Keep INVESTING Simple and Safe (KISS)***** Investment Philosophy, Strategy and various Valuation Methods***** Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Monday, 28 October 2024

Valuation cheat sheet. What are some of your favourite metrics?

Tuesday, 22 October 2024

Markets are Competitive

Passive Management

Holding a highly diversified portfolio

No attempt to find undervalued securities

No attempt to time the market.

Active Management

Finding mispriced securities

Timing the market

The biggest mistake that investors make

The biggest mistake that investors make is not sticking with the plan when the market goes down.

What you do when the market goes down is more important than what you do as it is rising. WHY?

Because the worse days are followed by the best days.

Manage your emotions

When it is our own money, we think it is math, but it is actually not. Just because we learn about money in math class doesn't mean it is math to us. It is actually very EMOTIONAL.

One of the things that we need to do is manage the emotion, because we do feel the pain of a loss more than the euphoria of a gain.

Manage the emotion and just keep plodding along, paddling along in the markets for a long time.

Catherine Keating

Global Head of BNY Wealth

Bloomberg Interview

Thursday, 17 October 2024

Emotional Intelligence

Conflict between our thinking and our feelings makes things complicated.

Instincts, feelings and personal values take over and become a major part of our actions and behaviour.

Gut instincts or intuition rely a great deal on emotion and feelings.

Both feelings and instincts are major influences on our behaviour in the real world.

How can you benefit from improving your emotional intelligence?

Doing so, will also make life easier for those who have to interact with you.

Emotional intelligence is a valuable set of ideas you can use everyday and everywhere: in the workplace and in the home; as a parent, teacher or manager.

It is about being aware of feelings in yourself and in others, understanding them and managing their impact.

It is about being in control, interpreting body language, coping with negativity, working with others and building psychological well-being.

Emotional Intelligence

Emotional Intelligence is an assortment of mental abilities and skills that can help you to successfully manage both yourself and the demands of working with others.

Developing your own emotional intelligence enables you to:

- Know yourself reasonably well

- Control your own emotions

- Show empathy with the feelings of others

- Use social skills in an effective as well as simply pleasant way.

- Mindfulness: being aware - understanding yourself and others

- Being in control of your own thoughts, emotions and needs

- Being positive and self motivated particularly in the face of setbacks

- Using empathy: being able to put yourself in others' shoes

- Communicating effectively to build productive and positive relationships

- Using emotional reasoning: being able to use emotions to enhance rather than restrict your thinking.

- It is estimated that 15% of people will have a bout of severe depression at some point in their lives.

- 2% of teenagers are diagnosed with emotional disorders before the age of 18.

- Emotional disorders in old age is also a major and increasing problem.

Thursday, 26 September 2024

The Next Global Crash is Inevitable - Top Economist Professor Linda Yueh (An excellent video)

Tuesday, 10 September 2024

Selling is often a harder decision than buying

Selling is often a harder decision than buying

Investing is fun. For every rule, there is always an exception.

The main reasons for selling a stock are:

1. When the fundamental has deteriorated permanently, (Sell urgently)

2. When it is overpriced, whereby the upside gain will be unlikely or very small and the downside loss will be big or certain.

We shall examine reason No. 2 through the property market. The property market is also cyclical. There were periods of booms and dooms.

If you have a good piece of property that is always 100% tenanted and which gives you good consistent return (let's say 2x or 3x risk free FD rates), would you not hold this property forever? The answer is probably yes.

Then, when would you sell this property?

Note that the valuation of property, as with stocks, is both objective and subjective.

Would you sell when someone offered to buy at 500% above your perceived market price?

Probably yes, as this is obviously overpriced. You could cash out and probably easily re-employ the money to earn better returns in another property (or properties) or other assets.

Would you sell when someone offered to buy at 50% above your perceived market price?

Maybe yes or maybe no. You can offer your many reasons.

However, all these will be based on the perceived future returns you can hope to get from this property in the future. This is both objective based on past returns obtained and subjective and speculative on future returns.

However, unlike reason No.1 when you would need to sell urgently to another buyer to prevent sustaining a permanent loss, you need not sell just because someone offered to buy the property at high price. (However, there are also those who "flip properties" for their earnings; they will sell quickly for a quick profit.) You will not suffer a loss but only a diminished return at worse. You can take your time to work out the mathematics.

You maybe surprised that you may still achieve a return higher at a time in the near future by rejecting the present immediate gain based on the present high price offered.

Also, you would need to price in the lost opportunity cost when the property is sold at this price, even though it is 50% above the perceived normal market price. Could you buy a similar quality property with the same sustainable increasing income or return by offering the same price?

Similarly, the same line of thinking can be applied to your selling of shares.

When should you sell your shares?

Yes, definitely when the fundamentals have deteriorated permanently. The business has suffered for various reasons and going forward, the earnings will be permanently impaired and deteriorating.

Yes, when the price is very very overpriced. However, you need not sell your shares in good quality companies that you bought at fair or bargain price. As long as the fundamentals are strong and the business is adding value, selling now at a higher price may mean losing the return that you could have obtained in the future years from owning this stock and the opportunity cost of reinvesting the cash into another stock of similar quality and returns.

Once again, the importance of sound reasoning and doing the mathematics in making a decision whether to sell or not.

Is it not true, that the really big fortunes from common stocks have been garnered by those

- who made a substantial commitment in the early years of a company in whose future they had great confidence and

- who held their original shares unwaveringly while they increased 10-fold or 100-fold or more in value?

The answer is "Yes."

http://myinvestingnotes.blogspot.com/2012/07/my-18-points-guide-to-successfully.html

Additional notes:

Other reasons for selling a stock (or property) are:

- To raise cash to reinvest into another asset with better return.

- A certain stock (or property sector) may be over-represented in your portfolio due to recent rapid price rises and you need to reduce its weightage to reduce your risk of over-exposure in this single stock (or property sector).

Footnote:

This is a true story.

Monday, 2 September 2024

Sunday, 1 September 2024

The best investors have a process. Masters of the Market: featuring Alex Green

Tuesday, 25 June 2024

Friday, 14 June 2024

Supply Shocks and Stagflation

Box: Supply Shocks and Stagflation

If a supply shock is sufficiently large or persistent, it not only causes cost‑push inflation, but can noticeably reduce both the current and potential level of output in an economy. In this case, there can be the unusual combination of a period of ‘stagnation’ as output declines at the same time that prices are rising. This combination of stagnant growth – with high or rising unemployment – and high inflation is referred to as stagflation. Stagflation can become entrenched when inflation expectations are not well anchored.

The 1970s were a period of stagflation that featured two oil price shocks. In October 1973, the members of OPEC (the Organization of Petroleum Exporting Countries), as well as Egypt and Syria, imposed an oil embargo on industrial nations that had supported Israel in the Yom Kippur War of the same period. The embargo resulted in a quadrupling of oil prices and energy rationing, culminating in a global recession in which unemployment and inflation surged simultaneously. Central banks did not target inflation at this time, and this was the start of a prolonged period of high inflation in many economies.

Inflation expectations

Inflation expectations

Inflation expectations are the beliefs that households and firms have about future price increases. They are important because expectations about future price increases can affect current economic decisions that can influence actual inflation outcomes. For example, if firms expect future inflation to be higher and act on those beliefs, they may raise the prices of their goods and services at a faster rate. Similarly, if workers expect future inflation to be higher, they may demand higher wages to make up for the expected loss of their purchasing power. These behaviours, sometimes called ‘inflation psychology’, can contribute to a higher rate of actual inflation so that expectations about inflation become self-fulfilling.

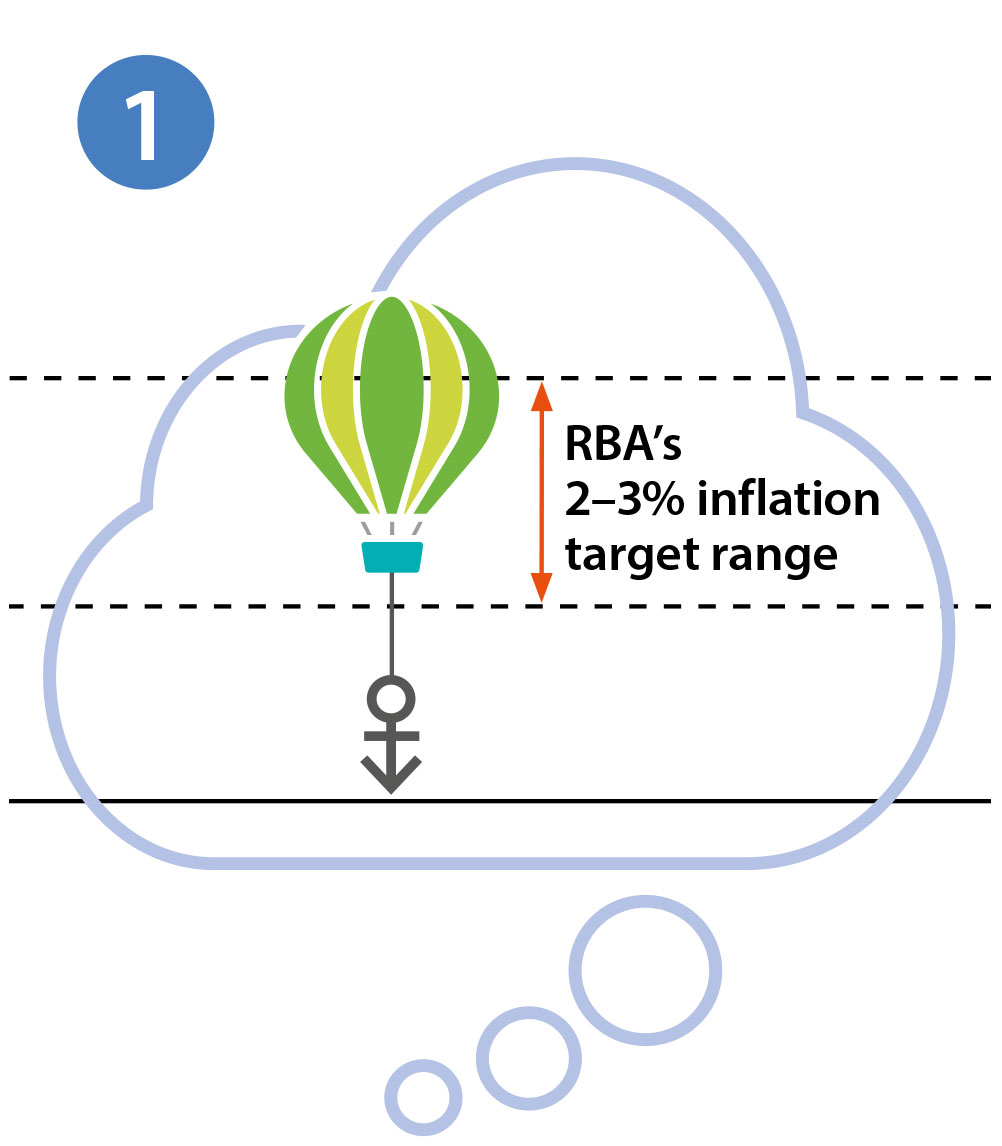

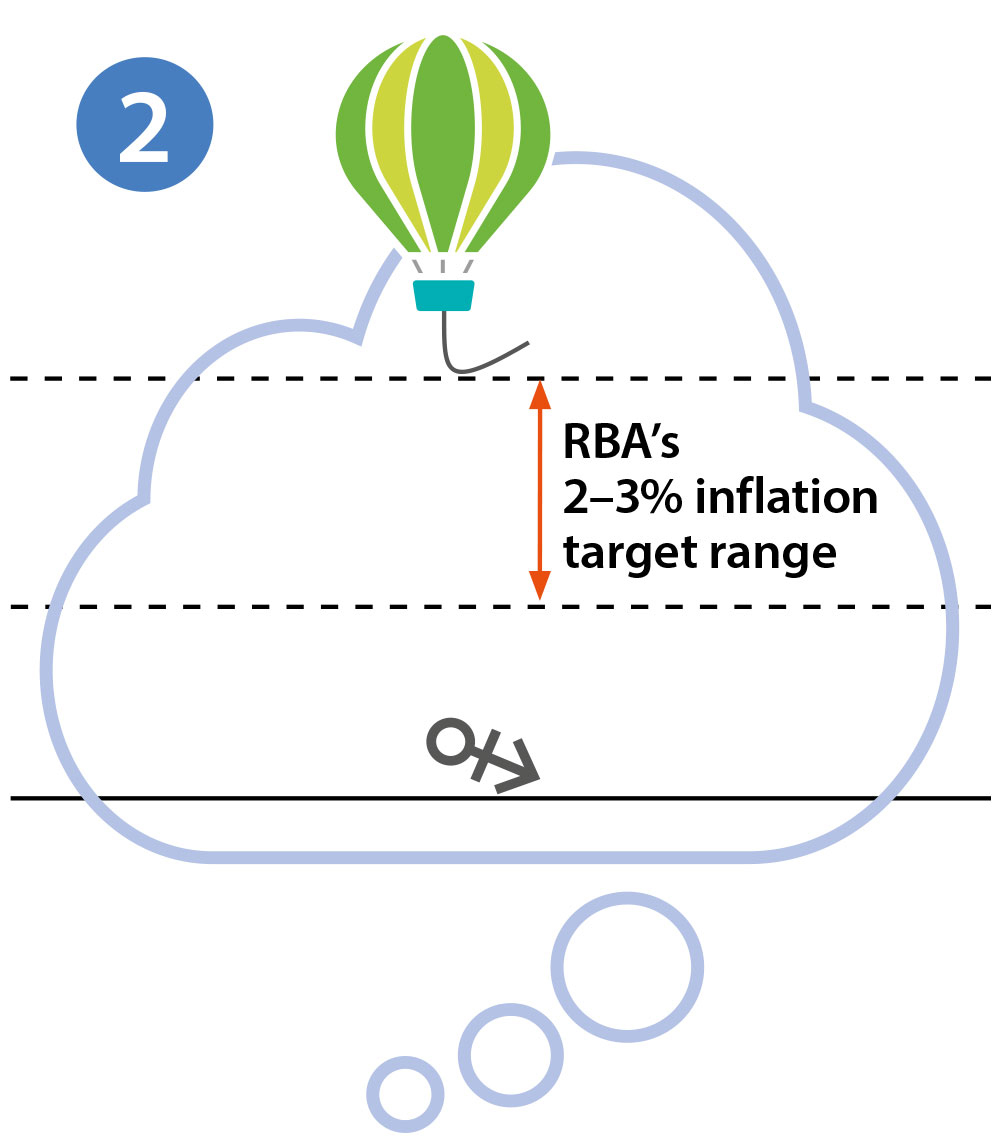

Given that inflation expectations can influence actual price and wage setting, the extent to which inflation expectations are ‘anchored’ has implications for future inflation outcomes. For example, if households' and firms' expect that inflation will return to the central bank's inflation target at some point in the future, regardless of what current inflation is, we describe their expectations as being ‘anchored’ to the inflation target. When expectations are anchored, a period of higher inflation – perhaps resulting from a cost‑push event – will not cause households and firms to change their behaviour and, as a result, inflation is likely to eventually return to its target. But if the inflation psychology of households and firms shifts and inflation expectations move away from the central bank's inflation target (i.e. they become ‘unanchored’), a period of higher inflation will become persistent because households and firms will expect inflation to be higher in the future and adjust their behaviour accordingly. Consequently, it is much easier for a central bank to manage inflation if inflation expectations are anchored rather than unanchored.

Illustrative Example of Anchored and

Unanchored Inflation Expectations

While inflation expectations have an important influence on actual inflation outcomes, they are not directly observable. Instead, policymakers such as the Reserve Bank have to rely on measures of expected inflation that are based on surveys (where people are asked their views about the inflation outlook directly) or financial assets like government bonds (where the price of the asset reflects assumptions made about the future path of inflation, see Explainer: Bonds and the Yield Curve).

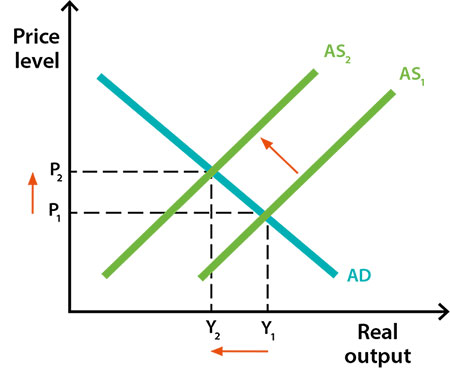

Cost-push inflation

Cost-push inflation

Cost-push inflation occurs when the total supply of goods and services in the economy which can be produced (aggregate supply) falls. A fall in aggregate supply is often caused by an increase in the cost of production. If aggregate supply falls but aggregate demand remains unchanged, there is upward pressure on prices and inflation – that is, inflation is ‘pushed’ higher.

An increase in the price of domestic or imported inputs (such as oil or raw materials) pushes up production costs. As firms are faced with higher costs of producing each unit of output they tend to produce a lower level of output and raise the prices of their goods and services. This can have flow-on effects by pushing up the prices of other goods and services. For example, an increase in the price of oil, which is a major input in many sectors of the economy, will initially lead to higher petrol prices. However, higher petrol prices will also make it more expensive to transport goods from one location to another which, in turn, will result in increased prices for items like groceries.

Cost-push inflation can also arise due to supply disruptions in specific industries – for example, due to unusual weather or natural disasters. Periodically, there are major cyclones and floods that damage large volumes of agricultural produce and result in significant increases in the price of processed food and both takeaway and restaurant meals, resulting in temporary periods of higher inflation.

Imported inflation and the exchange rate

Exchange rate movements can also affect prices and influence inflation outcomes. A decrease in the value of the domestic currency − that is, a depreciation − will increase inflation in two ways. First, the prices of goods and services produced overseas rise relative to those produced domestically. Consequently, consumers pay more to buy the same imported products and firms that rely on imported materials in their production processes pay more to buy these inputs. The price increases of imported goods and services contribute directly to inflation through the cost-push channel.

Second, a depreciation of the currency stimulates aggregate demand. This occurs because exports become relatively cheaper for foreigners to buy, leading to an increase in demand for exports and higher aggregate demand. At the same time, domestic consumers and firms reduce their consumption of relatively more expensive imports and shift their purchases towards domestically produced goods and services, again leading to an increase in aggregate demand. This increase in aggregate demand puts pressure on domestic production capacity, and increases the scope for domestic firms to raise their prices. These price increases contribute indirectly to inflation through the demand-pull channel.

In terms of imported inflation, the exchange rate has a greater influence on inflation through its effect on the prices of goods and services that are exported and imported (known as tradable goods and services), while prices of non-tradable goods and services depend more on domestic developments.