Tan warns of overvalued global markets

FORMIDABLE Malaysian fund managers who speak their mind are hard to come by.

But you would not think of that when you meet the unassuming Capital Dynamics founder and managing director Tan Teng Boo – also the founder of Malaysia’s only closed-end listed fund, iCapital.biz.

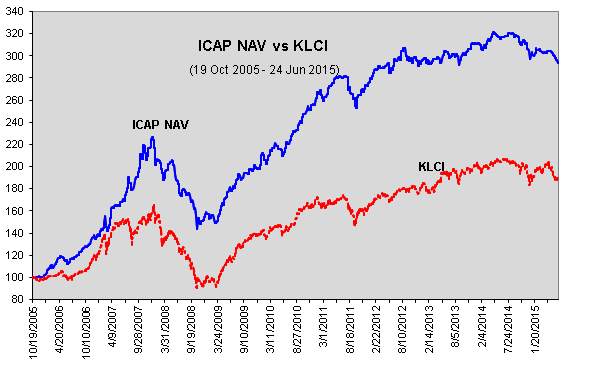

For the record, iCapital.biz recorded a compounded return of 13.78% a year since its listing in 2005 versus 8.17% for the KLCI.

If the cash portion of RM240mil is removed, that return would be much higher. (Capital Dynamics is the fund manager of iCapital.biz).

Capital Dynamics now has three funds, with its biggest exposure in stocks listed on the London Stock Exchange. In Asia, its highest weightage are stocks listed on the Hong Kong Stock Exchange.

So this week, when we spoke with Tan, he was again armed with some interesting contrarian insights.

“To know whether a market is bullish or bearish, you see what kind of fools are around. In a bear market, the old fools are in the market. These are the seasoned people who have made mistakes. Today, there are a lot of new fools around,” he says.

On a more serious note, Tan expects global markets to fall drastically. All his funds presently have high cash levels. He bases this view purely on stretched valuations.

“Look at the last 12 months. The S&P 500 is now trading at a price earnings ratio of 20 times PE. What is more significant is that if you look at the Schiller cyclically-adjusted 10-year PE, it is now at 26 times.

“The last three times it was at this level was in 1929, 1999 and 2007 to 2008,” Tan says.

“When valuations are high, anything can be a trigger, and just like that, people will sell. And when markets are overvalued, you get bad returns.”

Are there anything in particular he is eyeing?

“For now, I cannot find specific stocks. I can’t buy crude palm oil (CPO) stocks.

“CPO prices are down 50%, but stocks are at an all-time high!” he says.

Secondly, Tan resolutely says that he is underweight on the Malaysian oil and gas sector, as well as some of the oil and gas service providers in Singapore.

“The oil and gas business is a commodity business where margins are not sustainable. Now, it appears that the barriers to entry are so low. When you have players like Eversendai Corp and Yinson Holdings Bhd, who have never seen a rig in their lives, now becoming global players, I would be very careful,” he says.

Tracking the economy

Tan says post World War 2, inflation has been on a steady uptrend.

Thus, although the Conference Board Leading Economic Index (LEI) has been rising, he feels that this cannot be used as the ultimate indicator to track the economy.

(According to Wikipedia, LEI is an American economic leading indicator intended to forecast future economic activity.

It is calculated by The Conference Board, a non-governmental organisation, which determines the value of the index from the values of 10 key variables.

These variables have historically turned downward before a recession and upward before an expansion).

“In the second half of the 19th Century, recessions took place even when there was inflation. The lack of or presence of inflation was not a consideration of recession.

“I think we are now entering that phase. In the United States, real wages have been horrible and have not improved.

“Savings rates are at historic lows.

“And right now, the US economy is deleveraging. Thus, not increasing interest rates will not stop the recession from taking place,” he says.

He notes that there are some clues from Japan.

“Post 1990, there has been no inflation. While unemployment is low, there is, however, no aggregate demand. Consumers are simply not spending, and this is causing the recession”.

Meanwhile, when meeting the management of a company, Tan still prefers to look at the numbers.

He says the best measure is still the return on capital employed.

“You will notice that most analysts or people who invest in stocks put more attention on the investment decision.

“For us, we put the bulk of our attention on the research.

“And when we do research, we talk to the regulators, the vendors, the competitors, then finally only do we talk to the targeted company,” he says.

Tan says it is because of this sort of analysis that iCapital sold all of its Tesco shares in 2011.

“We felt the management was not getting their strategy right,” says Tan.

Tesco has recently been hit by allegations of an accounting scandal and Warren Buffett is losing more than 40% of his US$1.7bil (RM5.44bil) investment.

China

Tan has been a strong advocator of China, and this view is still just as entrenched.

“The re-emergence of Asia is taking place, and it will be led by China, and it’s going to be earth-shattering. This re-emergence, however, will not be welcomed by developed countries and Japan,” says Tan.

“China has all the capabilities.

“People think China just copies intellectual properties, but that is not the case. If you go back to history, you will see that the Chinese have a tremendously rich past.

“There is immense potential, and over the next 30 to 50 years, many things are going to change.

“Values for one, will change. The corporate governance of the West will change. For example, maybe they will realise that democracy doesn’t seem to work,” he says.

“The new synthesis could be something like socialism but with Chinese characteristics. Or capitalism with Chinese characteristics,” he adds.

Tan likes what Chinese president Xi Jinping is doing to clamp down on corruption. He sees this as real courage.

“He is now trying to bring back self-respect , where people must respect their culture. He is trying to revive Confucianism. He is aiming for a cleaner government, different values. It will not just be a case of being glorious to be rich,” says Tan.

Tan claims that for all of Japan’s technological advancement, the Japanese haven’t invented a single thing.

“Research shows that half the modern technologies of the world all originate from China. Football and golf, for instance, come from China.”

There are only two countries in this world which are able to launch missiles at hypersonic speed - China and the United States.

“The world hasn’t really seen the transformation of China,” says Tan.

He says that if China could become something like Singapore in terms of per capita income, then the world is only just witnessing the beginning of it.

“Every dynasty in China has spanned a few hundred years. So we are just seeing the beginning of the era of the Communist Party,” said Tan.

Hong Kong

On the issue of Hong Kong pro-democracy demonstrators demanding the right to elect the city’s chief executive via democratic elections, Tan describes their move as silly against a benevolent China.

“The people of Hong Kong should remember that Hong Kong has always been part of China until the First Opium War. The British victories over China resulted in the cessation of Hong Kong to the UK (United Kingdom) via the enactment of new treaties in 1842.”

He says that in July 1992, Chris Patten, who was the last British Governor of Hong Kong, quickly introduced reforms that increased the number of elected members in the legislative council.

“Why did Patten do this so close to the 1997 handover when all the time that Hong Kong was under British colonisation, the long-held British practice of no general elections was never questioned? Why do the people of Hong Kong behave so aggressively against China, but against the British, they did not dare make any noise?” he asks.

“Britain ruled Hong Kong to selfishly benefit Britain. China did the opposite when she took back Hong Kong,” he claims.

The next big thing

Tan thinks that whatever it is, it will be coming from China.

“If you’re talking of an Internet-related technology, it could be Alibaba (China’s biggest online commerce company) or something similar to it. The number of Internet users are three to four times larger than that of the United States and it is still growing. In fact it can still double up,” he says.

Tan says that Asia, with its three billion people, is also re-emerging, particularly India and Indonesia.

“The people of Indonesia are hardworking and creative. Now, if their new president can really enact change and lead them in the right way, I see tremendous potential for them. If India and Indonesia can start from where China started 20 years ago, the potential will be tremendous,” he said.

On oil, Tan says predicting its movement has become a lot more complex today.

This is because when crude oil moves to a certain level, renewable energies become a lot more attractive. He sees shale as just one of many factors contributing to the drop in oil prices.

“What’s clear is that the reliance on OPEC (Organisation of the Petroleum Exporting Countries) has dropped, and moving forward it will become less important,” he said.

Tan’s immediate ambition is to get iCapital.biz a dual listed global fund listed.

“As an Asian gentleman, this is a promise I have made to the share owners and I want to deliver,” says Tan., adding that what is important is how you do whatever you are doing.

“Do it the best that you can, then you become good at it. And once you become good at it, then you become interested in your career,” he says.

http://www.thestar.com.my/Business/Business-News/2014/10/04/The-cautious-contrarian-Capital-Dynamics-Tan-warns-of-overvalued-global-markets/?style=biz