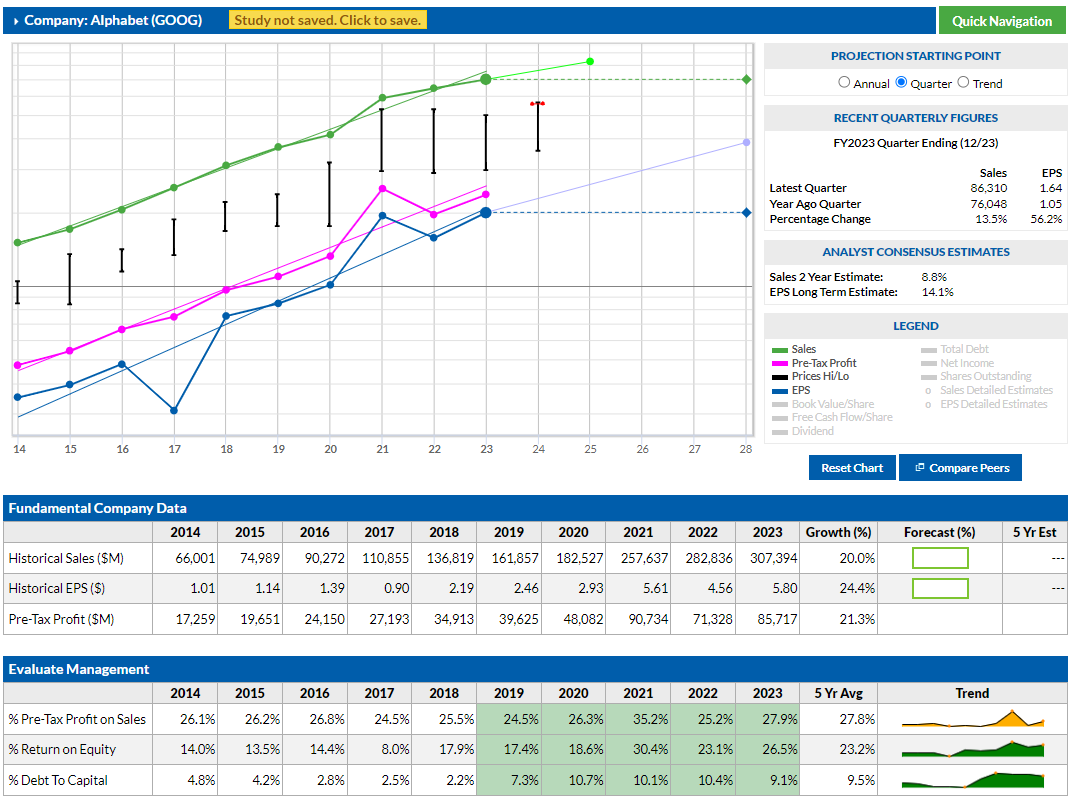

Here is a detailed breakdown of Alphabet Inc. (Google)'s revenues and net earnings for the calendar years 2015 to 2025, followed by a summary of the Compound Annual Growth Rate (CAGR).

**Important Note:** Alphabet's fiscal year aligns with the calendar year (ending December 31). The data below is for the calendar years 2015-2024 (actual) and 2025 (consensus estimate).

---

### **Alphabet's Revenue and Net Earnings (2015 - 2025)**

All figures are in USD millions. Data for 2015-2024 is sourced from Alphabet's official annual reports (10-K filings). **Data for 2025 is based on the current consensus analyst estimates** compiled by financial data providers.

| Calendar Year | Revenue ($ millions) | Net Earnings ($ millions) |

| :------------ | :------------------- | :------------------------- |

| **2015** | $74,989 | $16,348 |

| **2016** | $90,272 | $19,478 |

| **2017** | $110,855 | $12,662 |

| **2018** | $136,819 | $30,736 |

| **2019** | $161,857 | $34,343 |

| **2020** | $182,527 | $40,269 |

| **2021** | $257,637 | $76,033 |

| **2022** | $283,576 | $59,972 |

| **2023** | $307,394 | $73,795 |

| **2024** | $319,616 | $84,093 |

| **2025 (Est.)**| ~$355,500 | ~$98,200 |

**Key Context for the Data:**

* **2015-2017: Solid Growth & EU Fine Impact.** Steady growth in core advertising was the driver. The significant drop in 2017 net earnings was due to a **$2.7 billion antitrust fine** levied by the European Union, which is treated as an operating expense.

* **2018-2020: Consistent Expansion.** This period saw strong, consistent growth in Google Search and the rapid scaling of YouTube as an advertising powerhouse. The cloud business also began to become a more meaningful contributor.

* **2021: The Post-Pandemic Boom.** A massive surge in digital advertising spend as the economy reopened led to a record year for both revenue and profitability.

* **2022: The Correction.** Growth slowed and earnings dipped due to macroeconomic headwinds, inflation, and reduced advertiser spending, highlighting the cyclical nature of the ad business.

* **2023-2024: AI-Driven Re-acceleration.** Revenue growth stabilized and profitability rebounded strongly. The company focused on cost discipline (e.g., layoffs) and began integrating generative AI across its products (Search, YouTube, Cloud) to drive efficiency and new revenue streams.

* **2025 (Est.): Sustained Momentum.** Analysts project a return to double-digit revenue growth, fueled by the broader adoption of AI-powered advertising products and continued strong performance in Google Cloud. Profit growth is expected to outpace revenue growth due to ongoing operational efficiency.

---

### **Summary of CAGR (2015 to 2025)**

The Compound Annual Growth Rate (CAGR) measures the mean annual growth rate over a specified period.

**Period:** From the end of **2015** to the end of **estimated 2025** (a 10-year period).

* **Revenue CAGR (2015 to 2025 Est.):**

* Starting Value (2015): $74,989 million

* Ending Value (2025 Est.): ~$355,500 million

* Number of Years: 10

* **CAGR = ~16.9%**

* **Net Earnings CAGR (2015 to 2025 Est.):**

* Starting Value (2015): $16,348 million

* Ending Value (2025 Est.): ~$98,200 million

* Number of Years: 10

* **CAGR = ~19.6%**

### **Conclusion**

Over the ten-year period from 2015 to the projected 2025, Alphabet has demonstrated an exceptional ability to scale its core advertising business while successfully building other massive ventures.

* The **Revenue CAGR of approximately 16.9%** is remarkable for a company that was already a giant in 2015, showing its enduring dominance in the digital ecosystem and its ability to continuously capture a large share of global ad spend.

* The **Net Earnings CAGR of ~19.6%** is even more impressive. It shows that the company has not only grown its top line but has also improved its profitability over the decade. This is a testament to the high-margin nature of its primary businesses and, more recently, a disciplined approach to cost management. The journey includes absorbing multi-billion dollar regulatory fines and navigating economic cycles, yet still achieving nearly 20% annualized profit growth.

This performance underscores Alphabet's resilience and its successful navigation of the transition from a desktop-search company to a diversified tech leader in advertising, cloud computing, and artificial intelligence.

***Disclaimer:*** *This information is for illustrative purposes only. Data for 2015-2024 is historical. Data for 2025 are analyst estimates and are not guaranteed. This is not financial advice. Investing in the stock market involves risk, including the possible loss of principal.*