How to Fail at Investing in 5 Easy Steps

By Morgan Housel

January 14, 2010 | Comments (1)

I'm a fan of checklists. Especially the ones listing things you shouldn't be doing. It's easier to overlook what you shouldn't be doing than to focus on what you think you're doing right. If you're not humble enough to admit this, you've just proven the point accurate.

One such list I came across resides in Philip Fisher's groundbreaking 1958 book, Common Stocks and Uncommon Profits. Who is Philip Fisher? You could ask Warren Buffett, who admits, "I'm 15 percent Fisher and 85 percent Benjamin Graham." Ben Graham is Buffett's well-known, highly praised, mentor. Philip Fisher, a sort of godfather of growth investing, doesn't get enough credit.

Common Stocks and Uncommon Profits is one of the best guides for evaluating businesses ever written. Buried in the back of the book, right after "Five Don'ts for Investors," is "Five More Don't for Investors." It's quite simple. To fail at investing …

1. Overstress diversification

Diversification is usually a good thing, but Fisher cautions against blind diversification. In his own words, "Investors have been so oversold on diversification that fear of having too many eggs in one basket has caused them to put far too little into companies they thoroughly know and far too much in others about which they know nothing at all."

Far too many investors approach diversification with the mindset of, "I need financials. I need tech. I need telecom. I need healthcare," etc., etc. Wrong. What you need is diversification among good, high-quality companies, not a blind selection among diverse sectors. Let me give you an example of a "diverse" portfolio gone astray:

Financials: Lehman Brothers

Telecom: WorldCom

Energy: Enron

Industrials: General Motors

Technology: GlobalCrossing

These are obviously cherry-picked. But you can see how, in an attempt to blindly diversify among sectors, you can just as easily concentrate in failure. Even slight diversification among good companies that you understand can be superior to blind, yet broad, diversification.

2. Be afraid of buying on a war scare

Fisher writes, "The fears of mass destruction of property, almost confiscatory higher taxes, and government interference with business dominate what thinking we try to do on financial matters. People operating in such a mental climate are inclined to overlook some even more fundamental economic influences."

In short, don't be scared of investing in wartime. Some might even say: Buy on the cannons, sell on the trumpets.

Fisher's more direct point regards war's ability to spread inflation through increased government spending. Again, that's quite analogous to today. "Modern war always causes governments to spend far more than they can possibly collect from their taxpayers while the war is being waged. This causes a vast increase in the amount of money … the classic form of inflation."

But rather than sell in panic, "This is the time when having surplus cash for investment becomes least, not most, desirable."

Bingo. If you're scared witless over today's policies, and many are, cash isn't your answer. There are several very high-quality companies that derive enormous revenue from abroad, enabling success in the face of ravaging domestic inflation. Philip Morris International (NYSE: PM), Coca-Cola (NYSE: KO), and Johnson & Johnson (NYSE: JNJ) are three such examples.

3. Forget your Gilbert and Sullivan

"The flowers that bloom in the spring, tra-la, have nothing to do with the case." This Gilbert and Sullivan tune confused me, too. Fisher's analogous takeaway from the example is that "there are certain superficial financial statistics which are frequently given an underserved degree of attention by many investors."

His examples include focusing on past share performance and previous years' earnings. "One reason [investors are] fed such a diet of back statistics is that if this type of material is put in a report it is not hard to be sure it is correct" he writes.

Another set of data investors give undue focus to is quarterly earnings. Lehman Brothers was announcing record quarterly earnings not much over a year before it went kablooey. Ford (NYSE: F), Citigroup (NYSE: C), and Bank of America (NYSE: BAC) announced abysmal earnings in the process of becoming multibaggers last year. The underlying value of company's shares can be far disconnected from their short-term reported earnings.

4. Fail to consider time as well as price

"When the indications are strong that [rapid growth] is coming, deciding the time you will buy rather than the price at which you will buy may bring you a stock about to have extreme further growth at or near the lowest price at which that stock will sell from that time on."

This is a hard point to understand, but Fisher apparently studied companies' prices and found they were normally lower at certain points in their business cycle -- say, about a month before a venture reaches the pilot-plant stage. I finally equated it to Buffett's rule that, "if you wait for the robins, spring will be over." Waiting for Apple (Nasdaq: AAPL) to actually release a new product like the iPhone, for example, means undoubtedly foregoing the gains that anticipation has priced in.

5. Follow the crowd

Around 2000, top-selling books included Dow 36,000 and The Roaring 2000s. Whoops. In 2006, Why the Real Estate Boom Will Not Bust was a big hit. As of late, top-sellers have included The Great Depression Ahead and The Ultimate Depression Survival Guide.

Pandering to fear and exuberance at or near the peak is nothing new. That's when it's most prevalent. That's when it sells the most. But if the history of the outcome of these extreme views is any indication, you might find optimism in visiting the business section of your local bookstore. More often than not, popular yet awe-inspiring views are dead wrong.

Tying it all together

These are five useful tips for failing at investing. Please don't follow them. Truly triumphant investing means binding together hundreds of factors successfully.

http://www.fool.com/investing/general/2010/01/14/how-to-fail-at-investing-in-5-easy-steps.aspx

Keep INVESTING Simple and Safe (KISS) ****Investment Philosophy, Strategy and various Valuation Methods**** The same forces that bring risk into investing in the stock market also make possible the large gains many investors enjoy. It’s true that the fluctuations in the market make for losses as well as gains but if you have a proven strategy and stick with it over the long term you will be a winner!****Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Friday, 15 January 2010

Beware of buying Private Limited Companies

Wednesday January 13, 2010

Beware of buying Private Limited Companies (PLCs)

Personal Investing - By Ooi Kok Hwa

SOME investors are concerned over the shares that they own in some private limited companies (companies that are registered as “Sdn Bhd”).

Most are just minority shareholders, owning about 10%-20% of the companies’ shares, and they have not received much dividend from the companies over the past few years.

Now that they intend to sell their shares, they do not know the right price to sell. In this article, we will look at two main key issues related to owning private limited companies’ shares, namely

Comparing a major shareholder of a public listed company (Position A) and a major shareholder of another similar size but not listed company (Position C), the discount on LOMD is about 35% ((RM100-RM65)/RM65).

Many investors do not realise that there are big differences between owning controlling interest and non-controlling interest shares. In general, if we own 50.1% of a company’s shares, we should be in a controlling position.

From the table above, whether you are in Position B, which is the non-controlling interest of a listed company or position D, which is the non-controlling position of a non-listed company, the LOCD can be as much as 35% (based on Mergerstat Studies in the US).

For example, if you own 49.9% of a private limited company (you are in Position D) and your partner is the major shareholder of the company with 50.1% interest (he is in Position C), which is 0.2% higher than you, his shares are worth RM65 each, but your shares will only worth about RM42 each, which is at a LOCD of 35% ((RM65-RM42)/RM65).

The main reason for this LOCD is that your partner, having the controlling interest, he can pay himself with very high salary, high director’s fee and enjoy all other benefits from the company.

Since you do not have the controlling position of the company, you have no control over a lot of company’s major decisions. Given that it is not a listed company, your return will depend highly on the dividend payments from the company.

If your partner does not want to share company’s profits with you by not paying out any dividend payments, you will not receive any returns for holding this company’s shares.

Nevertheless, if you own 49.9% of a listed company, which is in Position B, even though your shares is still subject to about a 35% LOCD compared with Position A ((RM100-RM65)/RM100), given that it is a public listed company on Bursa Malaysia, you can easily dispose of your shares in the open market.

The worst case is if you are holding a minority interest and it is a private limited company (Position D), your shares’ value is only at 58% discount ((RM100-RM42)/RM42) compared with a controlling interest in a public listed company (Position A) as your shares are subject to discounts due to lack of marketability and lack of control.

Therefore, when position A is worth RM100 per share, the value per share in Position B and Position C is about the same at RM65 per share.

Hence, if you intend to invest in any private limited companies, you need to be in the controlling position of the companies. Otherwise, if you are just a minority shareholder, it is more advisable for you to invest in listed companies.

Ooi Kok Hwa is an investment adviser and managing partner of MRR Consulting.

http://biz.thestar.com.my/news/story.asp?file=/2010/1/13/business/5458529&sec=business

Beware of buying Private Limited Companies (PLCs)

Personal Investing - By Ooi Kok Hwa

SOME investors are concerned over the shares that they own in some private limited companies (companies that are registered as “Sdn Bhd”).

Most are just minority shareholders, owning about 10%-20% of the companies’ shares, and they have not received much dividend from the companies over the past few years.

Now that they intend to sell their shares, they do not know the right price to sell. In this article, we will look at two main key issues related to owning private limited companies’ shares, namely

- lack of marketability discount (LOMD) and

- lack of control discount (LOCD).

Comparing a major shareholder of a public listed company (Position A) and a major shareholder of another similar size but not listed company (Position C), the discount on LOMD is about 35% ((RM100-RM65)/RM65).

Many investors do not realise that there are big differences between owning controlling interest and non-controlling interest shares. In general, if we own 50.1% of a company’s shares, we should be in a controlling position.

From the table above, whether you are in Position B, which is the non-controlling interest of a listed company or position D, which is the non-controlling position of a non-listed company, the LOCD can be as much as 35% (based on Mergerstat Studies in the US).

For example, if you own 49.9% of a private limited company (you are in Position D) and your partner is the major shareholder of the company with 50.1% interest (he is in Position C), which is 0.2% higher than you, his shares are worth RM65 each, but your shares will only worth about RM42 each, which is at a LOCD of 35% ((RM65-RM42)/RM65).

The main reason for this LOCD is that your partner, having the controlling interest, he can pay himself with very high salary, high director’s fee and enjoy all other benefits from the company.

Since you do not have the controlling position of the company, you have no control over a lot of company’s major decisions. Given that it is not a listed company, your return will depend highly on the dividend payments from the company.

If your partner does not want to share company’s profits with you by not paying out any dividend payments, you will not receive any returns for holding this company’s shares.

Nevertheless, if you own 49.9% of a listed company, which is in Position B, even though your shares is still subject to about a 35% LOCD compared with Position A ((RM100-RM65)/RM100), given that it is a public listed company on Bursa Malaysia, you can easily dispose of your shares in the open market.

The worst case is if you are holding a minority interest and it is a private limited company (Position D), your shares’ value is only at 58% discount ((RM100-RM42)/RM42) compared with a controlling interest in a public listed company (Position A) as your shares are subject to discounts due to lack of marketability and lack of control.

Therefore, when position A is worth RM100 per share, the value per share in Position B and Position C is about the same at RM65 per share.

Hence, if you intend to invest in any private limited companies, you need to be in the controlling position of the companies. Otherwise, if you are just a minority shareholder, it is more advisable for you to invest in listed companies.

Applied Value Investing

Applied Value Investing: The Practical Application of Benjamin Graham and Warren Buffett’s Valuation Principles to Acquisitions, Catastrophe Pricing and Business Execution

ISBN13: 9780071628181

Condition: NEW

Notes: Brand New from Publisher. No Remainder Mark.

Product Description

Since Benjamin Graham fathered value investing in the 1930s, the method of analysis has spawned a large number of highly successful investors, such as Graham’s own former student and employee, Warren Buffett, who is regarded as one of the most successful investors of modern times.

Over the years, numerous books have been published on Benjamin Graham’s approach. Most of these books present different interpretations of value investing and are generally introductory based. Until now, there has not been an advanced hands-on guide for investors and executives who may want to apply the powerful value investing discipline outside of stocks and bonds.

Applied Value Investing takes the same time-proven approach Graham introduced with David Dodd in their 1934 masterpiece, Security Analysis, and extends it in a variety of unique and practical ways—including mergers and acquisitions, alternative investments, and financial strategy.

This in-depth guide shows financially sophisticated readers how to use value investing in a macroinvesting framework and how to apply it to the emerging area of super catastrophe valuation. It illustrates how to put value investing to use with case studies on:

Eddie Lampert’s acquisition of Sears

Warren Buffett’s acquisitions of GEICO and General Reinsurance Corporation

The recent “new economy” boom and bust, and its aftermath

The underwriting of the Pepsi Play for a Billion sweepstakes

Applied Value Investing also demonstrates how to incorporate the cornerstones of valuation into an integrated business framework that can be used to assess and manage a franchise (or a firm operating with a sustainable competitive advantage).

In addition to its cutting-edge applications of value investing principles, Applied Value Investing sets itself apart by drawing on material published in leading academic journals to form the foundation of its presentation. However, value investing is inherently practical, and this comprehensive resource provides helpful guidance for successfully implementing value investing strategies in the real world.

To profit like the masters you have to think like them. Applied Value Investing can open new doors to value creating opportunities.

Applied Value Investing: The Practical Application of Benjamin Graham and Warren Buffett’s Valuation Principles to Acquisitions, Catastrophe Pricing and Business Execution

http://www.pdxpole.com/applied-value-investing-the-practical-application-of-benjamin-graham-and-warren-buffetts-valuation-principles-to-acquisitions-catastrophe-pricing-and-business-execution/

ISBN13: 9780071628181

Condition: NEW

Notes: Brand New from Publisher. No Remainder Mark.

Product Description

Since Benjamin Graham fathered value investing in the 1930s, the method of analysis has spawned a large number of highly successful investors, such as Graham’s own former student and employee, Warren Buffett, who is regarded as one of the most successful investors of modern times.

Over the years, numerous books have been published on Benjamin Graham’s approach. Most of these books present different interpretations of value investing and are generally introductory based. Until now, there has not been an advanced hands-on guide for investors and executives who may want to apply the powerful value investing discipline outside of stocks and bonds.

Applied Value Investing takes the same time-proven approach Graham introduced with David Dodd in their 1934 masterpiece, Security Analysis, and extends it in a variety of unique and practical ways—including mergers and acquisitions, alternative investments, and financial strategy.

This in-depth guide shows financially sophisticated readers how to use value investing in a macroinvesting framework and how to apply it to the emerging area of super catastrophe valuation. It illustrates how to put value investing to use with case studies on:

Eddie Lampert’s acquisition of Sears

Warren Buffett’s acquisitions of GEICO and General Reinsurance Corporation

The recent “new economy” boom and bust, and its aftermath

The underwriting of the Pepsi Play for a Billion sweepstakes

Applied Value Investing also demonstrates how to incorporate the cornerstones of valuation into an integrated business framework that can be used to assess and manage a franchise (or a firm operating with a sustainable competitive advantage).

In addition to its cutting-edge applications of value investing principles, Applied Value Investing sets itself apart by drawing on material published in leading academic journals to form the foundation of its presentation. However, value investing is inherently practical, and this comprehensive resource provides helpful guidance for successfully implementing value investing strategies in the real world.

To profit like the masters you have to think like them. Applied Value Investing can open new doors to value creating opportunities.

Applied Value Investing: The Practical Application of Benjamin Graham and Warren Buffett’s Valuation Principles to Acquisitions, Catastrophe Pricing and Business Execution

http://www.pdxpole.com/applied-value-investing-the-practical-application-of-benjamin-graham-and-warren-buffetts-valuation-principles-to-acquisitions-catastrophe-pricing-and-business-execution/

Benjamin Graham's 113 wise words

"The true investor scarcely ever is forced to sell his shares, and at all times he is free to disregard the current price quotation. He need pay attention to it and act upon it only to the extent that it suits his book, and no more. Thus the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage. That man would be better off if his stocks had no market quotation at all, for he would then be spared the mental anguish caused him by other persons' mistakes of judgement." - Benjamin Graham

Are Malaysian rubber glove makers overstretched?

Are Malaysian rubber glove makers overstretched?

Published: 2010/01/14

Bulls say rally still has legs, valuations not outrageous while bears say stocks run ahead of fundamentals, correction due

While the first wave of the H1N1 infections has ebbed, Malaysian rubber glove makers continue to see their share prices soar, raking in double-digit gains in the first two trading weeks of 2010.

The sharp gains have raised eyebrows after share prices skyrocketed last year as demand for rubber gloves surged following the global H1N1 pandemic.

Shares of Top Glove, the world’s biggest rubber glove maker by production capacity, jumped by about 156 per cent over the past 12 months, and second-ranked Supermax has surged 560 per cent.

Malaysia supplies more than 60 per cent of world’s rubber latex gloves, widely used for infectious disease control purposes.

Can the H1N1 flu, a sticky issue for countries, help rubber glove stocks defy the law of gravity?

STILL CHEAP

It may be to some extent.

“The rubber glove industry is not cyclical. Unlike commodities, it’s not affected by the business cycle. This is a very good, long-term business,” said Ang Kok Heng, who helps manage about US$125 million at Phillip Capital Management in Kuala Lumpur.

“The surge in demand is not a one-off thing. The glove industry tends to have a very good retention ratio, that means new customers added because of the H1N1 flu will likely become long-term customers for glove makers,” he said.

Ang said he would only consider to switch out from glove makers when valuations become too expensive. In the case of mid-cap stocks, such as Kossan and Adventa, that means a price-to-earnings (PE) ratio of more than 15 times, he said.

The rally still has legs, said Choo Swee Kee, chief investment officer of TA Investment Management which has about US$200 million asset under management.

“Good earnings growth has put down valuations. The PE ratio for glove makers ranges between 8 to 15 times, that’s not like way above the market PE,” said Choo.

This week, five out of 14 analysts on Top Glove have revised their annual earnings per share forecasts, hiking them by 9.1 per cent on average, according to StarMine. StarMine’s SmartEstimate shows a predicted earnings surprise of 10.8 per cent for the year to August 2010.

SmartEstimates predict future earnings more accurately than consensus estimates by putting more weight on the recent forecasts of StarMine’s top-rated analysts.

“We expect another 10 to 15 per cent upside. We are holding on to our shares and we will accumulate those with the lowest PE,” Choo said.

Malaysia’s benchmark share index trades at around 15 times 2010 earnings, higher than Top Glove’s 13.5 times and Supermax’s 11.3 times, Thomson Reuters data showed.

Kossan and Adventa, which are smaller in both market share and size than Top Glove and Supermax, trade at single-digit PEs.

“VERY OVERBOUGHT"

Malaysian rubber glove makers are “very overbought, the bull will have to pause a bit,” said Stephen Soo, senior technical analyst at TA Securities.

On technical charts, the Relative Strength Indicator (RSI) for all Malaysian rubber glove makers are hovering around 90, way above the 70 level that marks the overbought territory.

Share prices of rubber glove makers may drop one-third over a period of two weeks when a correction takes place, said Soo.

“The share price gains have run ahead of 2010 earnings,” said a chief investment officer from a bank-backed fund management firm whose company policy does not allow him to be quoted.

While demand was strong, it remained to be seen if glove makers could ramp up production capacity fast enough to meet it. There was also a risk that surging raw material costs could dent profit margins, he said.

Infrastructure constraints, such as natural gas shortages, could derail companies’ expansion plans, industry players have said.

And the price of rubber latex, from which gloves are made, has risen by more than two-thirds since last July. -- Reuters

Published: 2010/01/14

Bulls say rally still has legs, valuations not outrageous while bears say stocks run ahead of fundamentals, correction due

While the first wave of the H1N1 infections has ebbed, Malaysian rubber glove makers continue to see their share prices soar, raking in double-digit gains in the first two trading weeks of 2010.

The sharp gains have raised eyebrows after share prices skyrocketed last year as demand for rubber gloves surged following the global H1N1 pandemic.

Shares of Top Glove, the world’s biggest rubber glove maker by production capacity, jumped by about 156 per cent over the past 12 months, and second-ranked Supermax has surged 560 per cent.

Malaysia supplies more than 60 per cent of world’s rubber latex gloves, widely used for infectious disease control purposes.

Can the H1N1 flu, a sticky issue for countries, help rubber glove stocks defy the law of gravity?

STILL CHEAP

It may be to some extent.

“The rubber glove industry is not cyclical. Unlike commodities, it’s not affected by the business cycle. This is a very good, long-term business,” said Ang Kok Heng, who helps manage about US$125 million at Phillip Capital Management in Kuala Lumpur.

“The surge in demand is not a one-off thing. The glove industry tends to have a very good retention ratio, that means new customers added because of the H1N1 flu will likely become long-term customers for glove makers,” he said.

Ang said he would only consider to switch out from glove makers when valuations become too expensive. In the case of mid-cap stocks, such as Kossan and Adventa, that means a price-to-earnings (PE) ratio of more than 15 times, he said.

The rally still has legs, said Choo Swee Kee, chief investment officer of TA Investment Management which has about US$200 million asset under management.

“Good earnings growth has put down valuations. The PE ratio for glove makers ranges between 8 to 15 times, that’s not like way above the market PE,” said Choo.

This week, five out of 14 analysts on Top Glove have revised their annual earnings per share forecasts, hiking them by 9.1 per cent on average, according to StarMine. StarMine’s SmartEstimate shows a predicted earnings surprise of 10.8 per cent for the year to August 2010.

SmartEstimates predict future earnings more accurately than consensus estimates by putting more weight on the recent forecasts of StarMine’s top-rated analysts.

“We expect another 10 to 15 per cent upside. We are holding on to our shares and we will accumulate those with the lowest PE,” Choo said.

Malaysia’s benchmark share index trades at around 15 times 2010 earnings, higher than Top Glove’s 13.5 times and Supermax’s 11.3 times, Thomson Reuters data showed.

Kossan and Adventa, which are smaller in both market share and size than Top Glove and Supermax, trade at single-digit PEs.

“VERY OVERBOUGHT"

Malaysian rubber glove makers are “very overbought, the bull will have to pause a bit,” said Stephen Soo, senior technical analyst at TA Securities.

On technical charts, the Relative Strength Indicator (RSI) for all Malaysian rubber glove makers are hovering around 90, way above the 70 level that marks the overbought territory.

Share prices of rubber glove makers may drop one-third over a period of two weeks when a correction takes place, said Soo.

“The share price gains have run ahead of 2010 earnings,” said a chief investment officer from a bank-backed fund management firm whose company policy does not allow him to be quoted.

While demand was strong, it remained to be seen if glove makers could ramp up production capacity fast enough to meet it. There was also a risk that surging raw material costs could dent profit margins, he said.

Infrastructure constraints, such as natural gas shortages, could derail companies’ expansion plans, industry players have said.

And the price of rubber latex, from which gloves are made, has risen by more than two-thirds since last July. -- Reuters

Quek makes voluntary takeover offer for Hume

Quek makes voluntary takeover offer for Hume

Published: 2010/01/15

Tycoon Tan Sri Quek Leng Chan has made a voluntary takeover offer for Hume Industries (Malaysia) Bhd, with the aim of taking the manufacturer of concrete products private.

Hong Leong Co (Malaysia) Bhd's (HLCM) wholly-owned unit, Spectrum Arrangement Sdn Bhd, is offering RM4.30 cash per share in Hume.

Quek is HLCM's director and substantial shareholder.

Spectrum directly holds 118.8 million Hume shares, representing 64.94 per cent of the issued capital.

In a letter by Hong Leong Investment Bank to Hume, Spectrum said the offer is not conditional upon any minimal level of acceptance of the offer shares as it already owns more than 50 per cent of the voting shares in Hume.

Spectrum also plans to delist Hume from Bursa Malaysia if it receives acceptance in aggregate of more than 75 per cent of Hume shares.

Hume shares were placed on a trading halt yesterday, pending the release of the announcement.

Its shares rose 15 sen to RM4.15 before the suspension. Trading in the shares will resume from 10am today.

Published: 2010/01/15

Tycoon Tan Sri Quek Leng Chan has made a voluntary takeover offer for Hume Industries (Malaysia) Bhd, with the aim of taking the manufacturer of concrete products private.

Hong Leong Co (Malaysia) Bhd's (HLCM) wholly-owned unit, Spectrum Arrangement Sdn Bhd, is offering RM4.30 cash per share in Hume.

Quek is HLCM's director and substantial shareholder.

Spectrum directly holds 118.8 million Hume shares, representing 64.94 per cent of the issued capital.

In a letter by Hong Leong Investment Bank to Hume, Spectrum said the offer is not conditional upon any minimal level of acceptance of the offer shares as it already owns more than 50 per cent of the voting shares in Hume.

Spectrum also plans to delist Hume from Bursa Malaysia if it receives acceptance in aggregate of more than 75 per cent of Hume shares.

Hume shares were placed on a trading halt yesterday, pending the release of the announcement.

Its shares rose 15 sen to RM4.15 before the suspension. Trading in the shares will resume from 10am today.

Malaysians’ biggest money worries: Cost of living, salary and debt

Malaysians’ biggest money worries: Cost of living, salary and debt

By IZATUN SHARI

- 69% of respondents said they were extremely concerned about the cost of living expenses

- while 62% were worried about salary changes and

- 59% about personal debt respectively.

Thursday, 14 January 2010

Contrarian Investment

Tuesday, September 26, 2006

Quick Comment: Contrarian Investment

I came across an article on contrarian investment recently and thought it is a nice article to share. According to Investopedia, the contrarian approach is an investment style that goes against prevailing market trends by buying assets that are performing poorly and selling when they perform well. A contrarian investor believes that the people who say the market is going up do so only when they are fully invested and have no further purchasing power. At this point the market is at a peak. On the other hand, when people predict a downturn, they have already sold out, at which point the market can only go up. Contrarian investing also emphasizes out-of-favor securities with low P/E ratios.

According to the article,

· It is a long-term strategy.

· It is not about timing the market, it is about value. For instance, "If your neighbour offers you his $500,000 house for $250,000 you don't wait for it to be offered at $200,000".

· One of the biggest errors is selling too early.

· You have to be prepared to look dumb for significant periods of time sometimes.

· Never expect to buy a stock right at the bottom.

· Staying out of companies that lose you money will save more than being in the ones that make you money. Preservation of capital and management of risk are paramount.

· Emotion is a contrarian's friend. When the market is going down the average man is looking at all the negatives and forgets the positive; that's when the opportunities arise.

The companies that contrarians look for are those that:

· Have solid brands.

· Have good cash flows.

· May be suffering a temporary economic setback.

· Would benefit from recapitalisation.

· Need management change.

· Would be capable of being changed.

· Opportunities seem to be where the market isn't, in sectors out of favour.

· Booms like the tech boom and the resources boom are good for contrarian investors because they take people away from value areas and make investors give up on long-term proven methods of investment and value assessment. They present opportunities that would never have been there otherwise.

· The contrarian is looking for market overreaction and the opportunity that overreaction presents.

· Don't be a mindless contrarian. Being contrarian is not about buying a share when it has fallen 10 per cent in a day just because everyone else is selling it. Only one in 20 major falls is an opportunity.

· Being contrarian means doing hard work to identify a situation the market hasn't while a stock is still at a price below what you calculate it to be worth.

· Contrarian investment does not rely on timing markets. You have to take a long-term view.

Sounds very much like TANJONG doesnt it? It has strong cash flow and is out of favour for fear of the negative effects of the PPA negotiations. However, the government has made it clear that it should be a win-win situation. Even if it ends up losing out a bit due to the new PPAs, downside would be rather limited since the bad news have already been priced in. Long term wise, it is still a very solid company.

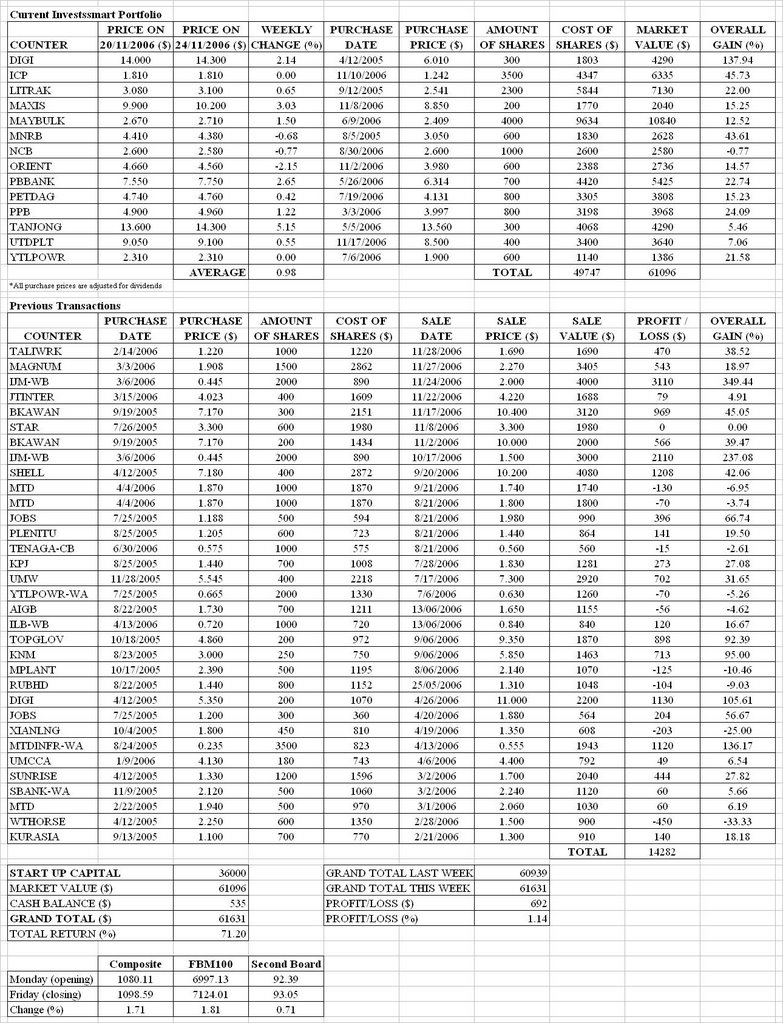

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_09_01_archive.html

Quick Comment: Contrarian Investment

I came across an article on contrarian investment recently and thought it is a nice article to share. According to Investopedia, the contrarian approach is an investment style that goes against prevailing market trends by buying assets that are performing poorly and selling when they perform well. A contrarian investor believes that the people who say the market is going up do so only when they are fully invested and have no further purchasing power. At this point the market is at a peak. On the other hand, when people predict a downturn, they have already sold out, at which point the market can only go up. Contrarian investing also emphasizes out-of-favor securities with low P/E ratios.

According to the article,

· It is a long-term strategy.

· It is not about timing the market, it is about value. For instance, "If your neighbour offers you his $500,000 house for $250,000 you don't wait for it to be offered at $200,000".

· One of the biggest errors is selling too early.

· You have to be prepared to look dumb for significant periods of time sometimes.

· Never expect to buy a stock right at the bottom.

· Staying out of companies that lose you money will save more than being in the ones that make you money. Preservation of capital and management of risk are paramount.

· Emotion is a contrarian's friend. When the market is going down the average man is looking at all the negatives and forgets the positive; that's when the opportunities arise.

The companies that contrarians look for are those that:

· Have solid brands.

· Have good cash flows.

· May be suffering a temporary economic setback.

· Would benefit from recapitalisation.

· Need management change.

· Would be capable of being changed.

· Opportunities seem to be where the market isn't, in sectors out of favour.

· Booms like the tech boom and the resources boom are good for contrarian investors because they take people away from value areas and make investors give up on long-term proven methods of investment and value assessment. They present opportunities that would never have been there otherwise.

· The contrarian is looking for market overreaction and the opportunity that overreaction presents.

· Don't be a mindless contrarian. Being contrarian is not about buying a share when it has fallen 10 per cent in a day just because everyone else is selling it. Only one in 20 major falls is an opportunity.

· Being contrarian means doing hard work to identify a situation the market hasn't while a stock is still at a price below what you calculate it to be worth.

· Contrarian investment does not rely on timing markets. You have to take a long-term view.

Sounds very much like TANJONG doesnt it? It has strong cash flow and is out of favour for fear of the negative effects of the PPA negotiations. However, the government has made it clear that it should be a win-win situation. Even if it ends up losing out a bit due to the new PPAs, downside would be rather limited since the bad news have already been priced in. Long term wise, it is still a very solid company.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_09_01_archive.html

Speculative stocks

Thursday, July 20, 2006

Market Talk: Speculative stocks

DJ MARKET TALK: Speculative Stks Hammered; May Fall Further - 2006-07-20 07:29:00.0

1529 [Dow Jones] Speculative issues and stocks usually associated with syndicates sharply lower; Iris (0010.KU) down 29% at 71 sen with 108.7 million shares traded, Poly Tower (7175.KU) down 16.8% at 86.5 sen, Sugar Bun (7036.KU) down 8.6% at 96 sen. "It looks like the syndicates used this morning's knee-jerk reaction to distribute their holdings to retail players. There currently does not seem to be much buying support for these stocks," dealer says; adds stocks may fall further.(VGB)

Investssmart: I am not surprised by the hammering at all. It was just a matter of time and the manipulators chose the best time. Dow Jones Industrial Index rose 212 points of 2% overnight and punters would have expected a sharp rise today on Bursa Malaysia. Of course, many rushed into speculative stocks like IRIS early in the morning hoping to get in at a lower price. It should be noted that IRIS rose by 8% to $1.08 this morning before succumbing to strong selling and reached a low of 67c.

The manipulators are not stupid. They cash in when market sentiment is strong and the naive retail investors purchase the shares hoping for a small gain. Has anyone wondered how much IRIS was worth at its peak? There are 914m IRIS shares, 368 IRIS-PA and 55m IRIS-WA on issue. At their peaks of $1.39, $1.28 and $1.17 respectively, the total value of IRIS works out to be $1806m. Was IRIS really ever worth $1.8 billion? It only made a profit of $1.8m in the latest quarter.

Every investor knows that IRIS is a manipulated counter but that did not stop them from purchasing its shares. Bursa Malaysia designated it. Brokers demand cash up front for purchases. News articles comment on it all the time but yet, some people choose to buy the shares, hoping to make some money from it. Who can you blame when they lose money? If someone throws a gold bar into the river and tell you that the river is infested with crocodiles but yet you jump in for the gold bar, who is to blame if you are eaten by the crocs?

The point I am trying to say is "dont try your luck in manipulated stocks". You may earn a little money each time but you could lose it all in just one day. This is an extract from an Australian financial journalist's comments on the share market:

"You need patience. If you try to rush your financial transformation you will fail. Patience is about having realistic expectations. You won't get anywhere trying to make money every day. I've seen people in the market who spend most of the time doing nothing. Just sitting watching things going by. On the lookout. They don't try to generate opportunities out of nothing, they just wait for them."

In conclusion, there is no need to try and earn a little bit of money every day. Even with IRIS at 82.5c, IRIS-PA at 43.5c and IRIS-WA at 38c, it is still way overvalued with a total value of the company at close to $1b. Everyone knows IRIS rose because of the manipulation of its shares. If you are still trying to beat the manipulators to make a profit, please give up because it is almost impossible. In this game, you are the player, the manipulators are the bankers and I don't remember GENTING ever reporting an annual loss. You may beat them once, you may beat them twice or even 10 times but at the end, there is only one winner. And unfortunately, it won't to be the player.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_07_01_archive.html

Market Talk: Speculative stocks

DJ MARKET TALK: Speculative Stks Hammered; May Fall Further - 2006-07-20 07:29:00.0

1529 [Dow Jones] Speculative issues and stocks usually associated with syndicates sharply lower; Iris (0010.KU) down 29% at 71 sen with 108.7 million shares traded, Poly Tower (7175.KU) down 16.8% at 86.5 sen, Sugar Bun (7036.KU) down 8.6% at 96 sen. "It looks like the syndicates used this morning's knee-jerk reaction to distribute their holdings to retail players. There currently does not seem to be much buying support for these stocks," dealer says; adds stocks may fall further.(VGB)

Investssmart: I am not surprised by the hammering at all. It was just a matter of time and the manipulators chose the best time. Dow Jones Industrial Index rose 212 points of 2% overnight and punters would have expected a sharp rise today on Bursa Malaysia. Of course, many rushed into speculative stocks like IRIS early in the morning hoping to get in at a lower price. It should be noted that IRIS rose by 8% to $1.08 this morning before succumbing to strong selling and reached a low of 67c.

The manipulators are not stupid. They cash in when market sentiment is strong and the naive retail investors purchase the shares hoping for a small gain. Has anyone wondered how much IRIS was worth at its peak? There are 914m IRIS shares, 368 IRIS-PA and 55m IRIS-WA on issue. At their peaks of $1.39, $1.28 and $1.17 respectively, the total value of IRIS works out to be $1806m. Was IRIS really ever worth $1.8 billion? It only made a profit of $1.8m in the latest quarter.

Every investor knows that IRIS is a manipulated counter but that did not stop them from purchasing its shares. Bursa Malaysia designated it. Brokers demand cash up front for purchases. News articles comment on it all the time but yet, some people choose to buy the shares, hoping to make some money from it. Who can you blame when they lose money? If someone throws a gold bar into the river and tell you that the river is infested with crocodiles but yet you jump in for the gold bar, who is to blame if you are eaten by the crocs?

The point I am trying to say is "dont try your luck in manipulated stocks". You may earn a little money each time but you could lose it all in just one day. This is an extract from an Australian financial journalist's comments on the share market:

"You need patience. If you try to rush your financial transformation you will fail. Patience is about having realistic expectations. You won't get anywhere trying to make money every day. I've seen people in the market who spend most of the time doing nothing. Just sitting watching things going by. On the lookout. They don't try to generate opportunities out of nothing, they just wait for them."

In conclusion, there is no need to try and earn a little bit of money every day. Even with IRIS at 82.5c, IRIS-PA at 43.5c and IRIS-WA at 38c, it is still way overvalued with a total value of the company at close to $1b. Everyone knows IRIS rose because of the manipulation of its shares. If you are still trying to beat the manipulators to make a profit, please give up because it is almost impossible. In this game, you are the player, the manipulators are the bankers and I don't remember GENTING ever reporting an annual loss. You may beat them once, you may beat them twice or even 10 times but at the end, there is only one winner. And unfortunately, it won't to be the player.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_07_01_archive.html

'Expensive' shares

Quick Comment: 'Expensive' shares

Some time ago, I had a conversation with my ASX remisier based in Australia and I think some of his comments are worth sharing.

*Me refers to myself when I was speaking to him.

*Investssmart is also myself but from my point of view now.

Me: Good shares in Malaysia are expensive.

Remisier: What do you mean by expensive? When you say expensive, do you mean in absolute terms or in terms of valuation? When I say it is expensive, it normally means overvalued or fully valued. Some companies can trade at $30 but we still call them cheap.

Investssmart: This is very true. The word expensive should be used more carefully when talking about shares. The absolute value does not really count. A Mercedes for $100k is 'cheaper' than a Waja for $60k. It is the value that counts.

Me: Malaysians' perception is that the higher the share price is, the more it can drop.

Remisier: That happens all the time. It is important to remember that we should look at the movements in terms of percentage. If a $50 company can drop to $5, a $5 company can drop to 5c as well. The important thing is to fix the absolute amount you invest. Purchasing 100 shares in a $50 company is the same as purchasing 1000 shares in a $5 company. If both rise by 10%, you will still earn the same amount of $500 no matter which company you invest it.

Investssmart: We should not be put off by the share price. It is the valuation that we should worry about. The chances of IRIS to drop from 90c to 20c is higher than the chances of BKAWAN dropping from $7.80 to $2. But somehow, if you give investors just these two choices, many would rather invest in IRIS because they think it is 'cheaper'!

Remisier: Do you remember me recommending you Rio Tinto ($30), BHP ($15), Woodside ($20) and Cochlear ($25)? You did not purchase any either! Perhaps, this changed your view on 'expensive' stocks!

Investssmart: These four stocks have skyrocketed since his recommendation. They are now about $75, $30, $45 and $50 respectively. Never say that upside of highly priced shares are limited. There is no such thing. Upside of overvalued/expensive shares is limited but upside of highly priced shares is not. Although I did not purchase these shares, it was not because I was scared of the high prices. It was mainly because I did not have the strong confidence in the commodity bull and sadly, I was proven to be wrong. Could have made tonnes more from the ASX. Nevertheless, in a bull market, almost everything on the ASX rose.

Me: I did not buy those few but I still bought some highly priced ones. What would I be trading if I don't buy any highly priced shares? I don't remember you ever recommending me any penny stocks!

Remisier: Good stocks are normally highly priced because the demand for good stocks is very strong. Lowly priced shares are normally those that are speculative or not performing.

Investssmart: It is strange but true to a certain extent. Of course, it does not apply to all company shares.

Strange but could be true: I don't think it is a coincidence that most of the true blue chips throughout the world are trading at high prices. Most of these blue chips have been there for ages. It had to start off somewhere as a smaller company and it takes time to reach where it is today. If the company was trading at $1 ten years ago, it will probably trade at $10 today to be considered a top performer. Otherwise, it would not be considered a blue chip.

Fundamental based investors always look at companies that have excellent track records and therefore, end up investing in highly priced shares. That is because it is very rare that we can get such companies at low prices as share prices should have risen as companies perform well over the years. I doubt fundamental based investors would be interested in companies that trade at low prices over the last few years because that means that they probably do not have a good track record. Of course, this does not apply to all shares but I believe that it is true to a certain extent.

Conclusion: Do not look at how high the share price is. It is the valuation that counts.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_04_01_archive.html

Some time ago, I had a conversation with my ASX remisier based in Australia and I think some of his comments are worth sharing.

*Me refers to myself when I was speaking to him.

*Investssmart is also myself but from my point of view now.

Me: Good shares in Malaysia are expensive.

Remisier: What do you mean by expensive? When you say expensive, do you mean in absolute terms or in terms of valuation? When I say it is expensive, it normally means overvalued or fully valued. Some companies can trade at $30 but we still call them cheap.

Investssmart: This is very true. The word expensive should be used more carefully when talking about shares. The absolute value does not really count. A Mercedes for $100k is 'cheaper' than a Waja for $60k. It is the value that counts.

Me: Malaysians' perception is that the higher the share price is, the more it can drop.

Remisier: That happens all the time. It is important to remember that we should look at the movements in terms of percentage. If a $50 company can drop to $5, a $5 company can drop to 5c as well. The important thing is to fix the absolute amount you invest. Purchasing 100 shares in a $50 company is the same as purchasing 1000 shares in a $5 company. If both rise by 10%, you will still earn the same amount of $500 no matter which company you invest it.

Investssmart: We should not be put off by the share price. It is the valuation that we should worry about. The chances of IRIS to drop from 90c to 20c is higher than the chances of BKAWAN dropping from $7.80 to $2. But somehow, if you give investors just these two choices, many would rather invest in IRIS because they think it is 'cheaper'!

Remisier: Do you remember me recommending you Rio Tinto ($30), BHP ($15), Woodside ($20) and Cochlear ($25)? You did not purchase any either! Perhaps, this changed your view on 'expensive' stocks!

Investssmart: These four stocks have skyrocketed since his recommendation. They are now about $75, $30, $45 and $50 respectively. Never say that upside of highly priced shares are limited. There is no such thing. Upside of overvalued/expensive shares is limited but upside of highly priced shares is not. Although I did not purchase these shares, it was not because I was scared of the high prices. It was mainly because I did not have the strong confidence in the commodity bull and sadly, I was proven to be wrong. Could have made tonnes more from the ASX. Nevertheless, in a bull market, almost everything on the ASX rose.

Me: I did not buy those few but I still bought some highly priced ones. What would I be trading if I don't buy any highly priced shares? I don't remember you ever recommending me any penny stocks!

Remisier: Good stocks are normally highly priced because the demand for good stocks is very strong. Lowly priced shares are normally those that are speculative or not performing.

Investssmart: It is strange but true to a certain extent. Of course, it does not apply to all company shares.

Strange but could be true: I don't think it is a coincidence that most of the true blue chips throughout the world are trading at high prices. Most of these blue chips have been there for ages. It had to start off somewhere as a smaller company and it takes time to reach where it is today. If the company was trading at $1 ten years ago, it will probably trade at $10 today to be considered a top performer. Otherwise, it would not be considered a blue chip.

Fundamental based investors always look at companies that have excellent track records and therefore, end up investing in highly priced shares. That is because it is very rare that we can get such companies at low prices as share prices should have risen as companies perform well over the years. I doubt fundamental based investors would be interested in companies that trade at low prices over the last few years because that means that they probably do not have a good track record. Of course, this does not apply to all shares but I believe that it is true to a certain extent.

Conclusion: Do not look at how high the share price is. It is the valuation that counts.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_04_01_archive.html

Is the market short of retail players?

Quick Comment: Is the market short of retail players?

After reading some articles in the newspapers today, I feel that Bursa Malaysia is managed by a pack of jokers (management of Bursa Malaysia). Not only that, these jokers are supported by another group of jokers (brokerage and remisiers). And since they are all jokers, smarter opportunists out there took advantage of the market to make some good money. Here is what I read and my comments:

First article: Bursa woos retail investors

In the article, it says "BURSA Malaysia Bhd is working with several broking houses to increase retail participation in the stock market. Bursa Malaysia chief executive officer Yusli Mohamed Yusoff said that while the stock market had been performing relatively well in the past few months, more could be done to improve retail participation."

Investssmart: Do we actually need more retail participation? What we lack now is foreign funds participation. We have enough of retail participation. After all, retail participation will not help Bursa Malaysia because most Malaysian retail investors are interested in speculative stocks like TIMECOM, NSCOM and the chicken stocks. By encouraging more retail investors to invest in these kinda stocks is to cheat them off their money because most will end up losing. Where are the foreign funds? Everyone knows Malaysia has hardly any foreign funds participation. Bursa Malaysia should work hard with the government to get the foreign funds. Without them, Bursa Malaysia cannot perform well. Enough of swindling retailers money.

Second article: Advice from broking houses to retail players

Advice from broking houses? What? Aren't these the people who managed the unit trusts that losses money year after year? Yes, it is a shame that most of the unit trusts and funds managed by Malaysian fund managers are losing money. Of course there are exceptional ones like Public Mutual and ICapital but for every good one in Malaysia, there are probably 9 lousy ones. A lot of these funds are there just to support the market, not to maximise your wealth. Is their advise (or bullshit to some of us) worth listening to? Of course not. Even Investssmart is better.

Third article: SMR Technologies 108 times oversubscribed

Bursa Malaysia says they want more retail participation but their latest IPO was oversuscribed an astonishing 108x! How much money were there in just this IPO just from retail investors? 2.5m shares were offered to the public at 33c each. Oversuscription of 108x means that the public suscribed a total of $90m just for one IPO! And yet, Bursa Malaysia complained of the lack of retail participation. Where are their senses? What the market lack is foreign funds participation! Not retail investors.

SMR Technologies offered only 2.5m shares for the public. At 33c, it is only raising $825k from the public! What a joke! If you convert that to USD, it will be just USD223k. If you want to raise so little from the public, don't even go for listing. Or at least, Bursa Malaysia should not allow the listing. We have enough companies on Bursa Malaysia and one which raises $825k from the public is just not needed. If they don't want to let the public own more of their shares, just ask them to keep it as a private company!

These companies are listed by those who is taking advantage of the stupidity of the management of Bursa Malaysia. They are all going for the easy money. All they need to do is offer as little shares as possible and make it look very much in demand. Then, on the first day of trading, its share price will soar at least 50%! These opportunists will then start unloading their shares. Investors overseas will laugh if they hear an IPO raising USD223k from the public. They are probably already laughing. What can we expect? We have a market managed and supported by jokers.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_03_01_archive.html

After reading some articles in the newspapers today, I feel that Bursa Malaysia is managed by a pack of jokers (management of Bursa Malaysia). Not only that, these jokers are supported by another group of jokers (brokerage and remisiers). And since they are all jokers, smarter opportunists out there took advantage of the market to make some good money. Here is what I read and my comments:

First article: Bursa woos retail investors

In the article, it says "BURSA Malaysia Bhd is working with several broking houses to increase retail participation in the stock market. Bursa Malaysia chief executive officer Yusli Mohamed Yusoff said that while the stock market had been performing relatively well in the past few months, more could be done to improve retail participation."

Investssmart: Do we actually need more retail participation? What we lack now is foreign funds participation. We have enough of retail participation. After all, retail participation will not help Bursa Malaysia because most Malaysian retail investors are interested in speculative stocks like TIMECOM, NSCOM and the chicken stocks. By encouraging more retail investors to invest in these kinda stocks is to cheat them off their money because most will end up losing. Where are the foreign funds? Everyone knows Malaysia has hardly any foreign funds participation. Bursa Malaysia should work hard with the government to get the foreign funds. Without them, Bursa Malaysia cannot perform well. Enough of swindling retailers money.

Second article: Advice from broking houses to retail players

Advice from broking houses? What? Aren't these the people who managed the unit trusts that losses money year after year? Yes, it is a shame that most of the unit trusts and funds managed by Malaysian fund managers are losing money. Of course there are exceptional ones like Public Mutual and ICapital but for every good one in Malaysia, there are probably 9 lousy ones. A lot of these funds are there just to support the market, not to maximise your wealth. Is their advise (or bullshit to some of us) worth listening to? Of course not. Even Investssmart is better.

Third article: SMR Technologies 108 times oversubscribed

Bursa Malaysia says they want more retail participation but their latest IPO was oversuscribed an astonishing 108x! How much money were there in just this IPO just from retail investors? 2.5m shares were offered to the public at 33c each. Oversuscription of 108x means that the public suscribed a total of $90m just for one IPO! And yet, Bursa Malaysia complained of the lack of retail participation. Where are their senses? What the market lack is foreign funds participation! Not retail investors.

SMR Technologies offered only 2.5m shares for the public. At 33c, it is only raising $825k from the public! What a joke! If you convert that to USD, it will be just USD223k. If you want to raise so little from the public, don't even go for listing. Or at least, Bursa Malaysia should not allow the listing. We have enough companies on Bursa Malaysia and one which raises $825k from the public is just not needed. If they don't want to let the public own more of their shares, just ask them to keep it as a private company!

These companies are listed by those who is taking advantage of the stupidity of the management of Bursa Malaysia. They are all going for the easy money. All they need to do is offer as little shares as possible and make it look very much in demand. Then, on the first day of trading, its share price will soar at least 50%! These opportunists will then start unloading their shares. Investors overseas will laugh if they hear an IPO raising USD223k from the public. They are probably already laughing. What can we expect? We have a market managed and supported by jokers.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_03_01_archive.html

Warrants

Questions: Warrants

Question: Let say i have a warrant at 50c and the mother share is $1.50 with exercise price at $1.10..so the premium is 10c.. are we actually banking for the mother share to rise b4 expiry to earn some money? let say b4 expiry it goes up to 2.00, that means we get profit 40c izzit? next, if in betweeen there are any divs and cap repayment of let say 20c...then $1.50 will be adjusted to $1.30 and exercise price will go down from $1.10 to 90c ... am i correct?

Investssmart: Yes, the premium is 10c or 6.7% (10c out of $1.50). That means that the warrant will reach its fair value when the mother share rises 10c or 6.7% to $1.60. Yes, we are banking on the mother share to rise. If the mother share rises 33% or 50c to $2 before its expiry, it is highly likely that the warrant will rise 40-50c as well. Taking into account a gain of 50c for the warrants will equate to a 100% profit. It is amplified by three times because of the 3x leverage ($1.50/50c). IJM-WB offers a leverage of 10x!

You are right on the reduction of exercise price but it will be reduced only when there is a capital repayment. It will not be reduced because of dividends. In other words, the lower the dividend, the better for the warrants. It has to be noted that the time span to expiry is very important for warrants. The longer it is from expiry, the higher should be the premium because longer time will be afforded for the mother share to rise.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

Tuesday, March 07, 2006

Comments: Warrants

kchim26 said...

One thing not mentioned here is that, buying warrant, u r betting against time. It is true that warrant can provide leveraging oppotunity, one negative point is that we have limited time on our side. If price go against us, we might lose all our investment in the warrant when it is expired while investing in Mother share will provide us unlimited time to wait for the price to recover.

Conclusion is that, only buy warrant for short term bet, for long term bet, buying mother is better. If we wish to buy warrant to capitalize on higher return, we need to have enough confidence that the company will be performing well before the expiry date. Just my 2cents. ;)

Investssmart: I have to say that I disagree with most of your points. Time is always against warrants but it is not that bad unless your purchase warrants that are way out of money. I recommended earlier in the year YTLPOWR-WA, MTDINFR-WA and ILB-WB. They are all in the money. IJM-WB is just 2% away from being in the money. Warrants actually limit your losses. The important part is not to overexpose yourself. If you would normally purchase 1000 of the company shares, then purchase 2500 warrants at most.

Consider this case: I were to purchase YTLPOWR-WA (expiring 2010 and exercise price $1.43) now at 75c and you were to purchase YTLPOWR now at $2.18. If it drops to just $1 in 2010, I will end up losing all the 75c because the warrants expire out of money. On the other hand, you will lose $1.18.

But you have to remember that I can just purchase these shares from the market at $1 at the time in 2010. That means that both of us are now equal shareholders but your cost stays at $2.18 whereas mine is just $1.75 (75c for warrants+$1 for shares at 2010). Therefore, your statement that mother share is better because it provides unlimited time is not true. Through the warrants, I get the cheaper option as well as the unlimited time by purchasing the shares when the warrants expire out of money.

Of course, you are entitled to dividends as shareholders, but as a warrant holder, I only need to pay a fraction of what shareholders pay. The rest of the money could be used to generate more money by investing in pure dividend stocks. I have to emphasise that warrants are generally undervalued in Malaysia from my experience trading in Australia. Most Malaysian investors do not have a good understanding of warrants. However, it must be noted that we should not purchase warrants that are grossly out of money. I give IJM-WB (2% out of money) an exception because of its long date to expiry, world class management, 10x leverage and low dividend yield.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_03_01_archive.html

Question: Let say i have a warrant at 50c and the mother share is $1.50 with exercise price at $1.10..so the premium is 10c.. are we actually banking for the mother share to rise b4 expiry to earn some money? let say b4 expiry it goes up to 2.00, that means we get profit 40c izzit? next, if in betweeen there are any divs and cap repayment of let say 20c...then $1.50 will be adjusted to $1.30 and exercise price will go down from $1.10 to 90c ... am i correct?

Investssmart: Yes, the premium is 10c or 6.7% (10c out of $1.50). That means that the warrant will reach its fair value when the mother share rises 10c or 6.7% to $1.60. Yes, we are banking on the mother share to rise. If the mother share rises 33% or 50c to $2 before its expiry, it is highly likely that the warrant will rise 40-50c as well. Taking into account a gain of 50c for the warrants will equate to a 100% profit. It is amplified by three times because of the 3x leverage ($1.50/50c). IJM-WB offers a leverage of 10x!

You are right on the reduction of exercise price but it will be reduced only when there is a capital repayment. It will not be reduced because of dividends. In other words, the lower the dividend, the better for the warrants. It has to be noted that the time span to expiry is very important for warrants. The longer it is from expiry, the higher should be the premium because longer time will be afforded for the mother share to rise.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

Tuesday, March 07, 2006

Comments: Warrants

kchim26 said...

One thing not mentioned here is that, buying warrant, u r betting against time. It is true that warrant can provide leveraging oppotunity, one negative point is that we have limited time on our side. If price go against us, we might lose all our investment in the warrant when it is expired while investing in Mother share will provide us unlimited time to wait for the price to recover.

Conclusion is that, only buy warrant for short term bet, for long term bet, buying mother is better. If we wish to buy warrant to capitalize on higher return, we need to have enough confidence that the company will be performing well before the expiry date. Just my 2cents. ;)

Investssmart: I have to say that I disagree with most of your points. Time is always against warrants but it is not that bad unless your purchase warrants that are way out of money. I recommended earlier in the year YTLPOWR-WA, MTDINFR-WA and ILB-WB. They are all in the money. IJM-WB is just 2% away from being in the money. Warrants actually limit your losses. The important part is not to overexpose yourself. If you would normally purchase 1000 of the company shares, then purchase 2500 warrants at most.

Consider this case: I were to purchase YTLPOWR-WA (expiring 2010 and exercise price $1.43) now at 75c and you were to purchase YTLPOWR now at $2.18. If it drops to just $1 in 2010, I will end up losing all the 75c because the warrants expire out of money. On the other hand, you will lose $1.18.

But you have to remember that I can just purchase these shares from the market at $1 at the time in 2010. That means that both of us are now equal shareholders but your cost stays at $2.18 whereas mine is just $1.75 (75c for warrants+$1 for shares at 2010). Therefore, your statement that mother share is better because it provides unlimited time is not true. Through the warrants, I get the cheaper option as well as the unlimited time by purchasing the shares when the warrants expire out of money.

Of course, you are entitled to dividends as shareholders, but as a warrant holder, I only need to pay a fraction of what shareholders pay. The rest of the money could be used to generate more money by investing in pure dividend stocks. I have to emphasise that warrants are generally undervalued in Malaysia from my experience trading in Australia. Most Malaysian investors do not have a good understanding of warrants. However, it must be noted that we should not purchase warrants that are grossly out of money. I give IJM-WB (2% out of money) an exception because of its long date to expiry, world class management, 10x leverage and low dividend yield.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_03_01_archive.html

Making a million made easy

Sunday, February 19, 2006

News article: Making a million made easy

Just came across this article in TheAge Australia and thought it would be a good article to share with you guys. For your info, Kerry Packer, the richest Australia, passed away recently. For those who have the time, it is good to read the whole lot but for those who don't, here are the quotes I would like to share.

"The stockmarket is not life changing — 9.5 per cent per annum plus dividends is not going to turn you and I into Kerry Packer. But there are plenty of people in the stockmarket that have made it. Maybe not the billions, maybe not the millions, but plenty the million."

"You need patience. If you try to rush your financial transformation you will fail. Patience is about having realistic expectations. You won't get anywhere trying to make money every day. I've seen people in the market who spend most of the time doing nothing. Just sitting watching things going by. On the lookout. They don't try to generate opportunities out of nothing, they just wait for them."

"The mistake too many people make is to pursue opportunities frantically. Let them come. They always do. If you miss one, there'll be another."

"Terrific gains come from terrific information. Information is everywhere but most people don't use it, probably because they haven't got the time. There is plenty of money to be made out of the information gap. Knowing more than anyone else, because you bothered to do the work. Investssmart: Best describe the situation in Malaysia. Investors don't bother doing any research. They just buy TIMECOM, the billion dollar company which has never made an operating profit.

"You will not make extraordinary gains without investing in volatile (small and risky) stocks. The only way to do that is to narrow your odds significantly, minimise the risk. That means knowing what the company does. Knowing where it is in its development. Knowing what's ahead. Knowing more about it than almost anyone else. Getting to know people in the company. Talking to them. Only then can you take a big slug in a small stock that might see extraordinary gains."

Investssmart: This does not necessarily work in Malaysia because of syndicates and also because people tend to lie a lot more.

"You need mates. Kerry Packer had them. You will not make a fortune in the stockmarket by shutting yourself off in a small dark room. Information comes from mates. Opportunities come from mates."

Investssmart: Can I be your mates? :)

"Patience, information and mates. Your recipe for success."

"This isn't how you become a billionaire. The only real way to make a fortune is to build a business, build assets and employ people to build them for you."

Investssmart: That is very true. Warren Buffett is not an legendary investor for nothing. Being a multi-millionaire is enough for me.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_02_01_archive.html

News article: Making a million made easy

Just came across this article in TheAge Australia and thought it would be a good article to share with you guys. For your info, Kerry Packer, the richest Australia, passed away recently. For those who have the time, it is good to read the whole lot but for those who don't, here are the quotes I would like to share.

"The stockmarket is not life changing — 9.5 per cent per annum plus dividends is not going to turn you and I into Kerry Packer. But there are plenty of people in the stockmarket that have made it. Maybe not the billions, maybe not the millions, but plenty the million."

"You need patience. If you try to rush your financial transformation you will fail. Patience is about having realistic expectations. You won't get anywhere trying to make money every day. I've seen people in the market who spend most of the time doing nothing. Just sitting watching things going by. On the lookout. They don't try to generate opportunities out of nothing, they just wait for them."

"The mistake too many people make is to pursue opportunities frantically. Let them come. They always do. If you miss one, there'll be another."

"Terrific gains come from terrific information. Information is everywhere but most people don't use it, probably because they haven't got the time. There is plenty of money to be made out of the information gap. Knowing more than anyone else, because you bothered to do the work. Investssmart: Best describe the situation in Malaysia. Investors don't bother doing any research. They just buy TIMECOM, the billion dollar company which has never made an operating profit.

"You will not make extraordinary gains without investing in volatile (small and risky) stocks. The only way to do that is to narrow your odds significantly, minimise the risk. That means knowing what the company does. Knowing where it is in its development. Knowing what's ahead. Knowing more about it than almost anyone else. Getting to know people in the company. Talking to them. Only then can you take a big slug in a small stock that might see extraordinary gains."

Investssmart: This does not necessarily work in Malaysia because of syndicates and also because people tend to lie a lot more.

"You need mates. Kerry Packer had them. You will not make a fortune in the stockmarket by shutting yourself off in a small dark room. Information comes from mates. Opportunities come from mates."

Investssmart: Can I be your mates? :)

"Patience, information and mates. Your recipe for success."

"This isn't how you become a billionaire. The only real way to make a fortune is to build a business, build assets and employ people to build them for you."

Investssmart: That is very true. Warren Buffett is not an legendary investor for nothing. Being a multi-millionaire is enough for me.

Disclaimer: This report is brought to you by Investssmart, an unlicensed investment adviser. Please exercise your own judgment or seek professional advice from your remisiers. By law, they are the experts. I am not responsible for your investment decisions.

http://investssmart.blogspot.com/2006_02_01_archive.html

Questions: Why are manipulated stocks so risky?

Questions: Why are manipulated stocks so risky?