Keep INVESTING Simple and Safe (KISS) ****Investment Philosophy, Strategy and various Valuation Methods**** The same forces that bring risk into investing in the stock market also make possible the large gains many investors enjoy. It’s true that the fluctuations in the market make for losses as well as gains but if you have a proven strategy and stick with it over the long term you will be a winner!****Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Sunday 28 April 2024

What you look for in the financial statements of those great businesses with durable competitive advantage

Friday 26 April 2024

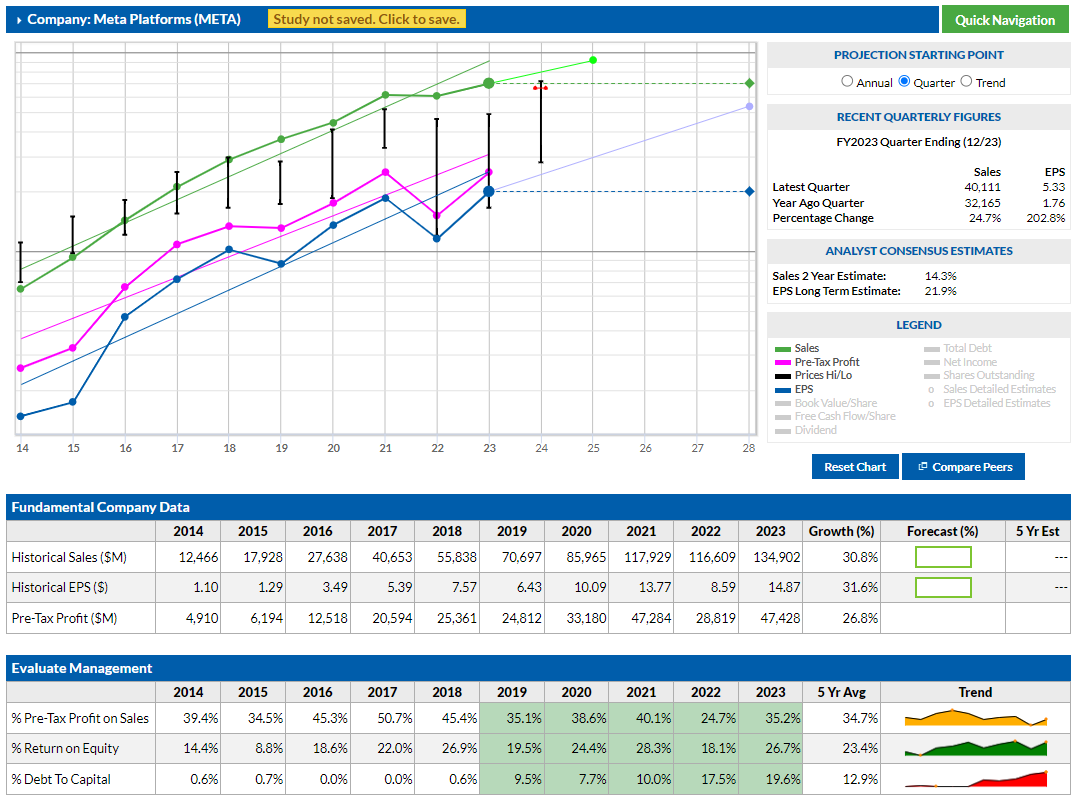

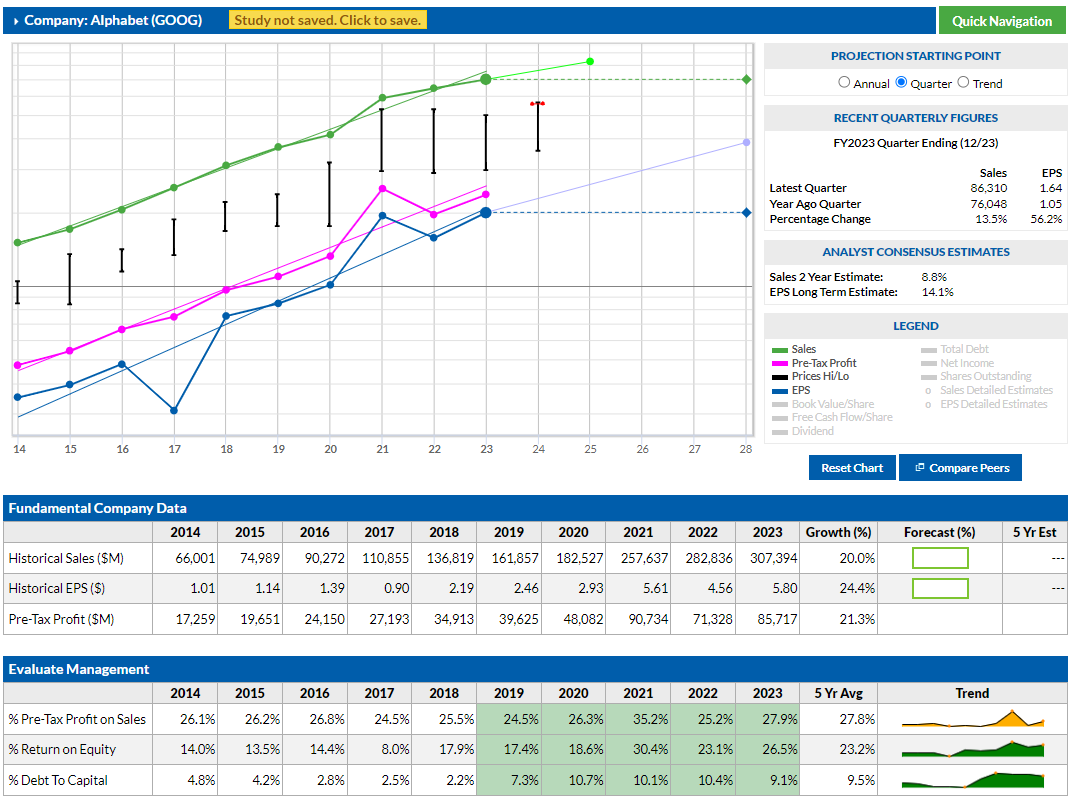

The Magnificent Seven stocks: Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla

Dubbed the Magnificent Seven stocks, Apple, Microsoft, Google parent

Thursday 25 April 2024

Wednesday 24 April 2024

Tuesday 23 April 2024

Monday 22 April 2024

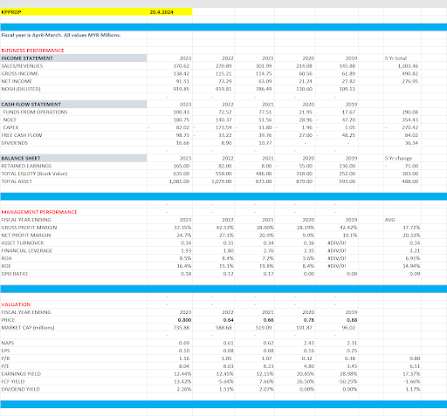

Comparing Dutch Lady and Farm Fresh

Period 2019 to 2023

Revenue

Farm Fresh grew revenue from 164m to 636m.

Dutch Lady grew revenue from 1067m to 1443m

Net Earnings

Farm Fresh grew net earnings from 27.4m to 50.1m

Dutch Lady dropped its net earnings from 103m to 72m

Gross Margin

Farm Fresh's GPM for 2023 was 23.73% (average of last 5 Years GPM was 26.98%)

Dutch Lady's GPM for 2023 was 29.66% (average of last 5 Years GPM was 32.38%)

Net Profit Margin

Farm Fresh's NPM for 2023 was 7.95% (average of last 5 Years NPM was 11.05%)

Dutch Lady's NPM for 2023 was 4.99% (average of last 5 Years NPM was 9.32%)

ROE, ROA, P/B and P/E

Farm Fresh ROE 7.87% ROA 4.65% P/B 4.33 P/E 55.03

Dutch Lady ROE 16.47% ROA 7.60% P/B 4.81 P/E 29.19

Free Cash Flow

Farm Fresh FCF for 2023 was -174.6m

Dutch Lady FCF for 2023 was 14.3m

Market Capitalisation

Farm Fresh @1.48 per share Market Cap 2,755.6m

Dutch Lady @32.48 per share Market Cap 2,101.6m

Sunday 21 April 2024

Detecting Frauds. When to Sell. Avoiding Value Traps.

How do you decide whether it is a value trap or not?

Value traps are statistically very cheap and very alluring.

First question to ask: “Why is God so kind on you that you are the only one who has this tremendous insight that this stock is cheap and all the other people who are very active, smart and intelligent in the market are ignoring this company?”

Is there an embedded growth optionality in the company? Can the company have a growth phase? Can the company come out with some new product offering which can introduce growth?

This is a dynamic exercise. You will need to revisit the hypothesis every now and again, at intervals.

Two characteristics of value traps are:

- (1) They typically don’t tend to grow more than the nominal GDP

- (2) They cannot reinvest their cash flow.

So the question you should ask is what is the catalyst which will change this and allow them to reinvest the capital which they are throwing off? In its absence, you have a classic example where the company had great cash flows and no catalyst.

Your sole focus of whether to participate in a seemingly value trap could be you calling out the catalyst that will catapult it out of this situation.

Friday 19 April 2024

Monday 15 April 2024

With a few simple steps, you could be on your way to millionaire status.

This Is Hands-Down the Simplest Way to Earn $1 Million or More in the Stock Market

By Katie Brockman – Apr 13, 2024 at 4:00PM

KEY POINTS

Building wealth in the stock market requires a long-term strategy.

Consistency is key to reducing risk while maximizing earnings.

The investments you choose can make or break your portfolio.

With a few simple steps, you could be on your way to millionaire status.

Investing in the stock market is a tried-and-true way to generate long-term wealth, and while reaching $1 million may seem like a lofty goal, it's not as difficult as it might appear.

You don't have to be a stock market expert to earn $1 million or more, but you will need the right investing strategy. There's no single correct way to invest, and the best approach for you will depend on your preferences and risk tolerance.

That said, there's a simple and straightforward strategy to maximize your long-term earnings while minimizing risk. Whether you're new to the stock market or just want a no-fuss way to build wealth, this step-by-step process can take you from $0 to $1 million or more.

1. Get started investing right now

The more time you give your money to grow, the less you'll need to invest each month to reach $1 million. Thanks to compound growth, your investments will accumulate exponentially faster over time. Getting started as soon as possible, then, is key to maximizing your earnings.

Even if you can't afford to invest much right now, every year counts. For example, say you're earning a modest 9% average annual return on your investments -- which is just under the market's historic average. Here's approximately how much you'd need to invest each month to reach $1 million, depending on how many years you have to save:

NUMBER OF YEARS AMOUNT INVESTED PER MONTH TOTAL PORTFOLIO VALUE

20 $1,700 $1.044 million

25 $1,000 $1.016 million

30 $625 $1.022 million

35 $400 $1.035 million

40 $250 $1.014 million

DATA SOURCE: AUTHOR'S CALCULATIONS VIA INVESTOR.GOV.

It's never too early to start investing, and the sooner you begin, the easier it will be to build a substantial amount of wealth. You can always invest more later if you can swing it, but you won't get this precious time back.

2. Don't worry about timing the market

The stock market will always be volatile to a degree, and it can be nerve-wracking trying to determine the best time to buy. Many people are understandably worried about investing right before prices drop, and it can be tempting to hold off on buying until the perfect moment.

However, there's never going to be a perfect time to invest in the stock market, and the longer you wait to invest, the harder it will be to catch up later. While it may seem counterintuitive, it's often safer to simply invest consistently no matter what the market is doing.

This approach is called dollar-cost averaging, and it involves investing a set amount at regular intervals throughout the year. Sometimes you'll end up buying when prices are at their peaks, and other times you'll snag investments at steep discounts. Over time, those highs and lows should average out.

Dollar-cost averaging can help take the guesswork out of when to buy, making it easier to invest consistently. Again, time is your most valuable resource when building wealth, so consistency is key to reaching $1 million or more.

3. Choose long-term investments

All investments are subject to short-term volatility, but stocks from healthy companies with solid underlying fundamentals have the best chance of recovering from downturns and earning positive long-term returns.

These types of stocks won't see explosive growth overnight, but they are more likely to earn consistent returns over time. This makes them much safer than short-term investments promising to make a quick buck.

If you'd prefer a more low-maintenance investment, a broad-market index fund or ETF may be your best bet. The S&P 500 index fund, for example, tracks the S&P 500 index and includes stocks from all 500 companies within the index itself. This can help create an instantly diversified portfolio with next to no effort, limiting your risk while still setting you up for positive long-term returns.

If you're willing to put in more effort for the chance to earn above-average returns, investing in individual stocks may be a better fit. This approach requires more research, as you'll need to study each stock you're interested in buying as well as keep up with industry trends going forward. But with the right portfolio, you could earn far higher-than-average returns over time.

Building a million-dollar portfolio isn't necessarily easy, but it's simpler than it might seem. By getting started early, investing consistently, and keeping a long-term outlook, you'll be on your way to becoming a stock market millionaire.

https://www.fool.com/investing/2024/04/13/simplest-way-earn-1-million-in-stock-market/