Mar. 16, 2020

Summary

- The bear market so many have long feared is here. Stocks didn't just enter a bear market last week, they crashed into one with gusto.

- COVID-19 panic, combined with worst oil crash since the Financial Crisis, have combined to create a perfect storm of fear, literally the second highest in 30 years.

- However, regardless of when this bear market ends (and it surely will), great companies are always on sale, BUT especially when the market is panicking.

- CFR, UMBF, ADM, CAT, GD, PH, CNI, GWW, MDT, SWK, TJX, ROST, CB, ADP and APD are 15 very safe blue chips who have collectively delivered 15% CAGR returns over the last 23 years.

- From today's 25% undervaluation they could deliver about 17% CAGR long-term returns. Just don't forget to always use the right asset allocation for your needs, because when the bears roar on Wall Street, almost no stock is spared short-term pain.

1. Why are global markets melting down over this?

Because while the COVID-19 Pandemic is indeed a global health crisis, what the market is worried about is the effect on earnings and the economy, both in the US and around the world.

US supply chains have been disrupted, with The Harvard Business Review estimating the end of March will represent peak supply chain disruption.

China's new cases have fallen below 40 per day over the last week (just 18 yesterday) and it's begun lifting travel restrictions, even in Wuhan where all this began.

By Q3 Goldman expects supply chains to be back up and running. By Q4 all COVID-19 effects are expected to reverse, resulting in 4+% GDP growth in 2020.

2. Does that mean the market is 100% wrong to dive into a bear market?

No, because the combined effects of the pandemic + oil crash are expected to hurt earnings significantly.

3. Goldman expects S&P 500 earnings to fall 5% this year due to the pandemic.

The big hit will come in Q2 and Q3, and then a strong recovery in Q4.

Goldman is forecasting a 27% bear market, that would be relatively short and mild. It expects a market bottom by the middle of the year and then a 31% rally to close the year about -2% for stocks.

That's not necessarily an outlandish forecast, given that the average non-recessionary bear market since 1945 has been a 24% decline.

Goldman Sachs just put out a new research note which states

- it expects -5% EPS growth for the S&P 500 this year (about $156.75)

- it expects the S&P 500 to bottom at 2,450 in the middle of the year

- 2450 on S&P 500 represents a 15% decline from today's levels

- it represents a forward PE of 15.6 vs 16.3 25-year average (about 4% undervalued)

Goldman expects earnings growth to "collapse" in the second and third quarters of 2020 before rebounding through the end of the year and into 2021. The S&P 500 will bottom out at 2,450 in the middle of the year, roughly 15% lower than its current level, the analysts projected. The fresh low will give way to a fourth-quarter surge and push the benchmark index to 3,200 by the end of 2020, they added." - Business Insider

4. Of course, the big question is whether or not we get a recession this year.

Jeff Miller and Moody's both estimate about 50% probability of a short and mild recession this year.

For next year the bond market/Cleveland Fed/Haver analytics model estimate about 21% chance of recession.

The bond market is potentially so nonchalant about next year's recession risk because it's now pricing in a near 100% probability of a rate cut to zero on March 19th (Fed meetings last two days).

Moody's estimates that each 25 bp rate cut stimulates economic growth by 0.1% to 0.15% within a year. The Fed will have made the equivalent of 7 rate cuts within two weeks, potential boosting growth by as much as 1% for 2021.

The Fed is also injecting at least $1.5 trillion into the repo market and resuming QE, all to ensure ample liquidity to prevent a repeat of the financial crisis.

So this is the good news. The bad news is that until now and the end of the year we have to deal with the second-highest market volatility in modern history.

5. Why are some people so worried that this historically mild bear market might become a raging inferno of paper wealth destruction?

Because low oil prices could trigger a wave of bankruptcies in that sector among highly leveraged junk bond rated companies. You can see that until just recently, investment-grade bond yields have been tracking 10-year yields lower. Junk bond yields have been rising throughout this crisis, as bond investors demand extremely high risk-premiums to buy high-risk bonds.

COVID-19 on its own is likely only capable of generating a short and mild recession, similar to the Gulf War oil shock recession of 1990, which lasted eight months and caused a 20% bear market.

BUT the potential is there for cascading loan defaults to trigger significant financial losses for bond investors, banks, and anyone holding high-yield debt.

6. The Fed's Emergency Rate Cut

The Fed's emergency rate cut (the first since 2008) was NOT meant to cause stocks to go up, as so many think. Rather it was meant to reduce short-term borrowing costs, which are mostly based on LIBOR, which you can see tracks the Fed Funds rate relatively closely.

Along with the Fed's repo short-term and QE long-term bond-buying, which is designed to ensure sufficient liquidity in the financial system, the Fed is just trying to grease the wheels of the financial system.

The goal is to either

- ameliorate the effects of the economic slowdown, or,

- if we get a recession, maximize the chances of it being brief, and a recovery being strong and beginning as soon as possible.

7. Bargains galore for blue chip dividend investors

So how long with the COVID-19 pandemic and bear market last?

In the meantime, there are bargains galore for blue chip dividend investors to cash in on.

There has always been volatility in the stock market and there always will be. That’s guaranteed as long as humans are the ones making buy and sell decisions.

In the short-term, the reasons for market sell-offs feel like they matter a lot. In the long-term, investors tend to forget the specific reasons stocks fell in the past.

In the short-term, market downturns feel like they will never end. In the long-term, all corrections look like buying opportunities.

Regardless of how long this correction lasts, to win in the stock market over the long haul you must be willing to lose over the short-term." -Ben Carlson (emphasis added)

8. 15 Very Safe Blue Chips To Consider During This Bear Market

Dividends are a function of share count, not price.

However, given the rapidly changing nature of the COVID-19 pandemic as well as significant economic/earnings uncertainty, for this article, I wanted to highlight companies with

9/11 blue chip quality

5/5 dividend safety

trading at fair value or better

These 15 blue chips are

- Cullen/Frost Bankers (CFR)

- UMB Financial (UMBF)

- Archer-Daniels-Midland (ADM)

- Caterpillar (CAT)

- General Dynamics (GD)

- Parker-Hannifin (PH)

- Canadian National Railway (CNI)

- W.W. Grainger (GWW)

- Medtronic (MDT)

- Stanley Black & Decker (SWK)

- TJX Companies (TJX)

- Ross Stores (ROST)

- Chubb Limited (CB)

- Automatic Data Processing (ADP)

- Air Products & Chemicals (APD)

Fundamental Stats On These 15 Companies

- average quality: 9.9/11 blue chip quality vs. 9.7 average dividend aristocrat and 7.0 average S&P 500 company

- average dividend safety: 5/5 very safe vs 4.7 average aristocrat and 3.0 S&P 500 average

- average yield: 2.9% vs. 2.3% S&P 500 and 2.7% most dividend growth ETFs

- average valuation: 23% undervalued vs fairly valued S&P 500

- average dividend growth streak: 35.7= dividend aristocrat/champion

- average 5-year dividend growth rate: 10.3% CAGR

- average analyst long-term growth consensus: 9.0% CAGR vs. 6.3% S&P since 2000

- average forward PE ratio: 13.6 vs 13.7 S&P 500 bottom on December 24th, 2018

- average PEG ratio: 1.51 vs. 1.69 S&P 500

- average return on capital: 58% = 84th industry percentile (very high-quality by Greenblatt's definition)

- average 13-year median ROC: 65% (relative stable moats/quality)

- average 5-year ROC trend: +6% CAGR (relative stable moats/quality )

- average credit rating: A (investment grade, very-high quality)

- average annual volatility: 24% vs. 15% S&P 500, 26% Master List Average, 22% average aristocrat

- average market cap: $38 billion

- average 5-year total return potential: 2.9% yield + 9.0% growth +5.4% CAGR valuation boost = 17.3% CAGR (12% to 22% CAGR with 25% margin of error)

Collectively these this is a group of dividend aristocrats, with a nearly 36-year dividend growth streak, A-rated balance sheet and returns on capital that are in the top 16% of their respective industries and growing over time.

In other words, just the kind of sleep well at night blue chips you can safely buy when bear market choppy waters are upsetting most investors.

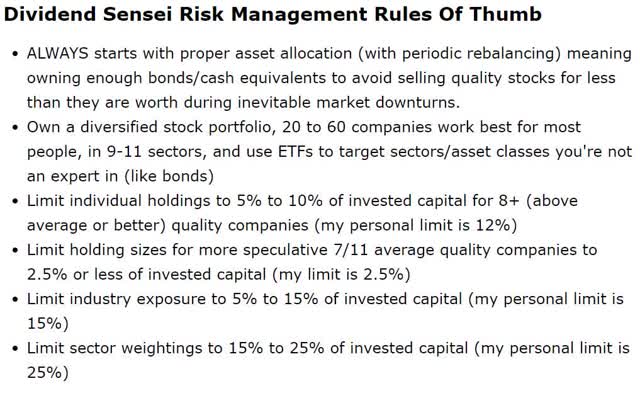

9. Risk management is the most important part of long-term investing success.

These are the risk management rules I use for all the portfolios I manage including my own. They are merely guidelines to start thinking about the best way to build a sleep well at night bunker portfolio for all market conditions, including bear markets such as this one.

These are the risk management rules I use for all the portfolios I manage including my own. They are merely guidelines to start thinking about the best way to build a sleep well at night bunker portfolio for all market conditions, including bear markets such as this one.

10. Consider Nibbling Today

Bottom Line: No One Knows Where The Bottom Of Any Bear Market Is So Consider Nibbling On These 15 Safe Blue Chips Today

Here's Ritholtz Wealth Management's CEO, Joshua Brown with what he's telling his clients about market timing right now.

Why don’t we just sell everything and wait this out? Get back in when the dust settles?”The great answer is that you won’t know when the dust settles. There’s no airplane writing the “all clear” in the sky above your neighborhood. And when the dust settles, do you think stocks will be at their lows? Or will they have already rallied furiously, in anticipation of this? Let me give you an example.Today is March 9th. Precisely eleven years ago today, in 2009, the stock market stopped going down. There was no reason. The dust had settled, without fanfare or any sort of official announcement. If you had polled people that day, or week or even month, most would not have agreed that we had seen the worst.The economic headlines were not improving. But there it was. And by June 1st, less than 3 months later, the stock market had climbed 41% from that March low. And even with that having happened, the majority of participants still weren’t clear that the dust had fully settled. That we had, in fact, seen the worst.There were still people calling us 3, 5 and 7 years later who had gone to cash and still hadn’t gotten back into stocks. They missed a new record-high a few years later and hundreds of percentage points in compounding on their assets." - Joshua Brown, CEO Ritholtz Wealth Management (emphasis added)

Don't get me wrong, I don't know where the bottom of this bear market is, given the factors that are hurting the global economy and corporate earnings right now.

All I do know is that great companies are on sale. I also know that the market, when it becomes excessively fearful becomes very wrong about the intrinsic value of companies.

The prices you see on your screen today are the transitory manic depressive opinions of the often mentally unstable Mr. Market. (If I have offended Mr. Market, my apologies). Mr. Market did not carefully value your companies today and decided that they are now worth less. No, he woke up in a grumpy mood and indiscriminately marked them down as if they were overripe bananas at the grocery store. (You cannot have enough metaphors here.)The stock prices on your screen say nothing about what these companies are worth. Nothing at all. But that is all that is going to matter in the long run. I promise you one thing: The value of your companies doesn’t change 8% a day, day after day."- Vitaliy Katsenelson, CEO of asset management firm IMA (emphasis added)

CFR, UMBF, ADM, CAT, GD, PH, CNI, GWW, MDT, SWK, TJX, ROST, CB, ADP, and APD represent blue chip quality dividend growth stocks with 5/5 very safe dividends that have bright futures ahead of them.

They might not necessarily have a great 2020, but good long-term investing requires looking beyond one or two bad years and looking at the likeliest long-term growth potential.

(Source: AZ Quotes)

By no means am I saying anyone should go "all in" to any stock all at once. That's market timing, and numerous articles I've shown why that doesn't work for regular investors.

I never buy at the bottom and I always sell too soon." ~ Baron Nathan Rothschild

I'm a big advocate of buying in stages, nibbling rather than chomping on quality companies at reasonable to attractive valuations.

Where once many of the world's best dividend stocks were overvalued, today you can buy the kind of quality bargains only available in a market panic.

No one rings a bell at the top or the bottom. And 80% of the market's best days come within two weeks of its worst.

According to Bank of America, 99.6% of long-term returns over the last 90 years have come from just the 90 best market days.

So as Buffett famously said, "be greedy when others are fearful" because some of these fantastic quality bargains won't last long.

Whether the market bottoms tomorrow, in mid-2020 or the end of the year, I'm confident that anyone buying these companies today, as part of a diversified, and prudently risk-managed portfolio, will be very pleased with the results in 5+ years.

No comments:

Post a Comment