir. Just when it seems

it can’t get any worse, things begin to get

better. A comeback of depressed Cyclicals

with strong balance sheets is inevitable.

• Cyclicals lead the market higher at the end

of a recession – how frequently today’s

mountains turn into tomorrow’s molehills,

and, vice versa.

• Cyclicals are like blackjack: stay in the game

too long and it’s bound to take back all your

profits. Things can go from good to worse

very quickly and it’s important to get out at

the right time.

• As business goes from lousy to mediocre,

investors in Cyclicals can make money; as it

goes from mediocre to good, they can make

money; from good to excellent, they may

make a little more money, though not as

much as before. It’s when business goes

from excellent back to good that investors

begin to lose; from good to mediocre, they

lose more; and from mediocre to lousy,

they’re back where they started.

• So, you have to know where we are in the

cycle. But it’s not quite as simple as it

sounds. Investing in Cyclicals has become a

game of anticipation, making it doubly hard

to make money. Large institutions try to get

a jump on competitors by buying Cyclicals

before they’ve shown any signs of recovery.

This can lead to false starts, when stock

prices run up and then fall back with each

contradictory statistic (we’re recovering,

we’re not recovering) that is released.

• The principal danger is that you buy too

early, then get discouraged, and, sell. To

succeed, you’ve to have some way of

tracking the fundamentals of the industry

and the company. It’s perilous to invest

without the working knowledge of the

industry and its rhythms.

• Timing the cycle is only half the battle.

Other half is picking companies that will

gain Most from an upturn. If Industry pick =

Right, but Company pick = Wrong, then you

can lose money just as easily as if you were

wrong about the industry.

• If investing in a troubled industry, buy

companies with staying power. Also, wait for

signs of revival. Some troubled industries

never came back.

• If you sell at 2x, you won’t get 10x. If the

original story is intact or improving, stick

around to see what happens and you’ll be

amazed at the results.

Examples

• Auto, airlines, steel, tyres, chemicals,

aerospace & defence, non-ferrous metals,

nursing, lodging, oil & gas

• Autos: 3-4 up years, after 3-4 down years.

Worse Slump = Better Recovery. An extra

bad year brings longer and more sustainable

upside. People will eventually replace their

cars, even if put off for 1-2 years.

o Units of pent up demand – compare

Actual Sales vs Trend, ie, estimate of

how many units should’ve been sold

based on demographics, previous year

sales, age of cars on road etc.

o 1980-83 = sluggish economy + people

saving up, therefore pent up demand =

7mm. 1984-89 boom, sales exceeded

trendline by 7.8mm.

o After 4-5 years below trend, it takes

another 4-5 years above trend, before

the car market can catch upto itself. If

you didn’t know this, you might sell your

auto stocks too soon. After 1983, sales

increased from 5mm to 12.3mm and you

might sell fearing the boom was over.

But if you follow the trend, you’d know

the pent up demand was 7mm, which

wasn’t exhausted until 1988, which was

the year to sell your auto stocks, since

pent up demand from early 80’s got used

up. Even though 1989 was a good year,

units sold fell by 1mm.

o If industry had 5 good years, it means

it’s somewhere in the middle of the cycle.

Can predict upturn, not downturn.

o Chrysler EPS for 1988, ’89, ’90 & ’91

was $4.7, $11.0, $0.3 & Loss,

respectively. When your best case is

worse than everyone’s worst case, worry

that the stock is floating on fantasy.

• At one point, high yield Utilities were 10% of

Magellan’s AUM. This usually happened

when interest rates were declining and the

economy was in a splutter. Therefore, treat

Utilities as interest rate Cyclicals and time

entry and exit accordingly. Can also treat

Fannie / NBFC’s as interest rate Cyclicals

benefitting from rate cuts.

• In the Gold Rush, people selling picks and

shovels did better than the miners. During

periods when mutual funds are popular,

investing in the fund companies is more

rewarding than putting money into their

funds. When interest rates are falling, bond

& equity funds attract most cash. Money

market funds prosper when rates rise.

• In US /Europe insurance companies, the

rates go up months before earnings show

any improvement. If you buy when the rates

first begin to rise, you can make a lot of

money. It’s not uncommon for a stock to

become 2x after a rate increase and another

2x on the higher earnings that result from a

rate increase.

People Examples

• Make all their money in short bursts, then

try to budget it through long, unprofitable

stretches. Farmers, resort employees, camp

operators, writers, actors. Some may also

become Fast Growers.

PE Ratio

• Slow Growers (7-9x) < Cyclicals (7-20x) <

Fast Growers (14-20x)

• Assigning PE’s: Peak EPS (3-4x) < Decent

EPS (5-8x) < Average EPS (8-10x)

• Stock Pattern: 1990 EPS = $6.5, Price Range

= $23 - $36, PE Range = 3.6-5.5x. 1991 EPS

= $3.9, Price drops to $26. PE = 6.7x, higher

than previous year PE, that had higher EPS.

• With most stocks, a Low PE is regarded as a

good thing, but not with Cyclicals. When

Low, it’s usually a sign that they are at the

end of a prosperous interlude.

• Unwary investors hold onto their shares

since business is still good & the company

continues to show higher earnings, but this

will change soon. Smart investors sell their

shares early to avoid the rush.

• When a large crowd begins to sell, the Price

and PE drops, making a Cyclical more

attractive to the uninitiated. This can be an

expensive misconception. Soon, the economy

will falter and earnings will decline at a

breathtaking speed. As more investors head

for the exit, price will plummet. Buying

Cyclicals after years of record earnings and

when PE has hit a low point is a proven

method to lose ~50% in a short time.

• Conversely, a High PE may be good news for

a Cyclical. Often, it means that a company is

passing through the worst of the doldrums

and soon its business will improve, earnings

will exceed expectations, and investors will

start buying the stock.

2 Minute Drill

• Script revolves around business conditions,

inventories and prices.

• There’s been a 3 year slump in autos but

this year things have turned around. I know

that because car sales are up across the

board for the first time in recent memory.

GM’s new models are selling well and in the

last 18 months GM closed down 5 inefficient

plants, cut 20% labour and earnings are

about to turn higher.

Checklist

• Inventories: keep a close eye on inventory

levels, changes, and, the supply & demand

relationship.

• Competition: new entrants / added supply =

dangerous development, because they may

cut prices to capture market share.

• Know your Cyclical: if you do, then you have

an advantage in figuring things out and

timing the cycles.

• Balance Sheet: strong enough to survive the

next downturn? Can it outlast competitors?

Is capex on upgradation / expansion a cause

for concern? How much of a drag is it on

FCF? Is CF > Capex, even in bad years? Are

plant & machinery in good shape?

Portfolio Allocation %

• 10-20% Allocation

Risk/Reward

• Low Risk – High Gain; or

High Risk – Low Gain, depending on

investor adeptness at anticipating cycles.

• +10x / (80-90% loss)

• Get out of situations where Price overtakes

Fundamentals and rotate into Fundamentals

> Price

Sell When

• Understand strange rules to play game

successfully, because Cyclicals are tricky.

Sell towards the end of the cycle, but who

knows when that is? Who even knows what

cycles they’re talking about? Sometimes, the

knowledgeable vanguard sells 1 year before

any signs of decline, so price falls for no

apparent reason.

• Whatever inspired you to buy after the last

bust, will help clue you in that the latest

boom is over. If you’d enough of an edge to

buy in the first place, then you’ll notice

changes in business and price.

• Company spends on new technological

expansion, instead of cheaper expenditures

on modernizing old plants.

• Sell when something has actually gone

wrong. Rising costs, 100% utilization but

spending on capacity expansion, labour asks

for increased wages, which were cut in the

previous bust etc.

• Final product demand slows down.

Inventory builds up and the company can’t

get rid of it. If storage is full of finished

goods, you may already be late in selling.

• Falling commodity prices, Futures < Spot

Price. Oil, steel prices turn lower much

earlier than EPS impact.

• Strong competition for market share leads to

price cuts. Company tries cost cuts but can’t

compete against cheap imports.

The Peter Lynch Playbook

Twitter@mjbaldbard 7 mayur.jain1@gmail.com

ASSET PLAYS

Traits

• Local edge is useful, since Wall Street

ignores/overlooks valuable assets.

Examples

• Railroads, TV stations, minerals, oil & gas,

timber, newspapers, real estate, depreciation

on assets that appreciate over time, patents,

cash, subsidiary valuations, foreign owner

priced cheaper than local subsidiary, tax

loss carry forwards, goodwill amortization,

brands, holding company / conglomerate

discount, depreciated assets that don’t need

maintenance capex but still produce FCF

(rental equipment EPS = 0, but FCF =3)

People Examples

• Never do wells, trust fund men, squires, bon

vivants

• Live off family fortunes but never labour –

issue is what will be left after payments for

travel, liquor, creditors etc.

PB Ratio

• If 2-5x is the expected return, then entry

point for P/NAV = 20-50%

2 Minute Drill

• What are the assets and what’s their worth?

• Stock = $8, but video cassette division = $4

and Real Estate = $7. That a bargain in itself

and the rest of the company = ($3). Insiders

are buying and the company has steady

earnings. There is no debt to speak of.

Checklist

• NAV? Any hidden assets?

• Debt – does leverage detract from asset

value? Is new debt being added?

• Catalyst – how will value get unlocked?

Raider / activist?

Portfolio Allocation %

• 0% - NO Allocation

Risk/Reward

• Low Risk – High Gain, IF you’re sure that

NAV = 2-5x current price

• If wrong, you probably don’t lose much

Hold

• If company isn’t going on a debt binge and

reducing NAV

Sell When

• Catalyst occurs – without raider/catalyst,

you may sit for ages

• Management dilutes/diworseifies

• Institutional ownership rises to 60% from 25

• Instead of a subsidiary selling for $100, it

sells for $60 - calculated NAV maybe inflated

• Tax rate deduction reduces value of tax loss

carry forwards

The Peter Lynch Playbook

Twitter@mjbaldbard 3 mayur.jain1@gmail.com

Monday, 11 March 2024

Enduring multi-baggers and Transitory multi-baggers.

Stocks for the long run.

The power of compounding is truly remarkable, almost magical for those with the ability to identify these companies with earnings power over the long term.

Do you know that DLady was priced RM 1.60 per share, Nestle RM 6 to RM 8 per share and Petdag RM 2.00 per share in the 1990s?

Today, DLady is RM 23.00 per share, Nestle is RM 120.00 per share and Petdag is RM 22.00 per share.

The prices of these stocks have dropped from their highest. DLady has dropped from its historical high price of RM 75.00 per share. Nestle has dropped from its high of RM 160+ per share. Similarly, Petdag has dropped from its high price of RM 30+ per share a few years ago.

DLady has dropped a lot and there are various reasons for these.

How can you exploit any opportunities depend on how you approach your investing.

Enduring multi-baggers and Transitory multi-baggers.

ENDURING multi-baggers are those companies whose wealth creation is long-lasting and correction from the peak valuation is limited.

In fact, they continue to exist as multi-baggers even after the correction.

The enduring multi-bagging companies are typically few and difficult to be spotted, and most of the time they appear to be expensive at the time of buying because of the lack of faith in their longevity and size of growth.

TRANSITORY multi-baggers, on the contrary, are easier to be spotted but they always end up giving nasty end results.

Corrections are typically almost 100 per cent.

Cyclicals broadly come under this category.

The tragedy with this class of companies is that if you cannot sell in time, nothing is left in your hand.

But as correction is inevitable, market as a whole is left high and dry with a bad experience.

These companies are plenty and easy to be found, and they attract a lot of crowd.

Ten-baggers operate in growth industries.

Ten-baggers are shares where you make 10 times your money (I believe the phrase is derived from baseball). Such opportunities are rare, but I have been fortunate enough over the years to be involved in a few such situations: DLady, Nestle, Petdag and others.

There tend to be some common characteristics among these winners. The businesses all operate in growth industries and the company in question must be able to grow the top line. No one ever made a tenfold return on a pure margin improvement, or cost-cutting story with no sales growth.

Turnarounds are, however, a rich source of 10-baggers. For these to work, one's timing has to be immaculate, and the underlying business has to be sound - just desperately unloved by the stock market.

Patience is needed.

Such returns need patience. A hedge fund that churns its holdings every few months will never enjoy a 10-bagger. And therein lies the greatest danger: selling too early to enjoy the 1,000 per cent gain.

When you have doubled or trebled your money, it is so tempting to cash in profits. It must have been tempting in the early 1950s to take profits on Glaxo shares, just a few years after their 1947 flotation. Or to have done the same for Tesco which floated in the same year. Or sell Racal in the late 1960s after its 1961 market debut, decades before it spun off Vodafone. Yet each of those shares rewarded patient investors with epic performances over many decades, all 20-baggers at least, not even allowing for dividend.

One of the advantages that private equity enjoys is that it is forced to take a reasonably long-term view, and so is usually unable to rush for the exit at the first opportunity. Venture capital's other edge over quoted investors is debt: gearing in successful situations always amplifies the return to equity-holders. Typically, buy-outs have structures where 70 per cent of the capital is borrowed.

Quoted companies probably have the reverse capitalisation, with equity providing three-quarters of the funding. And as ever in investing, those who regularly find 10-baggers say you should stick to your own sphere of competence: buy what you understand.

Usual rules apply: Quality, Management & Valuation

But the usual rules apply: look for real companies with competent management and a proven business model.

You won't find a 10-bagger among much of the over-hyped, speculative froth. Search for the solid operation with strong fundamentals and a high quality of earnings.

Very few acquisitive vehicles are 10-baggers. Management in such firms focuses on doing deals rather than organically growing its core business. This can produce reasonable returns, but rarely delivers the stellar, long-run performance that can come from a strong business franchise in an attractive niche.

And balance sheets matter: 10-baggers must be able to fund expansion internally or through debt. Companies that are forever issuing equity dilute their stock performance.

So good luck in your search for the next blockbuster. It may well be an obscure, neglected company now, but with the potential for greatness. The secret is to spot that potential.

When you buy into stocks you need to understand why you are buying. In doing this, it helps to categorise the company in determining what sort of returns you can expect. Catergorising also enforces some discipline into your investment process and aids effective portfolio construction.

Peter Lynch uses the six categories below;-

• Sluggards (Slow growers) – Usually large companies in mature industries with earnings growth below or around GDP growth. Such companies are usually held for dividend rather than significant price appreciation.

• Stalwarts (Medium growth) - High quality companies such as Coca-Cola, P&G and Colgate that can still churn out high single digit/low teens growth. Earnings patterns are not cyclical meaning that these stocks will protect you recession.

• Fast growers – Companies whose earnings are growing at 20%+ and have plenty of runway to attack e.g. think Google, Apple in their early days. It doesn’t have to be a company as “sexy” as those mentioned.

• Cyclicals – Companies whose fortunes are closely linked to the economic cycle e.g. automobiles, financials, airlines.

• Turn-arounds – Companies coming out of a depressed phase as a result of change in management, strategy or corporate restructuring. Successful turnarounds can deliver stunning returns.

• Asset plays – Firm has hidden assets which are undervalued or not recognized at all on the balance sheet or under appreciated by the market e.g. cash, land, property, holdings in other company.

Comment:

General observations about different types of stocks.

Wall Street does not look kindly on fast growers that run out of stamina and turn into slow growers and when that happens the stock is beaten down accordingly.