Keep INVESTING Simple and Safe (KISS) ****Investment Philosophy, Strategy and various Valuation Methods**** The same forces that bring risk into investing in the stock market also make possible the large gains many investors enjoy. It’s true that the fluctuations in the market make for losses as well as gains but if you have a proven strategy and stick with it over the long term you will be a winner!****Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Showing posts with label compounding. Show all posts

Showing posts with label compounding. Show all posts

Thursday 16 November 2017

Thursday 22 December 2016

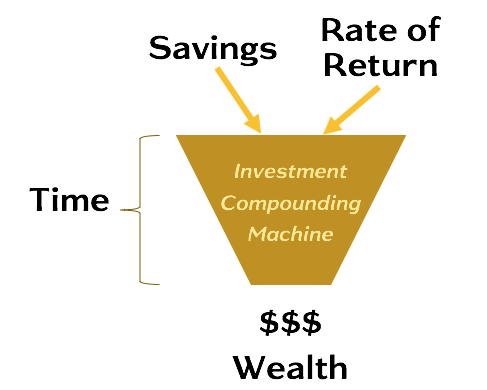

Future Value is an Extension of Compounding

A simple concept.

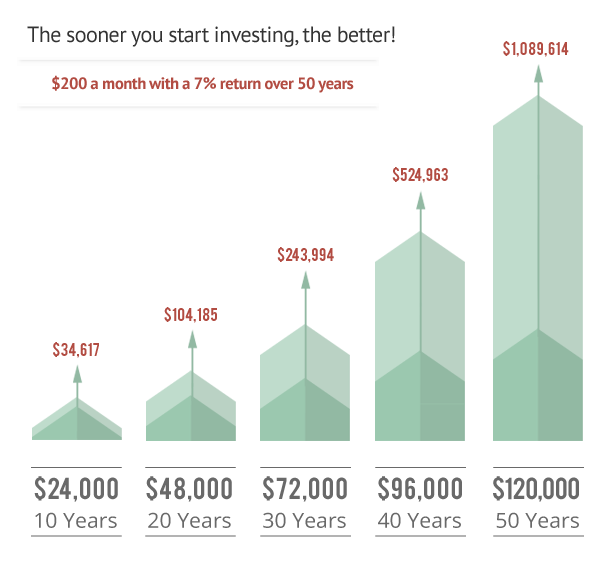

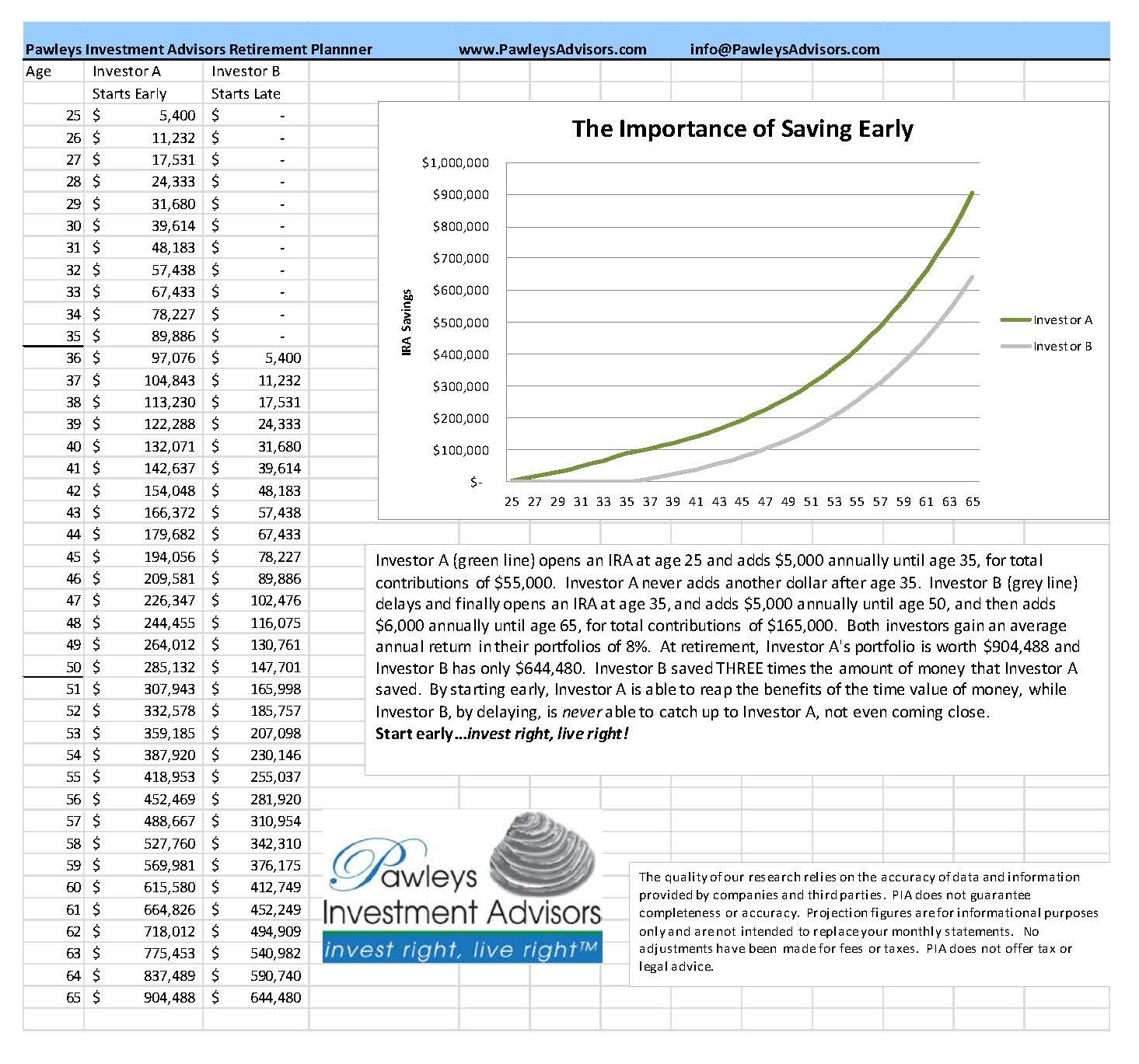

It is never too early to begin saving for retirement.

If you placed $2,000 per year for the next 8 years into an account that earned 10% and left those funds on deposit, in 40 years the $16,000 that you deposited would grow to more than $480,000. When investing, time is your biggest ally.

Time is on your side.

It is never too early to begin saving for retirement.

If you placed $2,000 per year for the next 8 years into an account that earned 10% and left those funds on deposit, in 40 years the $16,000 that you deposited would grow to more than $480,000. When investing, time is your biggest ally.

Time is on your side.

Saturday 6 June 2015

Take risks (but protect yourself) - Peter Lim

Much of Lim’s wealth was the product of an unlikely venture. His single investment of US$10 millionin Wilmar, an Indonesian palm oil startup, seemed far from promising in the late 90s, when Indonesia was facing political and social unrest. At the time, the currency fell from 2,500 to 16,000 rupiah against the US dollar. But against all odds, Wilmar began to pick up the pieces and Lim’s faith in the company paid off — in 2010, he cashed out his shares for US$1.5 billion.

“My Indonesian partner was asking me the other day: ‘How the hell did we make so much money?’Up to a point after people tell you a story and a vision, don’t write it off. Sometimes it comes true. You just make sure that if it doesn’t come true, you don’t get hurt too much.”(Source: The Business Times, AsiaOne News)

https://sg.news.yahoo.com/8-wise-lessons-wealth-singapore-053251357.html

Comments:

1998. US$10 million

2010. US$1,500 million (1.5 billion)

Period 12 years

Compound Annual Growth Rate:

51.82%. (WoW.

2015. US$ 3,000 million (3 billion). His present net worth.

CAGR from 2010 to 2015. 14.87%

CAGR from 1998 to 2015. 39.87%

He bought Wilmar in 1997/1998.

It was at the time of the Asian Financial Crisis.

Prices of stocks were very low.

Indonesian currency and regional currencies were at historical lows compared to US dollars and Singapore dollars.

He made a big investment. (Fat pitch when the opportunity came.)

He was in the position to make this investment and he took the risk, knowing his downside was protected. (My analysis.) (Luck = preparation + ability to seize opportunity when this presents)

He stayed with the company long term (12 years).

He cashed out in 2010. (Perfect timing or pricing. How did he do this?)

Since 2010, he has grown his wealth around 15% per year, doubling in 5 years.

There are many lessons one can learn from this investing behaviour of Peter Lim (almost sounds like Peter Lynch). :-)

For references.

CAGR

61.41% (Land - short term frenzyl)

8.14% (Property capital appreciation)

9.75% (Plantation capital appreciation)

17.79% (Land - long term)

9.65% (Property Total Return)

10.61% (Plantation Total Return)

15%+ (Equity)

Unlimited (Business)

Thursday 13 February 2014

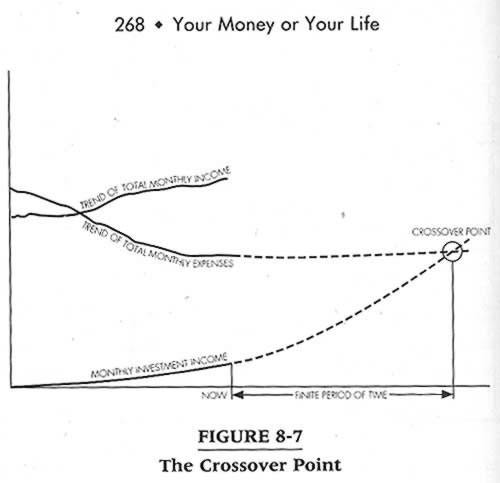

The FRIEND of your cash - The Magic of Compounding

Know the enemy of your cash: INFLATION

Know the friend of your cash: COMPOUNDING

Michael saved $1,000 per year from age of 21 for 10 years.

Terrence saved $2,000 per year from the age of 31 for 25 years.

Assuming they both had the same rate of return at 12% per year, at the age of 55 years, Michael grew his money more than Terrence.

The earlier you start, the less you need to save and the more you will have.

http://www.investlah.com/forum/index.php/topic,47111.msg1170071.html#msg1170071

Know the friend of your cash: COMPOUNDING

Michael saved $1,000 per year from age of 21 for 10 years.

Terrence saved $2,000 per year from the age of 31 for 25 years.

Assuming they both had the same rate of return at 12% per year, at the age of 55 years, Michael grew his money more than Terrence.

The earlier you start, the less you need to save and the more you will have.

http://www.investlah.com/forum/index.php/topic,47111.msg1170071.html#msg1170071

Tuesday 28 January 2014

Get to Know the Magic of Compounding

| Starting Value | Double | Triple | Quadruple | Rise 1,000% | |||||

| $1.00 | $2.00 | $3.00 | $4.00 | $10.00 | |||||

| 100% | 200% | 300% | 400% | 1000% | |||||

| Years | Years | Years | Years | ||||||

| Return | to | to | to | to | |||||

| Rates | Double | Triple | Quadruple | Rise 1,000% | |||||

| 6% | 12 | 19 | 24 | 40 | |||||

| 10% | 8 | 12 | 15 | 25 | |||||

| 14% | 6 | 9 | 11 | 18 | |||||

| 18% | 5 | 7 | 9 | 14 | |||||

| 22% | 4 | 6 | 7 | 12 | |||||

| 26% | 3 | 5 | 6 | 10 | |||||

| 30% | 3 | 5 | 6 | 9 | |||||

| Compounding factor | |||||||||

| Years | 6% | 10% | 14% | 18% | 22% | 26% | 30% | ||

| 0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | ||

| 1 | 1.1 | 1.1 | 1.1 | 1.2 | 1.2 | 1.3 | 1.3 | ||

| 2 | 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 | 1.7 | ||

| 3 | 1.2 | 1.3 | 1.5 | 1.6 | 1.8 | 2.0 | 2.2 | ||

| 4 | 1.3 | 1.5 | 1.7 | 1.9 | 2.2 | 2.5 | 2.9 | ||

| 5 | 1.3 | 1.6 | 1.9 | 2.3 | 2.7 | 3.2 | 3.7 | ||

| 6 | 1.4 | 1.8 | 2.2 | 2.7 | 3.3 | 4.0 | 4.8 | ||

| 7 | 1.5 | 1.9 | 2.5 | 3.2 | 4.0 | 5.0 | 6.3 | ||

| 8 | 1.6 | 2.1 | 2.9 | 3.8 | 4.9 | 6.4 | 8.2 | ||

| 9 | 1.7 | 2.4 | 3.3 | 4.4 | 6.0 | 8.0 | 10.6 | ||

| 10 | 1.8 | 2.6 | 3.7 | 5.2 | 7.3 | 10.1 | 13.8 | ||

| 11 | 1.9 | 2.9 | 4.2 | 6.2 | 8.9 | 12.7 | 17.9 | ||

| 12 | 2.0 | 3.1 | 4.8 | 7.3 | 10.9 | 16.0 | 23.3 | ||

| 13 | 2.1 | 3.5 | 5.5 | 8.6 | 13.3 | 20.2 | 30.3 | ||

| 14 | 2.3 | 3.8 | 6.3 | 10.1 | 16.2 | 25.4 | 39.4 | ||

| 15 | 2.4 | 4.2 | 7.1 | 12.0 | 19.7 | 32.0 | 51.2 | ||

| 16 | 2.5 | 4.6 | 8.1 | 14.1 | 24.1 | 40.4 | 66.5 | ||

| 17 | 2.7 | 5.1 | 9.3 | 16.7 | 29.4 | 50.9 | 86.5 | ||

| 18 | 2.9 | 5.6 | 10.6 | 19.7 | 35.8 | 64.1 | 112.5 | ||

| 19 | 3.0 | 6.1 | 12.1 | 23.2 | 43.7 | 80.7 | 146.2 | ||

| 20 | 3.2 | 6.7 | 13.7 | 27.4 | 53.4 | 101.7 | 190.0 | ||

| 21 | 3.4 | 7.4 | 15.7 | 32.3 | 65.1 | 128.2 | 247.1 | ||

| 22 | 3.6 | 8.1 | 17.9 | 38.1 | 79.4 | 161.5 | 321.2 | ||

| 23 | 3.8 | 9.0 | 20.4 | 45.0 | 96.9 | 203.5 | 417.5 | ||

| 24 | 4.0 | 9.8 | 23.2 | 53.1 | 118.2 | 256.4 | 542.8 | ||

| 25 | 4.3 | 10.8 | 26.5 | 62.7 | 144.2 | 323.0 | 705.6 | ||

| 26 | 4.5 | 11.9 | 30.2 | 73.9 | 175.9 | 407.0 | 917.3 | ||

| 27 | 4.8 | 13.1 | 34.4 | 87.3 | 214.6 | 512.9 | 1192.5 | ||

| 28 | 5.1 | 14.4 | 39.2 | 103.0 | 261.9 | 646.2 | 1550.3 | ||

| 29 | 5.4 | 15.9 | 44.7 | 121.5 | 319.5 | 814.2 | 2015.4 | ||

| 30 | 5.7 | 17.4 | 51.0 | 143.4 | 389.8 | 1025.9 | 2620.0 | ||

| 31 | 6.1 | 19.2 | 58.1 | 169.2 | 475.5 | 1292.7 | 3406.0 | ||

| 32 | 6.5 | 21.1 | 66.2 | 199.6 | 580.1 | 1628.8 | 4427.8 | ||

| 33 | 6.8 | 23.2 | 75.5 | 235.6 | 707.7 | 2052.2 | 5756.1 | ||

| 34 | 7.3 | 25.5 | 86.1 | 278.0 | 863.4 | 2585.8 | 7483.0 | ||

| 35 | 7.7 | 28.1 | 98.1 | 328.0 | 1053.4 | 3258.1 | 9727.9 | ||

| 36 | 8.1 | 30.9 | 111.8 | 387.0 | 1285.2 | 4105.3 | 12646.2 | ||

| 37 | 8.6 | 34.0 | 127.5 | 456.7 | 1567.9 | 5172.6 | 16440.1 | ||

| 38 | 9.2 | 37.4 | 145.3 | 538.9 | 1912.8 | 6517.5 | 21372.1 | ||

| 39 | 9.7 | 41.1 | 165.7 | 635.9 | 2333.6 | 8212.0 | 27783.7 | ||

| 40 | 10.3 | 45.3 | 188.9 | 750.4 | 2847.0 | 10347.2 | 36118.9 | ||

| 41 | 10.9 | 49.8 | 215.3 | 885.4 | 3473.4 | 13037.4 | 46954.5 | ||

Tuesday 10 December 2013

Pay for Retirement with a Cup of Coffee and an Egg McMuffin

Pay for Retirement with a Cup of Coffee and an Egg McMuffin

$3 a Day Can Add Up to a Serious Nest Egg

By Joshua Kennon

How many times have you swung by McDonalds on your way to work for a cup of coffee and an Egg McMuffin? It may seem like small change, but the $3 a day it is costing you to buy your breakfast can fund your retirement. Don't believe it? Let's take a look at the numbers.

The stock market has historically averaged a return of around twelve percent. If you began investing $3 a day at twenty five years old and earned the same rate of return, by the day you reached sixty-five, you would have saved a total of $381,437 before taxes. That's a pretty substantial nest egg by anyone's standards. The results are even more spectacular if you start younger (a sixteen year old would save $789,896 pretax by retirement).

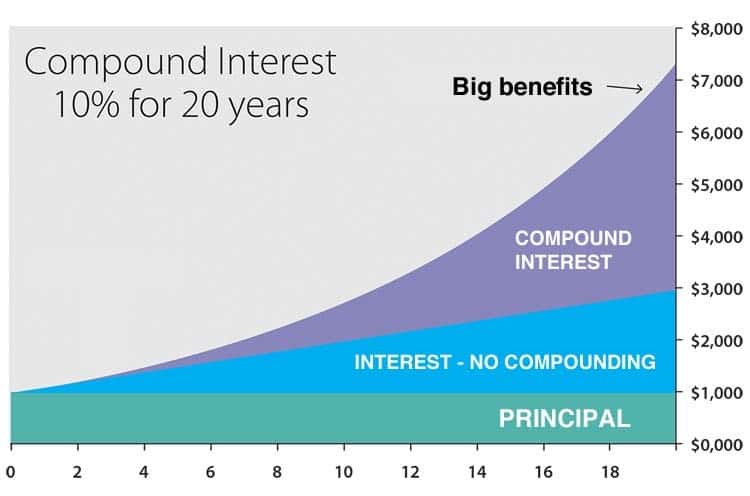

Why such the drastic difference between the 16 and the 25 year old? Compounding. When you invest or save, your money earns more money in the form of interest or dividends. If you reinvest these, you earn interest on your interest. Here's how it works: You put $100 in a savings account that earns 4% annually. At the end of the first year, you earn $4 in interest. Let's say you keep that $4 in the savings account. At the end of the second year, you would earn 4% on the $104 (instead of the original $100). This would result in your interest payments higher each subsequent year as you kept reinvesting your interest.

For those of you who are thinking, "Well, I'm 30, 40, 50, or 60+ years old. What can I do?", don't worry! No matter when you start, if you are diligent and intelligent in your investing, you will end up with more money than you would have had otherwise. A fifty year old could still put aside more than $36,013 by following the three-dollar-a-day plan.

The next time you bite into that sausage egg and cheese breakfast sandwich, keep in mind you may be eating your retirement.

http://beginnersinvest.about.com/cs/retirementcenter/a/040302a.htm

$3 a Day Can Add Up to a Serious Nest Egg

By Joshua Kennon

How many times have you swung by McDonalds on your way to work for a cup of coffee and an Egg McMuffin? It may seem like small change, but the $3 a day it is costing you to buy your breakfast can fund your retirement. Don't believe it? Let's take a look at the numbers.

The stock market has historically averaged a return of around twelve percent. If you began investing $3 a day at twenty five years old and earned the same rate of return, by the day you reached sixty-five, you would have saved a total of $381,437 before taxes. That's a pretty substantial nest egg by anyone's standards. The results are even more spectacular if you start younger (a sixteen year old would save $789,896 pretax by retirement).

Why such the drastic difference between the 16 and the 25 year old? Compounding. When you invest or save, your money earns more money in the form of interest or dividends. If you reinvest these, you earn interest on your interest. Here's how it works: You put $100 in a savings account that earns 4% annually. At the end of the first year, you earn $4 in interest. Let's say you keep that $4 in the savings account. At the end of the second year, you would earn 4% on the $104 (instead of the original $100). This would result in your interest payments higher each subsequent year as you kept reinvesting your interest.

For those of you who are thinking, "Well, I'm 30, 40, 50, or 60+ years old. What can I do?", don't worry! No matter when you start, if you are diligent and intelligent in your investing, you will end up with more money than you would have had otherwise. A fifty year old could still put aside more than $36,013 by following the three-dollar-a-day plan.

The next time you bite into that sausage egg and cheese breakfast sandwich, keep in mind you may be eating your retirement.

http://beginnersinvest.about.com/cs/retirementcenter/a/040302a.htm

Tuesday 23 April 2013

3 Reasons to Invest in Stocks

by MMARQUIT

With the recent volatility in the stock market, and with the financial crisis of 2008 still looming large in many memories, it isn’t too surprising that many people are wary of investing in stocks.

It’s true that stock investing comes with some risk. However, it doesn’t have to mean that you avoid stocks altogether. Here are 3 reasons to find the money to invest in stocks:

1. Build Wealth Over Time

One of the realities of life is that putting money in a high-yield savings account or high-yield CD just isn’t going to cut it if you want to more effectively build wealth over time. This is especially true in a low-yield environment like what we’ve got right now. Your low-yield products are unlikely even to earn a return that beats inflation. You can’t build adequate wealth over time with your earning power subject to real losses.

Investing in stocks gives you the chance to earn higher returns that beat inflation, and that put the magic of compound interest to work on your behalf. When you know how money works, and you can put that knowledge to work, you can build wealth more effectively over time. Stocks are among the best ways to do that.

2. The Stock Market Has Yet to Lose in the Long Run

Even though volatility is a problem in the short-term, and there are big crashes on occasion, the stock market hasn’t lost in the long run. If you plan out your long-term goals, you’ll find that investing gives you the best chance of reaching them.

Over long periods of time — 25 to 30 years — the stock market has always seen net gains. Over time, the trend line smooths out, and doesn’t look so scary. One of the biggest investing mistakes is to panic at short-term volatility, selling with the herd, even though it’s a great time to buy at bargain prices. Take a step back and really consider the big picture and the long-term. You might be surprised at what you find.

3. Stock Investing Doesn't Have to be Complex

The real hang up for many people is stock picking. They worry about whether or not they are choosing the right stocks, and get concerned about seemingly-complex concepts like P/E ratios and reading balance sheets. While these are things that can be learned, stock investing doesn’t have to be complex, especially to start.

Simple investments, like index funds, can help you avoid the pitfalls of stock picking. With index funds, you can start investing fairly easily, with little expertise, and with a small amount of money. An index fund, which follows a group of investments (you can even pick an all-market fund and track the entire market’s performance), allows you to avoid the need for stock picking. These types of investments have made the whole process less complex for large groups of people.

You can start with a small amount of money, and be consistent. Indeed, when it comes to investing success, consistency is key. Create a plan, and look for funds that you understand. You might get around to stock picking later, but to start, it doesn’t need to be complex — and over time it can result in true wealth.

http://couponshoebox.com/tips/3-reasons-to-invest-in-stocks/

Thursday 11 April 2013

David Bach on how to get rich

Financial writer and best selling author David Bach advises how to get rich in his book, "The Automatic Millionaire."

Important point: @ 19 min, 20 min.

Tuesday 2 April 2013

Wednesday 19 September 2012

Helping the small investor: The Magic Formula

| Why the Formula Matters | ||||||||||||||||||||||||||||||||||||

| Many hard working, middle class people find it very difficult to make ends meet, never mind make the appropriate contribution to their retirement savings. Even those that are making regular contributions to retirement savings find it unlikely their nest egg will grow large enough to let them live the dream retirement. There is a hope! Before we get to the impact of the magic formula, you need a specific goal. Find out how much you need to retire. Use one of the online calculators to find your number and write it down. Whatever number you came up with, chances are it shows that you should be saving more for retirement, correct? But what if you really have cut back as much as you can, and you still can't find that extra money to fund your retirement? Answer: If that extra income in not available in your budget, your retirement funds must earn more. Not paying attention to this fact is the single biggest risk you have to a happy, financially secure future. One of the great things about retirement accounts is that your earnings grow tax-deferred so you can realize the full power of compound interest. So what is the big deal anyway about a few percentage points over time? Does it really make a difference whether your retirement account earns 8%, 10%, or 15% a year? YES, YES, YES! It matters! In fact this is THE most important factor you need to consider. | ||||||||||||||||||||||||||||||||||||

| The Magic Formula for Building Investment Wealth: Compound Interest | ||||||||||||||||||||||||||||||||||||

COMPOUND INTEREST (FUTURE VALUE)You vaguely remember that Junior High School math lesson on simple and compound interest don't you? Suppose you open an account that pays a specific interest rate, compounded annually. If you make no further contributions and let compound interest work its magic the balance your account will grow to at some point in the future is known as the future value of your starting principal.

The above assumes we are compounding once per year. If you want to compound n times per year, you use: FV = P(1 + r/n)Yn

THE POWER OF A HIGH COMPOUNDED INTEREST RATEObviously you and everyone else in the world knows it is better to have a high rate of return, but have you ever paid attention to the enormous impact that compound interest has on your future financial security and happieness?Let's take a simple example: Suppose you are 40 years old and have $10,000 in a self-directed IRA account. For the purpose of this example, let's assume you will never add another dollar to that account out of your own pocket. How much will that $10,000 be worth at age 65? As you can guess the answer depends drastically on your rate of return. If you were getting a 6% annual return on your investment, then in 25 years that $10,000 would turn into $42,918. How would that same amount grow with a higher rate of return?

Think about that. Without adding a dime to that account you could turn that $10,000 into almost 1 million dollars. But who's going to give you 20% interest you say? You are. We'll let you in on a 3 little secrets,

| ||||||||||||||||||||||||||||||||||||

| Take Control of your Future | ||||||||||||||||||||||||||||||||||||

"Proverb: He who fears something gives it power over him"

So how do you consistently get that 15-20% return with almost no risk? You need to manage a portion of your future for yourself. It is not that difficult once you learn how, but most people won't get started because of fear. Fear that they will lose money. Fear that they will not be able to do as well as the market. The greater risk is *not* taking some responsibility for your own future. "But I can't beat the market", you say. As we'll explain that's the wrong yardstick to begin with. You don't want to beat the market, you want to earn a consistent level of return each year. If the market looses 8% one year, who wants to "beat the market" by losing only 5% that year? Not us. And hopefully not you. We want to earn at least 15% on our retirement investment. So why are we sharing this information? Let's put it this way. We're advocates for the little guy. There are a lot of people in the financial services industry that want to manage our money because that is how they make money. They don't necessarily want us to know what they know, because then we wouldn't need them. Luckily for them, there are many investing myths out there that keep us in check. We accept these myths as truths, and that keeps us from taking action. We're not suggesting that you try to manage your entire retirement nest egg yourself. At least not immediately. Rather think of it as a new definiton of diversification. To start, leave the majority of your funds with your current 401K or IRA, but move a small percentage, maybe 10-20% to a self-directed IRA account. Get started today!

"Never be afraid to try something new.

Remember, amateurs built the ark, professionals built the Titanic." |

Wednesday 15 August 2012

To reach large sums, you only need to save smaller amounts early on.

For selected good quality growth/value stocks, over a 10 years investing horizon, the upside reward/downside risk

= 100% upside gains / 0% downside loss.

Subscribe to:

Posts (Atom)