Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Tuesday, 25 June 2024

Friday, 14 June 2024

Supply Shocks and Stagflation

Box: Supply Shocks and Stagflation

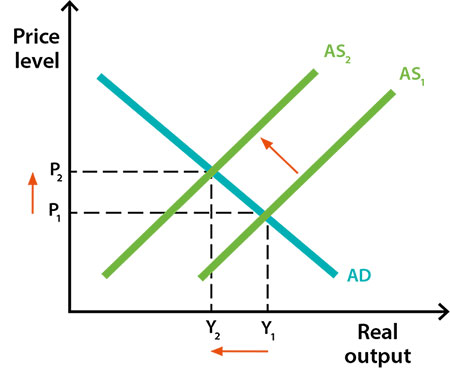

If a supply shock is sufficiently large or persistent, it not only causes cost‑push inflation, but can noticeably reduce both the current and potential level of output in an economy. In this case, there can be the unusual combination of a period of ‘stagnation’ as output declines at the same time that prices are rising. This combination of stagnant growth – with high or rising unemployment – and high inflation is referred to as stagflation. Stagflation can become entrenched when inflation expectations are not well anchored.

The 1970s were a period of stagflation that featured two oil price shocks. In October 1973, the members of OPEC (the Organization of Petroleum Exporting Countries), as well as Egypt and Syria, imposed an oil embargo on industrial nations that had supported Israel in the Yom Kippur War of the same period. The embargo resulted in a quadrupling of oil prices and energy rationing, culminating in a global recession in which unemployment and inflation surged simultaneously. Central banks did not target inflation at this time, and this was the start of a prolonged period of high inflation in many economies.

Inflation expectations

Inflation expectations

Inflation expectations are the beliefs that households and firms have about future price increases. They are important because expectations about future price increases can affect current economic decisions that can influence actual inflation outcomes. For example, if firms expect future inflation to be higher and act on those beliefs, they may raise the prices of their goods and services at a faster rate. Similarly, if workers expect future inflation to be higher, they may demand higher wages to make up for the expected loss of their purchasing power. These behaviours, sometimes called ‘inflation psychology’, can contribute to a higher rate of actual inflation so that expectations about inflation become self-fulfilling.

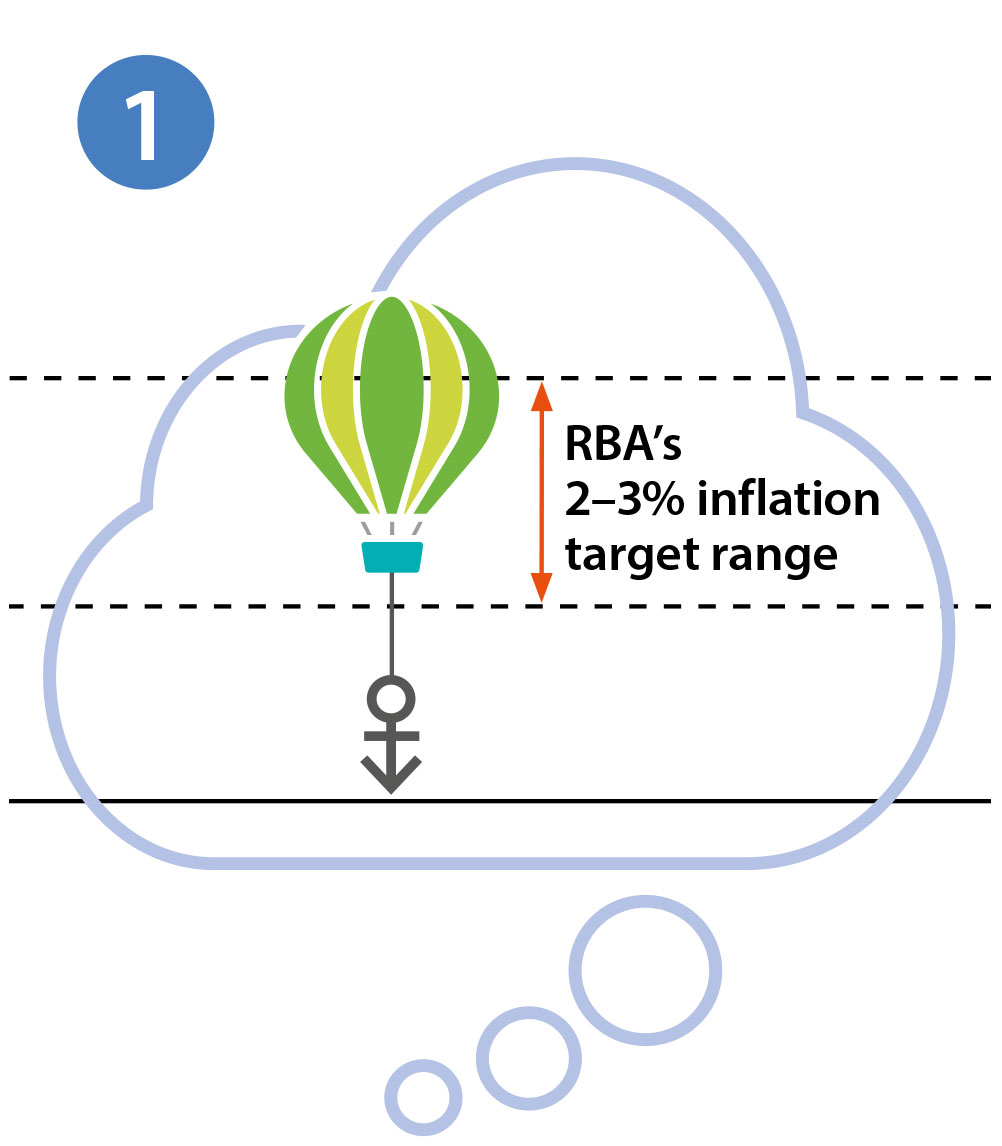

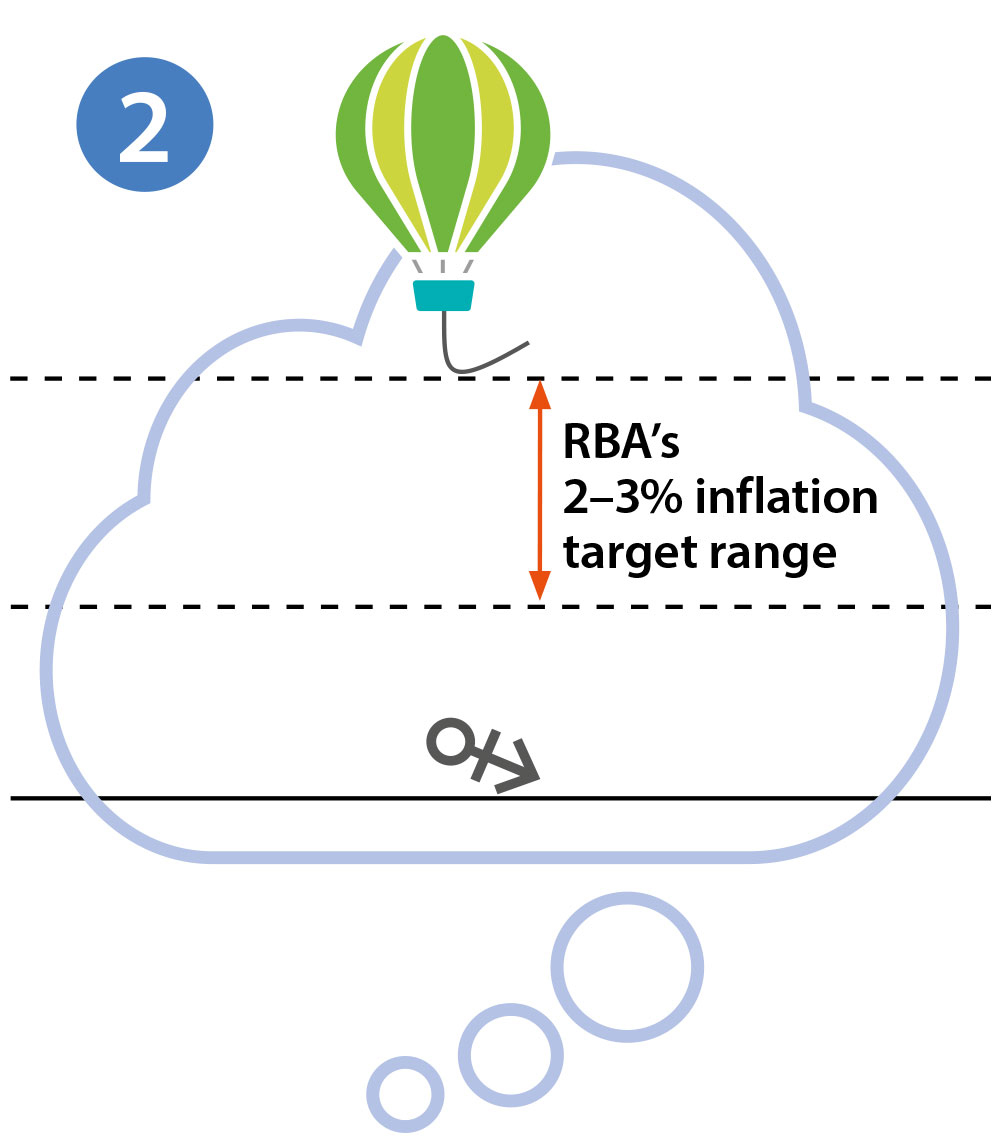

Given that inflation expectations can influence actual price and wage setting, the extent to which inflation expectations are ‘anchored’ has implications for future inflation outcomes. For example, if households' and firms' expect that inflation will return to the central bank's inflation target at some point in the future, regardless of what current inflation is, we describe their expectations as being ‘anchored’ to the inflation target. When expectations are anchored, a period of higher inflation – perhaps resulting from a cost‑push event – will not cause households and firms to change their behaviour and, as a result, inflation is likely to eventually return to its target. But if the inflation psychology of households and firms shifts and inflation expectations move away from the central bank's inflation target (i.e. they become ‘unanchored’), a period of higher inflation will become persistent because households and firms will expect inflation to be higher in the future and adjust their behaviour accordingly. Consequently, it is much easier for a central bank to manage inflation if inflation expectations are anchored rather than unanchored.

Illustrative Example of Anchored and

Unanchored Inflation Expectations

While inflation expectations have an important influence on actual inflation outcomes, they are not directly observable. Instead, policymakers such as the Reserve Bank have to rely on measures of expected inflation that are based on surveys (where people are asked their views about the inflation outlook directly) or financial assets like government bonds (where the price of the asset reflects assumptions made about the future path of inflation, see Explainer: Bonds and the Yield Curve).

Cost-push inflation

Cost-push inflation

Cost-push inflation occurs when the total supply of goods and services in the economy which can be produced (aggregate supply) falls. A fall in aggregate supply is often caused by an increase in the cost of production. If aggregate supply falls but aggregate demand remains unchanged, there is upward pressure on prices and inflation – that is, inflation is ‘pushed’ higher.

An increase in the price of domestic or imported inputs (such as oil or raw materials) pushes up production costs. As firms are faced with higher costs of producing each unit of output they tend to produce a lower level of output and raise the prices of their goods and services. This can have flow-on effects by pushing up the prices of other goods and services. For example, an increase in the price of oil, which is a major input in many sectors of the economy, will initially lead to higher petrol prices. However, higher petrol prices will also make it more expensive to transport goods from one location to another which, in turn, will result in increased prices for items like groceries.

Cost-push inflation can also arise due to supply disruptions in specific industries – for example, due to unusual weather or natural disasters. Periodically, there are major cyclones and floods that damage large volumes of agricultural produce and result in significant increases in the price of processed food and both takeaway and restaurant meals, resulting in temporary periods of higher inflation.

Imported inflation and the exchange rate

Exchange rate movements can also affect prices and influence inflation outcomes. A decrease in the value of the domestic currency − that is, a depreciation − will increase inflation in two ways. First, the prices of goods and services produced overseas rise relative to those produced domestically. Consequently, consumers pay more to buy the same imported products and firms that rely on imported materials in their production processes pay more to buy these inputs. The price increases of imported goods and services contribute directly to inflation through the cost-push channel.

Second, a depreciation of the currency stimulates aggregate demand. This occurs because exports become relatively cheaper for foreigners to buy, leading to an increase in demand for exports and higher aggregate demand. At the same time, domestic consumers and firms reduce their consumption of relatively more expensive imports and shift their purchases towards domestically produced goods and services, again leading to an increase in aggregate demand. This increase in aggregate demand puts pressure on domestic production capacity, and increases the scope for domestic firms to raise their prices. These price increases contribute indirectly to inflation through the demand-pull channel.

In terms of imported inflation, the exchange rate has a greater influence on inflation through its effect on the prices of goods and services that are exported and imported (known as tradable goods and services), while prices of non-tradable goods and services depend more on domestic developments.

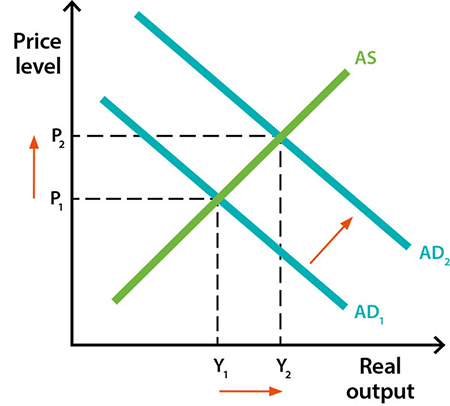

Demand-pull inflation

Demand-pull inflation

Demand-pull inflation arises when the total demand for goods and services (i.e. ‘aggregate demand’) increases to exceed the supply of goods and services (i.e. ‘aggregate supply’) that can be sustainably produced. The excess demand puts upward pressure on prices across a broad range of goods and services and ultimately leads to an increase in inflation – that is, it ‘pulls’ inflation higher.

Aggregate demand might increase because there is an increase in spending by consumers, businesses or government, or an increase in net exports. As a result, demand for goods and services will increase relative to their supply, providing scope for firms to increase prices (and their margins – which is their mark-up on costs). At the same time, firms will seek to employ more workers to meet this extra demand. With increased demand for labour, firms may have to offer higher wages to attract new staff and retain their existing employees. Firms may also increase the prices of their goods and services to cover their higher labour costs.[2] More jobs and higher wages increase household incomes and lead to a rise in consumer spending, further increasing aggregate demand and the scope for firms to increase the prices of their goods and services. When this happens across a large number of businesses and sectors, this leads to an increase in inflation.

The opposite will happen when aggregate demand decreases; firms facing lower demand will either pause hiring or make staff redundant which means that fewer staff are required. This puts upward pressure on the unemployment rate. More workers searching for jobs means that firms can offer lower wages, putting downward pressure on household incomes, consumer spending and the prices of their goods and services. As a result, inflation will decrease.

The supply of goods and services that can be sustainably produced is also known as the economy's potential output or full capacity. At this level of output, factors of production, such as labour and capital (which includes the machines and equipment firms use to produce their goods and services) are being used as intensively as possible without putting upward pressure on inflation. When aggregate demand exceeds the economy's potential output, this will put upward pressure on prices. When aggregate demand is below potential output, this will put downward pressure on prices.

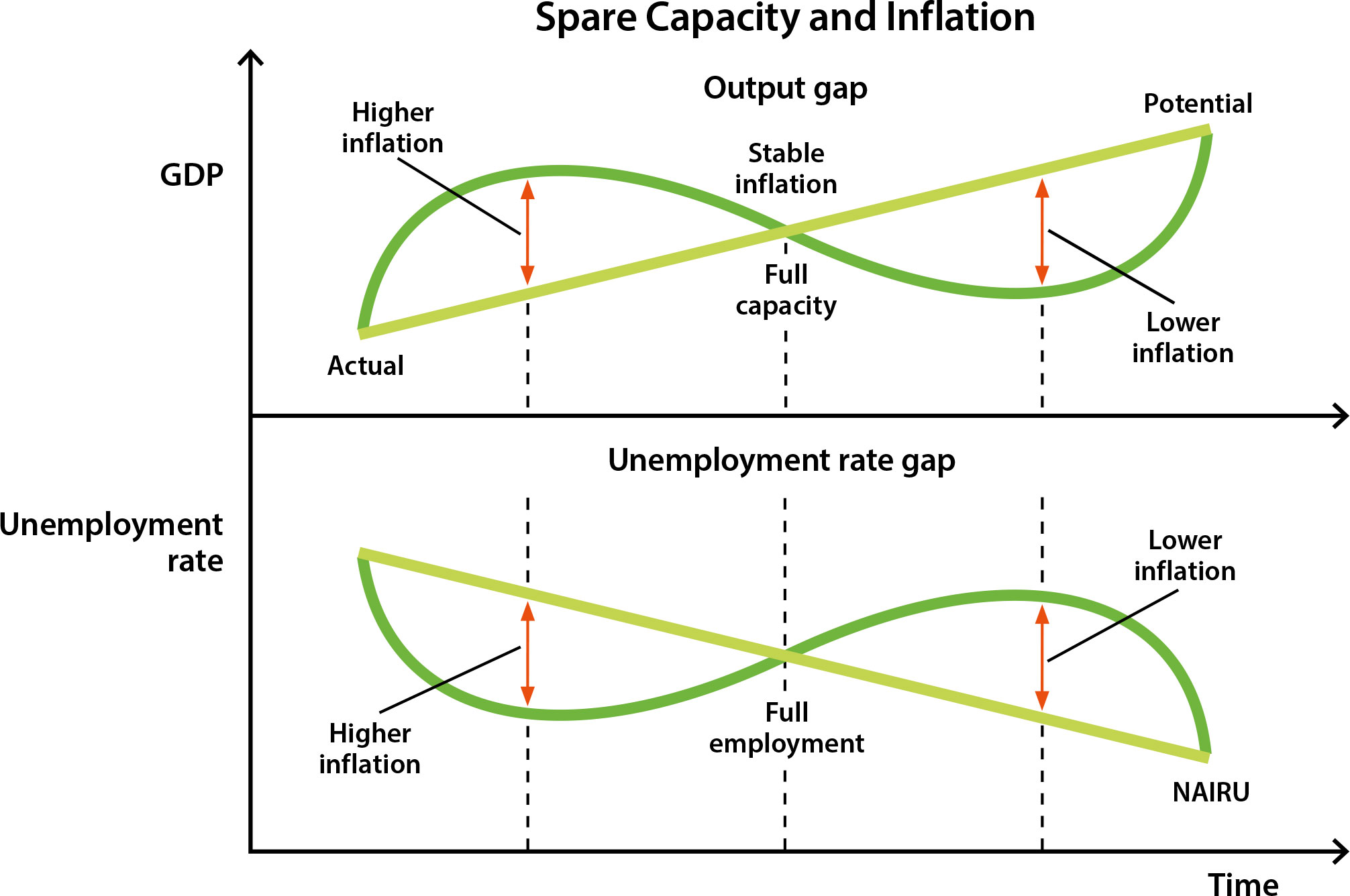

So how can we measure how far the economy is from its potential output (or full capacity) and what does this mean for inflation? While we can fairly accurately measure aggregate demand on a quarter to quarter basis using gross domestic product (GDP) data from the national accounts (see Explainer: Economic Growth), potential output is not directly observable − that is, we have to infer it from other evidence about the behaviour of the economy. For instance, just as there is a level of output where inflation is stable, there is also a level of the unemployment rate that is consistent with stable inflation. It is known as the Non-Accelerating Inflation Rate of Unemployment or NAIRU for short (see Explainer: The Non-Accelerating Inflation Rate of Unemployment (NAIRU)). When unemployment is below the NAIRU, inflation will increase and when it is above the NAIRU inflation will decrease.

Causes of Inflation: demand-pull, cost-push and inflation expectations

Causes of inflation

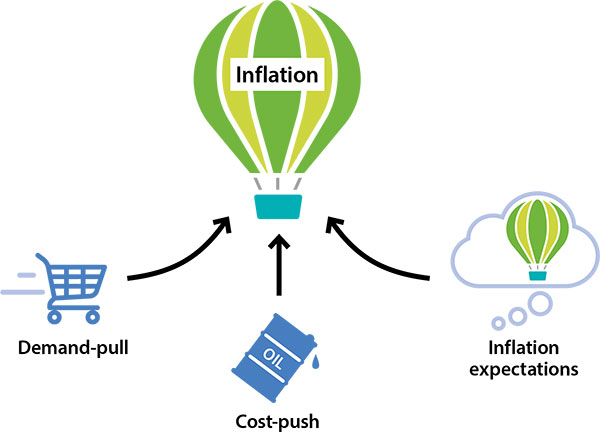

The main causes of inflation can be grouped into three broad categories:

- demand-pull,

- cost-push, and

- inflation expectations.

As their names suggest, ‘demand-pull inflation’ is caused by developments on the demand side of the economy, while ‘cost-push inflation’ is caused by the effect of higher input costs on the supply side of the economy. Inflation can also result from ‘inflation expectations’ – that is, what households and businesses think will happen to prices in the future can influence actual prices in the future. These different causes of inflation are considered by the Reserve Bank when it analyses and forecasts inflation.[1]

Inflation

Inflation is an increase in the prices of goods and services.

The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households (see Explainer: Inflation and its Measurement).

The CPI is the measure of inflation used by the Reserve Bank of Australia in its inflation target, where it aims to keep annual consumer price inflation between 2 and 3 per cent (see Explainer: Australia's Inflation Target).

Other measures of inflation are also analysed, but most measures of inflation move in similar ways over the longer term.

Causes of inflation

The main causes of inflation can be grouped into three broad categories:

- demand-pull,

- cost-push, and

- inflation expectations.