Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Showing posts with label Aeon Credit. Show all posts

Showing posts with label Aeon Credit. Show all posts

Sunday, 25 February 2024

Tuesday, 20 February 2024

Wednesday, 27 September 2023

Aeon Credit

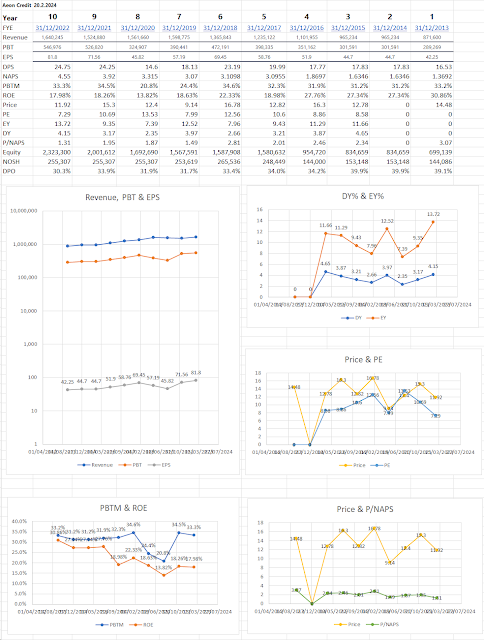

Its PBT margins are well maintained.

Its ROE is consistently above 15%.

However, share price dropped over the same period.

At today's share price of RM 11.44 per share it is trading at PE of 6.65 and gives a DY of 4.98%.

Quality: Great / Good

Management: Great / Good

Valuation: Undemanding valuation

(Not a recommendation. Always do your own homework. Invest at own risk.)

Friday, 15 September 2023

Aeon Credit

Excluding the very high PEs and very low PEs at the extremes, its usual historical PE ranged from low PE of 8.3 to high PE of 11.9 and its average or signature PE was 9.8.

At the current price of RM 11.40 per share, it is trading at a PE of 7.08x and its DY is 4.34%.

Friday, 10 April 2020

AEON Credit Service - FY20 Within Expectations (Kenanga Research & Investment)

Fri, 10 Apr 2020

FY20 CNP of RM274.4m (-20%) is within our estimate but full-year dividends of 31.5 sen missed target. We believe the on-going MCO will dampen prospects with lower consumer spending and repayments, with strong impact from its primary B40 customers. That said, the group is bolstered by a portfolio with strong asset quality (NPL: <2 10.0x="" and="" br="" but="" conservative="" could="" cut="" earnings="" from="" group="" lower="" more="" mp="" normalcy="" on="" our="" per="" returns.="" rm8.80="" sustain="" the="" to="" tp="" until="" up="" upgrade="" valuation="" which="" x="">FY20 met expectations. FY20 core earnings of RM274.4m (excluding sukuk distributions) made up 103% and 98% of our and consensus’ estimates, respectively. Although the final interim dividend of 14.0 sen raised the total payment to 31.5 sen, it is still below our earlier anticipated 45.0 sen, owing to our overly-bullish payout assumption.

YoY, FY20 total income grew by 12% to RM1.42b mainly from gains in net interest income (NII +15%). This was helped by a larger base in gross financing receivables (+20%), mainly from key auto, motorcycle and personal financing segments. However, net interest margin was softer at 11.7% (-0.7ppt), likely skewed by a poorer receivable mix in line with the group’s total portfolio growth. More prudent impairments were made from MFRS 9 which saw an increase in provision by 46%. On top of less favourable cost-to-income ratio (CIR) of 40.8% (+2.4ppt) and credit charge ratio (CCR) of 4.9% (+0.8ppt), core earnings registered at RM274.4m (-20%). On other key metrics, non-performing loan (NPL) ratio remained stable at 1.92% (4QFY19: 2.04%) while net credit cost ratio was higher at 3.41% (4QFY19: 2.16%).

QoQ, 4QFY20 total income improved by 5%, but this was mainly on the back of higher operating income (possibly from higher bad debts recoveries) while net interest income remained stagnant. Thanks to lower impairment allowances (-23%), core net profit rose by 15% to RM80.1m.

Trying to catch a break. Throughout FY20, the group has been coping with poorer reported earnings owing to the more stringent requirements set by MFRS 9. Going forward, the group looks to face more hurdles due to the Covid-19 pandemic. Locally, the implemented movement control order (MCO) is likely to gag receivables growth at least in the first quarter. While AEONCR is a Non-Bank Credit provider and does not need to adhere to the six months moratorium, it has offered to allow a one-month deferment of payment for its customers. Nonetheless, with the economic landscape being strained, it is probable that the group’s NPL ratio could be stressed, albeit presently at a low base of below 2.0%. This is especially so given the group’s high B40 mix which we believe constitutes at least 50% of the group’s customer profile.

Post-results, we cut our FY21E earnings assumption by 14% mainly on the back of more cautious receivables growth and credit ratios. Nonetheless, this still translates to a 2% earnings growth against FY20 as we anticipate a softer 1HFY21 to be compensated by a recovery in 2HFY21. We also introduce our FY22E numbers.

Upgrade to MARKET PERFORM (from UNDERPERFORM) but with a lower TP of RM8.80 (from RM12.80). In addition to lower earnings assumptions, we also reduce our applied valuations from 10.0x (0.5SD below 3-year mean) to 8.0x FY21E PER (1.5SD below 3-year mean). Our more conservative valuation is premised on the severely constrained market environment and we also do not discount the possibility of the MCO being extended beyond April 2020, which could further dampen sentiment. However, with dividend yields of c.4% which we view as sustainable, we recommend accumulating on weakness, for yield seeking investors.

Risks to our call include: (i) higher/lower-than-expected cost ratios, (ii) better/weaker-than-expected financing receivable growth, (iii) better/weaker-than-expected asset quality, and (iv) worsening pandemic impact leading to prolonged countermeasures (i.e. prolonged or enhanced movement control order).

Source: Kenanga Research - 10 Apr 2020

FY20 CNP of RM274.4m (-20%) is within our estimate but full-year dividends of 31.5 sen missed target. We believe the on-going MCO will dampen prospects with lower consumer spending and repayments, with strong impact from its primary B40 customers. That said, the group is bolstered by a portfolio with strong asset quality (NPL: <2 10.0x="" and="" br="" but="" conservative="" could="" cut="" earnings="" from="" group="" lower="" more="" mp="" normalcy="" on="" our="" per="" returns.="" rm8.80="" sustain="" the="" to="" tp="" until="" up="" upgrade="" valuation="" which="" x="">FY20 met expectations. FY20 core earnings of RM274.4m (excluding sukuk distributions) made up 103% and 98% of our and consensus’ estimates, respectively. Although the final interim dividend of 14.0 sen raised the total payment to 31.5 sen, it is still below our earlier anticipated 45.0 sen, owing to our overly-bullish payout assumption.

YoY, FY20 total income grew by 12% to RM1.42b mainly from gains in net interest income (NII +15%). This was helped by a larger base in gross financing receivables (+20%), mainly from key auto, motorcycle and personal financing segments. However, net interest margin was softer at 11.7% (-0.7ppt), likely skewed by a poorer receivable mix in line with the group’s total portfolio growth. More prudent impairments were made from MFRS 9 which saw an increase in provision by 46%. On top of less favourable cost-to-income ratio (CIR) of 40.8% (+2.4ppt) and credit charge ratio (CCR) of 4.9% (+0.8ppt), core earnings registered at RM274.4m (-20%). On other key metrics, non-performing loan (NPL) ratio remained stable at 1.92% (4QFY19: 2.04%) while net credit cost ratio was higher at 3.41% (4QFY19: 2.16%).

QoQ, 4QFY20 total income improved by 5%, but this was mainly on the back of higher operating income (possibly from higher bad debts recoveries) while net interest income remained stagnant. Thanks to lower impairment allowances (-23%), core net profit rose by 15% to RM80.1m.

Trying to catch a break. Throughout FY20, the group has been coping with poorer reported earnings owing to the more stringent requirements set by MFRS 9. Going forward, the group looks to face more hurdles due to the Covid-19 pandemic. Locally, the implemented movement control order (MCO) is likely to gag receivables growth at least in the first quarter. While AEONCR is a Non-Bank Credit provider and does not need to adhere to the six months moratorium, it has offered to allow a one-month deferment of payment for its customers. Nonetheless, with the economic landscape being strained, it is probable that the group’s NPL ratio could be stressed, albeit presently at a low base of below 2.0%. This is especially so given the group’s high B40 mix which we believe constitutes at least 50% of the group’s customer profile.

Post-results, we cut our FY21E earnings assumption by 14% mainly on the back of more cautious receivables growth and credit ratios. Nonetheless, this still translates to a 2% earnings growth against FY20 as we anticipate a softer 1HFY21 to be compensated by a recovery in 2HFY21. We also introduce our FY22E numbers.

Upgrade to MARKET PERFORM (from UNDERPERFORM) but with a lower TP of RM8.80 (from RM12.80). In addition to lower earnings assumptions, we also reduce our applied valuations from 10.0x (0.5SD below 3-year mean) to 8.0x FY21E PER (1.5SD below 3-year mean). Our more conservative valuation is premised on the severely constrained market environment and we also do not discount the possibility of the MCO being extended beyond April 2020, which could further dampen sentiment. However, with dividend yields of c.4% which we view as sustainable, we recommend accumulating on weakness, for yield seeking investors.

Risks to our call include: (i) higher/lower-than-expected cost ratios, (ii) better/weaker-than-expected financing receivable growth, (iii) better/weaker-than-expected asset quality, and (iv) worsening pandemic impact leading to prolonged countermeasures (i.e. prolonged or enhanced movement control order).

Source: Kenanga Research - 10 Apr 2020

Monday, 28 January 2019

Aeon Credit - Understanding its business.

Aeon Credit operates in the financing industry in the following segments:

1. Vehicle Easy Payment (VEP) segment (main segment)

-Motorcycle easy payment (MEP)

-Car easy payment, mainly used cars (CEP)

2. Household appliances General Easy Payment (GEP)

3. Personal loans

4. Credit cards

5. Other incomes:

-Recoveries

-Fees from credit card processing

-Insurance fees

-Aeon Big loyalty program processing fees.

--------------------

Consumer sentiment could weigh on the business of the provider of mirco credit financing’s loan growth.

Aeon Credit’s loan growth will continue to be driven by its vehicle easy payment (VEP) segment which is the largest contribution to the group’s revenue.

The research firm noted Aeon Credit’s loan portfolio comprised primarily of VEP which made up more than half of the micro credit financing provider’s total loans.

Aeon Credit’s VEP include motorcycle easy payment (MEP) and car easy payment (CEP) mainly used cars.

Aeon Credit also provide financing for the purchase of household appliances under general easy payment (GEP), personal loans and credit cards.

Aeon Credit’s other income line include recoveries as well as fee income from credit card processing fees, insurance fees and Aeon Big loyalty programme processing fees.

-------------------

The parent AEON FINANCIAL SERVICES JAPAN owns 59.7% of the company.

They operate in the financing industry for automobile, motorcycles, general easy payment (GEP), credit and personal financing.

They collect an effective gross yield of

- 14% for automobile,

- 21% for personal financing,

- 27% for GEP and

- 21-27% for motorcycles.

This business is highly profitable as they are able to cater to the financing needs of households.

-----------------

Re: Aeon Credit

« April 23, 2016, 01:04:41 PM »

TA (Total Asset) = RM 6097.5 m

Rev/TA 15.8%

EBIT/TA 7.6%

Finance Cost/TA 2.7%

PBT/TA 4.9%

Tax/TA 1.2%

PAT/TA 3.7% :thumbsup: (Return on Total Assets)

Total Borrowings 4908.1

Cost of borrowings 3.3%

Total receivables 5394.9

Finance Cost/Total receivables 3.0%

http://www.investlah.com/forum/index.php/topic,75807.msg1477954.html#msg1477954

---------------------------

« September 28, 2018, 12:48:06 PM »

Ratios & Margins AEON Credit Service (M) Bhd

All values updated annually at fiscal year end

Valuation

P/E Ratio (TTM) 12.43

P/E Ratio (including extraordinary items) 13.07

Price to Book Ratio 2.18

EPS (recurring) 2.52

EPS (basic) 1.43

EPS (diluted) 1.38

Efficiency

Profitability

Gross Margin +70.72

Operating Margin +54.03

Pretax Margin +29.26

Net Margin +21.04

Return on Assets 3.82

Return on Equity 23.21

Return on Total Capital 10.13

Return on Invested Capital 5.09

Interest Coverage 3.24

KEY STOCK DATA

P/E Ratio (TTM) 12.38 (09/28/18)

EPS (TTM) RM1.31

Market Cap RM3.97 B

Shares Outstanding 249.74 M

Public Float 72.70 M

Yield 2.47% (09/28/18)

Latest Dividend RM0.20 (07/19/18)

Ex-Dividend Date 06/27/18

----------------------

http://www.investlah.com/forum/index.php/topic,52325.msg1016913.html#msg1016913

Aeon Credit versus LPI

----------------------

20.12.2018

ACSM - Quarterly Results for the Third Quarter ended 30.11.2018.pdf

Performance Review

The Company‟s revenue recorded 11.6% and 8.7% growth for the current quarter and nine months ended 30 November 2018 as compared with the previous year corresponding period. Total transaction and financing volume in the current quarter and nine months ended 30 November 2018 had increased by 49.5% to RM1.488 billion and by 26.4% to RM3.887 billion respectively as compared with the previous corresponding period ended 30 November 2017.

The gross financing receivables as at 30 November 2018 was RM8.313 billion, representing an increase of 15.41% from RM7.203 billion as at 30 November 2017. The net financing receivables after impairment was RM7.737 billion as at 30 November 2018 as compared to RM7.034 billion as at 30 November 2017.

Nonperforming loans (NPL) ratio was 2.05% as at 30 November 2018 compared to 2.48% as at 30 November 2017.

Other income was recorded at RM27.999 million for the current quarter and RM105.574 million for the nine months ended 30 November 2018 respectively, mainly comprising bad debts recovered, commission income from sale of insurance products and loyalty programme processing fees.

Ratio of total operating expense against revenue was recorded at 55.6% for the current quarter as compared to 60.9% in the preceding corresponding period. The decrease is mainly due to increase in revenue.

The Company recorded a profit before tax of RM118.072 million for the current quarter and RM357.068 million for the nine months ended 30 November 2018, representing a growth of 23.9% and 21.9% respectively as compared with previous year corresponding period.

Funding cost for the current quarter was higher as compared to the preceding corresponding quarter mainly due to higher borrowings in line with the growth of receivables. The nominal value of borrowings as at 30 November 2018 was RM6.348 billion as compared to RM5.513 billion as at 30 November 2017.

--------------

How to read its accounts to understand its business.

Look at how much they have grown its financing receivables.

Here is how to study its accounts:

Interest income earned

less Interest costs incurred

less provision for loan losses

Net Interest income earned

Add Non interest (fees) income earned

Gross income

less Operating Expenditure

Profit Before Tax

less Tax

Profit After Tax

1. Vehicle Easy Payment (VEP) segment (main segment)

-Motorcycle easy payment (MEP)

-Car easy payment, mainly used cars (CEP)

2. Household appliances General Easy Payment (GEP)

3. Personal loans

4. Credit cards

5. Other incomes:

-Recoveries

-Fees from credit card processing

-Insurance fees

-Aeon Big loyalty program processing fees.

--------------------

Consumer sentiment could weigh on the business of the provider of mirco credit financing’s loan growth.

Aeon Credit’s loan growth will continue to be driven by its vehicle easy payment (VEP) segment which is the largest contribution to the group’s revenue.

The research firm noted Aeon Credit’s loan portfolio comprised primarily of VEP which made up more than half of the micro credit financing provider’s total loans.

Aeon Credit’s VEP include motorcycle easy payment (MEP) and car easy payment (CEP) mainly used cars.

Aeon Credit also provide financing for the purchase of household appliances under general easy payment (GEP), personal loans and credit cards.

Aeon Credit’s other income line include recoveries as well as fee income from credit card processing fees, insurance fees and Aeon Big loyalty programme processing fees.

-------------------

The parent AEON FINANCIAL SERVICES JAPAN owns 59.7% of the company.

They operate in the financing industry for automobile, motorcycles, general easy payment (GEP), credit and personal financing.

They collect an effective gross yield of

- 14% for automobile,

- 21% for personal financing,

- 27% for GEP and

- 21-27% for motorcycles.

This business is highly profitable as they are able to cater to the financing needs of households.

-----------------

Re: Aeon Credit

« April 23, 2016, 01:04:41 PM »

TA (Total Asset) = RM 6097.5 m

Rev/TA 15.8%

EBIT/TA 7.6%

Finance Cost/TA 2.7%

PBT/TA 4.9%

Tax/TA 1.2%

PAT/TA 3.7% :thumbsup: (Return on Total Assets)

Total Borrowings 4908.1

Cost of borrowings 3.3%

Total receivables 5394.9

Finance Cost/Total receivables 3.0%

http://www.investlah.com/forum/index.php/topic,75807.msg1477954.html#msg1477954

---------------------------

« September 28, 2018, 12:48:06 PM »

Ratios & Margins AEON Credit Service (M) Bhd

All values updated annually at fiscal year end

Valuation

P/E Ratio (TTM) 12.43

P/E Ratio (including extraordinary items) 13.07

Price to Book Ratio 2.18

EPS (recurring) 2.52

EPS (basic) 1.43

EPS (diluted) 1.38

Efficiency

Profitability

Gross Margin +70.72

Operating Margin +54.03

Pretax Margin +29.26

Net Margin +21.04

Return on Assets 3.82

Return on Equity 23.21

Return on Total Capital 10.13

Return on Invested Capital 5.09

Interest Coverage 3.24

KEY STOCK DATA

P/E Ratio (TTM) 12.38 (09/28/18)

EPS (TTM) RM1.31

Market Cap RM3.97 B

Shares Outstanding 249.74 M

Public Float 72.70 M

Yield 2.47% (09/28/18)

Latest Dividend RM0.20 (07/19/18)

Ex-Dividend Date 06/27/18

----------------------

http://www.investlah.com/forum/index.php/topic,52325.msg1016913.html#msg1016913

Aeon Credit versus LPI

----------------------

20.12.2018

ACSM - Quarterly Results for the Third Quarter ended 30.11.2018.pdf

Performance Review

The Company‟s revenue recorded 11.6% and 8.7% growth for the current quarter and nine months ended 30 November 2018 as compared with the previous year corresponding period. Total transaction and financing volume in the current quarter and nine months ended 30 November 2018 had increased by 49.5% to RM1.488 billion and by 26.4% to RM3.887 billion respectively as compared with the previous corresponding period ended 30 November 2017.

The gross financing receivables as at 30 November 2018 was RM8.313 billion, representing an increase of 15.41% from RM7.203 billion as at 30 November 2017. The net financing receivables after impairment was RM7.737 billion as at 30 November 2018 as compared to RM7.034 billion as at 30 November 2017.

Nonperforming loans (NPL) ratio was 2.05% as at 30 November 2018 compared to 2.48% as at 30 November 2017.

Other income was recorded at RM27.999 million for the current quarter and RM105.574 million for the nine months ended 30 November 2018 respectively, mainly comprising bad debts recovered, commission income from sale of insurance products and loyalty programme processing fees.

Ratio of total operating expense against revenue was recorded at 55.6% for the current quarter as compared to 60.9% in the preceding corresponding period. The decrease is mainly due to increase in revenue.

The Company recorded a profit before tax of RM118.072 million for the current quarter and RM357.068 million for the nine months ended 30 November 2018, representing a growth of 23.9% and 21.9% respectively as compared with previous year corresponding period.

Funding cost for the current quarter was higher as compared to the preceding corresponding quarter mainly due to higher borrowings in line with the growth of receivables. The nominal value of borrowings as at 30 November 2018 was RM6.348 billion as compared to RM5.513 billion as at 30 November 2017.

How to read its accounts to understand its business.

Look at how much they have grown its financing receivables.

Here is how to study its accounts:

Interest income earned

less Interest costs incurred

less provision for loan losses

Net Interest income earned

Add Non interest (fees) income earned

Gross income

less Operating Expenditure

Profit Before Tax

less Tax

Profit After Tax

Reinvestment risk

An old post discussing reinvestment risks posted in May 16, 2017. Data of Aeon Credit then was unadjusted for capital changes that have occurred since.

http://www.investlah.com/forum/index.php/topic,78077.msg1522231.html#msg1522231

Aeon Credit May 16, 2017

FY HPr LPr adjDPS (sen)

28-Feb-17 18.06 12.94 63

29-Feb-16 15.62 11.92 63.23

20-Feb-15 14.86 11.00 28.22

20-Feb-14 18.00 10.30 46.3

20-Feb-13 18.86 10.38 32.15

20-Feb-12 13.72 5.50 25

20-Feb-11 5.75 3.09 22.08

20-Feb-10 3.48 3.02 18.75

http://www.investlah.com/forum/index.php/topic,78077.msg1522231.html#msg1522231

Aeon Credit May 16, 2017

FY HPr LPr adjDPS (sen)

28-Feb-17 18.06 12.94 63

29-Feb-16 15.62 11.92 63.23

20-Feb-15 14.86 11.00 28.22

20-Feb-14 18.00 10.30 46.3

20-Feb-13 18.86 10.38 32.15

20-Feb-12 13.72 5.50 25

20-Feb-11 5.75 3.09 22.08

20-Feb-10 3.48 3.02 18.75

May 16, 2017

The price of Aeon Credit peaked in 2013. After then, it went on a decline.

I remembered discussing this company with fellow forum participant, cockcroach (who has since disappeared, hopefully temporarily).

Cockcroach sold his Aeon Credit around 16.00 per share.#

After selling a share at a certain price, when can we say we have made a profit from the sale?

For those who are long term invested into stocks, what do they do with the cash from the sale?

1. By selling a share at a certain price, have I made a profit?

Yes, since I bought the stock at a lower price in the past.

No, since I bought the stock at a higher price in the past.

2. What would you do with the cash from the sale?

I am out of the market, forever. In that case, you would have realised a gain or a loss, which is definite.

I am in the market for the long run. I would have to reinvest this cash into another stock or the same stock.

3. When would you have realised a gain, after selling a stock, if you were to be in the market for the long term?

I would have realised a gain, IF I am able to buy the same stock back at a lower price than I sold.

I would have realised a loss, IF I were to buy the same stock back at a higher price than I sold.

I would have also to take into account the dividends I did not receive (if any) while I was holding cash and out of the stock for that period.

4. Can you predict the short term volatility of the share prices of your stock?

I believe I cannot. Those who can, are either having uncanny abilities or are lying.

AEONCR November 03, 2017

Price 14.30

Market Capital (RM): 3.536b

Number of Share: 247.25m

EPS (cent): 119.03 *

P/E Ratio: 12.01

ROE (%): 24.54

Dividend (cent): 63.000 ^

Dividend Yield (%): 4.41

Dividend Policy (%): 0

NTA (RM): 4.850

Par Value (RM): 0.500

Price of 14.30 above is equivalent to 14.10 today when adjusted for capital changes.

AEONCR 27.1.2019

Price 15.98

Market Capital (RM): 4.007b

Number of Share: 250.78m

EPS (cent): 139.29 *

P/E Ratio: 11.47

ROE (%): 24.61

Dividend (cent): 41.130 ^

Dividend Yield (%): 2.57

Dividend Policy (%): 0

NTA (RM): 5.660

Par Value (RM): 0.500

Since Nov 2017, the share price of Aeon Credit has gained 13.3% (15.98/14/10 = 113%), excluding dividends received.

#(16.00 per share is equivalent to 15.78 per share today, adjusted for capital changes.)

Monday, 28 August 2017

Aeon Credit ICULS

Some notes extracted from a blog.

---------------

my understanding of iculs is a kind of loan. after the expired, it will automatically convert to common share, by the fixed convertion rate.

1st time subcrip of right 2000LA with cost RM2000, it is equal to 181.98 shares 3yrs later.

After 3yrs, 181.98shares will credit to your account. No need to pay rm10.99 for convertion

----------------

you can buy the ICULS because it is 2 for 1 share, mean if you have 100 units share you can buy 200 units ICULS, and it is round number lot. After that you have 3 years time to sell the ICULS at anytime if you don't convert them to share. If you convert to share, you may have odd lot.

------------------------

For those who dont understand why share price drop from 12.80 to 12.52, I will show you the calculation

for example if you have

109900 units of AEONCR you will be entitled 219800 units of AEONCR-LR,219800 units of AEONCR-LR can be converted to 20000 units of AEONCR

so today open price=(109900*12.8+109900*2)/(109900+20000)=12.52

----------------------

To subscribe the Iculs is a form of hedging on future price increase; much the same as airline's forward purchase of their fuel requirement. Of course the outcome can go either way. One pays RM 10.99 + RM 1.00 to lock in the mother share's price 3 years down the road. In view of the potential of Aeoncr, it is a portfolio worth locking in.

------------------------

We get LR (right) now. We can then buy LA (ICULS) with RM1 each. After we have LA, we have option to convert this LA to mother share (no cash involved) anytime from day 1 to 3 years time. After 3 years, all remaining LA will auto convert to mother share.

LR or later LA most probably will have premium (over price) because these financial derivatives have gearing ratio to their mother share. For instance you can now see the Aeoncr rose from RM12.44 to RM12.60 (+1.2%), but the Aeoncr-LR has risen from RM0.13 to RM0.20 (+53.8%). So over price is acceptable in this case.

------------------------------

You don't pay rm10.99+rm1 for the share. You subscribe to the ICULS at rm1 and you can convert 10.99 of your ICULS to the mother share when you like from issued date to 3 years time.

-----------------------------------

Aeoncr-LR is not the same as aeoncr-LA(loan stock) , a lot of ppl kind of confused here. The aeoncr-LR is a right for you to exercise to buy aeoncr-LA and will expiring on 28-8-17, the Aeoncr-LR of what existing aeoncr shareholder received will become worthless after 28-8-17. For those who exercise their right and pay to buy Aeoncr-LA. You will receive Aeoncr-La after ceasation of the right and you have another right to convert your loan stock to the mother shares at 10.99 anytime within 3 years (or mandatory conversion on the end of 3rd year) with no conversion fee as you already pay to exercise your right before.

https://klse.i3investor.com/servlets/stk/5139.jsp

---------------

my understanding of iculs is a kind of loan. after the expired, it will automatically convert to common share, by the fixed convertion rate.

1st time subcrip of right 2000LA with cost RM2000, it is equal to 181.98 shares 3yrs later.

After 3yrs, 181.98shares will credit to your account. No need to pay rm10.99 for convertion

----------------

you can buy the ICULS because it is 2 for 1 share, mean if you have 100 units share you can buy 200 units ICULS, and it is round number lot. After that you have 3 years time to sell the ICULS at anytime if you don't convert them to share. If you convert to share, you may have odd lot.

------------------------

For those who dont understand why share price drop from 12.80 to 12.52, I will show you the calculation

for example if you have

109900 units of AEONCR you will be entitled 219800 units of AEONCR-LR,219800 units of AEONCR-LR can be converted to 20000 units of AEONCR

so today open price=(109900*12.8+109900*2)/(109900+20000)=12.52

----------------------

To subscribe the Iculs is a form of hedging on future price increase; much the same as airline's forward purchase of their fuel requirement. Of course the outcome can go either way. One pays RM 10.99 + RM 1.00 to lock in the mother share's price 3 years down the road. In view of the potential of Aeoncr, it is a portfolio worth locking in.

------------------------

We get LR (right) now. We can then buy LA (ICULS) with RM1 each. After we have LA, we have option to convert this LA to mother share (no cash involved) anytime from day 1 to 3 years time. After 3 years, all remaining LA will auto convert to mother share.

LR or later LA most probably will have premium (over price) because these financial derivatives have gearing ratio to their mother share. For instance you can now see the Aeoncr rose from RM12.44 to RM12.60 (+1.2%), but the Aeoncr-LR has risen from RM0.13 to RM0.20 (+53.8%). So over price is acceptable in this case.

------------------------------

You don't pay rm10.99+rm1 for the share. You subscribe to the ICULS at rm1 and you can convert 10.99 of your ICULS to the mother share when you like from issued date to 3 years time.

-----------------------------------

Aeoncr-LR is not the same as aeoncr-LA(loan stock) , a lot of ppl kind of confused here. The aeoncr-LR is a right for you to exercise to buy aeoncr-LA and will expiring on 28-8-17, the Aeoncr-LR of what existing aeoncr shareholder received will become worthless after 28-8-17. For those who exercise their right and pay to buy Aeoncr-LA. You will receive Aeoncr-La after ceasation of the right and you have another right to convert your loan stock to the mother shares at 10.99 anytime within 3 years (or mandatory conversion on the end of 3rd year) with no conversion fee as you already pay to exercise your right before.

https://klse.i3investor.com/servlets/stk/5139.jsp

Wednesday, 23 August 2017

Aeon Credit 23.8.2017

| Aeon Credit | 23.8.2017 | |||||

| 5 Years Quarterly Report History | ||||||

| Qtr | Financial | Revenue | PBT | PAT | PBT | |

| No | Quarter | (RM,000) | (RM,000) | (RM,000) | Margin | |

| 1 | 31-May-17 | 302,282 | 101,869 | 75,812 | 33.7% | |

| 4 | 28-Feb-17 | 290,842 | 103,064 | 80,053 | 35.4% | |

| 3 | 30-Nov-16 | 280,347 | 90,807 | 67,053 | 32.4% | |

| 2 | 31-Aug-16 | 269,128 | 73,175 | 55,194 | 27.2% | |

| 1 | 31-May-16 | 261,638 | 84,116 | 62,727 | 32.1% | |

| 4 | 29-Feb-16 | 258,292 | 90,551 | 68,133 | 35.1% | |

| 3 | 30-Nov-15 | 245,780 | 70,502 | 53,362 | 28.7% | |

| 2 | 31-Aug-15 | 228,723 | 64,272 | 48,486 | 28.1% | |

| 1 | 31-May-15 | 232,439 | 76,266 | 58,241 | 32.8% | |

| - | 28-Feb-15 | 18,795 | 11,227 | 8,357 | 59.7% | |

| - | 20-Feb-15 | 226,374 | 74,022 | 55,363 | 32.7% | |

| - | 20-Nov-14 | 216,215 | 65,016 | 48,293 | 30.1% | |

| - | 20-Aug-14 | 209,316 | 63,487 | 47,431 | 30.3% | |

| - | 20-May-14 | 200,900 | 75,517 | 56,282 | 37.6% | |

| 4 | 20-Feb-14 | 187,989 | 64,571 | 47,818 | 34.3% | |

| 3 | 20-Nov-13 | 178,034 | 56,094 | 43,055 | 31.5% | |

| 2 | 20-Aug-13 | 162,868 | 57,176 | 43,136 | 35.1% | |

| 1 | 20-May-13 | 143,871 | 56,033 | 41,342 | 38.9% | |

| 4 | 20-Feb-13 | 131,683 | 52,101 | 39,008 | 39.6% | |

| 3 | 20-Nov-12 | 121,334 | 46,901 | 34,941 | 38.7% | |

| 5 Years Trailing 4 Quarters | ||||||

| No. | Financial | ttm-Rev | ttm-PBT | ttm-PAT | ttm-PBT | |

| Qtr. | Quarter | (RM,000) | (RM,000) | (RM,000) | Margin | |

| 1 | 28-Feb-18 | 1,142,599 | 368,915 | 278,112 | 32.3% | |

| 4 | 28-Feb-17 | 1,101,955 | 351,162 | 265,027 | 31.9% | |

| 3 | 28-Feb-17 | 1,069,405 | 338,649 | 253,107 | 31.7% | |

| 2 | 28-Feb-17 | 1,034,838 | 318,344 | 239,416 | 30.8% | |

| 1 | 28-Feb-17 | 994,433 | 309,441 | 232,708 | 31.1% | |

| 4 | 29-Feb-16 | 965,234 | 301,591 | 228,222 | 31.2% | |

| 3 | 29-Feb-16 | 725,737 | 222,267 | 168,446 | 30.6% | |

| 2 | 29-Feb-16 | 706,331 | 225,787 | 170,447 | 32.0% | |

| 1 | 29-Feb-16 | 693,823 | 226,531 | 170,254 | 32.6% | |

| - | 28-Feb-15 | 670,700 | 213,752 | 159,444 | 31.9% | |

| - | 20-Feb-15 | 852,805 | 278,042 | 207,369 | 32.6% | |

| - | 20-Feb-15 | 814,420 | 268,591 | 199,824 | 33.0% | |

| - | 20-Feb-15 | 776,239 | 259,669 | 194,586 | 33.5% | |

| - | 20-Feb-15 | 729,791 | 253,358 | 190,291 | 34.7% | |

| 4 | 20-Feb-14 | 672,762 | 233,874 | 175,351 | 34.8% | |

| 3 | 20-Feb-14 | 616,456 | 221,404 | 166,541 | 35.9% | |

| 2 | 20-Feb-14 | 559,756 | 212,211 | 158,427 | 37.9% | |

| 1 | 20-Feb-14 | 509,374 | 198,733 | 147,379 | 39.0% | |

| 4 | 20-Feb-13 | 467,128 | 181,107 | 134,126 | 38.8% | |

| 3 | 20-Feb-13 | 429,720 | 165,907 | 122,834 | 38.6% | |

| 5 Years Adjusted EPS, DPS, NTA and ttm-EPS for capital changes | ||||||

| Shrs m | 216.0 | adj | adj | adj | adj | adj |

| Qtr | Financial | EPS | DPS | NTA | ttm-EPS | ttm-DPS |

| No | Quarter | (Cent) | (Cent) | (RM) | (Cent) | (Cent) |

| 1 | 31-May-17 | 35.10 | 0.0 | 4.99 | 128.76 | 44.15 |

| 4 | 28-Feb-17 | 37.06 | 22.6 | 4.60 | 122.70 | 44.15 |

| 3 | 30-Nov-16 | 31.04 | 0.0 | 4.32 | 117.18 | 42.30 |

| 2 | 31-Aug-16 | 25.55 | 21.6 | 4.20 | 110.84 | 42.30 |

| 1 | 31-May-16 | 29.04 | 0.0 | 4.19 | 107.74 | 42.02 |

| 4 | 29-Feb-16 | 31.54 | 20.7 | 3.81 | 105.66 | 42.02 |

| 3 | 30-Nov-15 | 24.70 | 0.0 | 3.65 | 77.98 | 41.05 |

| 2 | 31-Aug-15 | 22.45 | 21.3 | 3.59 | 78.91 | 41.05 |

| 1 | 31-May-15 | 26.96 | 0.0 | 3.62 | 78.82 | 19.75 |

| - | 28-Feb-15 | 3.87 | 19.7 | 3.15 | 73.82 | 38.01 |

| - | 20-Feb-15 | 25.63 | 0.0 | 3.24 | 96.00 | 18.27 |

| - | 20-Nov-14 | 22.36 | 0.0 | 2.92 | 92.51 | 34.26 |

| - | 20-Aug-14 | 21.96 | 18.3 | 2.85 | 90.09 | 34.26 |

| - | 20-May-14 | 26.06 | 0.0 | 2.79 | 88.10 | 16.00 |

| 4 | 20-Feb-14 | 22.14 | 16.0 | 2.53 | 81.18 | 16.00 |

| 3 | 20-Nov-13 | 19.93 | 0.0 | 2.54 | 77.10 | 13.00 |

| 2 | 20-Aug-13 | 19.97 | 0.0 | 2.22 | 73.35 | 13.00 |

| 1 | 20-May-13 | 19.14 | 0.0 | 2.17 | ||

| 4 | 20-Feb-13 | 18.06 | 13.0 | 1.99 | ||

| 3 | 20-Nov-12 | 16.18 | 0.0 | 1.74 | ||

| Capital changes | ||||||

| No. | Financial | No of | ||||

| Qtr. | Quarter | Shrs (m) | ||||

| 1 | 31-May-17 | 151.2 | ||||

| 4 | 28-Feb-17 | 150.0 | ||||

| 3 | 30-Nov-16 | 152.4 | ||||

| 2 | 31-Aug-16 | 152.9 | ||||

| 1 | 31-May-16 | 152.8 | ||||

| 4 | 29-Feb-16 | 151.1 | ||||

| 3 | 30-Nov-15 | 154.5 | ||||

| 2 | 31-Aug-15 | 154.2 | ||||

| 1 | 31-May-15 | 153.4 | ||||

| - | 28-Feb-15 | 144.1 | ||||

| - | 20-Feb-15 | 149.7 | ||||

| - | 20-Nov-14 | 148.6 | ||||

| - | 20-Aug-14 | 144.0 | ||||

| - | 20-May-14 | 144.0 | ||||

| 4 | 20-Feb-14 | 144.0 | ||||

| 3 | 20-Nov-13 | 144.0 | ||||

| 2 | 20-Aug-13 | 144.0 | ||||

| 1 | 20-May-13 | 144.0 | ||||

| 4 | 20-Feb-13 | 144.0 | ||||

| 3 | 20-Nov-12 | 137.5 | ||||

| 2 | 20-Aug-12 | 120.0 | ||||

| 1 | 20-May-12 | 120.0 | ||||

| 4 | 20-Feb-12 | 120.0 | ||||

| 3 | 20-Nov-11 | 120.0 | ||||

Wednesday, 22 March 2017

Aeon Credit (22.3.2017)

The revenue, profit before tax and EPS continue to grow.

In its latest quarter, it grew its quarterly revenue 14% and its quarterly EPS 27.4% when compared to the previous year same quarter.

Its share price peaked at RM 18.86 per share in 2013.

Since then its share prices have been range bound between RM 10 to RM 15 per share.

Its EPS continued to grow at a good rate during the same period from 93.1 sen per share to 158.5 sen per share.

The rising EPS and the flat share prices over the last 3 years, resulted in Aeon Credit trading at very low PE of below 10.

At today's closing price of RM 16.60 per share, it is trading at a PE of 10.5.

This stock pays dividend over the years. Its dividend payout ratio has been around 38%.

It has increased its dividends yearly over the years from 25 sen per share in 2012 to 59.5 sen per share in 2016 (more than double over this period).

At its present price of RM 16.60 per share, its dividend yield is 3.58%.

This dividend yield should appeal to those who are investing for income too.

Projecting into the future, Aeon Credit should continue to grow its revenues, profit before tax and EPS.

Those who own Aeon Credit for the long term should enjoy a satisfactory total return from its capital appreciation and its growing dividends.

In its latest quarter, it grew its quarterly revenue 14% and its quarterly EPS 27.4% when compared to the previous year same quarter.

Its share price peaked at RM 18.86 per share in 2013.

Since then its share prices have been range bound between RM 10 to RM 15 per share.

Its EPS continued to grow at a good rate during the same period from 93.1 sen per share to 158.5 sen per share.

The rising EPS and the flat share prices over the last 3 years, resulted in Aeon Credit trading at very low PE of below 10.

At today's closing price of RM 16.60 per share, it is trading at a PE of 10.5.

This stock pays dividend over the years. Its dividend payout ratio has been around 38%.

It has increased its dividends yearly over the years from 25 sen per share in 2012 to 59.5 sen per share in 2016 (more than double over this period).

At its present price of RM 16.60 per share, its dividend yield is 3.58%.

This dividend yield should appeal to those who are investing for income too.

Projecting into the future, Aeon Credit should continue to grow its revenues, profit before tax and EPS.

Those who own Aeon Credit for the long term should enjoy a satisfactory total return from its capital appreciation and its growing dividends.

Thursday, 6 October 2016

Aeon Credit an attractive alternative stock to sector

KUCHING: Aeon Credit Service (M) Bhd (Aeon Credit) high performing return on equity (ROE) generation of over 20 per cent has made in a favourable alternative to the banking sector.

Aeon Credit’ healthy receivable growth and improving asset quality are also key contributors to this growing sentiment focused in a recent company update on Aeoncs by the research arm of Affin Hwang Investment Bank Bhd (Affin Hwang Capital).

Looking at its receivables growth, the research arm expects Aeon Credit to grow at a steady 19 per cent in their financial year 2017 estimates (FY17E), 18 per cent FY18E, and 16 per cent FY19E.

Reasoning for these estimates are based on expectations that Aeoncs’ receivables will be driven by internal factors such as expansion in the personal financing space, further penetration into the high yielding small medium enterprise (SME) segment, the cross-selling of financial products Aeon’s existing customers, and expansion of customer service centres,

Additionally, the signing up of new merchant agreements which would also help drive fee income growth.

For external actors, the research arm has stated that the recent hike in civil servant wages would be an added bonus to Aeoncs receivables as it would boost consumption spending.

“The spill over effect will be on purchases of small ticket items such as electrical goods, electronic and IT gadgets, household furniture as well as increased the affordability to borrow personal loans,” explained the research arm.

In asset quality, Aeon Credit has continued to demonstrate a trend of consistent improvement since its peak in September-November in 2015 at 3.07 per cent.

The research arm affirmed their belief that this positive trend is a result of Aeoncs’s strict and prudent management on credit risk practices and their strong understanding of the consumer financing business.

As such, Affin Hwang Capital has estimated that the trend will continue into FY17 to 19.

“To further enhance its collection system, Aeon Credit has also started self-service kiosks with ATMs, cash-deposit machines and digital devices for its customers in 201,”added the research arm.

Additionally, the overall net credit cost has been slowly decreasing year-on-year and as a result, the research arm has predicted that for 2QFY17 results, “it will not be a surprise to potentially see some slight uptick in the net profit loss (NPL) ratio and credit cost since the quarter coincided with the Raya festival”.

“Based on 1QFY17’s results, the gross NPL ratio was down by five basis points (bps) quarter on quarter to 2.42 per cent, while on a YoY, it declined by 32 bps amidst a healthy growth in receivables to RM5.8 billion.”

When compared to the banking industry’s household sector gross impaired loan ratios, it should be noted that Aeoncs’ gross net profit loss (NPL) ratio is higher as their portfolio of receivable are in riskier assets and non collateralised.

Despite this, Aeoncs cash flows are compensated by a higher effective interest rate of around 16 to 17 per cent against a borrowing cost of 4.2 per cent.

While there has also been some concern regarding defaults among lower income borrowers in the non-banking financial institutions, the research explains that these issues are mostly triggered by the abundant availability of easy credit with long tenures of up to 25 years.

Additionally, it should be noted that the trend of easy personal financing schemes back in July 2013, did not affect Aeoncs in a significant way.

“This was due to Aeoncs’ management in-depth understanding of the consumer-financing business, adhering to proper risk management underpinned by tight credit approvals, strict scoring system as well as its prompt collection practices” explained the research arm.

As such, the research arm has opted to maintain their ‘Buy’ rating for Aeoncs while raising their price targe to RM16.60 from RM14.50.

While the research arm has had strong justification for their positive outlook on Aeoncs, investors should note that he current dizzying household debt to gross domestic product (GDP) of 89.1 per cent is a key risk to Affin Hwang Capital’s forecast.

“The central bank may undertake further tightening measures to control excessive growth in household debt subsequent to curbs that were imposed in 2013 on personal-loan tenures on all banks and non-banks as well as tighter limits on credit-card spending.

“Should more regulations be imposed, our FY17-19E forecasts could be negatively affected.”

http://www.theborneopost.com/2016/09/28/aeon-credit-an-attractive-alternative-stock-to-sector/

-------------------

http://klse.i3investor.com/servlets/stk/5139.jsp

Growth much stronger for underlying receivables growth, versus the 8-10% NP growth and according to management is on track to grow +20% y-y in FY17E, (FY16: +20% y-y; 1QFY17: +21% y-y to RM5.8bn). Motorcycle financing (29.9% of receivables), auto financing (29.5% of receivables) and personal financing (22.4% of receivables) are the three top categories. We do note that there is some conscious slowing down in general easy payment (GEP i.e. white goods financing) and used car financing and a greater emphasis on personal financing and credit cards (~200k cards in circulation).

Slowing economy, yet NPLs declined to 2.42% 1QFY17 (from 2.74% in 1Q16), due to ACSM’s prudent risk management policies and in-house expertise and processes having been in the business for over 20 years. Mr Lee believes that borrowers typically will continue repaying as long as they are employed. Classification of NPL happens after 3 months of non-payment, written-off after 6 months of non-payment. Net credit costs also fell to 3.32%, the lowest in 9 quarters.

No real competitor as ACSM is sandwiched between money-lenders and banks, with >70% of its c.1mn customer base earning < RM3,000/mth and coupled with the average loan ticket size of RM8,000 and average tenure of 4 years, ACSM is in a segment which does not interest the banks. It’s direct competitors are Bank Rakyat (unlisted) and MBSB (MBS MK, RM0.86, NR) but both have been unsuccessful in migrating from super-safe civil servant salary deduction lending to the “free market” i.e. ACSM makes about 13-15mn calls a year to customers to remind them to pay on time. Parkson Credit, Singer Credit, Wilayah Credit also offer consumer financing and motorcycle financing but we understand are much smaller places in this space.

Not as strictly regulated unlike the banks, ACSM only needs to ensure its capital ratio (total equity/receivables) does not fall < 16% as required for all credit card issuers. ACSM is given the freedom to set pricing, with gross yield from 14% for used car financing to as much as 27% for general easy payment.

Beneficiary of lower interest rates? ACSM will not immediately benefit from declining interest rates in terms of lowering its funding cost as close to 70% of its funding is fixed-rate (to match its fixed rate lending base) and locked in for 5-6 years from Japanese banks (LT fixed-rate at c.4.28% which is way better than any local bank offers) and the balance (which will benefit from lower interest rates), 30% from local banks (more ST facilities), for an average funding cost of around 4.2%. This is against the overall gross yield for ACSM at ~20%. Lower interest rates should improve demand and a relief for their customers.

Trading at 8.3-8.7x PER, below market average 15x, with 29% ROE and 4.2-4.6% div yield: Adjusting for RM14.4mn/p.a. distribution paid to perpetual note holders (below net earnings line), ACSM is trading at trading at 8.4-8.7x ann. 1QFY17/FY17E PER or 8.3x FY18E based on consensus estimates, offering a 4.2%/4.6% FY17E/18E dividend yield. ROE were ~35% in FY2014/15 but is lower ~29% in FY16.

-------------------

http://klse.i3investor.com/servlets/stk/5139.jsp

Earnings still on a growth path: ACSM recorded a NP growth of +10% y-y in FY16 (Feb yr-end), +8% y-y for 1QFY17 and based on street estimates, growth is expected to continue with +6.2% y-y/+7.3% y-y FY17E/FY18E (despite earnings contraction within the banking sector). In my view, there is potentially upside risk to these numbers (volume growth), as ACSM’s target market are more sensitive to interest rate cuts (we expect another 50bps) and fiscal measures targeted for the low-middle income, which we expect in 2H16, i.e. min wage & civil servant wage increases, reduction in EPF contribution, more BR1M payouts.

Growth much stronger for underlying receivables growth, versus the 8-10% NP growth and according to management is on track to grow +20% y-y in FY17E, (FY16: +20% y-y; 1QFY17: +21% y-y to RM5.8bn). Motorcycle financing (29.9% of receivables), auto financing (29.5% of receivables) and personal financing (22.4% of receivables) are the three top categories. We do note that there is some conscious slowing down in general easy payment (GEP i.e. white goods financing) and used car financing and a greater emphasis on personal financing and credit cards (~200k cards in circulation).

Slowing economy, yet NPLs declined to 2.42% 1QFY17 (from 2.74% in 1Q16), due to ACSM’s prudent risk management policies and in-house expertise and processes having been in the business for over 20 years. Mr Lee believes that borrowers typically will continue repaying as long as they are employed. Classification of NPL happens after 3 months of non-payment, written-off after 6 months of non-payment. Net credit costs also fell to 3.32%, the lowest in 9 quarters.

No real competitor as ACSM is sandwiched between money-lenders and banks, with >70% of its c.1mn customer base earning < RM3,000/mth and coupled with the average loan ticket size of RM8,000 and average tenure of 4 years, ACSM is in a segment which does not interest the banks. It’s direct competitors are Bank Rakyat (unlisted) and MBSB (MBS MK, RM0.86, NR) but both have been unsuccessful in migrating from super-safe civil servant salary deduction lending to the “free market” i.e. ACSM makes about 13-15mn calls a year to customers to remind them to pay on time. Parkson Credit, Singer Credit, Wilayah Credit also offer consumer financing and motorcycle financing but we understand are much smaller places in this space.

Not as strictly regulated unlike the banks, ACSM only needs to ensure its capital ratio (total equity/receivables) does not fall < 16% as required for all credit card issuers. ACSM is given the freedom to set pricing, with gross yield from 14% for used car financing to as much as 27% for general easy payment.

Beneficiary of lower interest rates? ACSM will not immediately benefit from declining interest rates in terms of lowering its funding cost as close to 70% of its funding is fixed-rate (to match its fixed rate lending base) and locked in for 5-6 years from Japanese banks (LT fixed-rate at c.4.28% which is way better than any local bank offers) and the balance (which will benefit from lower interest rates), 30% from local banks (more ST facilities), for an average funding cost of around 4.2%. This is against the overall gross yield for ACSM at ~20%. Lower interest rates should improve demand and a relief for their customers.

Trading at 8.3-8.7x PER, below market average 15x, with 29% ROE and 4.2-4.6% div yield: Adjusting for RM14.4mn/p.a. distribution paid to perpetual note holders (below net earnings line), ACSM is trading at trading at 8.4-8.7x ann. 1QFY17/FY17E PER or 8.3x FY18E based on consensus estimates, offering a 4.2%/4.6% FY17E/18E dividend yield. ROE were ~35% in FY2014/15 but is lower ~29% in FY16.

24/08/2016 08:19

Subscribe to:

Comments (Atom)