Certain businesses are not easy to manage. This company is in real estate development. The business was doing well from 2009 to 2016. From 2016 to now, it had done so poorly.

Look for businesses with durable competitive advantage, selling unique products and services. These businesses should have earnings that are consistent and growing over the long term.

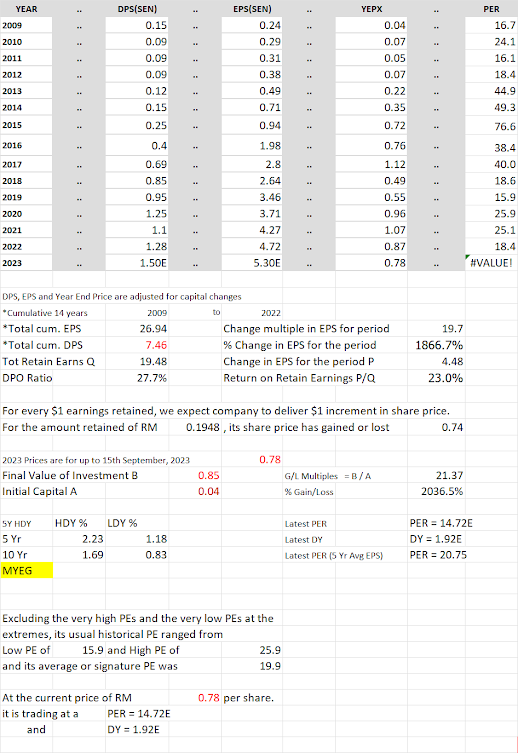

I briefly looked at this company in past and was impressed by its performance. Look at the increasing EPS and DPS from 2009 to 2016.

Perhaps, a lesson here is 5 years is probably a business cycle for many businesses and looking at 10 years or even 15 years results may offer one a better understanding of the long term sustainability of a business.